Pgiam/iStock via Getty Images

Due to the ongoing bear market, most investors are wondering how they should position their portfolio, especially given the headwind from the surge of inflation to a 40-year high. Financial stocks are interesting candidates, as they are among the few beneficiaries from the aggressive interest rate hikes of the Fed and the resultant expansion of their net interest margin. However, as the risk of an upcoming recession has greatly increased, investors should be especially careful and focus exclusively on banks that have proved resilient to recessions.

Prosperity Bancshares, Inc. (NYSE:PB) certainly fits this description. This disciplined bank has repeatedly proved resilient to recessions and it is currently trading at a nearly 10-year low price-to-earnings ratio. Therefore, investors should consider purchasing this stock around its current price.

Business overview

Prosperity Bancshares was founded in 1983 as a community bank, but it has greatly expanded since then thanks to organic growth and the acquisition of smaller banks. It currently operates 258 full-service banking locations in the greater Houston area and some neighboring counties in Texas, as well as 14 branches in Oklahoma.

Prosperity Bancshares benefits from some key characteristics of Texas, which is the second-largest state in the U.S., with 29 million residents. This state is characterized by superior economic growth compared to the rest of the country and has been ranked the #1 state for business for 9 consecutive years. It is also the state with the most headquartered companies in the Fortune 500 list, with 53 companies this year.

Prosperity Bancshares has a key competitive advantage when compared to most financial companies, namely its exemplary management. Thanks to the disciplined strategy of its management, the bank has proved exceptionally resilient to downturns. To be sure, in the Great Recession, while most banks incurred excessive losses and reduced their dividends sharply, Prosperity Bancshares grew its earnings per share by an impressive 29% and kept raising its dividend.

The bank has also proved resilient throughout the coronavirus crisis. Despite the fierce recession caused by the pandemic in 2020 and the nearly all-time low interest rates that prevailed in 2020-2021, Prosperity Bancshares grew its earnings per share by 10% in 2020 and by another 1% in 2021, to a new all-time high.

The conservative business model of Prosperity Bancshares causes the bank to grow at a slower pace than its peers during boom times. The financial companies that use a great amount of leverage are in principle able to grow at a fast pace during favorable economic periods. However, whenever a recession shows up, these banks incur a collapse in their earnings whereas Prosperity Bancshares remains highly profitable thanks to its prudent strategy. Overall, investors will be hard-pressed to identify a more disciplined and defensive bank than Prosperity Bancshares.

Thanks to its conservative strategy, this bank has exhibited a consistent growth record. It has grown its earnings per share at a 6.4% average annual rate over the last decade and at a 7.3% average annual rate over the last five years.

Prosperity Bancshares Growth (Investor Presentation)

The company has grown its bottom line consistently thanks to organic growth as well as a series of acquisitions of smaller financial companies. It is also worth noting that insiders own 4.2% of the shares of the bank and hence their interests are aligned with the interests of the shareholders.

As the Fed is raising interest rates aggressively in an effort to cool the economy and restore inflation to its normal levels, the economy has already slowed down and it is likely to enter a recession in the upcoming quarters. In such a case, most banks are likely to significantly increase their provisions for loan losses.

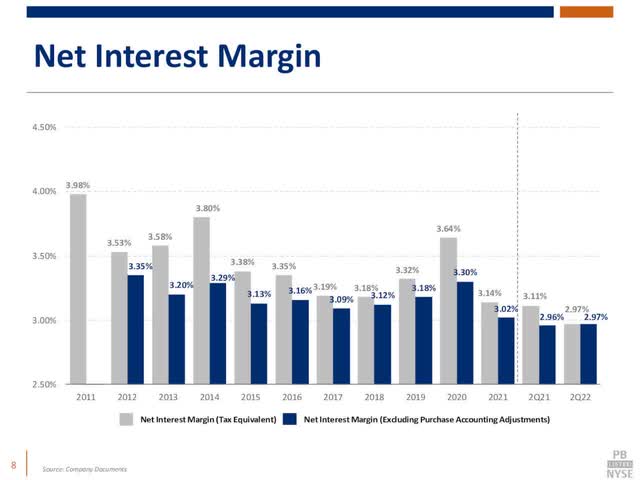

On the contrary, thanks to its disciplined approach, Prosperity Bancshares is not likely to incur material loan losses. Its non-performing loans, which have remained negligible for several consecutive quarters, are currently only 0.07% of total assets. As the bank has repeatedly proved in previous downturns, it has a high-quality loan portfolio and hence its loan losses are likely to remain limited even in the event of a recession. Even better, the bank will greatly benefit from the interest rate hikes implemented by the Fed. Due to the headwind from depressed interest rates, the company posted a 10-year low net interest margin in 2021.

Prosperity Bancshares Net Interest Margin (Investor Presentation)

Fortunately, Prosperity Bancshares is likely to soon begin to take advantage of rising interest rates, and thus it will probably enhance its net interest margin significantly in the upcoming quarters. This will provide a strong tailwind to the earnings of the company.

Signs of this tailwind have already shown up in the results of Prosperity Bancshares. In the second quarter, the bank grew its net interest margin sequentially from 2.88% to 2.97% and thus it grew its earnings per share by 5%, from $1.33 to $1.40. Further improvement is expected at this front, as the bank has only recently begun to take advantage of rising interest rates. Analysts seem to agree on the bright outlook of Prosperity Bancshares, as they expect the company to grow its earnings per share by 3% this year and by 10% next year.

Valuation

Prosperity Bancshares is currently trading at a nearly 10-year low price-to-earnings ratio of 12.6, which is lower than the 10-year average of 14.3 of the stock. It is also worth noting that the stock is currently trading at only 11.3 times its expected earnings in 2024. Moreover, the company has not missed the analysts’ earnings-per-share estimates for 17 consecutive quarters. As a result, it is reasonable to expect the bank to meet or exceed the analysts’ estimates in 2023 and 2024.

The reason behind the cheap valuation of Prosperity Bancshares is the effect of inflation on the valuation of most stocks, as inflation reduces the present value of future cash flows. However, the Fed is more determined than ever to restore inflation to its long-term target of 2%. To be sure, the central bank is raising interest rates at an unprecedented pace in order to cool the economy. The Fed is well aware that its policy is likely to cause a (hopefully mild) recession but it has prioritized reducing inflation to viable levels. Whenever inflation begins to subside, the valuation of Prosperity Bancshares will probably revert towards its historical average and thus the stock will enjoy a material tailwind. Nevertheless, as inflation has persisted for much longer than initially anticipated, great patience may be required for the investment thesis to play out.

Dividend

Prosperity Bancshares has raised its dividend for 18 consecutive years and it is currently offering a nearly 10-year high dividend yield of 2.9%. As the bank has a solid payout ratio of 38% and has proved resilient to downturns, investors should rest assured that the company will continue raising its dividend for many more years. The bank has grown its dividend by 8.9% per year on average over the last five years and by 8.3% per year on average over the last three years. Overall, Prosperity Bancshares is currently offering a lackluster dividend yield but it is likely to continue raising its dividend meaningfully for many more years.

Risks

A potential risk is the adverse scenario of a severe recession. As the Fed has adopted an aggressive stance towards inflation, the case of a severe recession cannot be ruled out completely. In such a case, Prosperity Bancshares is likely to incur material loan losses. However, thanks to its disciplined approach, the bank has always endured downturns more readily than most of its peers and hence investors will just need to be patient until the subsequent recovery in such an adverse scenario.

The other risk is the scenario of persistently high inflation for years. In such a case, Prosperity Bancshares will benefit from high interest rates but the valuation of its stock will probably remain under pressure for a long period. Therefore, great patience will be required in such a scenario as well.

Final thoughts

Prosperity Bancshares is an exceptionally managed bank, which has repeatedly proved resilient to recessions. As the stock is trading at a nearly 10-year low valuation level, it is likely to greatly reward investors over the long term. On the other hand, due to the pronounced economic slowdown and the markedly negative market sentiment prevailing right now, investors should be aware that great patience may be required for the investment thesis to play out.

Be the first to comment