undefined undefined/iStock via Getty Images

A study from JPMorgan argues that expanded unemployment benefits didn’t keep people on the sidelines:

We do not see clear evidence that PUA recipients exhibited greater work disincentive effects than did traditional UI recipients.

This is key:

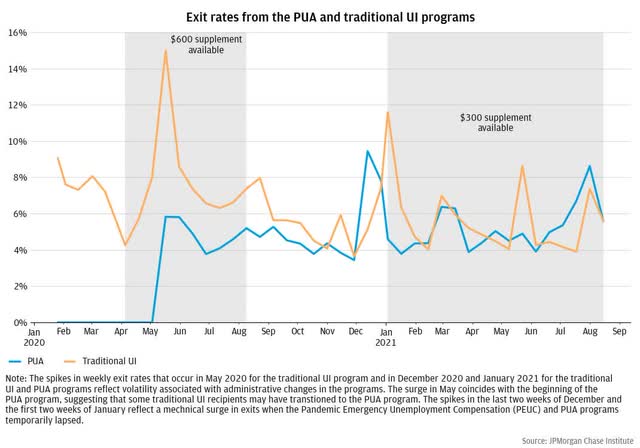

Figure 10 compares the exit rate out of traditional UI versus PUA throughout the pandemic and hones in on potential work disincentive effects. If UI benefits were especially discouraging work for PUA recipients, we would expect significantly lower exit rates for PUA recipients than for traditional UI recipients. However, although the PUA exit rate is slightly lower than the exit rate for traditional UI in 2020, it hovers around 5 percent throughout the time when the $600 supplement was available. Exit rates are comparable between traditional UI and PUA recipients in 2021, when the $300 supplement was available. Results do not change when we control for age or 2019 income differences between traditional UI and PUA recipients.

Figure 10:

Exit rates from two unemployment insurance programs (JPMorgan Study)

Higher interest rates are starting to hurt the housing market:

U.S. consumers expect mortgage rates to increase substantially over the next several years, with households on average projecting rates of 6.7% a year from now and 8.2% in three years, the survey shows.

The average probability of buying a home if a household moved over the next three years dropped sharply to 60.7% from 68.5% in 2021, marking the first decline since the annual housing survey started in 2014.

Now early data and interviews across the industry suggest that many buyers have finally been exhausted by declining affordability and cutthroat competition, causing the gravity-defying pandemic housing market to start easing up.

Open houses have thinned. Online searches for homes have dropped. Homebuilders, many of whom have accrued backlogs of eager buyers, say rising mortgage rates have forced them to go deeper into those waiting lists to sell each house. In a recent survey of builders, Zelman & Associates, a housing research firm, found that while builders were still seeing strong demand, cancellations had inched up, though still well below historically low levels. Builders have also grown increasingly concerned about rising mortgage rates and surging home prices.

Confidence among U.S. single-family homebuilders fell to a seven-month low in April as surging mortgage rates and snarled supply chains boosted housing costs, shutting out some first-time buyers from the market, a survey showed on Monday.

Econ 101: when prices increased (interest rates) demand declines (here, the demand for loans).

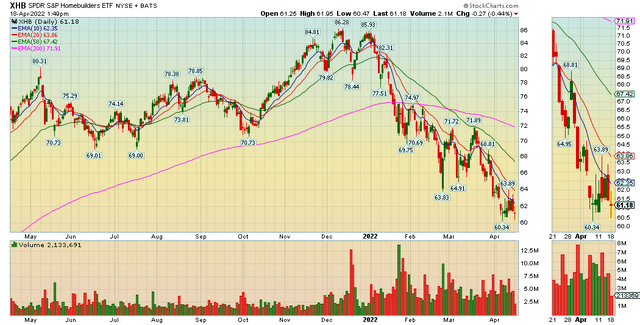

Homebuilders continue to decline:

The XHB printed a triple top at the end of last year and has been declining since.

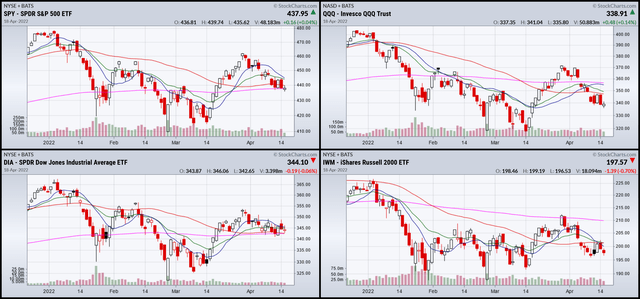

Let’s take a look at the charts:

1-month SPY, QQQ, DIA, and IWM (StockCharts)

The IWM (lower right) continues to try and bottom; that index has been trending sideways since 4/7/. The SPY and QQQ continue to trend lower.

3-month SPY, QQQ, DIA, and IWM (StockCharts)

The SPY and DIA are sitting right at the 200-day EMA. The IWM has already dropped while the QQQ is barely hanging on.

As I noted this weekend, the overall tone is, at best, neutral. The above charts show that prices are looking for an excuse to drop.

Be the first to comment