D-Keine

Co-produced with Treading Softly

It’s rare in life that we recognize at the moment that a bad situation can actually be the foundation of something good. We’ve long been told that many things are cyclical.

Housing markets. The shipping sector. The credit cycle. The business cycle.

They all have expected boom and bust periods of time.

When it comes to the overarching economy, we also recognize that it, too, operates on a cycle. However, as we naturally do as humans, we attempt to elongate the good times to delay or avert the potential hard times as much as possible.

To do this on a nationwide scale, the United States has created the Federal Reserve, which attempts to tinker with the economy in a general way, not specific to any one area or sector, but through interest rates or other financial manipulations. It aims to keep the good time rolling as long as possible, then it aims to “soften” the pain of the bad times.

Their success rate is questionable, depending on the metrics you decide to weigh as important to evaluate their performance. Overall, you might be able to delay the inevitable, but invariably by doing so, you make the bad worse.

Back in May, I wrote that I hoped the market would crash deeper:

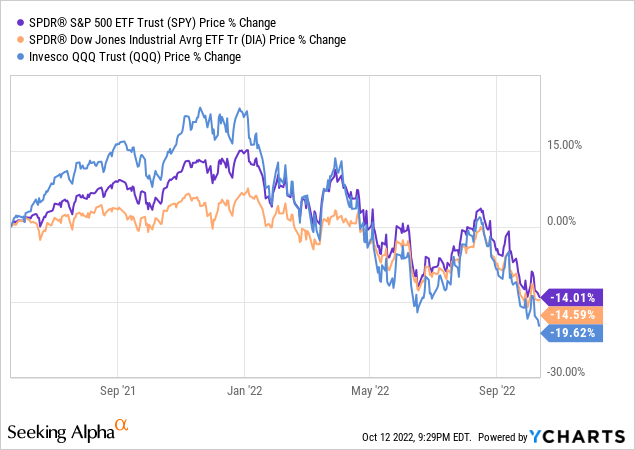

I wasn’t wrong. While the market rallied against my desires, in the end, I was right:

I made a simple argument why, for many of you, a deeper crash would be a blessing and not a curse.

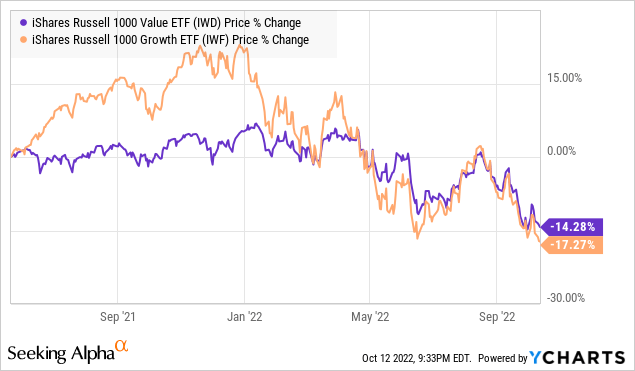

I argued that no matter how impressive the attempts Growth was trying to stage, it was still failing to upstage Value as the new better performer. Since my article, Growth tried again and failed again to post better returns:

I also argued that this was prime time for investors who failed to invest for income to get their portfolios reorganized. Invest for dividends and see the benefit from recurring income.

So today, I want to revisit this topic of a falling market and discuss why your retirement may depend on an even starker fall in the market.

Recessions are an Economic Necessity

I’ll be honest. I don’t like recessions in general. Like almost everyone else, I do not like to see others lose their jobs, businesses, or livelihoods due to poor economic output or performance.

Yet, I do recognize that recessions are a required part of the economic lifecycle of a national or even global economy. Let me use this example to help explain why:

Imagine you have a big firepit in your backyard, and you get all the wood, timber, and scraps of wood all nicely set up and light the fire. It starts to burn slowly, but as the heat builds, so too does the fire. As it burns, you’ll have to add fuel to keep it burning, but add too much and you’ll have a runaway fire burning down your whole backyard, add too little and the fire will die. This balancing act is what the Federal Reserve tries to do. They enact policies to help keep the fire burning at a healthy rate without getting out of control. However, as they continue to feed the fire, ash and soot build up in the firepit. This build-up of worn-out and used material makes keeping the fire burning harder and harder. The balancing act gets more strenuous and delicate.

A recession is when we’re down to just hot coals, the fire is mostly out, choked, and clogged by the old burned out, and useless materials that have built up over time. The Federal Reserve will try to bring this fire back to life by Quantitative Easing and interest rate cuts, actions that equal tossing gasoline on a low-burning fire, it may spring it back to life for a short time, but the build-up of excess ash will keep it dying once the fuel is gone.

Eventually, a recession hits, and during this time, the ash and burned-out materials are cleared away, allowing new fresh wood to be assembled, and the fire rekindled from the embers once more.

The cycle repeats itself.

The longer the Federal Reserve delays the clean out of the pit, the more work there will be that needs to be done to get it ready for the next cycle, however, like my firepit at home. I prefer to delay the work as long as I can, as I enjoy a good fire.

How Does the Market Do Historically?

The question retirees and investors often ask is how does the market and by extension their portfolio do in recessions?

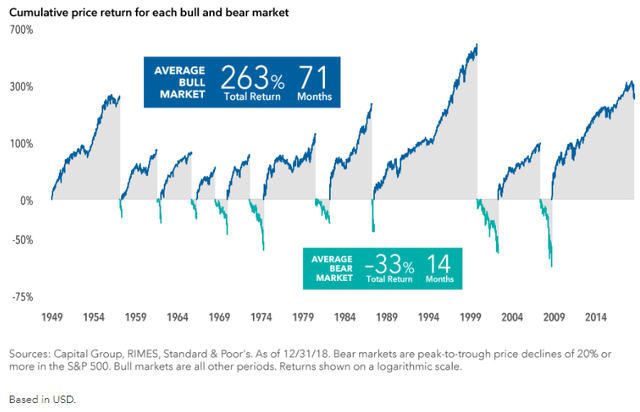

Most bear markets correspond to a recession in the U.S. economy, so we can see the average Bear market returns and length, then consider the following bull market returns by contrast. This chart from 2018 is helpful to see the comparison:

On average, the market falls around 33% when it reaches a Bear market, and lasts 14 months. It definitely can be an uncomfortable time, but the returns it produces thereafter are outstanding. An investor must learn to be comfortable with short-term discomfort to enjoy outsized returns.

The reason so many investors see poor results in their portfolio is they sell in an attempt to avoid a downdraft, then rebuy after a large upswing has occurred, in essence selling low to buy high. This causes them to underperform in the market.

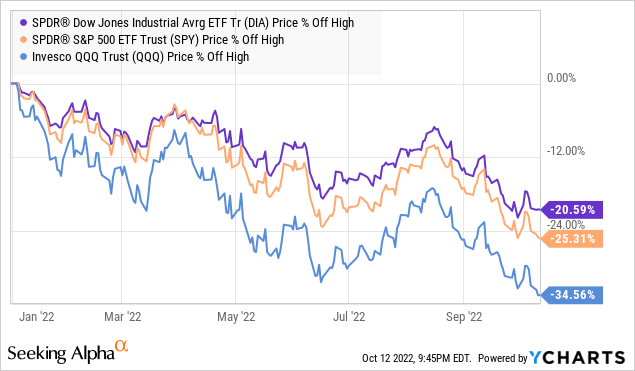

Currently, the broad market (SPY) (QQQ) (DIA) hasn’t reached the average drop:

So, what do we want? We want it to fall further, and expect it to.

The Deeper the Crash, the Better the Compounding

Let me ask you this: would you rather have a CD at 3% or 7% if all else was equal? Most of you would take the higher yield as a no-brainer.

What if I said you could get a Jeep Wrangler for 50% off, and it was in the exact same condition as the full-price one? Again, those who wanted it would take the cheaper option.

Yet when it comes to investing, if the market drops, investors often refuse to accept and buy companies on sale because they fear something is flawed with them. They discredit the fact the entire market has fallen 18-30% when evaluating an individual company or holding. While its earnings remain strong, dividend covered and unchanged, they assume something must be wrong and sell. How do I know this? You wouldn’t be able to buy any shares at today’s prices if no one was selling them to you.

Yet as an income investor, I am a net buyer in all market environments. The deeper the crash, the more effective my reinvestment becomes. I recommend even retirees reinvest at a minimum of 25% of all their dividends received to keep their income growing.

So while the market is offering many double-digit and completely covered yields, why wouldn’t you be out there buying income?

For those of you who have seen your portfolio smashed against the rocks of reality with no dividends or payouts to hold on to as your retirement picture becomes less and less clear or certain: this market is a gift to you. It’s time to make a switch and benefit from the fall to lock in 10% yields or higher while they’re still offered. We know that, on average, a bear market only lasts 14 months. They can be longer or shorter – that is the meaning of an average – so you have time to systematically switch over your holdings to start covering your life’s costs without having to hope for a better share price to sell to someone else tomorrow.

The rule of 72 tells us that a 4% yield compounded at the same rate takes 18 years to double. 8% takes 9 years. Use this time to reduce the time it takes for your income to double and learn to let falling prices benefit you, not scare you.

Getty

Conclusion

Earlier this year, I wrote an article that readily revealed who only reads titles, and who reads the entire article:

That article espoused the belief that for a simple and stress-free retirement, you need to stop relying on the flea market idea of the stock market and move on to recognize it as a tool. Stop trying to go and buy and sell trinkets and wares hoping to flip them for a profit. Buy a printing press, and let it print you money on a regular basis. No need to go back to the flea market.

How many of you have hobbies that you love and wish you had more time to enjoy? Imagine if you didn’t have to stress every market move or economic shift and could instead be focused on enjoying that hobby. Sounds pretty great, right? I think so.

The market shouldn’t consume your life. It should enable you to live it freely! The market needs to crash further. We need a recession. It’s just part of life, an uncomfortable part but a needed one.

I fully intend to allow this bear market to enable my income to soar to new heights. You can too. It only takes a change in perspective and some start-up effort.

After that, it’s enjoying a coffee on the beach or a fire at sunset with your favorite beverage in hand. See you there.

Be the first to comment