zorazhuang/E+ via Getty Images

The Chilton REIT Team descended upon San Francisco in mid-November for a packed three days of meetings with management and property tours. The annual REITworld conference is extremely important for us to catch up in person with the CEOs and CFOs of our portfolio companies, ramp up on potential new ideas, connect with peers, and explore the properties in the city that are owned by REITs.

We had 12 one-on-one meetings with REIT CEOs and CFOs, who rent a hotel room and have the bed taken out and replaced with a table. The other 20 meetings we had were organized by sell side analysts in these same rooms, where we would be one of several investors around the table asking questions. Finally, we attended three property tours organized by companies with properties in the area, where we were able to not only meet with the CEO and CFO, but also hear from local executives and other third parties (brokers, government reps) with more location-specific knowledge. The conference location in San Francisco and timing with the recently announced tech layoffs proved to be particularly prescient.

We came away from the conference with several actionable ideas which we will outline below. In summary, the tech boom that was fueled by easy money during the past few years has come to a screeching halt. Layoffs appear to just be beginning, as it takes time to unwind a machine that was built to hire thousands of employees every quarter. While having an obvious negative effect on office, the consequences for West Coast multifamily should not be ignored. The lack of investment in retail brick-and-mortar has many retailers playing catch-up nationwide, which could make shopping centers a ‘defensive’ sector for the first time in history. High growth, low cap rate sectors such as self storage, single family rentals, and industrial appear to be in excellent shape, and the 2022 sell-off in these sectors presents an excellent investment opportunity. Healthcare, cell towers, and data centers are all healthy and present idiosyncratic reasons for confidence about the future. Finally, the most common topic was capital market risk: equity, debt, cap rates on dispositions were all of concern as the recent sell off in each market has made them all unattractive. We favor REITs with little need for capital in the next few years, as well as low payout ratios which maximizes free cash flow to use at their discretion.

Data Centers

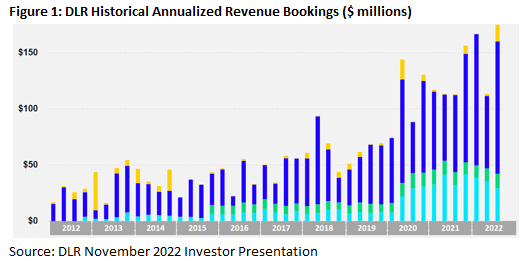

Within the data center sector, we met with Equinix (EQIX) and Digital Realty Trust (DLR). DLR is the most recent position we added to the portfolio, and they have been adamant about their ability to fund their $3 billion development pipeline, the largest among all of our portfolio companies. DLR has $540 million in forward equity that was issued at $155.69 per share back in September 2021 (versus a November 29, 2022 closing price of $108.75 per share), plus another $1.1 billion available on its line of credit. Furthermore, the development pipeline is expected to deliver at a 9.3% stabilized yield, making it an accretive investment even with interest rates rising. DLR’s 3Q revenue bookings was the third all-time record in the past four quarters, as shown in Figure 1.

EQIX might have been our most positive meeting. Management noted that the recent increase in the same store stabilized portfolio recurring revenue stream of 7% on a constant currency basis (the highest in years!) has come purely from leasing volume. The company only just started in the third quarter to push through price increases to account for inflation; furthermore, the company sent out expected increases in pricing for 2023 to all of its tenants to account for higher power costs, from which they expect little to no pushback. The combination of higher prices and volume should lead to an outsized year of growth in 2023. Both EQIX and DLR would disproportionately benefit versus other REITs if FX were to become a tailwind instead of a headwind.

Cell Towers

We met with American Tower (AMT), the largest REIT. As expected, the US macro-tower leasing market is among the strongest, which is especially comforting given the higher multiple ascribed to the US business due to its lower geopolitical and economic risk. DISH Network’s (DISH) expansion has made it truly a fourth tenant, and DISH was able to access the debt market recently to fund further site development. Unfortunately, several of the international markets (55% of AMT’s exposure) are going through some consolidation which is reducing growth in the near-term. The company also has elevated exposure to floating rate debt due to its purchase of CoreSite in 2021, which will weigh on 2023 earnings growth. We are still bullish on the long-term fundamentals for cell towers, but other factors specific to AMT could damper near-term growth. AMT would also benefit from a weaker US Dollar.

Shopping Centers And Malls

Retail – particularly shopping centers – were some of our most incrementally positive meetings. We had the opportunity to meet with management from InvenTrust (IVT), Site Centers (SITC), Phillips Edison (PECO), Brixmor (BRX), and CTO Realty (CTO) among the shopping centers, and Simon Property Group (SPG) in the mall and outlet sector. As we witnessed in 3Q earnings (and commented on in last month’s outlook), leasing activity remains robust. As this was mostly known, we spent much of our time drilling down on the tenant watch list – namely, Bed Bath & Beyond (BBBY), Party City (PRTY), and Regal/Cineworld (OTCPK:CNWGQ). The added clarity was very helpful and, in general, the REITs we met with own properties in desirable locations that should backfill pretty easily (and likely at materially higher rents). Relating to grocery anchored centers, the pending Kroger (KR)/Albertsons (ACI) merger was top of mind and we came away with less confidence in the deal going through. Chances likely remain above 50/50, but management teams noted broader inflationary pressures on grocery prices make the deal a lightning rod for regulatory scrutiny.

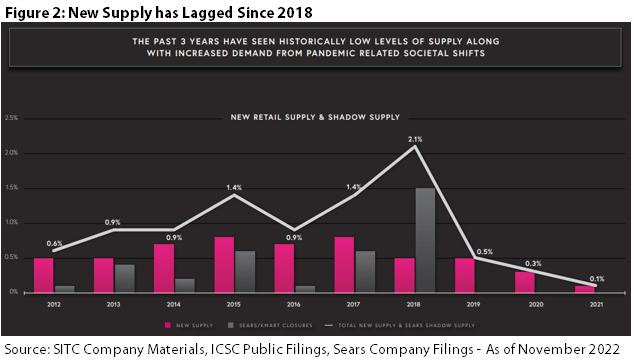

Another topic that thankfully got more air time at this year’s conference was the lack of construction in retail over the past few years. Highlighted in Figure 2, even when we include the added “shadow supply” from closing Sears and K-Marts, supply grew below 0.5% (e.g., replacement level) in 2019, 2020, and 2021. Looking forward, higher interest rates and construction costs likely keep supply additions below normal for a few more years.

Diversified

We met with Alexander & Baldwin (ALEX), American Assets (AAT), and JBG SMITH (JBGS). JBGS owns National Landing, the HQ2 for Amazon (AMZN) in Washington, DC, which has been slow to take up space in this new HQ. Meanwhile, its non-core office buildings have declined significantly in value. AAT’s stabilized office portfolio appears to be in solid shape in spite of its location in tech-heavy Bellevue and San Francisco. The company’s near term catalysts will rely upon its ability to lease up a vacant building in San Francisco under way with a major renovation called One Beach (which we toured during the conference) and a speculative development of a third tower at its La Jolla Commons. While both will be some of the highest quality office space in its markets, potential tenants may be hesitant to commit to new office leases in a declining economy. ALEX’s portfolio is 100% located in Hawaii, which is benefiting from relaxing restrictions for travel from Japan. Furthermore, ALEX is in the enviable position of being ‘under-levered’ thanks to non-core property sales. Importantly the company expects to sell Grace Pacific, its non-core infrastructure division, which could fund accretive acquisitions for years without tapping the capital markets. The most likely property types for acquisition would be industrial and shopping centers, though the company mentioned residential as a potential target as well.

Healthcare

Within the healthcare sector, we met with Ventas (VTR), Welltower (WELL), HealthPeak (PEAK), and Omega (OHI). Starting on the senior housing front (VTR and WELL), we heard a similar operational update to that from 3Q earnings, namely labor is and move-ins are looking stronger into next year. Additionally, Ventas walked through the price increases they’ve already sent out (plus the timing on the remaining notices), which gave us increased confidence in 2023. Aside from operations, the big update from WELL was a recently received Private Letter Ruling concluding that certain of WELL’s independent living facilities are not ‘health care facilities’ under REIT classifications. The ruling covered ~45,000 beds that Welltower could now operate directly without a third party manager. We will be looking for more details on this next year, but the upside is certainly compelling.

On the skilled nursing (SNFs) side of the business (SBRA and OHI), we heard a lot of questions on rent concessions after Sabra (SBRA) announced an operator transition for a 24 property portfolio at a lower rent last month. Most of the other operators didn’t see an immediate risk and highlighted that having as many operator relationships as possible is the best defense.

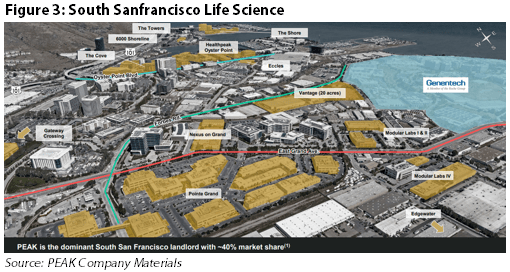

Finally, delving a little into office, our team had the opportunity to tour several Life Science properties in South San Francisco with HealthPeak and Kilroy. Figure 3 highlights PEAK’s major projects as well as the scale of Life Science in South San Francisco, rivaled only by Cambridge, MA.

Multifamily, SFR, and MH/RV

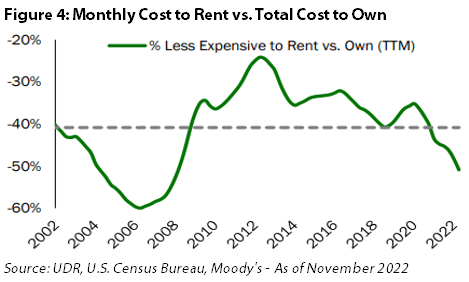

Within the multifamily sector, we had the opportunity to meet with the management teams of Equity Residential (EQR), AvalonBay Communities (AVB), UDR Inc. (UDR), and Essex Property Trust (ESS). Some key takeaways from our discussions with these REITs included the divergence in near-term rental growth across different markets, with general consensus being that the East Coast should outpace the West Coast in terms of revenue growth on the back of resilient demand out of Boston and New York versus the relatively lesser demand in the Bay Area and Seattle. Additionally, pricing power in the Sun Belt remains healthy given strong demand coming from Florida slightly offset by incremental signs of concerns in both Phoenix and Austin. Both EQR and AVB expect a huge cut to development starts in 2023, which should subdue the concern that too much supply is coming online. Something else to highlight is the rent-versus-own affordability analysis as seen in Figure 4 showing that it is ~50% less expensive to rent an apartment than own a home across UDR’s markets (West Coast, Sunbelt, and East Coast), which is a 15-20% improvement in relative affordability compared to pre-covid levels – this dynamic is discussed in more detail in our October 2022 REIT Outlook covering Residential REITs.

As for the single family rentals (SFR) sector, we were able to meet with the management teams of both American Homes 4 Rent (AMH) and Invitation Homes (INVH). All-in-all, demand remains notably strong for SFRs with occupancies around 97% and blended lease spreads in the low-double-digit to high-single-digit range for the month of October. Additionally, the number of showings per available unit in the third quarter of 2022 was up more than 60% vs. pre-Covid levels for AMH, another sign of resilient demand for SFRs in the face of rising mortgage rates.

Lastly, we had the chance to meet with Sun Communities (SUI), a manufactured housing (MH), RV, and marina focused REIT. From discussions with the management team, RV demand is holding up quite well with forward bookings for the winter season ahead of a year ago and the strength in annual / seasonal RVs is offsetting the softness in transient stays in 4Q 2022. Additionally, pricing remains competitive for high quality MH and RV properties with one large Florida MH portfolio recently trading in the mid-3% cap rate range, which compares to SUI’s implied cap rate of almost 5% as of November 29, 2022. As for the marina business, demand is again outstripping supply as there is a wait list in 85% of Safe Harbor’s communities (SUI’s marina brand name), providing us with comfort that SUI is well-positioned for 2023.

Self-Storage

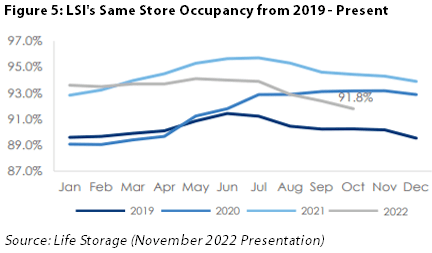

We met with the management teams of Public Storage (PSA), Life Storage (LSI), and Extra Space Storage (EXR). The tone in each of our meetings was a rather positive one due to the expectation for ECRI’s (Existing Customer Rate Increases) in 2023 to be well above historical averages, with PSA stating that they plan to be ‘fairly aggressive’ next year with regards to their ECRI program. Management from both LSI and PSA also boasted about the significant data on hand to support revenue management with PSA stating their ability to accurately estimate the length that a tenant will stay the moment the tenant goes to the website – crazy right? Additionally, PSA noted that less than 40% of customers that moved in during 3Q22 received a discount, which compares to historical 3Q levels of nearly ~70% of customers. Lastly, despite LSI’s October 2022 occupancy of 91.8% being down 220 basis points on a year-over-year basis given the return to seasonality, occupancy is still 210 bps above 2019 levels as seen below in Figure 5.

Industrial

Within the industrial sector, we met with Prologis (PLD) and Americold (COLD). For traditional industrial we didn’t hear many surprises versus 3Q earnings. Occupancy remained strong – in PLD’s system October occupancy ticked up 10 bps versus 3Q22 to 97.9% while rates continue to grow at an impressive clip. With that said, management expects a roughly 5-10% decline in appraised valuations given the upward move in cap rates, which could weigh on promote income for PLD. Finally, financing costs are starting to weigh more heavily on development, with management pointing to a possible slowdown in 2024 deliveries.

COLD updated investors on the continually improving occupancy picture, further highlighting that management believes it can exceed the pre-COVID high water mark in the low 80%’s. Additionally, management spent a good deal of time explaining the progress and rationale for the shift from variable to fixed commitments. We expect COLD to reach 50-60% fixed commitments shortly, which should support higher average occupancy throughout 2023 and beyond (e.g., temper seasonal fluctuations). Turning to rates, as we heard on 3Q the earnings call, COLD had successfully passed through all of the inflationary cost increases to date. Finally labor hiring has improved although retention remains challenged.

Office / Lodging

While we don’t currently own names directly in the Lodging or Office spaces, we met with some of the most prominent companies in both property types to keep up to date. In office, we met with Boston Properties (BXP) as well as Kilroy Realty (KRC), who both provided insight into the state of the office sector. ‘Return to office’ has certainly picked up over the past year, but the tech-dominated West Coast continues to meaningfully lag the East Coast. Given this year’s venue was in San Francisco, a lot of time was spent on the political shift prioritizing safety. Finally, while layoffs traditionally would be a major negative for office demand, management teams were hopeful that a mild recession could tilt power back to the employer thus enticing more employees to return to the office. We remain on the sidelines for office today, but we remain vigilant for any sign that fundamentals are improving.

We met with Pebblebrook (PEB), DiamondRock (DRH), and Host Hotels (HST) among lodging REITs. The shifting dynamics between leisure and business/group travel was very much in focus. Fall is a seasonally weak period for business travel so it was tough to get a gauge if the post labor day improvements will be sustained. Management thought group demand could get back to 2019 levels by the end of 2023, while business transient was likely ~2 years away from 2019 levels. With ~$30 billion of hotel debt maturing next year and, given the comparatively robust balance sheets for REITs, we could see some attractively priced acquisitions in the future. Finally, we heard a lot about the supply landscape, with under 1% additions currently, and even less in the resort space, providing a longer term tailwind for the industry.

Conclusion

The rise in interest rates has had multiple impacts on commercial real estate; in particular, the widespread re-pricing of all sectors and, in the near term, an expected decline in overall construction activity due to the capital squeeze by virtually all traditional players. What remains as a potential headwind is the risk of a recession in economies worldwide that would normally temper demand. The Federal Reserve appears adamant in their fight to combat inflation reversing the ‘easy money’ policies of the past decade. Fortunately, the majority of equity REITs learned their lesson from the Great Financial Crisis of 2008 of the importance of great balance sheets and enter this period well prepared to prosper and deliver dividend growth to investors above the rate of inflation.

Be the first to comment