FrankRamspott

Shares of The Progressive Corporation (NYSE:PGR) were hit hard on Thursday, down 8%, due to disappointing Q3 results, though the stock has been a strong performer over the past year, significantly outpacing the market. Insurance is generally a non-cyclical industry, which has made it a safe haven during a period of economic uncertainty. The short duration of its investment portfolio also makes Progressive a winner from higher interest rates. However, the company suffered significant losses from Hurricane Ian, which, given a very expensive multiple, the stock is struggling to withstand.

In the company’s third quarter, it earned just $0.20 a share. Now, it is important to adjust insurance company earnings for unrealized investment losses, as they generally hold securities until maturity. With $216 million in unrealized losses, “core” earnings were about $0.48 cents. This was well behind the $0.90 consensus.

Net premiums rose 5% to $13 billion, in line with expectations. The company saw solid growth in its commercial lines, up 9%, even as its auto business declined, leaving policies in force 1% higher than a year ago at about $26.9 billion. For the full quarter, Progressive had a combined ratio of 99.2 from 100.4 last year. This ratio measures insurance losses relative to premiums earned, with 100 representing breakeven. So, for the quarter as a whole, the company made $0.80 for every $100 in premiums. This was a really disappointing result.

In August, the combined ratio was 93.6, and in July it was 89.8. Last year, the business had been hurt by elevated used car prices, which meant it became more expensive to replace damaged vehicles, but with these strong underwriting results over the summer, it seemed like Progressive had returned to its best-in-breed underwriting results.

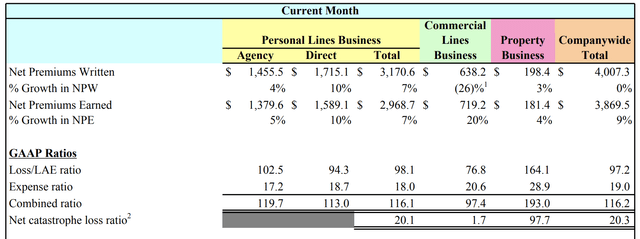

But in September, the company had a combined ratio of 116.2, leading to a monthly loss of $684 million, $350 million of which came from underwriting. The remainder was unrealized investment losses, which I am less concerned with. As you can see in September, its entirely personal line business lost money on underwriting. It nearly lost $2 for every dollar it wrote in the property business, and the commercial line barely eked out a profit.

For these disastrous underwriting results, the blame largely falls on Hurricane Ian. Given the storm hit on September 28th, very few claims had actually been filed by quarter end, but in anticipation, the company has incurred $760 million of Hurricane losses, or about $570 million after-tax. This is essentially the amount of market capitalization Progressive has lost since reporting the results.

$585 million of these losses came from autos, RVs, and boats. Its property unit suffered $175 million in losses. Fortunately, the company has effective reinsurance programs; otherwise, property losses would have been $1.4 billion. In total, Hurricane Ian contributed 20.3 points to the company’s combined ratio. Even absent it, its combined ratio would have been 95.9, which represents a disappointing deterioration in underwriting results from the previous months.

There is also always a debate on how much to “count” catastrophe losses when looking at an insurer’s profitability. Individual storms are one-time events. Southwest Florida does not get hit by a hurricane every September, after all. However, there is generally some hurricane damage every year. Some storms and years are worse than others, but insurers run their businesses anticipating some catastrophe losses every year. No one can know when they will happen or where, but they do.

Consequently, I think it is wrong to ignore the entire 20-point hit from Ian. If we did exclude it entirely, Progressive would have earnt about $1.40 in the quarter. Now, hurricanes typically only occur during Q3, but the company earns premiums against them the entire year, so if we give a ¼ weight to Ian’s losses, the company’s earnings run rate off of Q3 result was $1.17, or about $4.68 annualized.

At $115 a share, that is a 24.6x earnings multiple, and that is why these hurricane losses have created such a headwind for the stock. With that expensive of an earnings multiple, there is simply no margin for error. The company has a book value or $24.41, or $31.14, excluding unrealized losses, so shares are trading about 3.5x book value. This is essentially discounting the possibility of underwriting results.

Putting the valuation in further context, Progressive has total assets of $75.5 billion as of 9/30, and it carries $6.4 billion in debt. Excluding entirely its reserve for future underwriting losses and other liabilities, it has a net asset position of $69.1 billion. Its market capitalization today sits at about $68 billion, so its stock is essentially assuming it will never have to pay out assets to meet future liabilities, either because its underwriting results remain pristine or it is able to constantly write new policies to meet claims on existing policies.

For comparison, Cincinnati Financial (CINF) has $28 billion in assets less debt but a $15 billion market capitalization. The Travelers Companies (TRV) is $109 billion with a $38 billion market cap. Progressive’s historically strong underwriting has simply caused the valuation to get ahead of itself, and when there are months where its underwriting proves to be imperfect, the stock sells off. Ultimately, while a profitable property and casualty insurer should trade a premium to book value as it will not pay out losses immediately, it should trade at a discount to its assets because loss events, like Hurricane Ian, do occur.

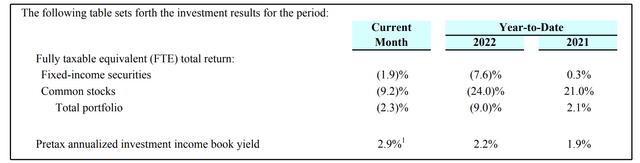

Now, one positive to highlight that can lift earnings power next year above the $4.68 Q3 run rate is that the company has a fixed income portfolio duration of just 2.7 year. In a period of rising interest rates, that means Progressive can invest maturities into new bonds with higher yields. That is exactly what is happening with its book yield rising from 1.9% last year to 2.9% this year. At the same time, credit quality of its assets is pristine at AA, meaning the portfolio should suffer very few credit losses even in a recession.

Assuming book yields can rise another 100bp over the next 12 months, to about 4%, that is about a $0.64 tailwind to earnings, meaning the company can earn about $5.2-$5.35 next year. That leaves the stock trading at a 22x forward multiple and over 3x book value. Even with shares lower today, the stock is still trading very expensive with little margin for error. While PGR is usually one of the best underwriters, I would recommend investors look at CINF or American International Group, Inc. (AIG) (which I recently discussed here), which offer significantly cheaper valuations and sufficiently strong underwriting. Granting the company deserves a premium multiple to other insurers, I view fair value for PGR at about 18x earnings or about $90-95 a share. At $115, shares are simply too high relative to PGR’s asset position and should be sold.

Be the first to comment