Chip Somodevilla/Getty Images News

Meta Platforms (NASDAQ:FB) has seen stock sentiment swing from being a growth stock to being a legitimate value stock – all in just a few months’ time. The stock has typically avoided tech-like volatility due to its strong free cash flows, but the recent earnings report sent the stock diving lower, wiping out nearly 3 years worth of gains. The stock is now trading at 16x trailing earnings, the kind of multiple that is typically assigned to companies with no growth. I expect growth to return and for the stock price to react in a dramatic fashion. I rate shares a strong buy as one of my higher conviction ideas in today’s market.

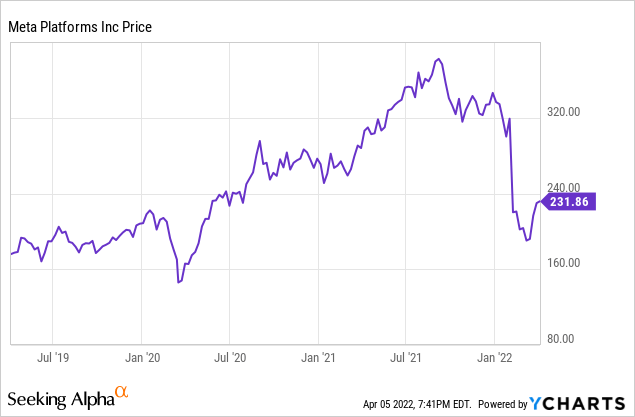

FB Stock Price

After peaking at $384 per share in late 2021, FB has tumbled over 40% to now trade around $230 per share.

This stock price places it cheaper than where the stock traded 2 years ago and around the same price it traded in July of 2018. The company has grown materially during this time frame, making this stock price action a reflection of the flip in sentiment towards the stock. Once a “must-own” growth stock, the company is now facing doubts regarding its ability to return to growth at all.

FB Stock Key Metrics

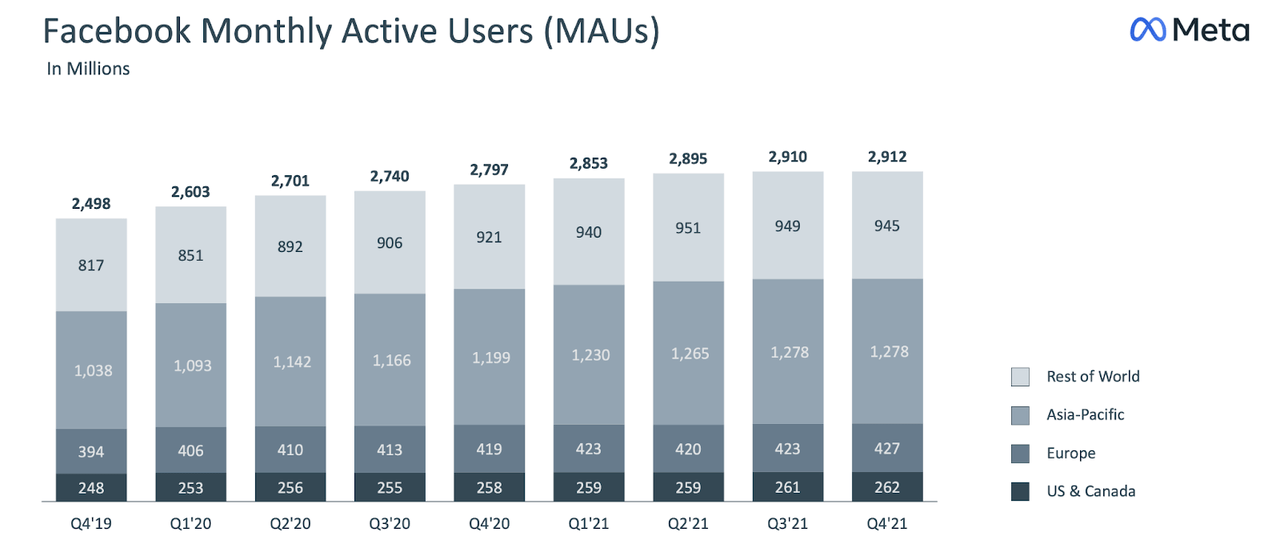

The latest quarter saw FB grow revenues by 20%. That was a solid growth rate, but investors were spooked by two issues. First, monthly active users essentially stalled sequentially. Investors have become worried that competition from companies like TikTok and Snapchat (SNAP) has finally caught up to the social media incumbent.

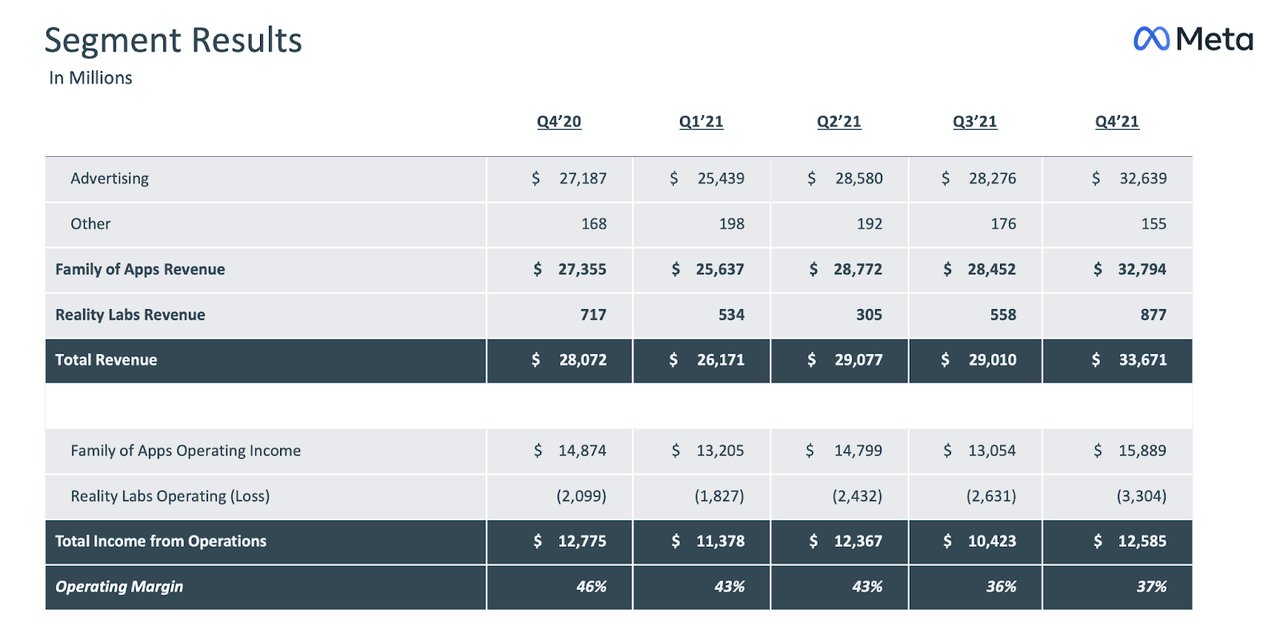

FB 2021 Q4 Presentation

Second, FB faced material impact from Apple’s (AAPL) data privacy changes, which management expects to impact revenues by $10 billion this year. The data privacy changes have negatively impacted the ROI of social media advertising, and it will take the company time to work through these changes.

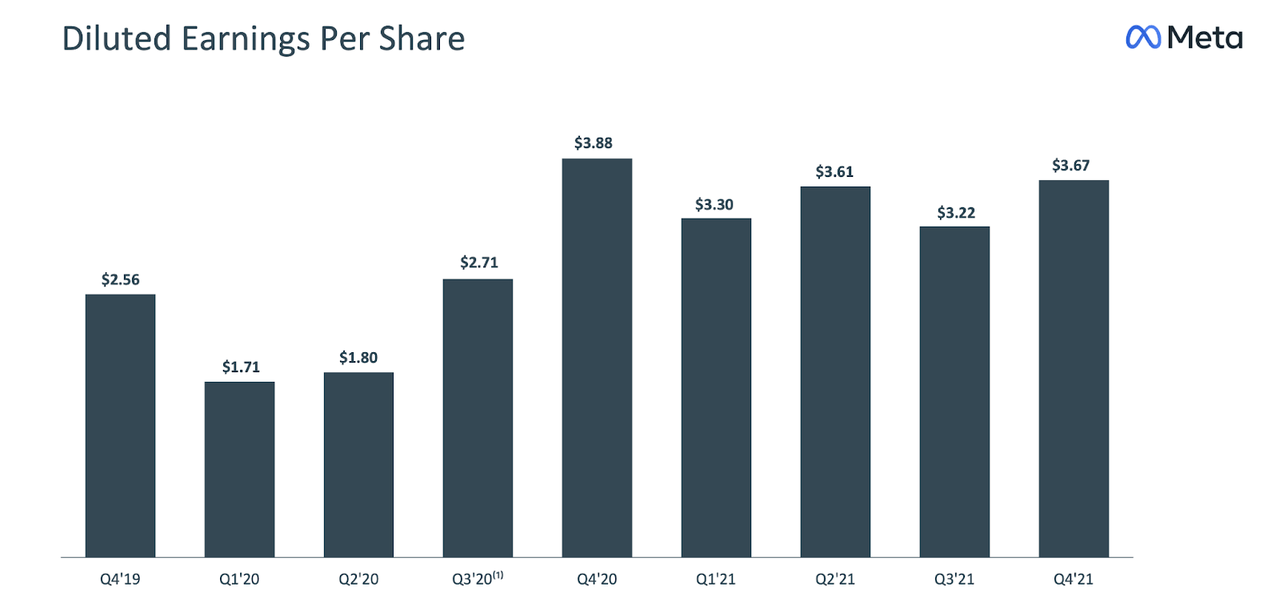

Add in the fact that FB has been investing aggressively in the metaverse (hence the name change to “Meta”), and the company saw EPS decline year over year – in spite of buying back $44.8 billion of stock in the past year.

FB 2021 Q4 Presentation

Pros Of Investing In Meta Platforms

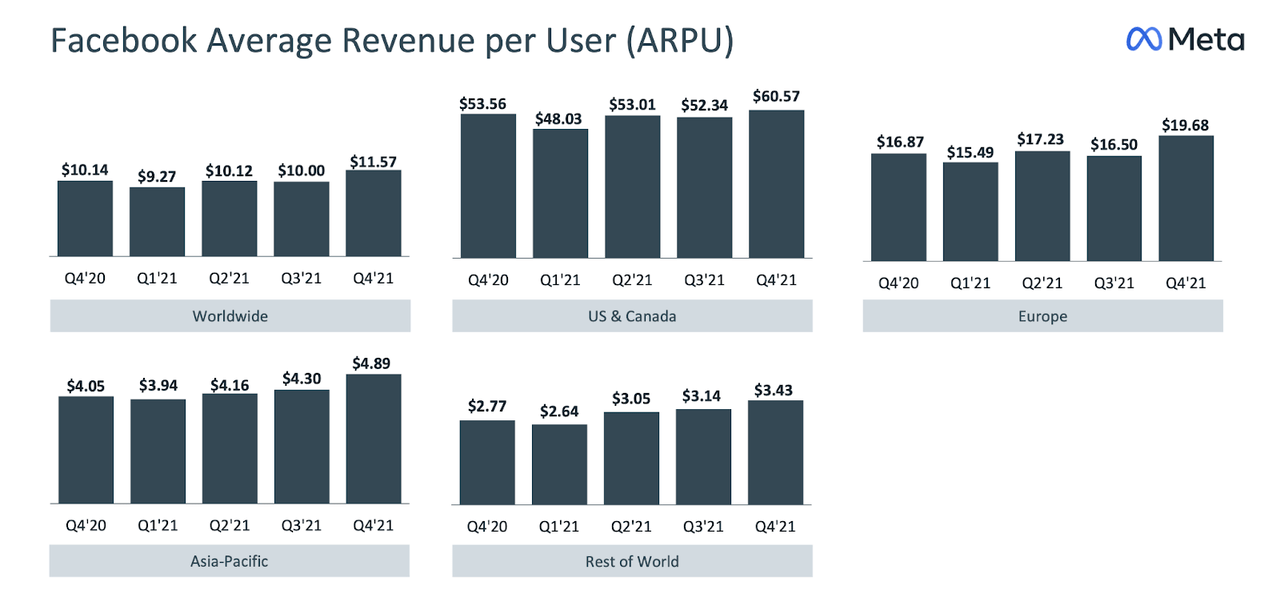

While sentiment remains poor for the stock, it is important to not let the stock price action influence the fundamental evaluation. FB remains one of the most attractive advertising platforms in the world as it has consistently increased its average revenue per user even as ARPU hovers above $50 per quarter.

FB 2021 Q4 Presentation

Yet at these prices, the fundamental thesis may be even more crude than that. FB trades at around 16x trailing earnings. The company converted 97% of net income into free cash flow in 2021 and has $48 billion of net cash on its balance sheet. The company repurchased $44.8 billion of stock in 2021, in excess of the $38 billion in free cash flow. That shift in capital allocation policies seems to have gone unnoticed by Wall Street – FB and much of tech for that matter have historically avoided aggressive share repurchases in favor of hoarding cash. I assume that FB should maintain a similar capital allocation policy moving forward considering that the stock price is at substantially lower levels. The company could theoretically buy back around 7% of shares outstanding every year using just free cash flow alone – providing an attractive shareholder yield while investors wait for growth to return.

Some investors might call potential ROI from metaverse investments as being a potential “pro” of buying the stock, but my view is that it is still too early to tell if the metaverse will pay off for the company.

Cons Of Investing In Meta Platforms

That brings us to the cons of investing in FB. I have already discussed the data privacy and competition issues facing the company. Besides this, FB is investing heavily in the metaverse. We can see below that “reality labs,” the segment containing metaverse investments, cost the company $3.3 billion in operating losses in the fourth quarter.

FB 2021 Q4 Presentation

I previously noted that the company trades at 16x earnings. To give an idea for how much the company is investing in the metaverse, if we adjust out metaverse losses, then the company would have earned $10 billion more in operating income and the stock would be trading at only 13x earnings. If the metaverse investments do not pay off, then investors would have essentially subsidized what would be remembered as an expensive side project for CEO Zuckerberg. That $10 billion (and growing) of investment spending could have been instead directed towards ramping up investment in their core businesses or even just buying back more shares.

Is FB Stock A Buy, Sell, or Hold?

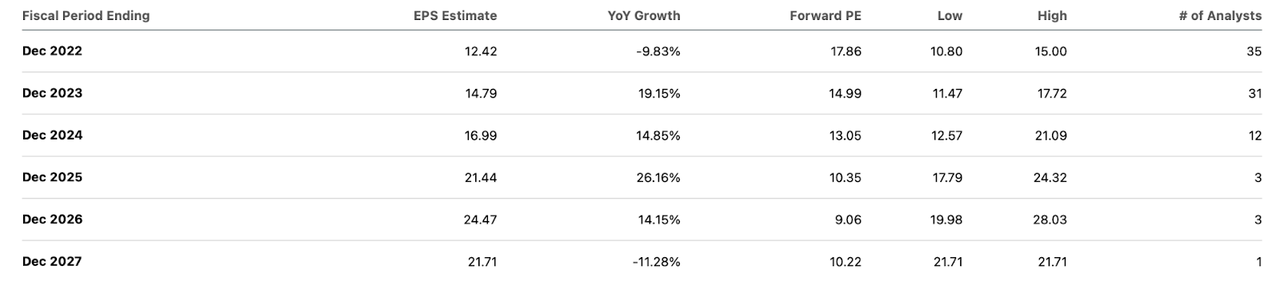

Wall Street consensus estimates call for earnings to decline 10% this year, before rebounding moving forward.

Seeking Alpha

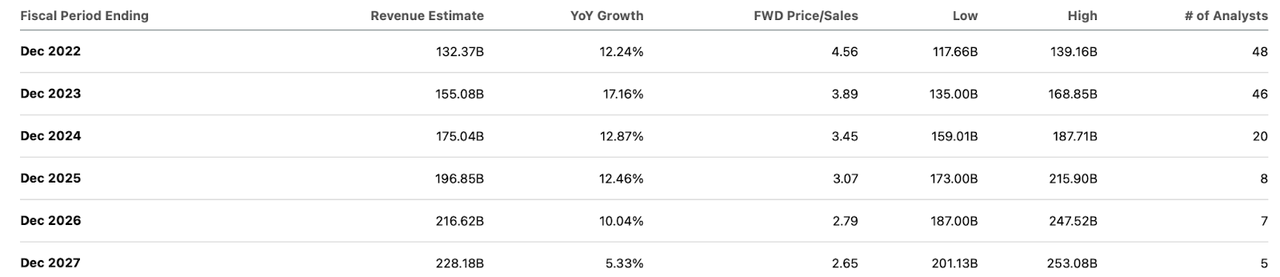

Earnings estimates look very conservative considering that earnings are expected to grow by only 78% over the next 5 years, when revenues are expected to grow by 84%.

Seeking Alpha

Wall Street is not giving the company the benefit of any operating leverage, as I expect profits to grow faster than revenues as the company eventually slows down its investment in hyper-growth ambitions. On account of the net cash balance sheet and willingness to repurchase shares, I could see the stock re-rating to at least a 1.5x price to earnings growth ratio (‘PEG ratio’), if not higher, upon a return to growth. Using the 19% projected 2023 earnings growth rate, I could see FB trading at 29x earnings by next year, presenting around 100% upside in 12 months’ time.

I am less concerned about FB’s ability to work around AAPL’s data privacy changes as the company’s track record has arguably earned the benefit of the doubt – at least for now. I am more concerned about potential competition from TikTok or SNAP. It is important for FB to work hard to win back lost market share because social networks lose relevance if all your friends and acquaintances aren’t on the network. It would be concerning if user growth does not return within 2-3 quarter’s time. The current valuation arguably can sustain a minimal growth outlook, but my conviction for the name would deteriorate significantly.

I rate shares a strong buy as one of my higher conviction ideas, as there are multiple catalysts for a re-rating and I have high confidence that the company will be able to work through the near-term headwinds.

Be the first to comment