Khanchit Khirisutchalual/iStock via Getty Images

The book value discount of Prospect Capital Corp (NASDAQ:PSEC) has widened significantly in June, but the stock should only be approached with extreme caution.

Even though Prospect Capital’s portfolio is currently performing well in terms of non-accruals, a recession is likely to result in an increase in problem loans, which could lead to another dividend cut.

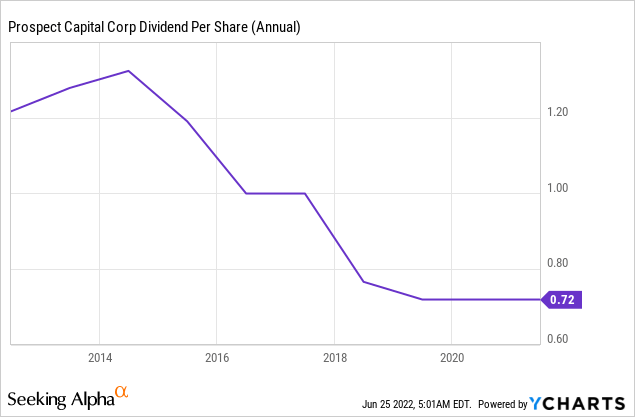

Prospect Capital has a history of cutting dividends, and investors should expect another dividend cut if the U.S. economy enters a slump.

Decent Portfolio Performance And A Low Amount Of Non-Accruals (So Far)

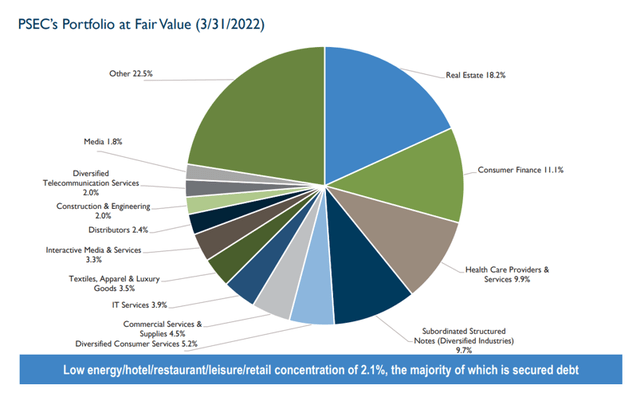

Prospect Capital is a business development firm with $7.5 billion in assets as of March 31, 2022. The BDC had 127 investments in 39 industries, but it makes a point of avoiding or limiting exposure to industries that pose cyclical earnings risks. Oil and gas, retail, and hospitality are examples of such industries.

Prospect Capital’s primary investment focus is on real estate, consumer finance, and healthcare providers, with 1st liens and other secured debt accounting for approximately 67% of Prospect Capital’s investments.

Other business development companies, such as Goldman Sachs BDC, Golub Capital BDC, or Owl Rock Capital, have significantly larger allocations of funds to 1st lien debt than Prospect Capital, making them safer BDCs to own.

Portfolio At Fair Value (Prospect Capital Corp)

Two Factors That Speak For Prospect Capital

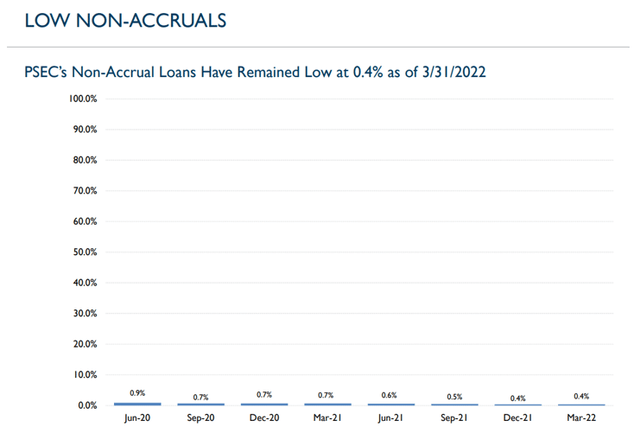

Prospect Capital has two positive attributes. The company currently has a very well performing loan portfolio, so the BDC does not need to change its pay-out policy. Prospect Capital’s non-accrual ratio was 0.4% as of March 31, 2022. There was no QoQ change in the non-accrual ratio in the first quarter.

As a result, Prospect Capital’s loan portfolio is generally producing the expected interest income. A recession, on the other hand, could drastically alter Prospect Capital’s investment landscape, as non-accruals typically rise rapidly during recessions.

Low Non-Accruals (Prospect Capital Corp)

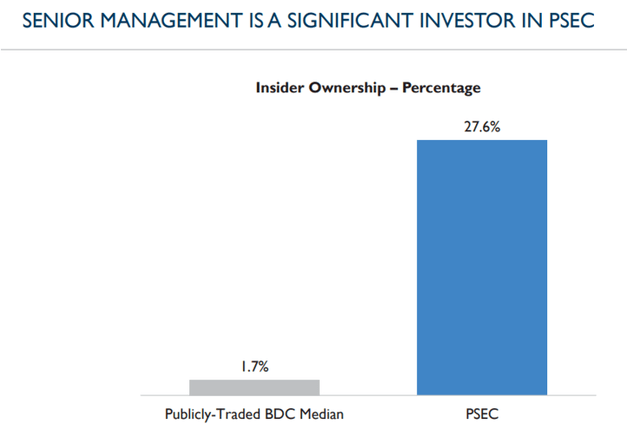

The second advantage Prospect Capital has is that management owns a significant portion of the business development company’s stock. Senior management at Prospect Capital owns 27.6% of the BDC’s shares.

Insider Ownership (Prospect Capital Corp)

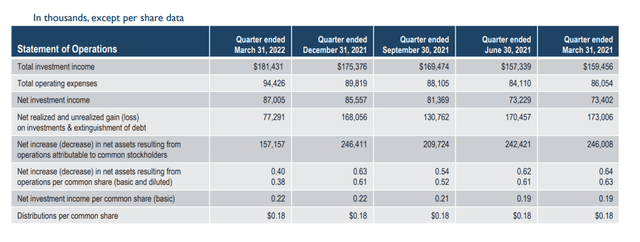

Dividend Remains Covered (For Now)

Prospect Capital’s dividend was covered by net investment income. Prospect Capital’s net investment income was $0.22 per share in 1Q-22, exceeding the $0.18 per share dividend payout. Prospect Capital had an 86% pay-out ratio based on net investment income in the previous year.

Net Investment Income (Prospect Capital Corp)

With that said, anyone who has owned PSEC for more than a year or two is aware that the company has been a serial dividend cutter. Prospect Capital currently pays a quarterly dividend of $0.18 per share, split into three equal monthly dividends of $0.06 per share. Prospect Capital’s long-term track record, on the other hand, is unimpressive, and it speaks volumes about the sustainability of the BDC’s current dividend payout.

Wide Discount, But Don’t Be Seduced To Buy

Prospect Capital is trading at 0.68x book value, representing a 32% discount to book value. Many BDCs began trading at book value discounts in June, owing to investors pricing recession-related book value losses into BDC valuations.

Prospect Capital has a relatively low amount of secured debt investments (67%), a history of dividend cuts, and a history of book value losses, so a 32% discount to book value, while significant, is not a compelling reason to buy PSEC here.

Why Prospect Capital Could See A Higher Stock Price

There is no certainty or guarantee that the U.S. economy will enter a recession or that a recession will be severe enough to cause large loan losses. However, if history is any guide, recessions do tend to cause financial stress for investment firms. PSEC would be a risky BDC to own, given that Prospect Capital has already cut its dividend several times.

As a result, I expect PSEC to trade at significantly greater discounts to book value than its competitors in the future.

My Conclusion

Prospect Capital’s book value discount increased to 32% in June. Despite the fact that the BDC profits from a well-performing loan portfolio, dividend risks have undoubtedly increased recently, and the book value discount suggests that investors are not confident in Prospect Capital’s book value.

Prospect Capital could suffer significant book value losses in the event of a recession, owing to its low level of secured debt in its portfolio. If the BDC’s net investment income begins to fall, investors should expect Prospect Capital to reduce its payout once more.

Be the first to comment