Bim/iStock via Getty Images

Introduction

I’m writing this article with mixed feelings. On the one hand, I get to discuss an incredible bull case built on strong warehousing demand and long-term secular growth with readers. On the other hand, rapidly rising rates are currently hurting the economy and making so-called yield-plays less attractive. After discussing Duke Realty’s (DRE) massive footprint in the US warehousing industry last month, it’s time to look into Prologis (NYSE:PLD). It’s the leader in global warehousing real estate and one of the world’s largest REITs in general. The company is benefiting from a desperate need for various value chains to replenish inventories and maintain high inventory levels due to changing procurement strategies and higher global tensions. The ongoing lockdowns in Shanghai are a sad but great example of this trend. Hence, the stock has added more than 50% to its market cap over the 12 months. Unfortunately, the valuation is lofty, the dividend yield is low, and rates continue to rise.

Prologis, The Warehousing Giant

Prologis is classified as an industrial REIT. In this case, it’s the largest company in that industry with a $125 billion market cap. It shares this industry with companies that engage in self-storage, cold storage, industrial properties, and others. In this case, it’s one of two companies focused on retail warehousing with its smaller peer Duke Realty.

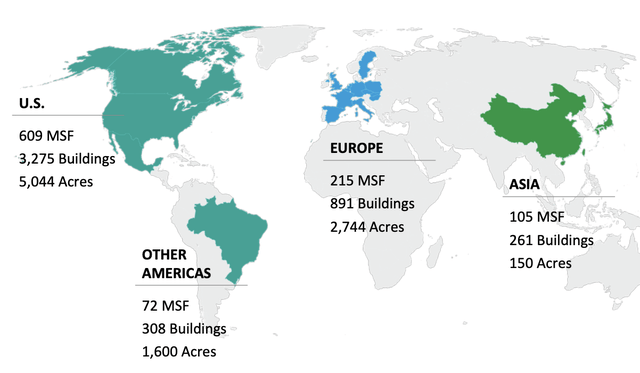

The size of Prologis is truly mind-blowing. With exposure in all major economic hotspots except for Africa and Australia, the company has more than $215 billion in assets under management. Founded in 1983, it has grown to more than 1 billion square feet in assets in 19 countries, impacting 15% of global goods consumption. That’s not a typo.

What makes Prologis so powerful is its position in various supply chains. The company owns gateway distribution centers, multi-market distribution, and city distribution + last touch. In other words, while it does not own trucks or any means of transportation, it owns a big chunk of everything that comes between us ordering something online (or in stores) and the very start of the retail supply chain.

Prologis Inc. (2021 10-K)

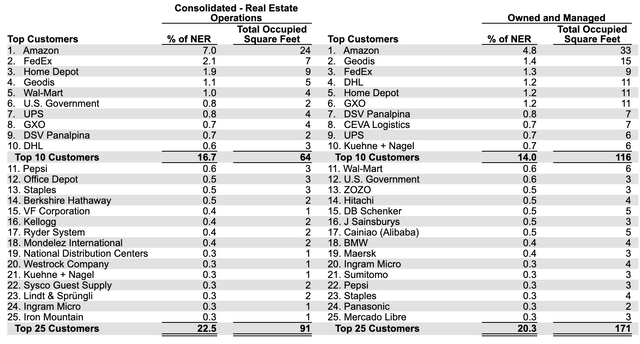

The company ended 2021 with more than 3,500 customers, diversified in a wide variety of industries as the list above shows. The list below shows the company’s largest 25 customers – as a % of net effective rent. Amazon (AMZN), which is by far the number one customer was responsible for 7.0% of NER. The second-largest tenant FedEx (FDX) contributed 2.1% to NER. In other words, the company is not dependent on a single big customer (excluding Amazon) but on the bigger trend towards e-commerce and smart warehousing.

And speaking of the biggest secular trends, let’s look at the reason I’m writing this article.

Higher Expected Growth Due To Supply Chain Changes

Albert Einstein once said, “In the midst of every crisis, lies great opportunity”. Hence, the Wall Street Journal headline below:

“Supply chain chaos” hits the nail on the head in this case. Trade has not been reliable since the outbreak of the pandemic. In early 2020, supply chains got interrupted by sudden global lockdowns. Even some factories shut down. Inventories were not restocked as nobody could predict how bad demand would be impacted. Heck, some thought the world was ending in April of 2020.

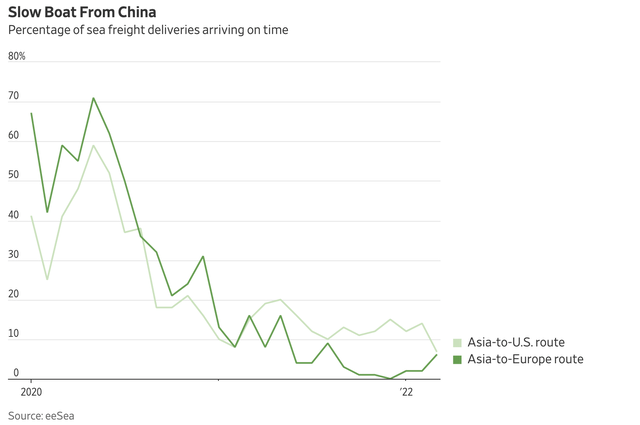

Then, as countries emerged from lockdowns, demand came back and inventories were empty. What followed was a stream of orders that no shipping company or producer could deal with. Then we got hit by additional labor issues that caused ports to clog up. Now we’re once again dealing with severe lockdowns in China, which is pushing on-time deliveries from China to less than 10%.

Even if China emerges from the lockdowns, this issue is far from over. Prior to and during the first weeks of the pandemic (when I was doing my master’s with a focus on supply chains – how convenient), purchasing managers were focused on just-in-time deliveries. Nobody wanted inventory. Demand should be streamlined and perfectly followed by production numbers. No inventory, no backlog, nothing. That was the perfect world – back then.

Now, these theories are in various landfills as the world knows that risk management is key. Globalization has taken a beating and nobody wants to get caught by surprise anymore.

To give you a number, WSJ mentions a steep (expected) increase in inventories:

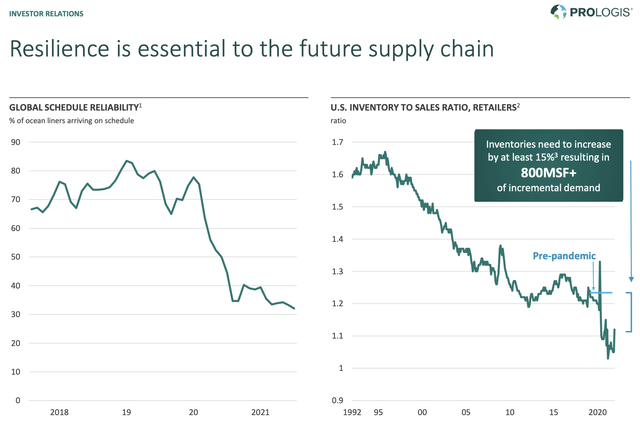

That points to stockpiling, which should boost demand for warehouses. Companies need to hold more goods so they don’t miss out on sales because of freight delays. Based on what they are hearing from tenants, big logistics landlords think inventories will eventually settle 10% to 15% higher than pre-pandemic levels.

Note that an increase of 10% to 15% above pre-pandemic levels is a huge deal. Not because that would indeed confirm that “old” theories are dead, but also that there’s a long way to go.

Right now, inventories are depleted. Prologis, which incorporated the 15% in its presentation slides estimates that it would come with an additional 800 million SF in incremental demand.

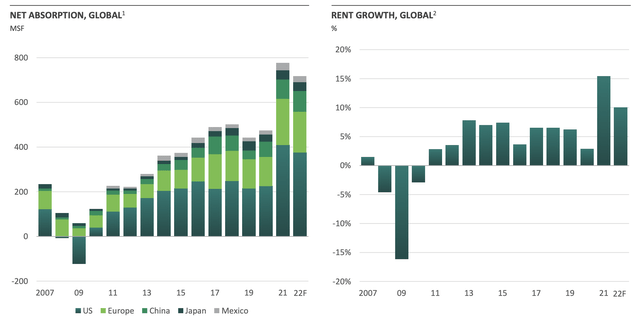

What this means is that higher demand is hitting an already overheated market. And as everyone knows what happens when demand growth outpaces supply growth, I doubt that anyone will be surprised by the uptrend in PLD’s rent growth.

It gets better – for PLD – as replacement costs have risen sharply. Total replacement costs including land value and construction costs have risen by 33%, 24%, and 25% in the US, Europe, and Mexico, respectively. This means that it’s harder to bring new supply online, which benefits existing players.

It also doesn’t help that people are getting annoyed by new warehouses. Especially because warehouses become smaller, more flexible, and closer to residential areas (last-mile transportation). Hence, people are getting a bit upset according to a different WSJ article:

File the article above under another reason why building additional warehouse supply is tough.

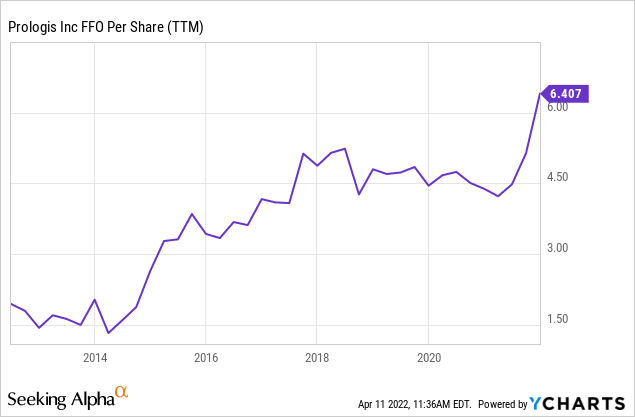

Needless to say, these numbers translate to high growth. Core FFO (funds from operations) has grown by roughly 10% per year over the past 5 years. Adjusted for share dilution (we’re looking at per share data), the company has grown FFO from $1.50 per share in 2014 to more than $6.40. Its occupancy rate is now close to 98% and rising is strong. I don’t see an end to this trend – for now.

As a result, dividend growth has been strong. Over the past 10 years, dividend growth has been 10% per year – compounded. More recently, this number has accelerated as the company announced a hike of 25.4% on February 25, bringing the annual payout to $3.16 per share. That’s a current yield of 1.9%.

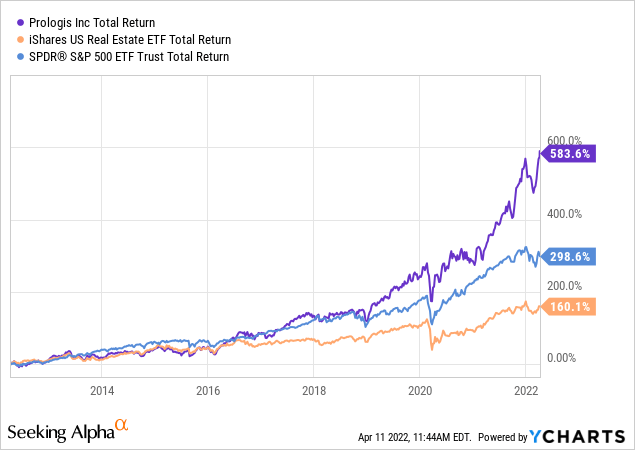

And as if that’s not enough, the stock has crushed everything in its way. Since my March 18, 2021, article, the price is up 62%. Over the past 10 years, the stock has returned 584% including dividends. That’s well above the S&P 500 return or the somewhat poor return of the iShares US Real Estate ETF (IYR).

There’s just one problem. And that’s the valuation.

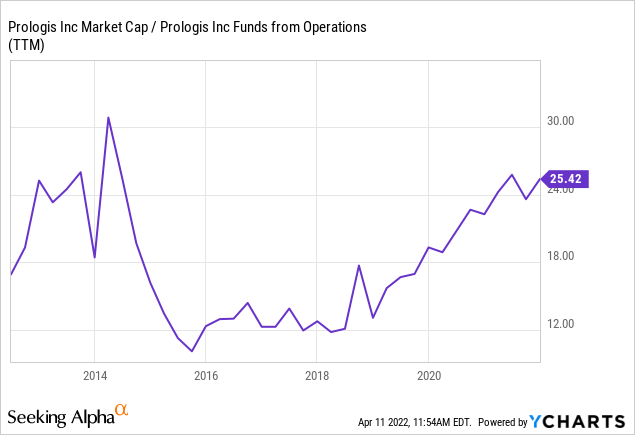

On a full-year basis, the company expects to do core FFO between $5.00 and $5.10. This implies a 32.4x multiple based on a $165 stock price.

In other words, the company needs to maintain strong double-digit (A)FFO growth to remain attractive.

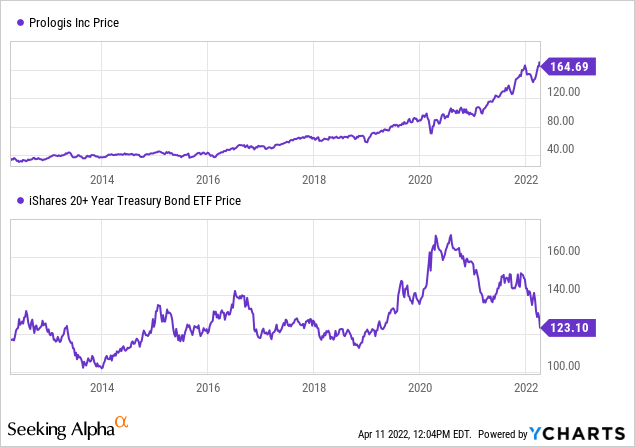

My strategy is to “hope” that the ongoing rise in yields will cause some REIT headwinds. Right now, yields are rapidly accelerating as the market is preparing for aggressive Fed rate hikes. The iShares 20+ Year Treasury Bond ETF (TLT), which is usually supporting REITs is falling off a cliff (higher rates mean lower bond prices). So far, it has not impacted REITs although borrowing costs are rising. It helps that PLD’s debt is just 4.2x adjusted EBITDA with a 13.4x interest coverage ratio. However, I assume that if rates continue to rise, investors might sell some REITs. If that happens, I’m a buyer. It’s also the reason why my rating on PLD is neutral.

Takeaway

Prologis is in a terrific spot as the world is witnessing the start of a massive shift to higher inventories as purchasing managers and related have learned a lesson from the pandemic.

Prologis is the world’s biggest warehouse REIT with massive exposure in key markets. The company has a healthy balance sheet, strong rent growth, and the ability to expand in a market where expanding is increasingly difficult.

The dividend yield is close to 2% again after a 25% hike and I believe that the stock is a buy on weakness. Personally, I’m waiting for higher rates to do some damage as I’m not a big fan of the current valuation.

Nonetheless, PLD is poised to remain one of the best REITs on the market and I have little doubt we’re looking at long-term outperformance.

(Dis)agree? Let me know in the comments!

Be the first to comment