Lorado/E+ via Getty Images

When 2022 began, Power REIT (NYSE:PW) was ranked by the Seeking Alpha Quant Ratings as the #1 real estate investment trust to buy, and all the Seeking Alpha authors who wrote articles about this company in January rated it a Buy or Strong Buy. On January 13, the stock price hit a high of $81.99. Since then, shares have nosedived, hitting a low of $41.44, before ticking up about 10% to the current level, still more than 40% off the January high.

Investors need to expect volatility from this company, for two obvious reasons:

- It is a tiny company, with a market cap of just $150 B.

- It operates in the cannabis sector, which is still in its infancy, with a patchwork of laws and regulations to contend with.

Nevertheless, the Cannabis sector is one of the 7 sectors I expect to outperform the market this year. So this is an interesting company for a closer look.

The Cannabis sector

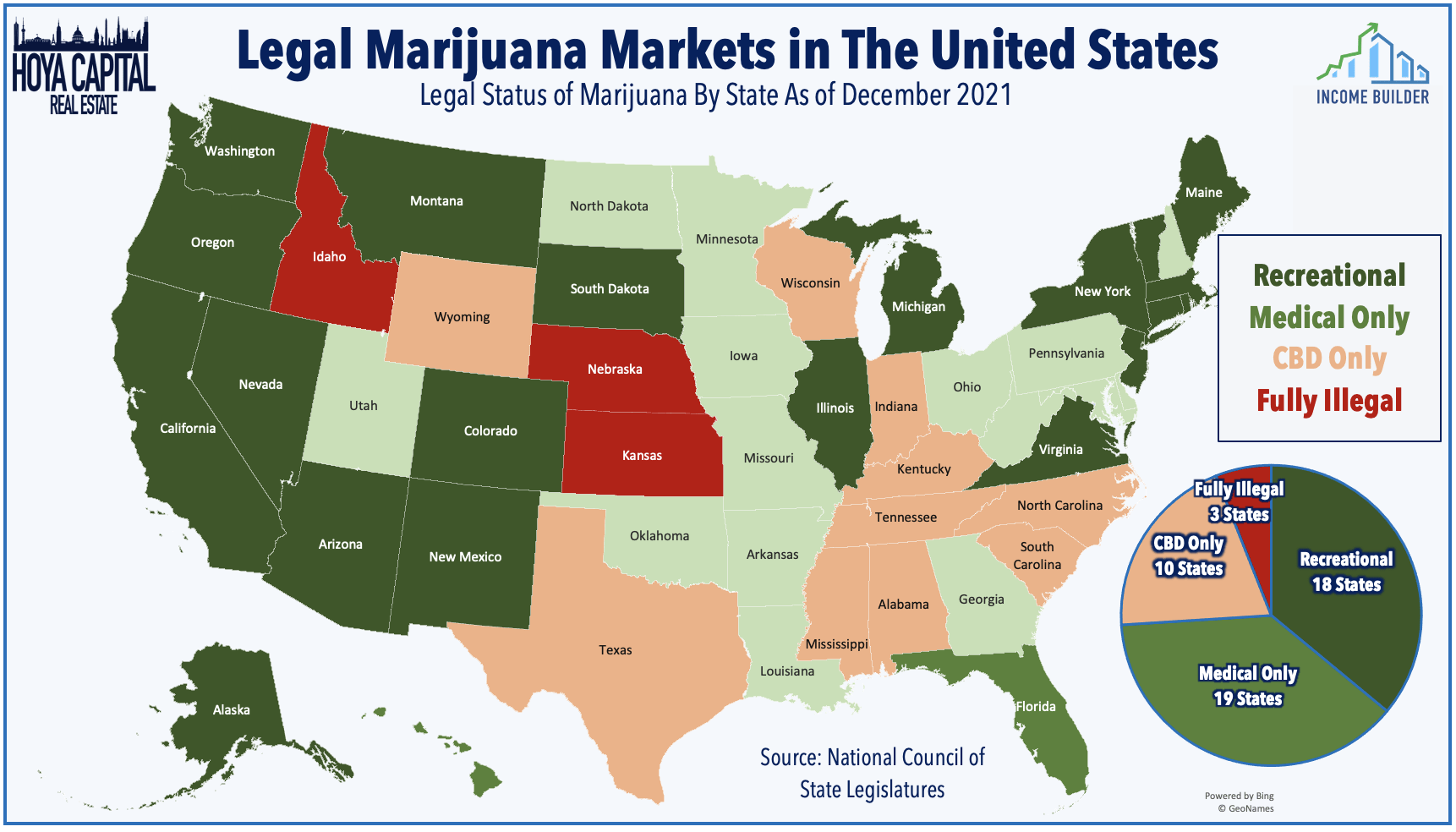

Cannabis legalization is gradually expanding nationwide, with 18 states fully legalizing all forms of use thus far, and only 3 states where it remains fully illegal.

Hoya Capital

Accordingly, the market for cannabis products of all kinds is growing rapidly. According to Headset, the total retail market for cannabis products is expected to grow by 29% in 2022, to a total of $30.5 billion.

Because cannabis is illegal at the federal level, cannabis growers are mostly unable to get financing from banks and other traditional lenders. This creates an opportunity for REITs to provide financing through sale-leaseback schemes that generate double-digit cap rates. Leases are typically 15-20 years with built-in rent escalators, and triple net structures, freeing the landlord from all costs and never requiring the owner to touch the crop. This business model was pioneered by the fastest-growing of all REITs, Innovative Industrial Properties (IIPR). Smaller copy-cats were bound to emerge, and Power REIT is bidding to be one of them.

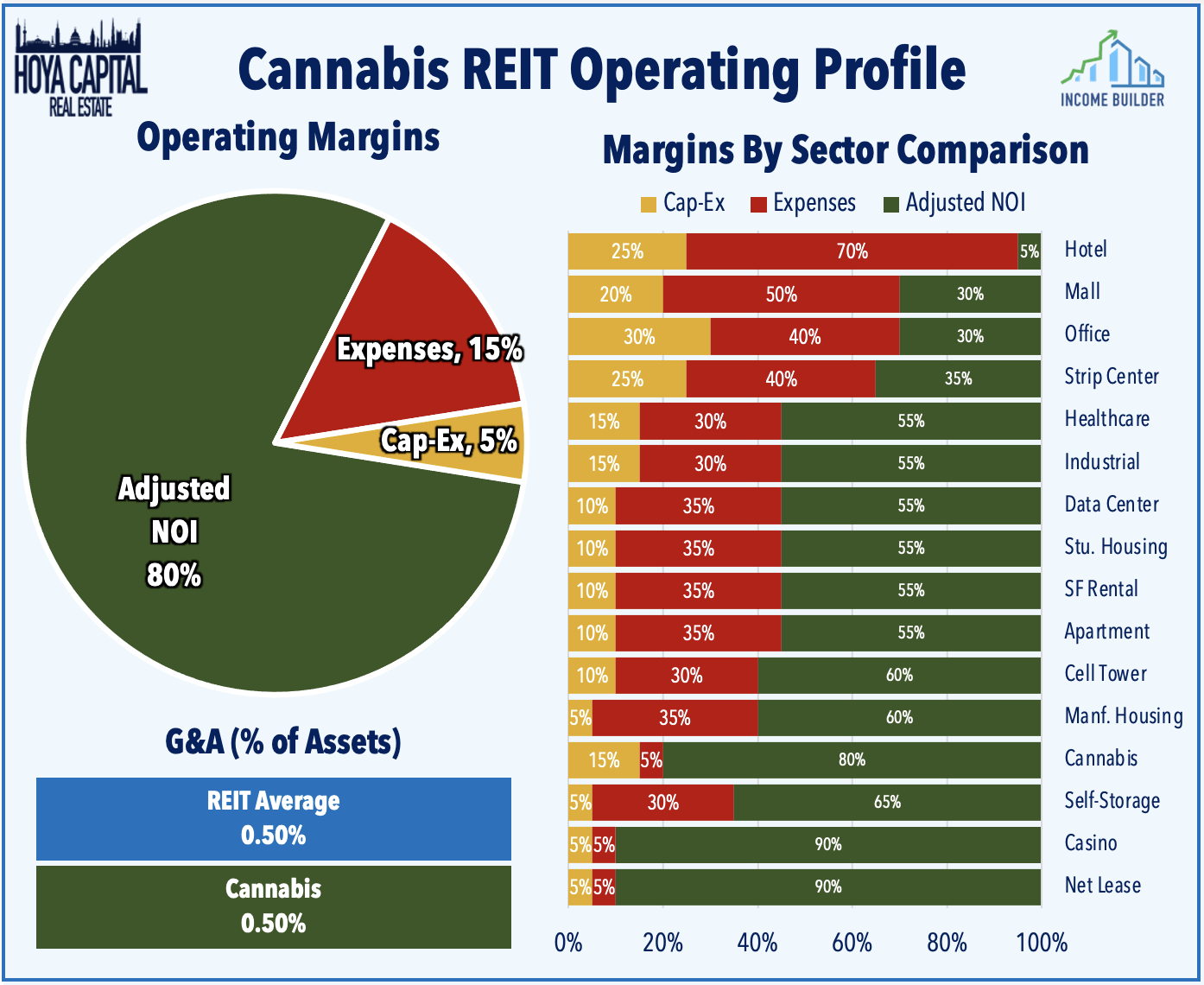

Cannabis REITs enjoy some of the highest operating margins in all of REITdom, with expenses and cap-ex typically totaling only 20%, leaving 80% for NOI.

Hoya Capital

Adding all these factors up, Cannabis has been the single highest-performing REIT sector in the past 5 years, and there is plenty of green grass ahead.

Meet the company

Power REIT

Headquartered in New York State, Power REIT owns three distinct classes of real estate:

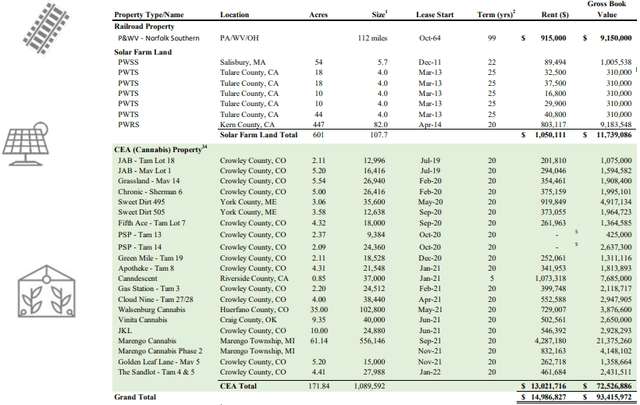

- 176 acres with approximately 1.1 million square feet of greenhouse space for cannabis cultivation, leased to licensed growers on a triple-net basis,

- 600 acres leased to utility scale solar farms, producing over 100 megawatts, and

- 112 miles of railroad in Pennsylvania, Ohio, and West Virginia, leased to Norfolk Southern Railway.

In its greenhouse segment, which accounts for 86% of its ABR (annual base rent), PW focuses on best-in-class sustainable greenhouse cultivation of cannabis and food, leased to growers on a triple-net basis. Compared to other forms of indoor agriculture, greenhouse (“controlled environment”) agriculture is marked by:

- lower construction costs,

- lower operating costs,

- natural light, and

- reduced carbon footprint

All facilities are in states where cannabis production is legal, with the lion’s share in Colorado, and the largest single facility in Michigan.

Revenue from solar farms, most of them in California, makes up about 7% of ABR for PW, and rent from the railroad lines makes up about 6%.

Detailed listing of PW real estate holdings (Power REIT investor presentation)

Occupancy is currently 100%.

Insiders own more than 20% of the common stock shares, and management gets 100% of its compensation in the form of company stock. Both these factors act strongly to align management incentives with shareholder interest.

Growth metrics

Here are the eye-popping growth statistics for Power REIT over the past 3 years in FFO (Funds from operations), and TCFO (Total cash from operations).

| Metric | 2018 | 2019 | 2020 | 2021 | CAGR |

| FFO (Millions) | $1.04 | $1.17 | $2.56 | $8.85 * | — |

| FFO Growth % | — | 12.5 | 118.1 | 245.7 | 103.9% |

| FFO/Share | $0.63 | $0.63 | $1.34 | $2.04 | — |

| FFO/Share Growth % | — | 0.0 | 112.7 | 52.2 | 47.9% |

| TCFO (Millions) | $1.27 | $1.37 | $2.93 | $8.11 * | — |

| TCFO Growth % | — | 8.4 | 113.7 | 176.6 | 85.72% |

Source: TD Ameritrade, MarketWatch, and author’s calculations

* Estimate, based on returns through Q3

The company was growing modestly as a solar power firm through 2019, then made a quantum leap when it went into the cannabis business. Share price nearly quadrupled from March 18, 2020 to the same date in 2021, but has since dropped nearly 50%. Still, investors who got in three years ago have seen their shares double in value.

Power REIT has a strategic alliance with even tinier Millennium Sustainable Ventures (OTCPK:MILC) to facilitate the acquisition of new properties. The company reports a growth pipeline of slightly over $100 million in various stages of negotiation. Given the small size of PW, this modest pipeline represents a huge percentage of growth if successfully executed. There is also the possibility of expanding the existing greenhouse facilities.

PW plans to finance its growth non-dilutively, through preferred stock, debt, and rights offerings. Double-digit cap rates on acquisitions allow the company to pay handsomely on preferred shares.

Balance sheet metrics

Here are the crucial balance sheet characteristics for PW.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| PW | 3.30 | 33% | 1.9 | — |

I like to see a liquidity ratio of at least 1.66, and preferably 2.0, so PW’s ratio of 3.30 is impressive, and so is the Debt/EBITDA of 1.9, which is lower by far than the current REIT average of 6.6. The company is small but muscular, and well-positioned to take advantage of appropriately-sized external acquisition opportunities.

Dividend metrics

Power REIT does not pay a dividend as yet, but by law, will have to begin pretty soon. Cannabis REIT Yields at purchase (YAP) are typically below average, but fast-growing companies usually grow dividends rapidly too.

Valuation metrics

The price tag matters to most REIT investors, although when investing speculatively in a fast-growing company like PW, they should be taken with a healthy dose of salt.

| Company | Share Price | Price/FFO | Premium to NAV |

| PW | $45.41 | 22.3 | 0.9% |

For a growth stock, the price multiple of 22.3 is remarkably low, coming in under both the Cannabis sector average and the overall REIT average. The pullback over the past two months has created a very attractive entry point.

What could go wrong?

The Cannabis industry in general is like the wild west of 150 years ago. There are vast opportunities, but little infrastructure. Tenants are small and their creditworthiness can be somewhat dubious. Laws are changing all the time, and the illegality of cannabis at the federal level hangs over the industry like a black cloud. This results in extreme volatility, even for the most successful players.

A bigger problem for PW is competition from IIPR. IIPR has been at this game longer and is focused entirely on cannabis, whereas PW has its solar farms and its railroad to deal with. IIPR is by far the top dog, with a market cap more than 30 times as large as PW, and the first mover in this space. If it’s a contest between a baby monkey and 500-pound gorilla, my money is on the silverback.

But the biggest risk for PW is its very small size, making it more vulnerable than most to unexpected turns in the market. Research and experience both show that small-cap REITs fight an uphill battle against cost of capital, and until they reach escape velocity at around $1.4 billion in market cap, their total returns tend to lag those of larger companies.

Investor’s bottom line

The Cannabis market will continue to grow, creating plenty of opportunities for PW to expand. The company’s robust balance sheet and external acquisition opportunities point to rapid but moderating growth in the next year or two. If you don’t mind extreme volatility, this company could be a decent speculative play. So I rate this company a Buy, with a very small allocation.

I started a very small position in January, and am not worried about the fact that it’s down over 40%, as my investing horizon is 3 – 5 years. On the whole, however, if you are inclined to invest in the Cannabis space, I regard IIPR as a much better choice.

The Seeking Alpha Quant ratings have a Buy on PW, as do The Street, Aegis Capital, and TipRanks. The Seeking Alpha Wall Street analysts rate PW a Strong Buy.

Be the first to comment