Bet_Noire/iStock via Getty Images

During the COP 26 UN climate change conference held from October 31 to November 12, 2021, in Glasgow, U.K., oil producers from Saudi Arabia to Shell (SHEL) were not welcome. Only two months ago, it was ‘criminal’ to produce oil and gas in Europe, bemoaned Eni SpA (E) CEO Claudio Descalzi.

Then, the Russian invasion of Ukraine changed everything. The crown prince of Saudi Arabia Mohammed bin Salman Al Saud was implored by western leaders to produce more oil. Oil executives in Houston were accused of unpatriotic act of not using the record profits to pump more oil.

More and more investors now ask whether they should invest in oil stocks or not, if it is too late to make an entry, and what stocks to buy.

The pros of investing in oil stocks

Oil stocks are a good investment at this time

I believe the merits of investing in any stock, or the lack thereof, should be assessed based on three criteria:

- Does the company own high-quality assets, the product from which will be needed by human beings in 10, 20, and 30 years, and which generate enough profits across industry cycles such that a high rate of return can be had?

- Is the business run by an able and shareholder-friendly management?

- Can I buy it at significant discount to its conservatively-estimated intrinsic value?

Firstly, oil and gas will continue to be used for decades to come. Elon Musk said, “If there was a button I could press to stop all hydrocarbon usage today, I would not press it.” Musk knows the mining equipment used for extracting nickel and lithium for Tesla EV batteries will stop humming without diesel. He knows many drivers will not be able to recharge their Tesla without the base-load electricity generated at coal or natural gas-fired power plants. It will take decades to replace hydrocarbons with renewable energy.

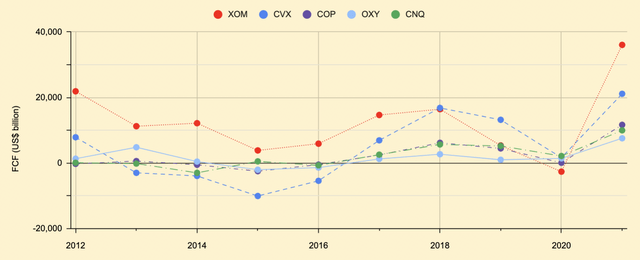

In 2021, the first year after oil companies came out of the worst bear market in its 175-year history, five randomly-selected large oil companies in North America – Exxon Mobil (XOM), Chevron (CVX), ConocoPhillips (COP), Occidental Petroleum (OXY), and Canadian Natural Resources (CNQ) – delivered a free cash flow yield of 6.66% to 14.23%, averaging 10.82% (Fig. 1). As a comparison, the FAANG stocks – market darlings – only pulled in an FCF yield of -0.89% to 6.46% with an average of 2.45%, which is only slightly better than what the oil stocks averaged during the 2014-2020 bear market.

Fig. 1. Annual free cash flow of five large-cap oil companies in North America. (Laurentian Research)

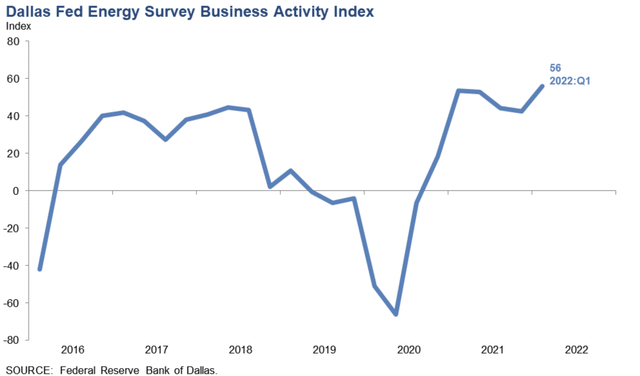

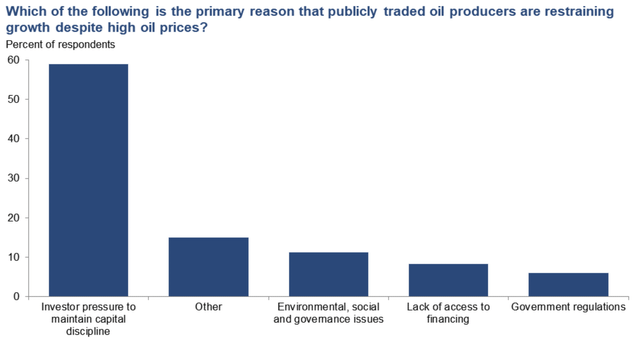

Despite record profits, capital discipline is still the management mantra in Houston. According to Dallas Fed Energy Survey, the oil industry business activity index hovered around 50 over the past five quarters, although WTI rose from $50 to $130 per barrel during that time (Fig. 2). Executives from 132 oil companies surveyed by Dallas Fed cited the need to reward shareholders – in the forms of debt repayment, cash dividends and share buyback – as the primary reason that they are restraining growth despite high oil prices (Fig. 3).

Fig. 2. Dallas Fed Energy Survey business activity index. (Dallas Fed)

Fig. 3. Statistics of the answers of executives from 132 oil companies to the question why publicly traded oil producers are restraining growth despite high oil prices. (Dallas Fed)

Lastly, oil stocks are still incredibly cheap as the rich FCF yield indicates. From a value investing point of view, oil stocks are clearly a better investment than big tech that dominates index funds these days (see above).

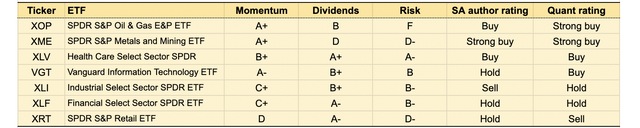

The above assessment is confirmed by a comparison of various sector ETFs using Seeking Alpha quant ratings. The SPDR S&P oil & gas E&P ETF (XOP) receives a ‘strong buy’ rating. Although it is perceived as very risky, XOP has the best momentum, suggesting oil stocks are a great contrarian buy at this time (Table 1).

Table 1. A selection of sector ETFs, shown with Seeking Alpha quant ratings. (Seeking Alpha compiled by Laurentian Research)

Has oil peaked?

I bet some of you are thinking of this: Well, oil stocks appear to be good value, but the oil prices may have peaked at $130 and are probably going downhill from here, aren’t they?

- Before I present an answer to the above question, let me say this first: Do not allow yourself be misled by those who claim they have the prowess of prophesying security or commodity prices. Not long ago, market pundits played the role of a Judas goat and led impressionable investors to frothy growth tech stocks right before a crash. Now, market pundits forecast that Russia’s invasion of Ukraine marked the oil price peak, warning it’s too late to get aboard the oil bull bus. Many of those who call peak oil today are probably the same people who told you back in 2020 that oil was on a terminal decline. I am not sure someone who failed to predict in March 2020 the start of a generational oil bull market is now able to forecast the beginning of an oil bear market.

To those who are worried that oil may have peaked, the good news is a commodity super-cycle seems to be in full swing, of which the oil bull market is a part. This commodity super-cycle is driven by a series of societal changes, including the global populist movement and ensuing wealth redistribution, de-globalization and resultant supply chain reset, and the decarbonization movement, as I summarized in a previous article. Further intensifying the demand-driven commodity super-cycle, capital investment in natural resources was reduced so much during the commodity bear market in the last decade that a sustained structural weakness in supply has resulted.

- The commodity super-cycle had already been ongoing before Putin decided to invade Ukraine. The Ukraine crisis only further strained commodity (especially oil and gas) supply weakness, and exposed the fragility of the global supply chain built during the last 30 years of radical globalization. The commodity super-cycle is thus to believed to continue even if the Ukraine War comes to a quick end.

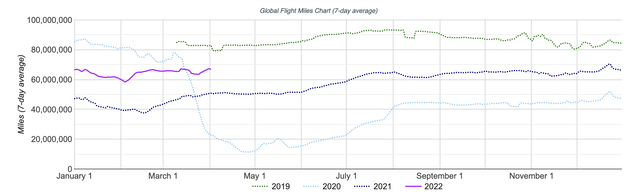

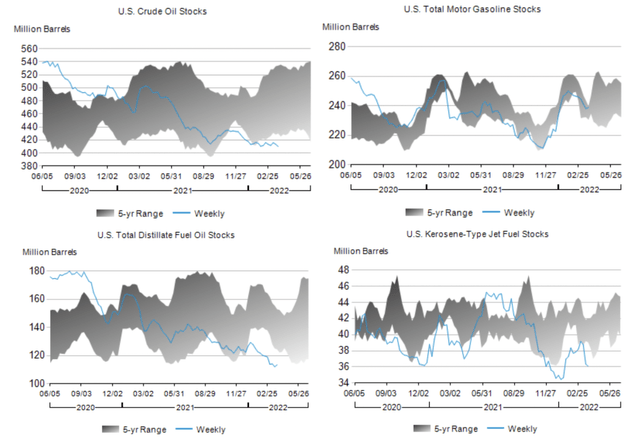

Looking at the oil supply-demand dynamics, there are still no signs that oil prices have peaked and that an oil bear market is afoot. U.S. demand remains strong even as gasoline prices reach new highs. Global flight miles continue to improve (Fig. 4). On the other hand, supply remains weak due to thin OPEC+ spare capacity and capital discipline of U.S. shale producers. As a result, liquids inventory continues to draw and has reached multi-year lows with no sign of abating (Fig. 5).

Fig. 4. Global flight miles chart, 7-day average. (Airportia)

Fig. 5. U.S. stocks of crude oil, gasoline, distillates, and jet fuel. (U.S. EIA)

- The exit of western capital, industry expertise (especially the big three oilfield service providers Schlumberger (SLB), Halliburton (HAL), and Baker Hughes (BKR)), and forced shut-in of high-cost wells should result in Russian supply weakness going forward, even if short-term interruption of Russian oil exports is resolved.

- Last week, the White House announced the release of 180 MMbbl of oil from the Strategic Petroleum Reserve (or SPR) ahead of the midterm elections, while IEA countries plan to dump additional 61.7 MMbbl of oil into the market. A bandaid for a hemorrhage, the SPR release only serves to validate the bull market perception for standers-by, reduce the SPR to a dangerously low level, and precipitate a massive refill down the road, thus providing a downside protection for future oil prices. The way the market reacted to the SPR release announcement is interesting. While the spot WTI oil price immediately dropped $6 per barrel, the back-end (2025) rose by some $7 to $80/bo. As we know, although reducing the front month price may have dented the earnings of the next quarter, lifting the entire futures curve by that much will surely lead to an upward rerating of the value of oil reserves, which makes oil equity an even better value – one more reason to go long oil stocks.

- Few politicians understand oilfield development has a project cycle as long as ~7 years; it is ludicrous to expect oilmen to just turn on the spigot to flow more oil for you. As much as today’s high oil prices are the consequence of yesteryear’s under-investment, continued denunciation of oil producers, strangulation of capital flowing into oil investment, and stringent regulations under the pretext of climate policy will only extend the energy crisis and prolong the oil bull market for investors.

Inflation

We had been told the inflation would be ‘transitory’ by Fed officials, citing it was driven by Covid-19 pandemic-related supply chain disruptions and demand issues. Then, we were told it’s time to retire the word and inflation is no longer ‘transitory’.

However, inflation continues to surge higher regardless of the deflationary tendency of technological innovation. Brevan Howard, a well-regarded macro hedge fund, even sees rising risk of 1970s-style inflation. As Russia’s invasion of Ukraine brings about a compartmentalized global supply chain, the West accelerates the pace of ditching JIT-kind of efficiency in favor of supply chain resilience, which is supposed to raise commodity prices.

Therefore, investors should be seriously considering hedging against inflation. To that end, Jeff Currie at Goldman Sachs suggests “Oil and copper are the best hedges against inflation”.

The cons of investing in oil stocks

As with any industries, the oil patch has its own dubious stocks that are characterized by lousy assets operated by fishy management. When a generalist investor arrives at the oil equity space, he may be first attracted to those stocks that have been pumped by torque-fetish promoters to a level unjustified by their intrinsic value. Therefore, caution must be applied to ensure only high-quality ideas are picked.

Even though oil is in the center of the ongoing commodity super-cycle, oil stocks are inherently cyclical. That means, at some point down the road, oil investors will have to exit to protect the gains. That requires investors to have a pretty good idea concerning which business operational parameters to monitor, how to inform themselves of the oil industry cycle, and what steps to take in an exit.

Above all, a new investor needs to rethink his own investment system to incorporate cyclical investing, and to manage the discomfort of purging certain received wisdom or specious perception regarding oil stocks, e.g., cyclicals are uninvestable, oil is evil, energy index funds are the way to go, and large-cap has lower risk than small-cap. Once an adequate circle of competence has created around oil stocks, an investor will find truly generational opportunities without much increased risk.

Which Oil Stocks to buy?

The best oil stock pick depends on an investor’s personalized investment goal, risk appetite, and time horizon.

If you need a source of income that is not only stable but also growing considerably faster than inflation, either Pembina Pipeline (PBA) or Diversified Energy Company Plc (OTCQX:DECPF) may suit you.

- Pembina Pipeline is a growing North American midstream player. Its existing infrastructure is protected by an economic moat that becomes wider every time Ottawa pushes forward its anti-oil policy. The stock currently has a dividend yield of 5.28% but you may wait for a dip to have a higher initial yield.

- Instead of succumbing to business cyclicity the industry is notorious for, Diversified Energy builds a highly-profitable, secularly-growing business by serially acquiring old producing gas wells in the U.S. The company keeps raising dividends, the stock currently pays a dividend yielding 10.86%, which is attractive even after foreign withholding tax.

If capital appreciation is what you desire, you may consider small-cap oil and gas companies that tend to be more aggressive in the pursuit of production growth than large-cap producers. Additionally, I believe oilfield service vendors stand to benefit massively in the back half of the oil bull market.

- E&P examples include Earthstone Energy (ESTE), a roll-up play in the Permian Basin; Headwater Exploration (OTCPK:CDDRF), the hottest Canadian heavy oil producer that is growing at a neck-breaking clip; Karoon Energy (OTCPK:KRNGF), an oil producer in offshore Brazil with a highly-visible growth trajectory; Africa Oil (OTCPK:AOIFF), a barbell play that produces oil in deepwater Nigeria and is full of optionality; and Santos (OTCPK:STOSF), a large indie that gives you exposure to Asian LNG as well as Alaskan conventional oil.

- I like Schlumberger, the industry leader, and Total Energy Services (OTCPK:TOTZF), a well-run Canadian small-cap, among oilfield service providers.

Investor takeaways

There are pros and cons of investing in oil stocks. However, as I reasoned above, the pros clearly dominate the cons. Well-picked oil stocks are a great investment in the value investing tradition, as Warren Buffett recently showed. The oil bull market, as part of the commodity super-cycle, still has legs.

Investors new to the oil patch do need to steer clear of heavily-promoted torquey stocks, and gravitate toward investment ideas underpinned by high-quality assets and upright management, examples of which are presented whether you need to generate income or whether you are after capital appreciation.

[This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.]

Be the first to comment