AndreyPopov/iStock via Getty Images

Main Thesis & Background

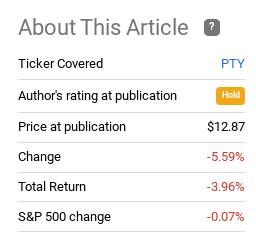

The purpose of this article is to evaluate the PIMCO Corporate & Income Opportunity Fund (NYSE:PTY) as an investment option at its current market price. The fund’s objective is “to seek high current income, with capital preservation and capital appreciation as a secondary objective”.

I last wrote about PTY in July, when I once again emphasized caution. I still saw it as overvalued, especially when factoring in all the risks facing the credit market as a whole. In hindsight, I was proven correct again, with PTY falling another 4% since publication:

Fund Performance (Seeking Alpha)

As we march closer to 2023, I figured another look at PTY would be worthwhile. Unfortunately, I still do not see a clear buy case here. This means I will be reinforcing my hold/neutral rating on this fund as we close out the year, and I will explain why in detail below.

What’s Behind The Poor Performance: Part 1

As followers of PTY know, this calendar year has not been a kind one – either to this particular fund or credit markets as a whole. Rising inflation, aggressive Fed rate hiking, and recession fears have sent bond and loan prices crumbling. Throw in the fact that the yield curve has inverted, and leveraged CEFs have simply been under tremendous pressure. This explains why PTY has offered investors a loss near 20% year-to-date (once distributions are factored in):

YTD Performance (Seeking Alpha)

Again, these are not factors exclusive to PTY, but to credit as a whole. So we have to take that with a grain of salt and understand most alternatives were not exactly winners this year either.

But why the persistent weakness since July? On the bright side, PTY’s NAV has held up fairly well in the interim:

| NAV on 7/11 | Current NAV | Change |

| $11.07/share | $10.92 | (1.4%) |

Source: PIMCO

Considering the fund has just over $.35/share in distributions over that same time period, readers can take some comfort in knowing the underlying performance has been stable. This is the good news.

Still we must reconcile that PTY has lost 4% in this environment. That brings the piece of bad news. A lot of that has to do with premium compression. In mid-July when I last covered it, PTY sat with a premium north of 15%. This is very expensive for a CEF. With the drop in share price, that figure has declined a bit (though not enough for my liking!):

Fund Valuation (PIMCO)

The takeaway for me is that we are once again reminded that valuation matters. PTY has pumped out a high distribution rate, kept a stable NAV, yet it has lost around 4%. This is because the premium investors were willing to pay for it has gone down, taking the share price down with it.

Of course, at this point, readers could be asking – isn’t now a good time to buy then? The answer is “it depends”. In fairness, the lower premium certainly means investors are getting a better “deal” than they were four months ago. But is it really a deal? To me personally, an 11% premium is expensive. Others can disagree and view this as a buying opportunity, but I do not. Hence the reason for my “hold” rating.

What’s Behind The Poor Performance: Part 2

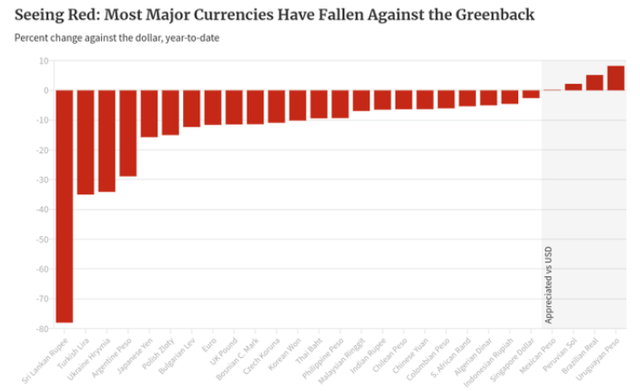

Another factor influencing PTY’s return in 2022 has been the strength of the U.S. dollar (USD). This is an important factor because the USD’s rise can be problematic for nations around the globe. Many emerging market economies in particular are sensitive to currency fluctuations because their home currencies are not as stable and/or in demand as major developed currencies. But a higher USD compared to the Euro, Yen, or British Pound certainly impacts developed world credit markets as well. Currency fluctuations are a normal way of life, but the problem in 2022 is that the USD has been in a straight line higher for the majority of the year:

US Dollar Currency Index (CNBC)

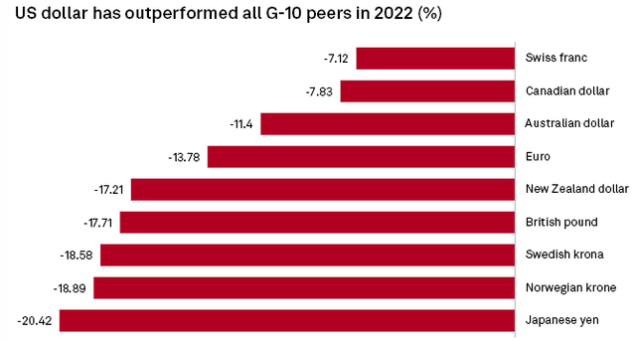

Not surprising, the USD has been strengthening against the majority of foreign currencies as a result. This includes both EM currencies and those from developed markets, as shown below, respectfully:

EM Currencies vs. USD (World Bank) Developed Currencies vs. USD (World Bank)

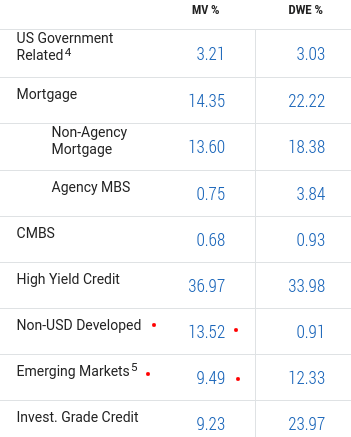

Why is this relevant for PTY? It has implications because PTY holds about one-quarter of its debt in either emerging markets or non-USD developed markets:

PTY Sector Breakdown (PIMCO)

The implication is that when the USD rises we often see other countries tighten their own monetary policy to head off further depreciation of their local currency. This can, in turn, send those bond and loan prices even lower as local rates rise. The other negative from an investor standpoint is this new rising rate environment will limit economic growth and challenge balance sheets. The worst case scenario would be this environment leading to higher levels of distressed debt and credit going into default.

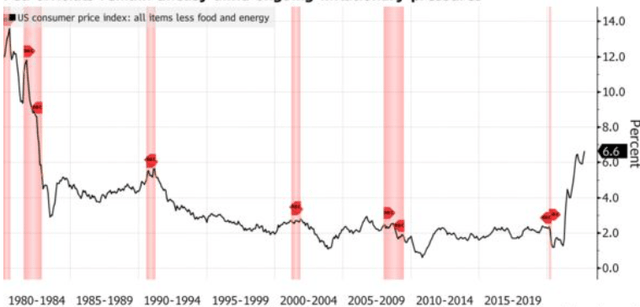

The broader takeaway is a rising dollar is a headwind. It has hurt PTY’s performance and that could continue to be the scenario in Q4 and Q1 2023 as well. The reason behind the Fed has a legitimate argument for continuing on its interest rate hiking path. While some market participants believe inflation has peaked, others are not so sure. While the CPI measure did appear to level off during the last reading, when we exclude food and energy we see that consumer prices are continuing their rise higher. This means that lower oil prices may have helped headline inflation by some accounts, but other prices keep going up regardless:

CPI (less food and energy) (Bloomberg)

What I am getting at here is that the pain may not be over. It is difficult to say one way or the other how the Fed is going to interpret current inflation readings. A few more rate hikes seems reasonable, but the credit market could rally if the outlook becomes more dovish in the second half of 2023 (earlier than the Fed has indicated it would shift policy). This would be a boon for funds like PTY that have been hammered this year, so there is plenty of upside potential ahead.

The reality is that downside risk is just as likely. When we factor out food and energy we see inflation continues to accelerate. This could leave the Fed tightening even more than previously expected, setting up the bond and loan markets for more losses. Obviously, we need to take on risk to earn reward, but I would question whether a leveraged fund with a premium near 11% is the right way to take on that risk in this climate.

High Yield Credit Looks Like A Buy, Unless Distressed Volumes Rise

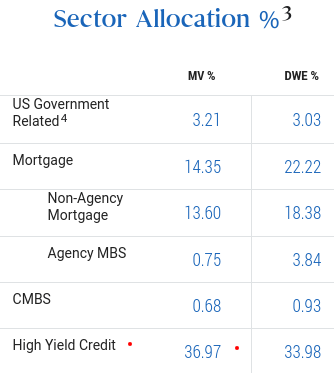

I will now shift the conversation to the high yield credit sector. This has been paramount to PTY’s return for many years that I have been reviewing it because it represents a large portion of total assets. The current reading sits near 37% – indicating total return is driven in large part by this sub-sector:

PTY’s High Yield Exposure (PIMCO)

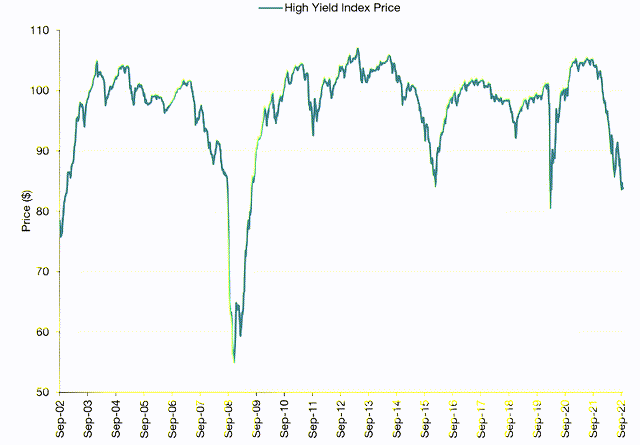

In some respects, this is an area that looks like a value opportunity. With rising rates and recession fears to contend with, junk credit has taken a beating in 2022. While justifiable to a degree, the collapse in prices is mirroring what we saw in the immediate aftermath of the announcement Covid-19 pandemic:

High Yield Prices (Lord Abbett)

I want to be clear that I would absolutely expect high yield prices to have declined in 2022. But is this a bit of an overreaction? Perhaps – and if so – then there could be a significant upside correction that brings PTY up along with it.

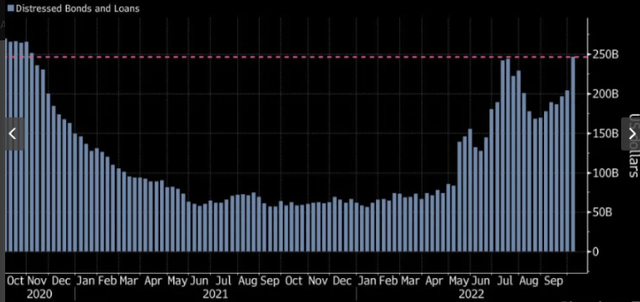

Of course, if we look at that historical chart we see that in 2008-09 prices plunged even further. So this in no way indicates a “bottom” in terms of how low high yield prices can fall. I am not predicting that as the likely scenario, but readers should make themselves aware of some of the cracks beginning to form. In particular, the amount of distressed debt has seen a steady uptick in the second half of this year:

Volume of Distressed Debt (America) (Yahoo Finance)

This is a troubling metric that suggests more defaults could be on the way. If economic conditions don’t improve and corporate earnings surprise to the downside, this volume of distressed debt is almost certain to rise. The implication is that the value of the debt will drop markedly and income production for funds like PTY would be at risk if borrowers stop paying timely.

This risk here is balanced by the fact that if the economy turns around in the new year and/or the Fed slows it pace of rate hikes, then distressed debt will probably fall in-line with 2021 levels. This will restore investors’ confidence – sending both bond and loan values higher and also support higher premiums on funds like PTY. But this is a gamble at the moment, and one readers need to be very careful about given all the uncertainty facing the global market.

Income Remains The Bright Spot

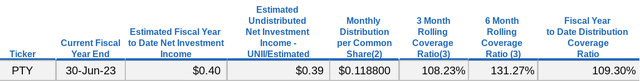

It is clear my outlook for PTY has not improved since July. But this is not to suggest PTY doesn’t have any positive attributes. The one most important for income investors in particular is the stability of the current distribution. In this case, PTY is shining in the short-term. Despite challenges in the past, the fund is enjoying a very healthy UNII balance and coverage metrics well above 100%. This means that income balance is safe and likely to result in a special distribution later this year:

The conclusion I draw here is that PTY’s 11.7% yield is going to bring in some interest. A double-digit yield supported by strong income metrics will have many investors buying regardless of premium. Whether or not that is the right move for an individual is up to them and their own risk tolerance and outlook for the market. But the strength of this attribute underscores why PTY deserves at least a look of consideration from time to time.

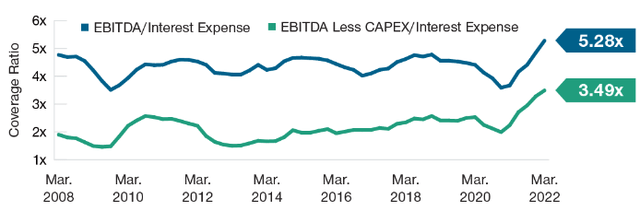

Further, it we expect the PIMCO management to be successful in their credit selections, then we have reason to believe this income story will remain in place. My point is that distressed debt levels are rising and economic concerns are top of mind. These factors could pressure income performance for high yield funds. However, as a whole, company earnings for high yield issuers are exceeding their ongoing interest expenses:

Coverage Ratios (High Yield Sector) (T.Rowe Price)

This is where selective buying comes in. There is certainly trouble brewing in the high yield market given how distressed volumes have risen. But as a whole interest coverage looks strong. So we have to rely on fund managers to be selective in what they buy and avoid those pesky loans and bonds that are going to default. If successful in avoiding the true junk, then high yield as a whole should continue to produce an income stream that is competitive in our current interest rate environment.

Bottom-line

With PTY there is always a lot to consider given its multi-sector focus and history of trading at lofty valuations. This time around, the buy or sell argument remains similarly mixed. Positive attributes such as strong income production and a potential for a turnaround in the high yield space bode well for the fund. On the other hand, an 11% premium to NAV, rising levels of distressed debt, and the likely continuation of a Fed rate hiking cycle all pose as headwinds. This leads me to balance my rating in favor of “hold” again, as has been the case for the last few reviews. As a result, I would suggest readers who choose to buy this fund approach it very selectively at this time.

Be the first to comment