Khosrork/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 28th.

The Pacer Trendpilot US Large Cap ETF (BATS:PTLC) uses rules-based trend following strategy to alternate exposure between the S&P 500 index and 3-month treasury bills. This is a market timing strategy, meant to invest in equities during bull markets, but switch to T-bills during bear markets.

In my opinion and experience, market timing strategies are rarely successful, especially simple quantitative strategies like the one used by PTLC. The fund’s strategy has not been successful in the past, with the fund underperforming relative to a combination of its underlying holdings since inception, although only very slightly so. As such, I see no reason to invest in the fund.

PTLC – Overview and Strategy Analysis

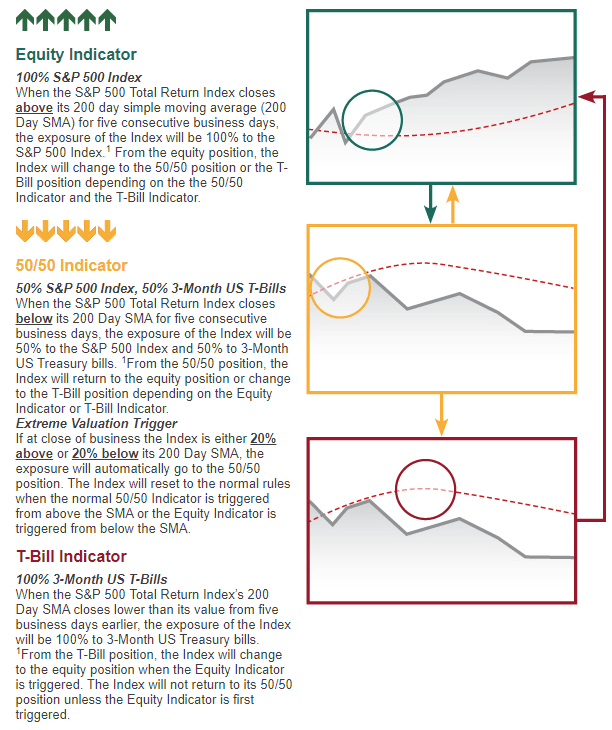

PTLC is an equity index ETF, tracking the Pacer Trendpilot US Large Cap Index. It is a bespoke index, specifically created by Pacer ETFs for use by PTLC. The fund alternates exposure between the underlying holdings of the S&P 500 and 3-month treasury bills. The strategy is quite complicated, but simplifying things a bit we can say it is as follows.

When the S&P 500 is higher than it was six months ago, the fund is completely invested in S&P 500 stocks.

When the S&P 500 is down from six months ago, or when there is any large sudden movement in its price, the fund is invested 50% in S&P 500 stocks and 50% in treasury bills.

When the S&P 500 is down from six months ago, and has been so for quite a while, the fund is invested 100% in treasury bills.

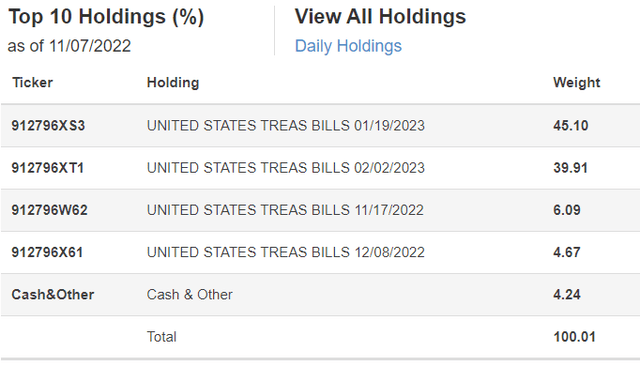

The S&P 500 has been down more or less uninterruptedly for months now, so the fund should be invested 100% in treasury bills. This is indeed the case, as expected.

PTLC’s actual strategy is as follows.

PTLC

In my opinion, although there are no significant negative issues with the strategy, there are some smaller negatives to consider. Two stand out.

First, is the fact that the strategy is very sensitive to market conditions and movements, and so fund holdings and performance can see significant changes from minor changes in conditions. As an example, the fund will shift to equities if the S&P 500 closes higher than average for five days straight, but won’t if it closes higher for only four days. Daily S&P 500 movements can have significant effects on the fund’s holdings, and hence its performance. This makes the fund’s strategy difficult to evaluate, increases risk, and makes fund performance very dependent on small, short-lived market movements.

Second, is the fact that the fund’s strategy is a form of market timing, which is incredibly hard, and rarely works. If timing the market were as simple as following a 1-page mechanical process everyone would do it, until the strategy ceased to work. In my opinion and experience, these simple mechanical market timing strategies rarely work, and I do not believe that PTLC will prove to be an exception. Importantly, the fund’s strategy has not been terribly successful in the past. Let’s have a look.

PTLC – Performance Analysis

PLTC’s performance track-record is mixed, but predominantly negative.

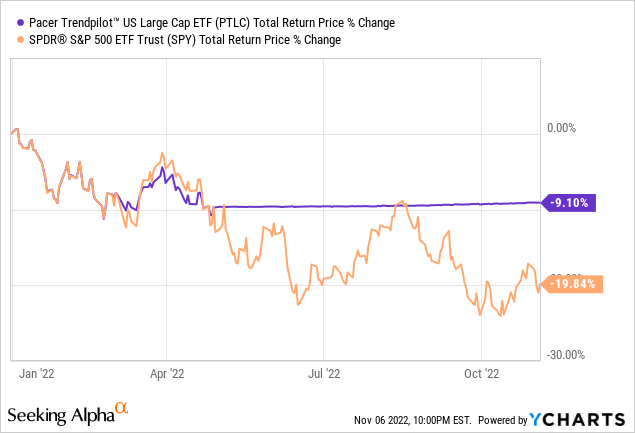

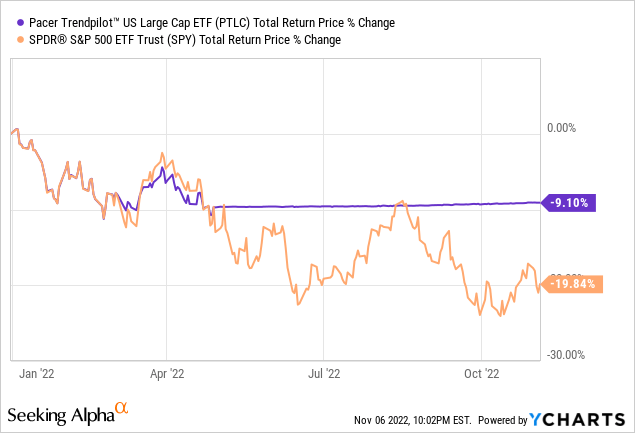

The fund is somewhat successful in shifting to treasuries during downturns and bear markets, reducing losses during these. As an example, the fund shifted to treasury bills in late April of this year, significantly reducing losses YTD.

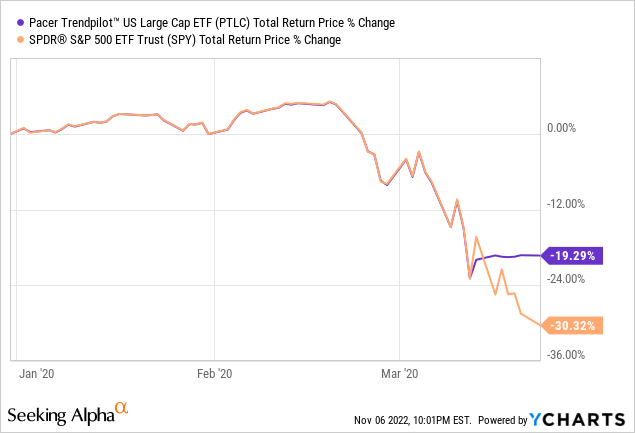

It was also technically the case during early 2020, the onset of the coronavirus pandemic, but barely so, owing to the suddenness of that crash.

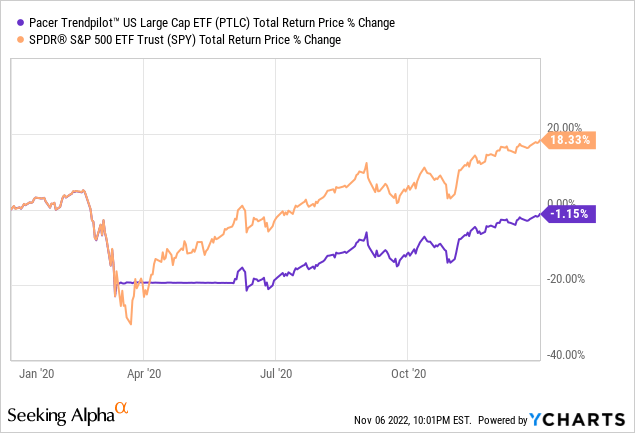

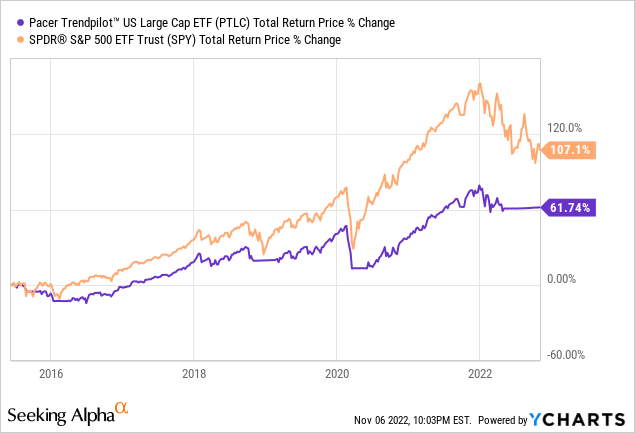

PTLC is less successful at shifting from T-bills to equities after markets bottom. In 2020, for instance, equities bottomed in late March, but the fund remained fully invested in T-bills until around June. Bad timing from PTLC’s part cost investors around 30% in gains. PTLC did avoid some losses, see above, but these were much lower, at around 10%. The net effect was negative, with the fund underperforming by around 20% during the year.

On a more positive note, the fund’s strategy seems to be working a bit better YTD. Conditions are in flux, but it seems that the fund has successfully avoided more in losses than in gains, so far at least.

As should be clear from the above, the fund’s strategy and performance track-record is mixed. Sometimes the strategy works, sometimes it does not. Since inception, the strategy has mostly been unsuccessful, with the fund significantly underperforming relative to the S&P 500 for the same. Underperformance is almost entirely concentrated in late 2015 to 2016, and early 2020.

Although PTLC’s performance could always improve moving forward, past performance is no guarantee of future results, I don’t believe that this will be the case. These market timing strategies rarely work, and there is simply no evidence to believe that PTLC’s strategy is the exception, nor any positive performance track-record one could point to.

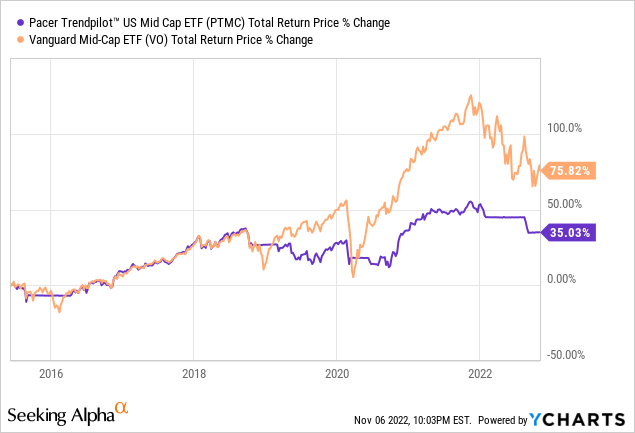

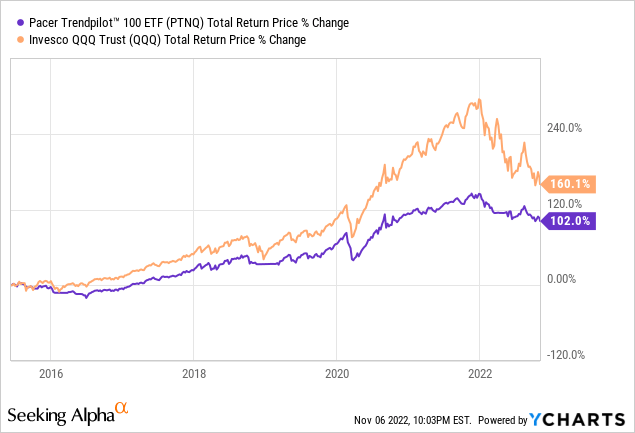

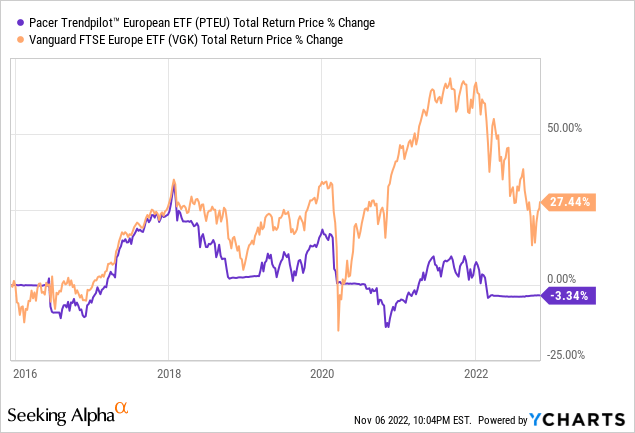

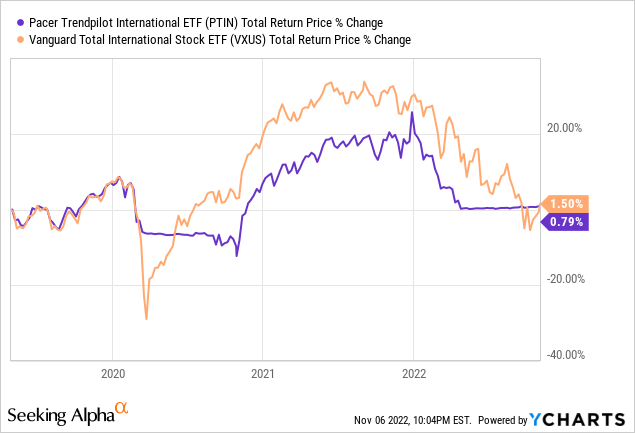

PTLC’s investment manager has four other ETFs with similar market timing strategies, but tracking other equity indexes. Three have underperformed relative to their index since inception, one matched / very slightly outperformed.

Pacer Mid-Cap ETF has underperformed.

Pacer Nasdaq-100 ETF has underperformed.

Europe ETF has underperformed.

International equity ETF has matched / slightly underperformed.

Of the above, only the international equity ETF has a reasonably strong performance track-record, and only because international equity indexes have performed terribly these past few years. The issue with these market timing strategies is remaining invested in T-bills when stocks start to post strong gains. International equities have posted very few gains these past few years, so this has been less of an issue.

In my opinion, the subpar performance of these ETFs is clear evidence that their strategies simply don’t work. Successful investment strategies don’t underperform four times out of five, and then have middling performance the other time. As such, I don’t believe that PTLC’s strategy will be successful moving forward.

Conclusion

PTLC uses rules-based trend following strategy to alternate exposure between the S&P 500 index and 3-month treasury bills. The strategy has been broadly unsuccessful in the past and will, I believe, continue to be unsuccessful in the future. As such, I see no reason to invest in the fund.

Be the first to comment