JHVEPhoto/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am constantly looking for additional income-producing assets that can supplement my current income. I use a variety of stocks in various sectors as I seek potential opportunities. I add to companies I own and start new positions when I seek more diversification. The current volatility may serve as an opportunity for investors.

In this article, I will look at a financial company. In my portfolio, I own banks, asset managers, and insurers. This article will analyze Prudential (NYSE:PRU), a prominent American insurer offering client asset management services. I have owned the stock since 2020 and am considering adding more to my current position.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Prudential Financial provides insurance, investment management, and other financial products and services in the United States and internationally. It operates through eight segments: PGIM, Retirement, Group Insurance, Individual Annuities, Individual Life, Assurance IQ, International Businesses, and Closed Block.

Fundamentals

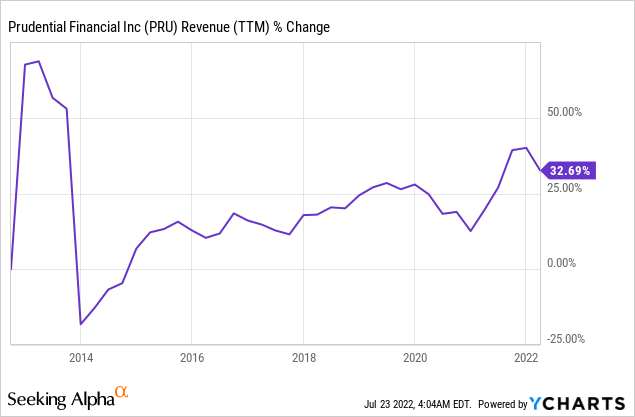

Revenues have increased by 33% over the last decade. Sales have increased by less than 3% annually over the past ten years. Prudential constantly buys and sells assets, focusing more on the bottom line growth. The company grows organically by increasing prices, selling more services, and through M&A activity, usually at a limited size, to improve its positioning. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Prudential to keep growing sales at an annual rate of ~2% following this year’s 10% decline due to weaker capital markets.

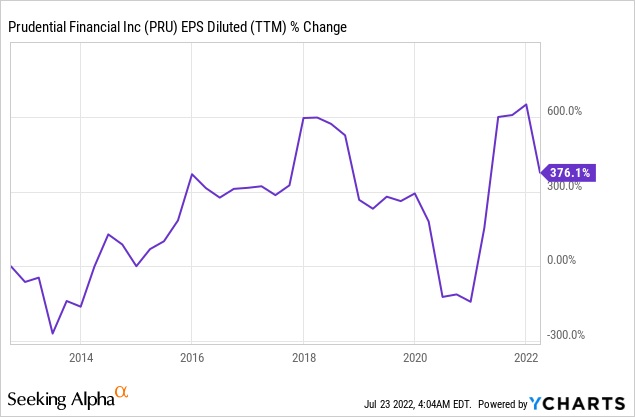

The EPS (earnings per share) has increased significantly over the same period. The volatility we see is due to the volatility in the stock market that affects returns. Prudential has been increasing EPS by achieving sales growth, buying back stock, and improving the margins by lowering expenses and focusing on assets with high returns while divesting others. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Prudential to keep growing earnings at an annual rate of ~10% following this year’s 10% decline due to weaker capital markets.

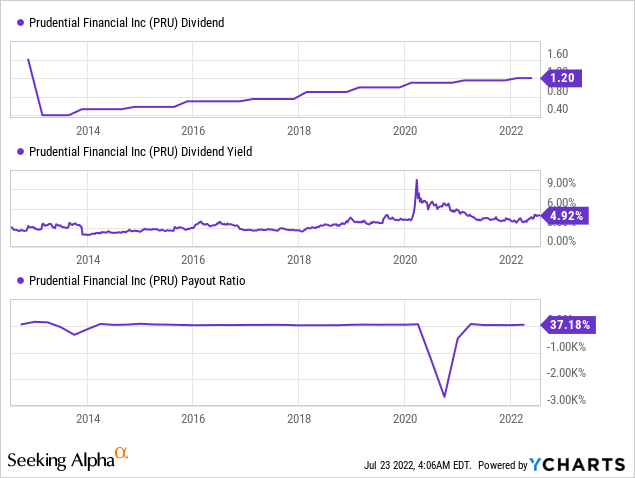

The dividend is one point where Prudential shines. The current dividend yield is 5%, following the latest 4% increase. It is a yield that surpasses the ten-year treasury yield significantly. The dividend is also safe as the company pays less than 40% of its EPS in dividends. Even the forecasted decline due to market volatility will likely not jeopardize the dividend, and investors should expect the 15th increase in a row in 2023.

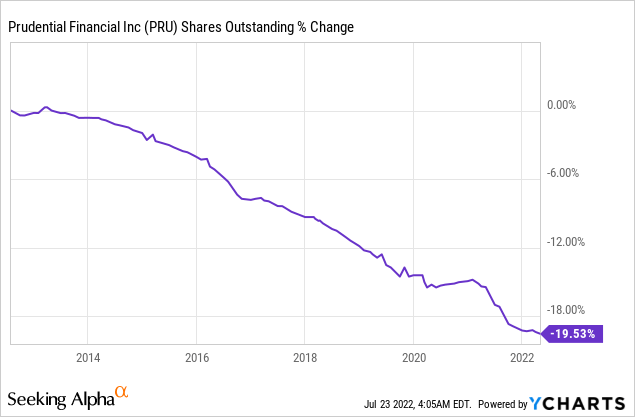

In addition to the significant dividend payments, the company also returns capital to shareholders by repurchasing its shares. Buybacks are an efficient way to return capital to shareholders, mainly in growing companies. Buybacks reduce the number of shares and thus support EPS growth. Prudential has decreased the number of shares by almost 20% in the last decade. The buybacks helped achieve significant EPS growth.

Valuation

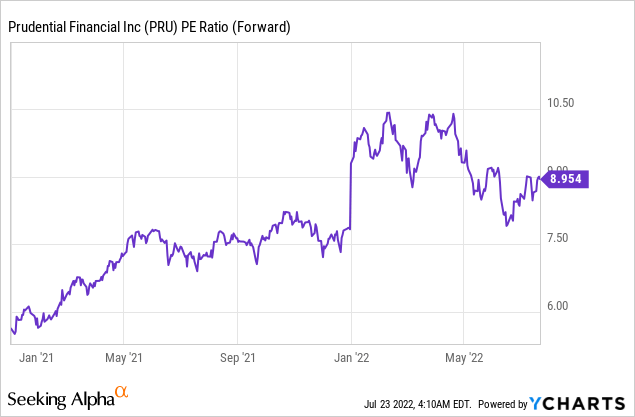

The P/E (price to earnings) ratio of Prudential has increased over the last twelve months. The forward P/E ratio using the forecasted EPS for 2022 is just shy of 9. It has increased in the previous year as the company is predicted to show lower EPS due to the declining capital markets. Yet, even under the soft guidance, a P/E ratio of 9 seems like a decent valuation. The current valuation allows Prudential to offer such a high and safe dividend.

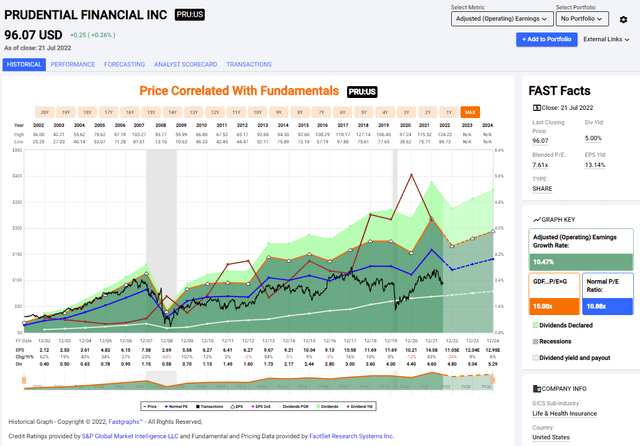

The graph below from Fastgraphs emphasizes that Prudential is trading below its average valuation. Over the last two decades, the company’s average P/E ratio was 10.9, significantly higher than the current 9. The growth rate over the previous twenty years was 10.5%. It is similar to the forecasted growth following a weaker 2022, which is already priced in the current share price.

Fastgraphs

To conclude, Prudential is one of the largest insurers in the United States and seems like a highly stable company. The company has strong fundamentals with top and bottom line growth, leading to dividends and buybacks to shareholders. In addition, the company is attractively valued compared to its historical valuation.

Opportunities

Diversification is a key growth opportunity. The company gains 39% of its sales from the international markets. Most prominently Japan and Brazil. Brazil is a growing emerging market, and Japan is the third largest economy in the world. It allows the company to use its scale to offer its diversified portfolio to many more clients and capitalize on the vast portfolio of products and services in insurance and asset management.

The superb execution of the company is a great opportunity. There are many companies with significant assets. Executing business plans using these assets is another challenge. Prudential showed strong execution capabilities during the pandemic when it dealt with a declining share price and high uncertainty. It also proved to be the case when the company announced a cost-cutting plan and managed to deliver. Despite the challenging environment, it has saved $680M out of the planned $750M.

In addition to cost cutting, the level of uncertainty in the central business, the insurance business, is declining. The pandemic is taking a much smaller part in our lives, and its impact is diminishing. The number of excess deaths is also on the decline, and the company has enough experience in pricing the risks of Covid. Therefore, the company can return more capital to shareholders. It paid $800M to shareholders in buybacks and dividends in Q1 and planned to keep increasing shareholders’ returns as it increased the dividend.

Risks

Inflation is risky for Prudential. The company has to deal with higher expenses due to increasing labor costs, making it harder to perform cost cutting. In addition, the inflation may lead to a recession which may cause clients to cancel their insurance and stop saving for retirement as they try to conserve cash to deal with the effect of the recession.

The recession risk is already affecting the market. The stock market shows negative returns, and it scares potential and current investors. The company has seen two quarters in a row with negative 3rd party net flows, and together with the higher expenses due to inflation, it pressures the margins. A deeper recession will make investors liquidate positions as they try to access their cash.

The competition is another risk for Prudential. In its life insurance business, it competes with other giants like New York Life, MetLife (MET), and Northwestern Mutual, and as an asset manager, it has to compete with BlackRock (BLK) and T. Rowe (TROW). They tend to offer more simple products compared to what insurers offer. Competition makes it harder to increase prices and forces companies to keep spending on marketing and innovation.

Conclusions

Prudential is a solid company with a long track record of good execution. The company combines solid fundamentals with great valuation. It has several growth prospects for the future, and the long-term trajectory is promising. However, the company has several short-term risks that increase the uncertainty due to its exposure to the capital market, making it harder to decide if this is an excellent point to acquire shares.

I believe the company is a HOLD as it is not significantly undervalued, and other asset managers have also performed poorly. However, I think investors should consider adding slowly to a position in Prudential. The risk of a recession is a significant short-term risk, and despite the company’s readiness for it, the share price might decline significantly. Therefore, investors should be cautious and hold or add very slowly.

Be the first to comment