AsiaVision/E+ via Getty Images

Investment summary

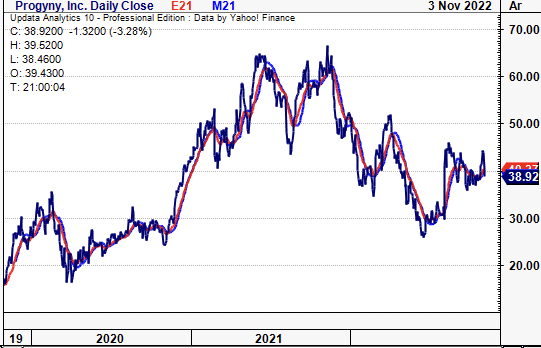

Following its most recent set of numbers, questions now arise on potential allocation of equity risk to Progyny, Inc (NASDAQ:PGNY) in cross-asset portfolios. With market volatility at highs, and being driven by a combination of systematic and macro-levers, investors have turned course away from rewarding top-line growth, and are rewarding bottom-line fundamentals instead. In the same vein, technicals have shown increasing importance in order to capture directional trends. This is important information for our PGNY investment thesis. Here I show that recent weakness in earnings and profitability have inflected poorly on the PGNY share price in recent times, likely justifying the stock’s weakness in FY22. This, coupled with certain technicals and valuations support a neutral view. Rate hold, price target $16.90.

Exhibit 1. PGNY 3-year price evolution

Data: Updata

Mixed numbers for PGNY in Q3

Third quarter numbers were mixed for the company despite upsides versus consensus at the top and bottom-lines. Management reported the strongest adoption rates for Progyny Rx, with 97% of clients now adopting the pharmacy benefit. Revenue of $205.4mm exhibited a ~68% YoY growth schedule and marked the company’s first >$200mm quarter. This was propped by a growth of 200,000 in weighted average covered lives, with 9 additional clients obtained in the segment throughout the quarter. This brought the number of clients to 282 at the end of Q3. The company’s average number of covered lives was subsequently up 57% to 4.5mm [from 188 clients and 2.9mm in Q3 FY21]. Revenue upside was seen in both the medical and pharmacy segments, given this growth in both clients and covered lives, with the former expanding 52% YoY to $129mm. Meanwhile, pharmacy revenue doubled to $76mm.

Moving down the P&L and gross profit margin compressed by ~90bps YoY. Hence, whilst gross profit increased 61% YoY to $46mm in absolute terms, the 225.9% YoY increase in stock-based compensation to $23.3mm [from $7.1mm a year ago] capped the upside in gross margin. This had an impact to earnings as well, with quarterly EPS tightening to $0.13 from $0.17 the same time last year. There was also the base effect of a large tax benefit throughout FY21.

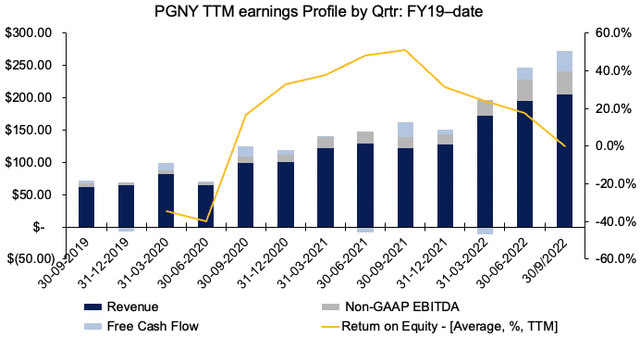

As seen in Exhibit 2, bottom-line fundamentals have softened for PGNY over the pandemic period to date, with ROE tightening to 12.1% from 51% in the 12 months to Q3 FY22. With shares trading at 11.5x book value, the investor’s ROE drops to just 1.05% if paying this multiple. Meanwhile, free cash flow conversion has been lumpy, despite substantial top-line growth over this period. The company’s income tax benefit of FY21 will skew these results, however, with $17.8mm in income booked under this ledger by the 9 months to Q3 FY21 compared to $6.65mm in Q3 FY22.

Exhibit 2. Recent contraction in bottom-line fundamentals and profitability suggesting recent downside warranted

Data: HB Insights, PGNY SEC Filings and Prospectus

Management raised FY22 guidance at both the upper and lower bounds and expect top-line growth of 55–57%, calling for $775–$785mm at the top-line. This would also call for ~$202–$212mm in revenue for the fourth quarter, another c.60% growth requirement. Management also foresee earnings between $0.26–$0.29 per share, a down-step from $$0.46 in full-diluted EPS in FY21. The wind-back in earnings upside and profitability is supportive of a neutral viewpoint.

Technicals potentially balance risk/reward calculus

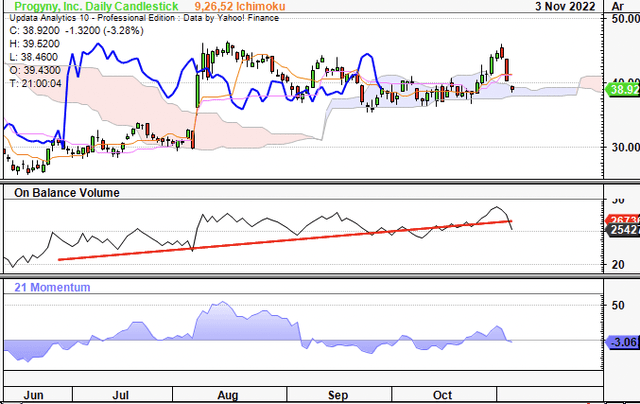

Despite the softening fundamental momentum outlined above, market mechanics suggest there is still buying support for PGNY. As seen in the 6-month daily cloud chart below, shares are testing the cloud after backing and filling since August, with the lag line also in this position. Despite an attempted breakout back to August highs, it was rejected and this led to a sharp reversal in on-balance volume (“OBV”) to break its long-term uptrend, as observed.

In spite of this, the upward trajectory of the PGNY share price remains in-situ, with the stock now testing support as mentioned. The question turns to whether this trend is sustainable or not. If there is in fact buying support at these current levels, there’s a good chance the stock could rally back to its previous highs of ~$45 last seen in August, by my estimation.

Exhibit 3. Testing cloud support, and whilst long-term trend indicators have shown a slowdown in November, longer-term trend remains in situ.

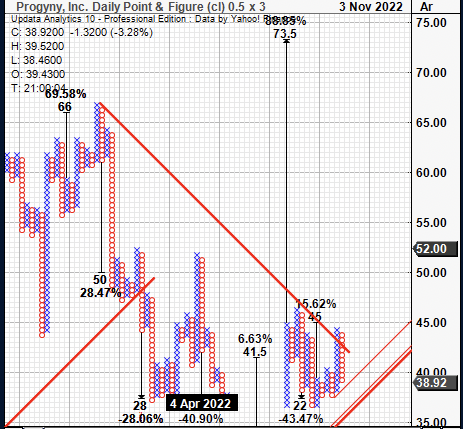

Evidence of this price objective is seen in the point and figure chart below, that suggests upside support to a target of $45. Shares have recently broken through a longer-term resistance line as observed, and recent buying activity has lifted the stock from its 52-week lows. With this technical information at hand, I submit price distribution has good reason to work towards a $45 handle in the medium-term. This price action advocates against a period downside looking ahead for PGNY. As such, this too is supportive of a neutral view.

Exhibit 4. Multiple upside targets to $45 objective

Data: Updata

Valuation and conclusion

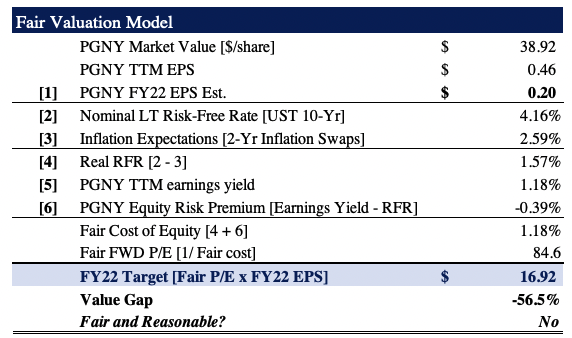

Shares are trading at a premium to GICS Managed Health Care Industry peers at 59x trailing earnings vs. the peer median of 30x. The lack of earnings upside doesn’t go un-noticed either. Our internal estimates are behind management’s, and we forecast PGNY to deliver $0.20 in EPS for FY22, behind last year’s $0.66 in fully diluted EPS. As such, this means the stock should trade at ~84.5x forward earnings and is worth ~$16.90, as seen below, versus consensus estimates of 204x forward earnings [the consensus price target is also $55.50 per Refinitiv Eikon consensus data]. Either way, both multiples are unreasonable in my estimation.

Normally, a stock trading at a premium to peers on forward earnings is attractive, as it suggests the market expects an above-average growth from the company at the bottom-line. However, this is only valid if there is earnings upside forecast in the first place, in which PGNY’s case there isn’t in our base case. Moreover, with shares also priced at a premium at ~11.5x book value, the equity premium we’d hope to achieve from earnings and return on capital/equity is substantially narrowed [see below: Exhibit 5, the lack of earnings yield and real equity risk premium on offer with our calculations]. Hence, valuations are also supportive of a neutral view.

Exhibit 5.

Data: HB Insights Estimates

Net-net, the near-term upside case for PGNY has exhausted for the time being, according to data taken from this analysis. Whilst buyers continue to fill the order book, thus making technicals seem appealing, investors have also positioned against bottom-line fundamentals in FY22 and look to continue doing so into the periods ahead. Discounted future cash flows point to a lack of earnings upside into FY22/FY23, along with the company’s softening numbers to date. With this in mind, we rate PGNY a hold on weakness for now, price target $16.92.

Be the first to comment