JHVEPhoto

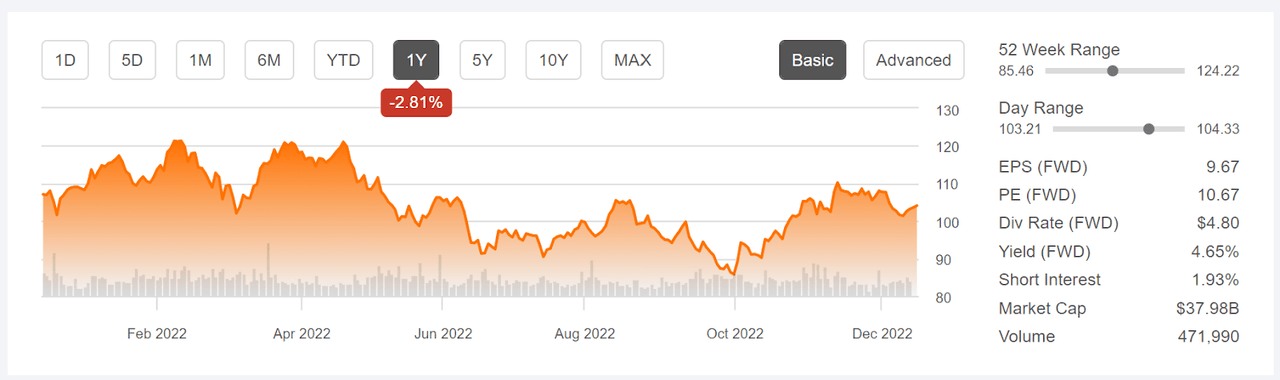

Prudential (NYSE:PRU) has delivered surprisingly good returns over the past year, even as earnings have been declining and are expected to continue to fall. The shares have returned a total of 2.8% over the past 12 months, as compared to 5.7% for the life insurance industry as a whole (as tracked by Morningstar) and -12.5% for the S&P 500 (SPY). Rising interest rates tend to be a tailwind for insurance companies, reducing the net present value of future liabilities. As I noted in a previous analysis of PRU, there is a long-term substantial positive correlation between changes in Treasury yield and PRU’s total returns.

Seeking Alpha

12-Month price history and basic statistics for PRU (Source: Seeking Alpha)

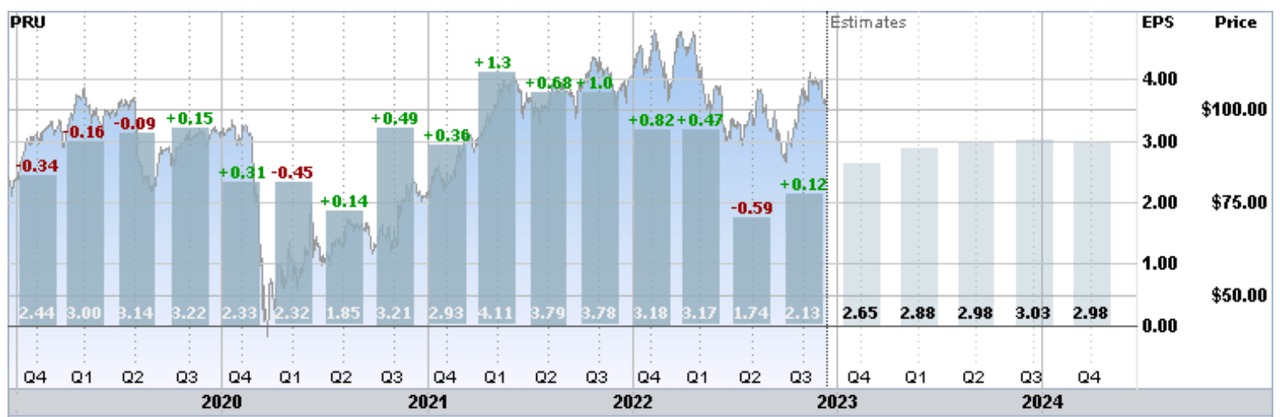

After missing the consensus on EPS for Q2, the company beat the earnings estimate for Q3 (reported on November 1, 2022). The EPS for the full year will be well below last year (2021). The outlooks for 2023, 2024, and 2025 have EPS coming in below the result for 2021 (Source: ETrade). According to Seeking Alpha, the consensus estimate for EPS growth is -6.4% per year over the next 3 to 5 years and Seeking Alpha growth grade is an F.

ETrade

Trailing (4 years) and estimated future quarterly EPS for PRU. Green (red) values are amounts by which EPS beat (missed) the consensus estimate (Source: ETrade)

Prudential is engaged in a major cost-cutting effort and management reported exceeding the planned $750 Million in cost savings a year ahead of schedule. In the near-term, further declines in the equity markets would tend to suppress earnings as asset-based fees decline and individuals are less inclined to invest. Over the longer term, Prudential’s strong balance sheet, growth in the pension risk transfer (‘PRT’) business, and the expectation that higher interest rates will persist are significant favorable attributes.

Generally speaking, PRU’s primary appeal will be to income-oriented investors. The forward dividend yield of 4.65% and the solid dividend growth over the past 10 years demonstrate the stock’s ability to provide current and future income. The dividend growth rate has been falling, with the 3-year annualized growth rate below the 5-year, and the 5-year below the 10-year.

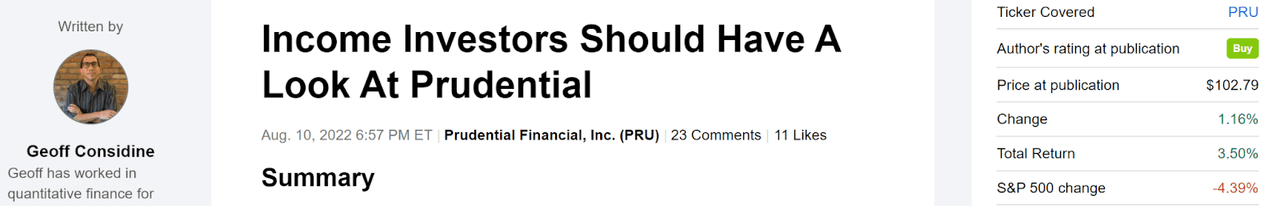

I last wrote about PRU about 4 months ago, on August 10, 2022, and I maintained a buy rating on the shares. At that time, the forward dividend yield was 4.77% and the forward P/E was 9.96. The Wall Street consensus rating on the shares was a hold, and the consensus 12-month price target was about 1.4% below the share price at that time.

By contrast, the market-implied outlook, a probabilistic price forecast that represents the consensus view from the options market, was slightly bullish to early 2023. Weighing the positive indicators (dividend track record, valuation, interest rate outlook, and market-implied outlook) vs. the negative indicators (Wall Street consensus outlook), I was convinced to maintain my buy rating. In the period since this post, PRU has returned a total of 3.5% vs. -3.9% for the S&P 500, including dividends.

Seeking Alpha

Previous analysis of PRU and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have calculated updated market-implied outlooks for PRU and I have compared these with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for PRU

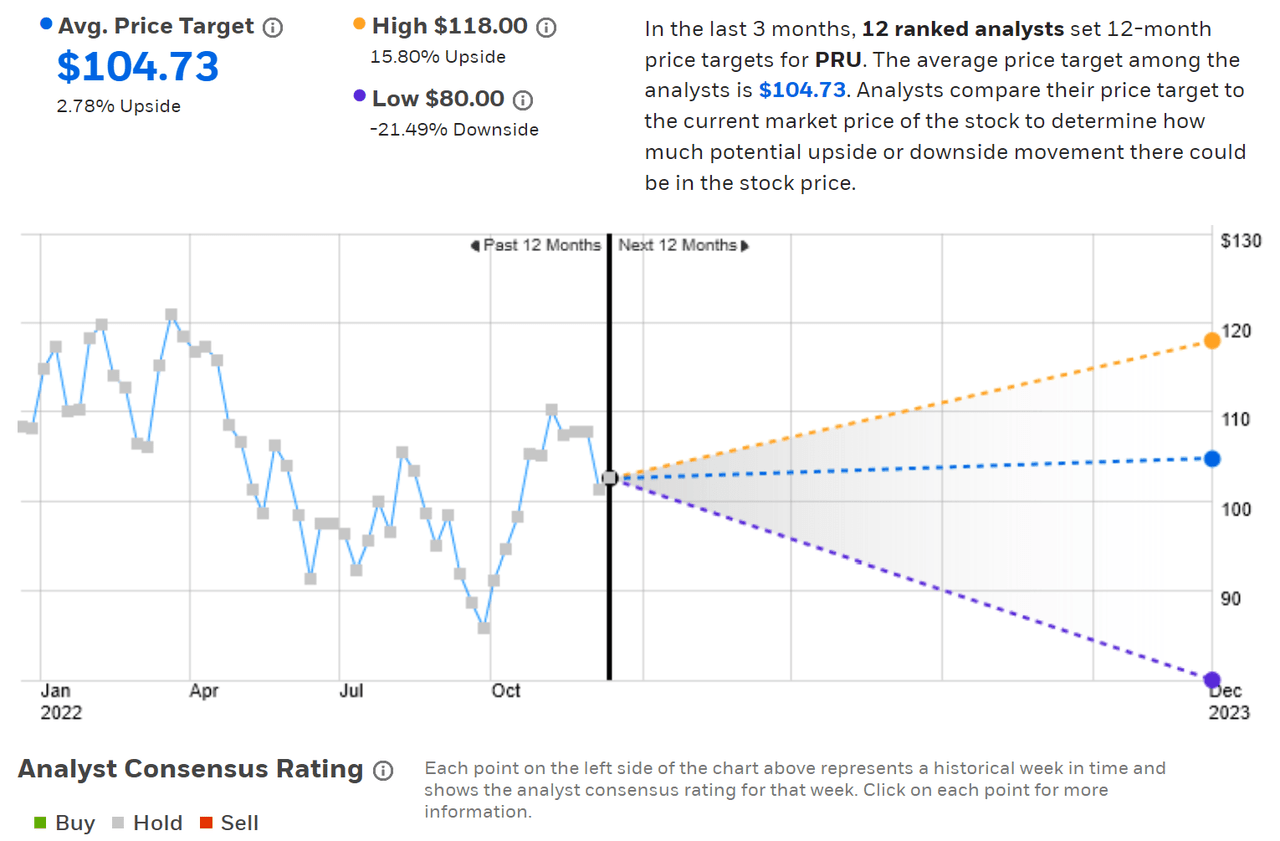

ETrade calculates the Wall Street consensus outlook for PRU using the views of 12 ranked analysts who have published ratings and price targets in the last 3 months. The consensus rating is a hold and the consensus 12-month price target is 2.8% above the current share price.

ETrade

Wall Street analyst consensus rating and 12-month price target for PRU (Source: ETrade)

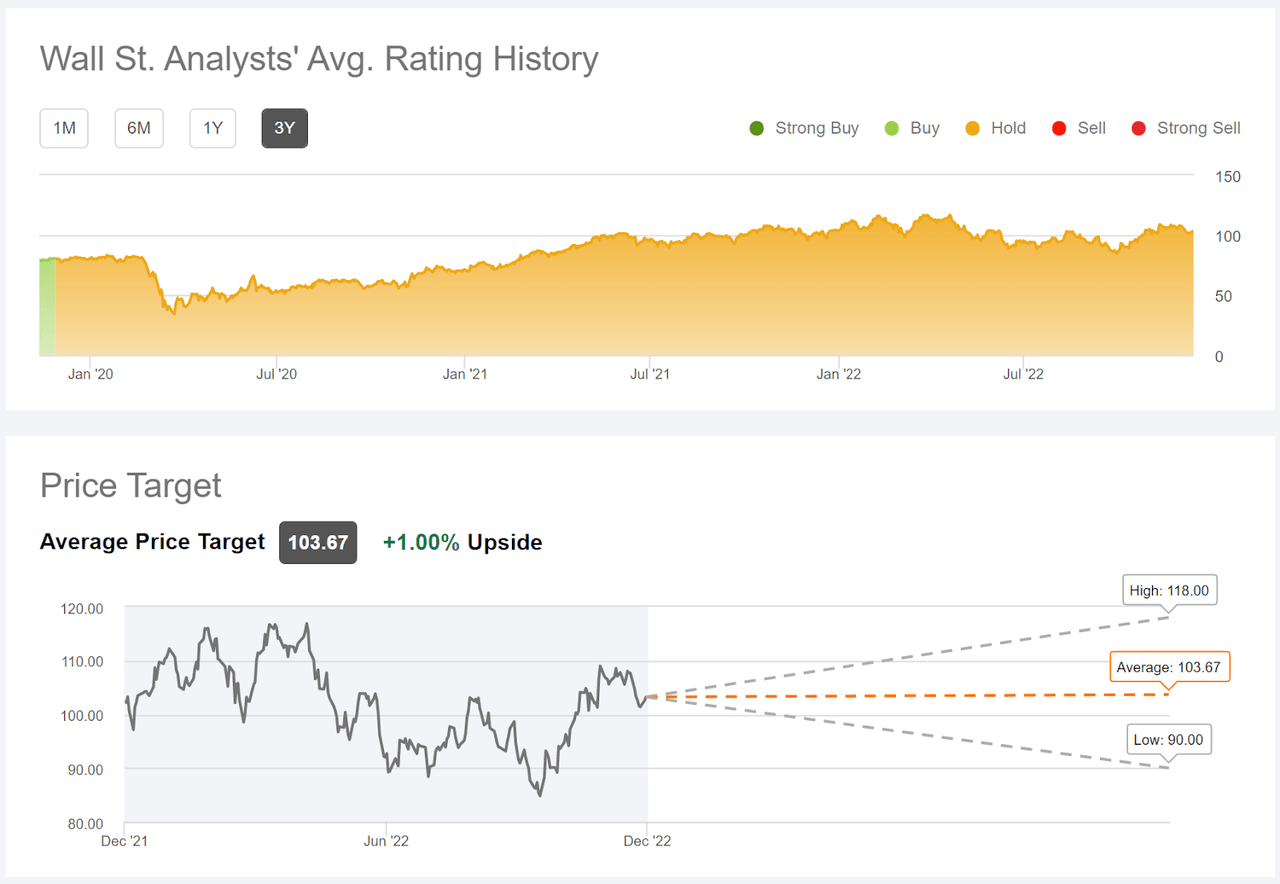

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 17 analysts who have published opinions over the past 90 days. The consensus rating is a hold and the consensus 12-month price target is 1% above the current share price. The consensus rating has been a hold for almost all of the past 3 years, including the period since late March of 2020 during which the share price has increased by 2.6X (PRU traded as low as $38.62 on March 23, 2020).

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for PRU (Source: Seeking Alpha)

The Wall Street consensus outlook for PRU is very similar to the results in my previous post: a hold rating and almost no expected price appreciation over the next year.

Market-Implied Outlook for PRU

I have calculated the market-implied outlook for PRU for the 6-month period from now until June 16, 2023 and for the 13.1-month period from now until January 19, 2024, using the prices of call and put options that expire on these dates. I selected these specific expiration dates to provide a view to the middle of 2023 and through the entire year.

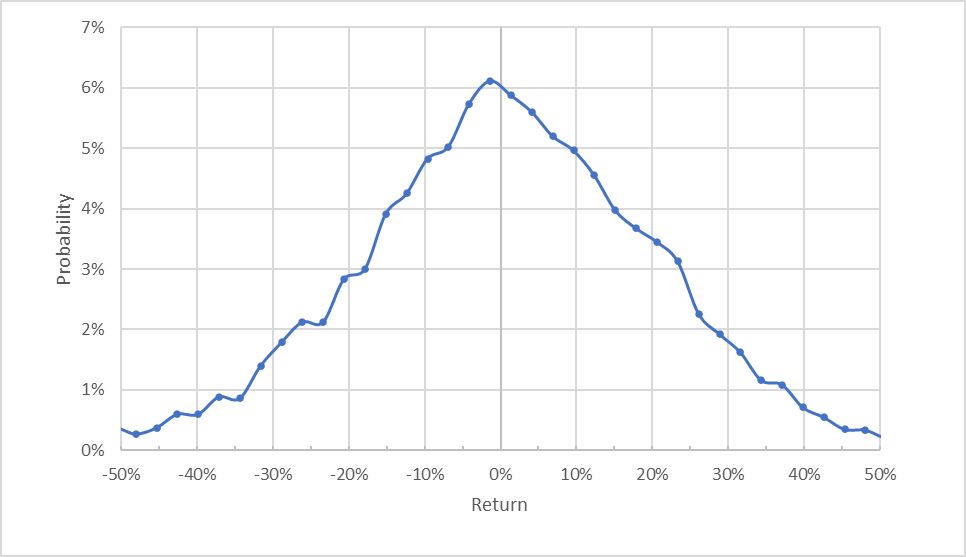

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for PRU for the 6-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook for the next 6 months is generally symmetric, with comparable probabilities for positive and negative returns of the same magnitude. The expected volatility calculated from this distribution is 30% (annualized), very close to the value that I calculated in August. For comparison, ETrade calculates an implied volatility of 29% for the options expiring on June 16, 2023.

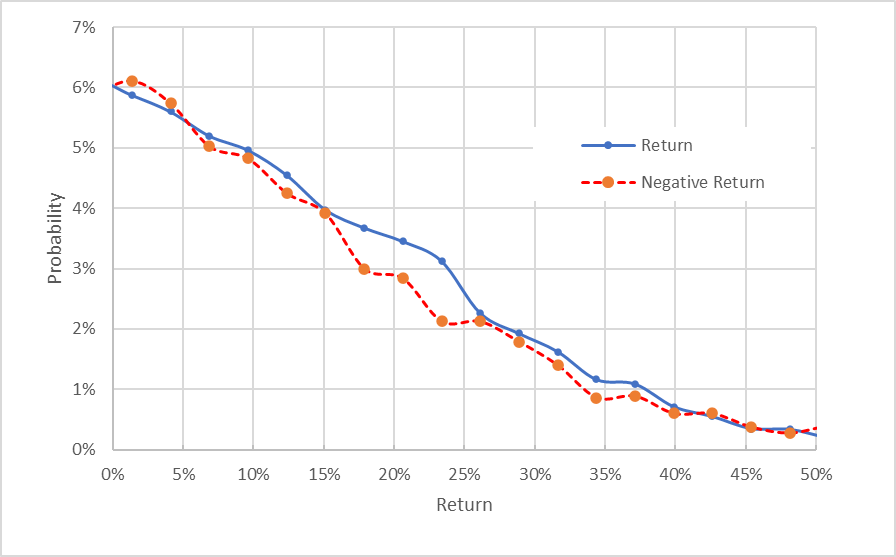

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for PRU for the 6-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows that the probabilities of positive returns tend to be slightly higher than for negative returns of the same magnitude, across a wide range of the most probable outcomes (the solid blue line is above the dashed red line over most of the left ⅘ of the chart above). This outlook exhibits a slight bullish tilt.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the bullish interpretation of this outlook.

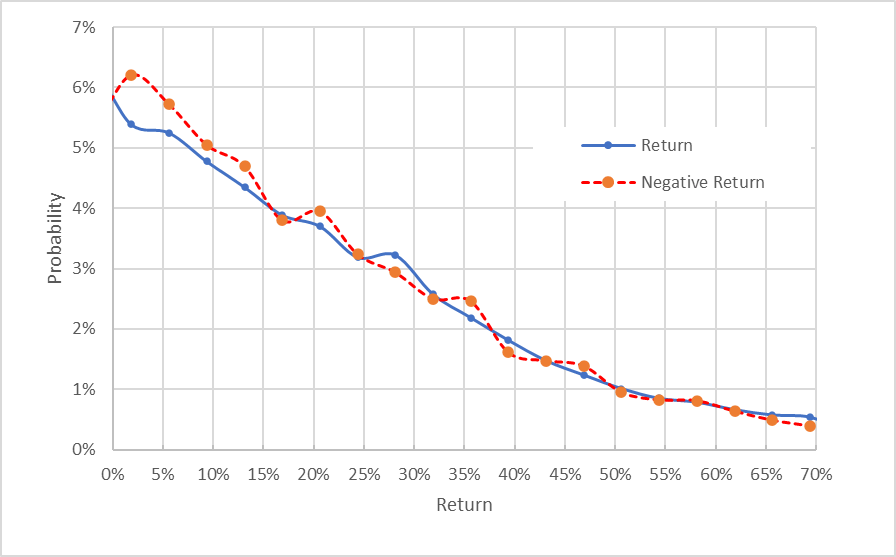

The outlook for the next 13.1 months has probabilities of positive and negative returns that are closer to one another than in the shorter-term outlook, although there is a range of smaller-magnitude returns for which the probabilities of negative returns are higher (the dashed red line is above the solid blue line over the left ⅕ of the chart below). Considering the potential for a negative bias, I interpret this outlook as neutral. The expected volatility calculated from this outlook is 30%.

Geoff Considine

Market-implied price return probabilities for PRU for the 13.1-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook for PRU is slightly bullish to the middle of 2023 and neutral for the full year, with expected volatility that is stable at 30%.

In my previous post, I discussed selling covered calls against PRU and that is the position that I have maintained (as disclosed in that post). Today, it is possible to buy PRU for $103.92 and to sell call options with a strike of $110, expiring on January 19, 2024, for $9.90 (this is the bid price).

Buying PRU and selling these calls results in a net position with 9.5% in option premium income ($9.90 / $103.92) plus 3.5% in dividends over the 13.1-month period from now until January 19, 2022 (it is expected that there will be 3 dividend payments of $1.20 each over this period). This 13% in income for 13.1 months corresponds to annual income of 11.9%, in addition to potential price appreciation of 5.9% (before the share price exceeds the option strike price).

Summary

Prudential’s earnings are in decline, and the consensus outlook is that they will continue to decline. That said, the company’s balance sheet is strong and the lower expected earnings are not a threat to the company’s long-term viability. The company may be able to offset some earnings pressure with cost-cutting and efficiency measures. The Wall Street consensus rating for PRU continues to be a hold, and the consensus 12-month price target is only 1%-2% above the current share price.

The prevailing analyst view may be underestimating the tailwinds provided by higher interest rates. The market-implied outlook is slightly bullish to the middle of 2023 and neutral for the full year, with moderate volatility. I am maintaining my buy rating on PRU. Because of the prevailing concerns about earnings growth, it is worth considering selling covered calls.

Be the first to comment