Nandani Bridglal

Investing can be a humbling experience. Although you might be correct in your initial assessment of a company, shares of that business could move in the opposite direction of what you expect for an extended period of time before ultimately realizing their potential. One company going through an adverse price movement compared to what I believe is warranted is PriceSmart (NASDAQ:PSMT). For those not familiar with the company, it owns and operates warehouse clubs just like Costco Wholesale (COST), BJ’s Wholesale Club Holdings (BJ), and the Sam’s Club brand that’s owned by Walmart (WMT). The only two differences would be that, for starters, PriceSmart is far smaller with a market capitalization of only $1.91 billion and, second, is that the company has an emphasis on Central America, the Caribbean, and Colombia. Even though financial performance achieved by the company has been positive as of late, shares have still taken a step back. While this could be annoying for investors who are bullish to the firm, it could also represent a good buying opportunity for those who are patient enough to wait out the pain.

Robust performance continues

The last time I wrote an article about PriceSmart was back in late February of this year. In that article, I described the company as a small, niche membership-based retailer that has performed exceptionally well in recent years. All things considered, I felt as though the company’s prospects looked bright and I believed the cash flows would likely continue improving over time. Add on top of this the fact that shares looked attractively priced, both on an absolute basis and relative to similar firms, and I could not help but to rate the enterprise a ‘buy’ to reflect my view that shares should outperform the broader market for the foreseeable future. Fast forward to today, and things have not gone exactly as planned. While the S&P 500 is down 10.5%, shares of PriceSmart have generated downside for investors of 12.4%.

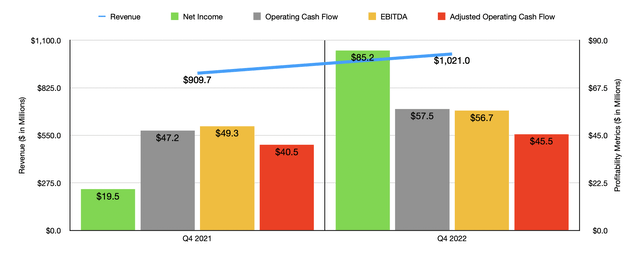

What’s most perplexing to me is that I don’t really understand why the market has decided to punish the company. More likely than not, it has to do with general market malaise. I say this because, fundamentally speaking, the picture for the business looks fine. Take the final quarter of its 2022 fiscal year, the most recent quarter for which we have data available. Sales totaled $1.02 billion for that quarter. That’s 12.2% higher than the $909.7 million in revenue the company generated the same time one year earlier. This growth was driven in large part by a sizable improvement in the number of members in its network. By the end of 2022, the company had 1.76 million members. That’s up from the 1.67 million reported only one year earlier. It’s also worth noting that the company is continuing to benefit from customers moving in the direction of its higher-tiered offerings. For instance, its Platinum Membership program, which costs around $75 per year, provides members with a 2% rebate on most items up to an annual maximum of $500. By the end of the latest quarter, 7.4% of its total membership base was signed up under this program. That’s up from the 6.2% report at the same time last year.

This rise in revenue brought with it improved profits. Net income in the final quarter was $85.2 million. That compares favorably to the $19.5 million reported in the final quarter of its 2021 fiscal year. Other profitability metrics also followed this path, though the disparities from year to year were not as great. Operating cash flow, for instance, increased from $47.2 million in 2021 to $57.5 million the same time of 2022. If we adjust for changes in working capital, it would have risen from $40.5 million to $45.5 million. Meanwhile, EBITDA also increased, rising from $49.3 million to $56.7 million.

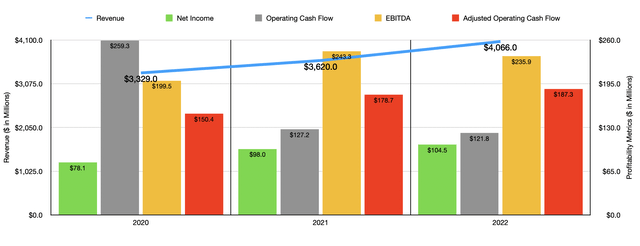

The results achieved in the final quarter of 2022 were not a one-time event. For 2022 as a whole, sales came in at $4.07 billion. That’s up nicely from the $3.62 billion achieved in 2021. It also marks the highest year in the company’s history from a revenue perspective. Profitability also improved, growing from $98 million to $104.5 million. Operating cash flow admittedly did drop, dipping from $127.2 million to $121.8 million. But if we adjust for changes in working capital, it would have risen from $178.7 million to $187.3 million. This is not to say that everything was perfect. Just as was the case with operating cash flow, EBITDA for the company also took a dip in 2022, dropping to $235.9 million compared to the $243.3 million reported for 2021.

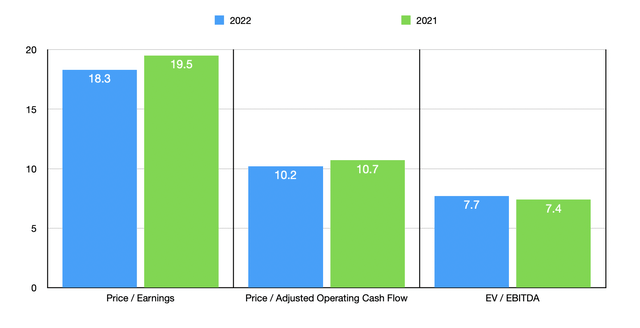

If we were to value the company based on results achieved in 2022, we would find that the firm is trading at a price-to-earnings multiple of 18.3. This compares favorably to the 19.5 reading that we get using data from 2021. On a price to adjusted operating cash flow basis, the multiple of 10.2 achieved using data from 2022 is slightly lower than the 10.7 reading that we get using data from 2021. The only valuation approach where shares look more expensive year over year involves the EV to EBITDA approach, with a multiple of 7.7 coming in slightly higher than the 7.4 reading that we get using data from the year prior. As I do with other companies, I decided to compare PriceSmart with some similar entities. Although these firms are all considerably larger than our prospect, they do operate in a similar manner. As you can see in the table below, they range, on a price-to-earnings basis, from a low of 19.1 to a high of 44.1. On a price to operating cash flow basis, the range was from 13.2 to 31.8. And when it comes to the EV to EBITDA approach, the range was from 11.3 to 20.9. In all three cases, PriceSmart was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PriceSmart | 18.3 | 10.2 | 7.7 |

| BJ’s Wholesale Club Holdings | 19.1 | 13.2 | 11.3 |

| Costco Wholesale | 34.9 | 31.8 | 20.9 |

| Walmart | 44.1 | 16.7 | 16.7 |

Takeaway

At this point in time, I don’t see any reason to be bearish about PriceSmart. The company continues to grow at a steady pace and, for the most part, it is seeing its profit figures improve. This is not to say that economic pain won’t impact the entity. It certainly could. I would also make the case that shares aren’t exactly the cheapest. But relative to similar firms, they definitely look like a bargain. Given all of these factors combined, I do believe strongly that the company still makes for a solid ‘buy’ prospect at this time.

Be the first to comment