Bet_Noire/iStock via Getty Images

Investment Thesis

Power Integrations, Inc. (NASDAQ:POWI) provides semiconductor products used to convert electric power from one form to another. This is often termed power electronics.

POWI has a solid record of delivering revenue growth, profits, and free cash flow, with exceptional revenue growth of 44% in 2021 (although 2022 revenue is likely to be ~ flat).

The secular trend toward increased energy efficiency, driven by both economics and increasingly stringent regulatory requirements, provides a sustained tailwind for POWI. This plays directly to their establish focus on integration and efficiency. Electric vehicles (EVs) will provide a significant new opportunity, with the potential to become POWI’s largest addressable market.

POWI has paid dividends since 2008, and spent $292 million to repurchase 3.5 million shares in Q1 and Q2 2022. With no debt and $325 million in cash, POWI’s strong balance sheet will allow the company to easily fund their growth plans and return capital to shareholders.

Introduction

Founded in 1988, public since 15 December 1997 (it closed at $2.28 that day), and now with almost 800 employees, POWI had 2021 revenue of $700 million.

Ranked 30 out of 65 by market cap in Seeking Alpha’s semiconductor industry list, POWI has been a member of S&P MidCap 400 since December 2021. It is considered an analog semiconductor company. To give a sense of scale, POWI’s revenue is about 4% of Texas Instruments (NASDAQ:TXN), which competes in markets including power electronics.

POWI designs, develops, manufactures, packages, and markets integrated circuits (ICs) and other electronic components used to convert electric power from one form to another. In simple terms, they make critical parts for power supplies.

The most common power conversion is from the relatively high-voltage 120/240 volts AC power at a wall socket to the 5 or 12 volt DC power required by end user devices, e.g. a cell phone, TV, or fan. A variety of other conversions (DC-DC, DC-AC) are also supported. Power levels range up to 400-500 watts.

End use applications that require greater power (e.g. industrial motors, EVs, solar power systems) often use IGBT or SiC MOSFET components. A gate driver is required to properly operate these high power components, and POWI supplies a family of gate drivers.

Three Core Threads

I initially thought Power Integrations was awkwardly named, but came to realize their name actually captures exactly the core of what they do. One can identify three core threads that show up repeatedly:

- focus on power management

- value added via integration

- a drive for energy efficiency

Focus on Power Management

POWI’s mission is improved power management, in contrast to larger firms with a broader scope, or to some smaller firms focused on exploiting a particular technology. This mission focus promotes flexibility and “best-fit-to-customer-needs” technology selection, e.g. offering silicon (Si), silicon carbide (SiC), and gallium nitride (GaN) versions of some products.

Value of Integration

Balu Balakrishnan, President and CEO, said in the Q1 earnings call:

Integration has always been the core of our value proposition, bringing reliability, ease of use and time to market. In today’s supply environment, integration has the added benefit of eliminating components that are difficult or more expensive to obtain … competing products require far more external components than our IC.

Rather than provide simple discrete devices, POWI provides IC’s (integrated circuits) with additional functionality. This can reduce the number of parts in the bill of materials (BOM) by 50% or more. For their customers, this reduces labour, materials, complexity, and cost during manufacturing, and yields smaller and more reliable circuit boards (i.e. fewer components and connections to fail). Reductions in size allow for smaller and lighter end user products. This also allows POWI to earn a higher price for their IC than for a simple discrete component.

An additional advantage is that the simplicity provided by the IC’s increased built-in functionality allows easier and faster engineering design-in, reducing customer’s engineering effort and time to market.

POWI has invested to further capitalize on this advantage, for example providing the PI Expert™ design software and the Motor Expert™ software suite.

Balu Balakrishnan noted this evolution in the Q2 earnings call:

Integration is no longer strictly a function of hardware, but a combination of hardware and software to provide comprehensive protection and preventive maintenance features. The simplicity of BridgeSwitch architecture, combined with our Motor Expert software enables rapid design cycles, a capability that has been especially powerful in recent months with many customers forced into sudden redesigns by competitor supply shortages and changes in efficiency regulations.

Energy Efficiency

The drive for energy efficiency is also deep in POWI’s corporate culture.

Several of POWI’s ICs reduce standby power consumption to essentially zero.

Out of curiosity, I pulled out my watt meter and measured the standby power consumption for three appliances and two pieces of office equipment in my home. I found that the five – a stereo with remote, washing machine, K-cup coffee maker, shredder, and printer – together draw 7.9 watts of standby power; 69 kWh and about $12 per year.

While this is <1% of my power use, its pure waste, and across hundreds of millions of households, it adds up. Given increasing concerns about the cost and even availability of power, it offers considerable value.

Product Families

POWI offers about 15 families of products, targeting AC-DC conversion, LED drivers, gate drivers, and motor drivers. Most families have multiple products, to meet specific use cases, but essentially all the ICs offer increased efficiency, reliability, and reduced BOM component count.

Overall POWI supports AC-DC power outputs up to ~ 500 watts, motor-drive applications up to ~ 400 watts, and gate-drive applications up to gigawatts. Some key families are noted below (initial introduction dates give a sense of the steady growth in the scope of POWI products).

TopSwitch™ IC, the companies first commercial product, introduced in 1994.

TinySwitch™ IC, with EcoSmart (see below), 1998.

LinkSwitch™ IC, in 2002.

Hiper™ ICs, multi-die ICs, targeting 75-400 watt power supplies for LED lighting, PC and TV power, video game power, printers, copiers, and power tool chargers, 2011.

LytSwitch™ IC, drivers for industrial and residential LED lighting, 2012.

InnoSwitch™ IC integrates the power transistor (Si, SiC, or GaN) with other components to significantly simplify designs and reduce BOM, 2014. There are multiple versions of InnoSwitch. Sales of InnoSwitch passed 1 billion units in 2020.

SCALE-iDriverTM family of ICs, drivers for high power IGBT and SiC for 400V and 800V EVs, 2016.

BridgeSwitch™ motor-driver ICs, targeting brushless DC motors up to 400W for appliances, fans, pumps, etc., 2018.

MinE-CAP™ IC, to reduce the size of bulk capacitors.

The Zero families of simple, low-cost ICs – SenZero™ LinkZero™ and ClampZero™ – reduce power consumption to near zero in standby mode.

Technologies

EcoSmart™ technology (near zero standby current), has been included in all ICs since 1998. POWI has sold ~ 20 billion chips with EcoSmart technology.

ICs with PowiGaN™ GaN transistors were introduced in 2019 after nearly a decade of development, to provide more efficient, cooler, smaller power supplies without heatsinks or active cooling and increase average selling price (ASP).

This 2019 teardown of a fast charger shows details (X-ray, etc.) of an InnoSwitch3, and indicates at least some version were built with GaN on a sapphire substrate. POWI marked the delivery of 1 million InnoSwitch3 with GaN to Anker Innovations Co., Ltd. for 65 watt power supplies in October 2019.

This May 2021 interview outlines the use of the POWI’s InnoSwitch4-CZ and ClampZero chips, each about $3.85 in volume, in Anker’s new Nano II series of 30-45-65 watt GaN chargers.

Balu Balakrishnan, from the Q1 earnings call again:

We expect GaN to replace silicon across a broad range of power supply market in years ahead and the technology features prominently in our roadmap as we look to double our adjustable market over the next five years.

And from the Q2 call:

great progress penetrating the market with our highly integrated GaN products, including InnoSwitch, MinE-CAP and ClampZero as well as the recently introduced power factor chip HiperPFS-5. We won a wide range of GaN designs in Q2.

Segments and End Markets

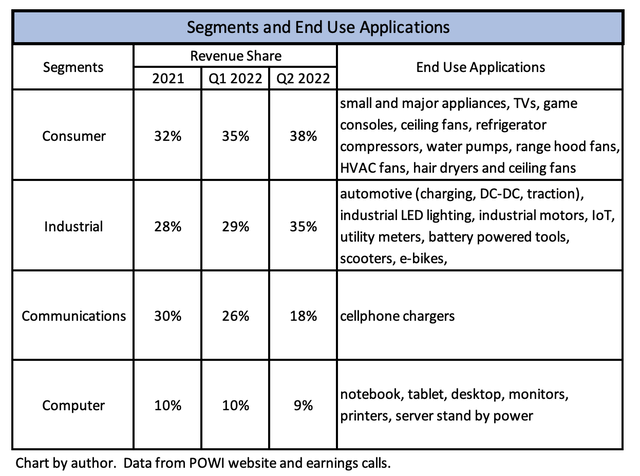

POWI estimates their addressable market is $4 billion, split into 4 segments, with multiple end use applications. They believe they are making significant market share gains in 2022.

POWI Segments and End Use Applications (POWI website and earnings calls.)

Regulatory Requirements Expand Markets

New efficiency standards for air conditioning in China, and for ceiling fans in India will expand the market for efficient power supplies in the Consumer segment, and POWI already has a number of design-ins.

In the US, the Department of Energy is currently in the process of rulemaking for external power supplies, and has identified a number of options to improve energy efficiency including GaN and SiC, modern designs, and active power factor correction – all current POWI products. A similar multi-year process is starting for consumer products (TVs, refrigerators, etc.).

The Auto Market

The auto market will be important. Balu Balakrishnan says in the Q2 call:

Automotive is shaping up to be our largest addressable market opportunity as the EV market continues to grow and we expand our portfolio of automotive qualified products.

The auto market has long design cycles – up to four years for some components, so revenue ramp up will take some time. Auto revenue is projected to become material in 2024, and will likely be broken out from industrial as a 5th reporting segment when it reaches ~ 10% of revenue.

Products already qualified to the automotive AEC-Q100 standard include SCALE-iDriver, InnoSwitch™ and LinkSwitch™ ICs.

In February 2022, POWI announced two new 1700V-rated ICs in its InnoSwitch3-AQ family, incorporating a SiC primary switching MOSFET. Higher voltage ratings will become important as EV architectures migrate from the current typical 400V to 800V, which is expected to dominate the market.

In addition to automobiles, this market is expected to include buses, trucks, mining, and construction equipment.

Manufacturing

POWI outsources wafer fabrication and assembly operations, and most test operations.

Wafer fabrication is performed in Japan and the US, by ROHM Co., Ltd. (OTCPK:ROHCY), Seiko Epson Corporation (OTCPK:SEKEY), X-FAB (OTCPK:XFABF), and Toshiba (OTCPK:TOSYY), with wafer supply agreements with Lapis and Epson.

Assembly is performed by subcontractors in China and elsewhere in Asia.

POWI allows inventory to wax and wane to maintain stable foundry capacity, and manages inventory among distributors, OEMs, and POWI to ensure inventory is available where needed. Inventory at the end of Q2 was 11.6 weeks at distributors, and 132 days internally. Because most products have both a stable configuration and many applications, there is little risk of inventory obsolescence.

Financials

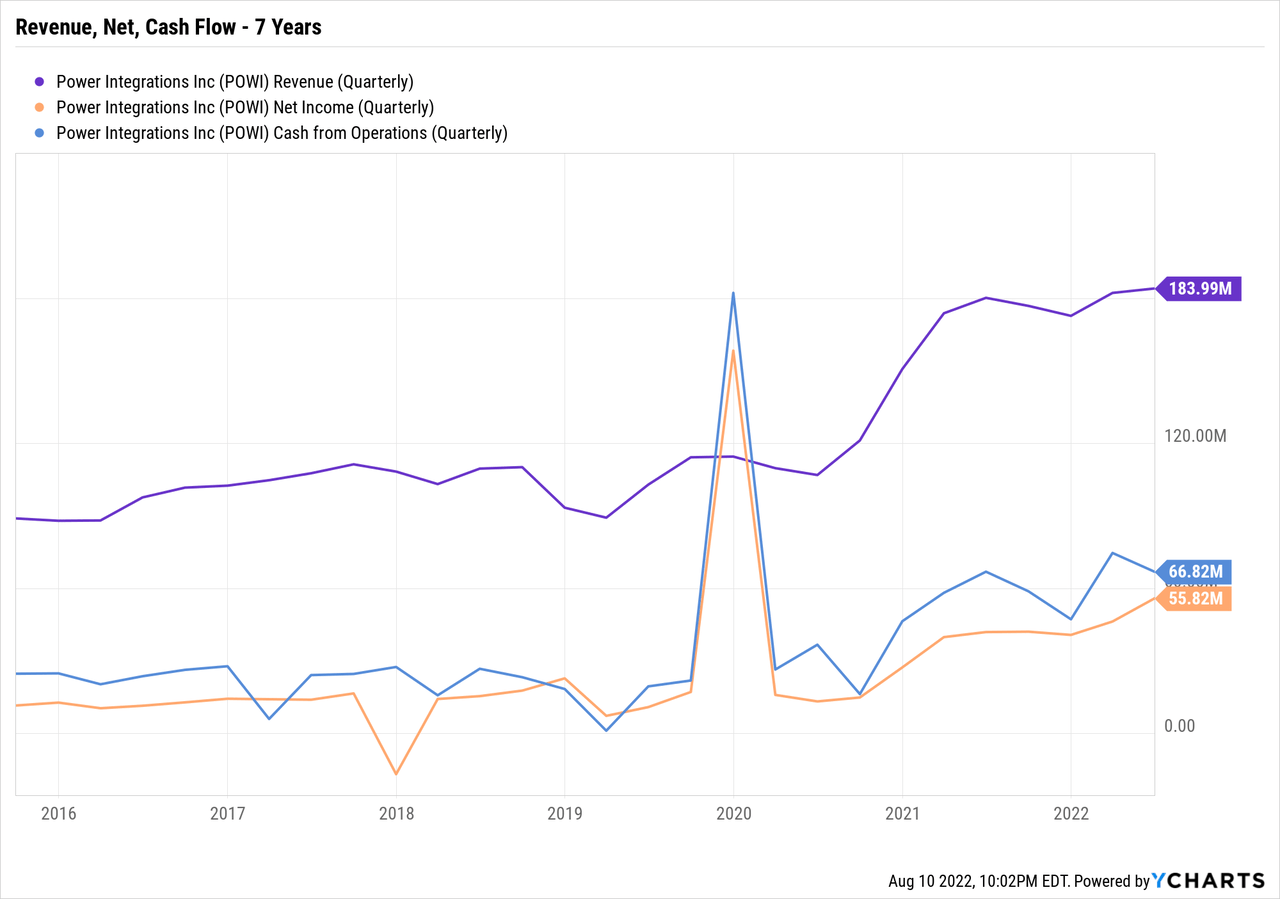

Revenue for 2022 is up only marginally vs. 2021. Q2 was $184 million, up ~ 2% for the quarter vs. 2021, and 4% for the six-month period vs. 2021.

The most notable contributor to this ~ flat revenue was highlighted in the Q2 earnings call:

The weakness in smartphone market has been confirmed by many of our peers this earnings season and had a greater-than-expected impact on our Q2 results. Revenues from our communications category were 30% lower sequentially and driven entirely by Chinese handset customers.

Looking back seven years (see chart below), POWI has generated fairly steady financial results, with revenue, net income, and cash flow growing, particular in 2021. The spike in the chart below represents a $175 million settlement in October 2019 from ON Semiconductor (NASDAQ:ON) regarding patent infringement.

YCharts

At 30 June 2022, POWI had no debt, and $325 million in cash and equivalents. The company has paid a dividend since 2008.

In the first six months of 2022, POWI repurchased 3.5 million shares for $292 million, i.e. an average price of $83.42, exhausting it stock repurchase authorization. About 20% of this reduction was offset by shares issued under employee stock plans, leaving about 57 million shares outstanding at the end of Q2 2022.

POWI sells to distributors (~73% of revenue in H1 2022), OEMs, and power supply manufacturers. Their top 10 customers account for ~ 80% of revenue. Distributor Avnet (NASDAQ:AVT) accounted for 30% of revenue. Geographically, 53% of revenue comes from China and 10% from Korea.

The industrial segment provides the highest margins, followed by consumer, computer, and communications.

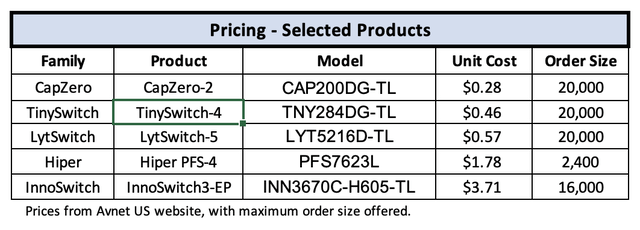

Revenue growth faces two opposing forces, growing power management unit volume and routine declines in ASP. POWI sells nearly two billion ICs a year to generate ~ $700 million revenue, making their 50-55% gross margins a testament to their efficiency. The table below (data from the Avnet US distributor website) for a small sample of products provides some sense of the price environment in which POWI operates.

Table by author, data from Avent website.

In aggregate, this normally results in relatively low revenue growth, absent increased share of existing markets or expansion into new markets. From the Q2 earnings call:

Analyst

And then over the last couple of years because of the shortage of semiconductor, I don’t think you have really passed along cost savings to your customers. Now that people are comfortable with their inventory positions … are you planning on doing the normal 5% price reductions going forward?

Balu Balakrishnan, CEO

We always price our products based on value. To the extent the discrete components supply becomes easier and the cost on those come down, yes, it will have some impact on our pricing, but it’s all value. It is — it will not be driven by the dynamics of the market.

POWI has taken both approaches; new product families, extending products to higher power levels, and developing new applications (e.g. “smart” utility meters, battery-powered lawn equipment).

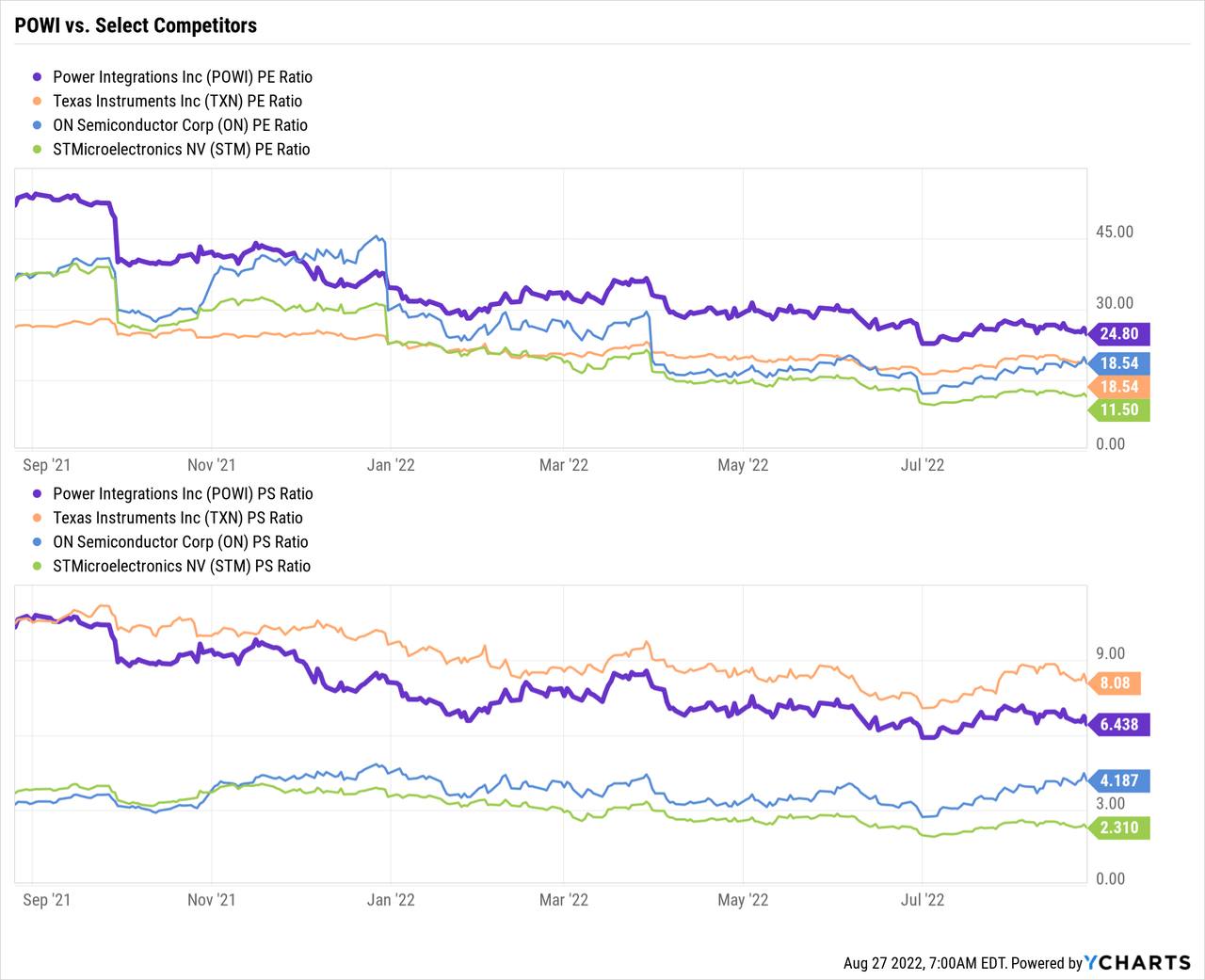

Valuation

POWI does not appear compellingly inexpensive on a P/E or P/S basis.

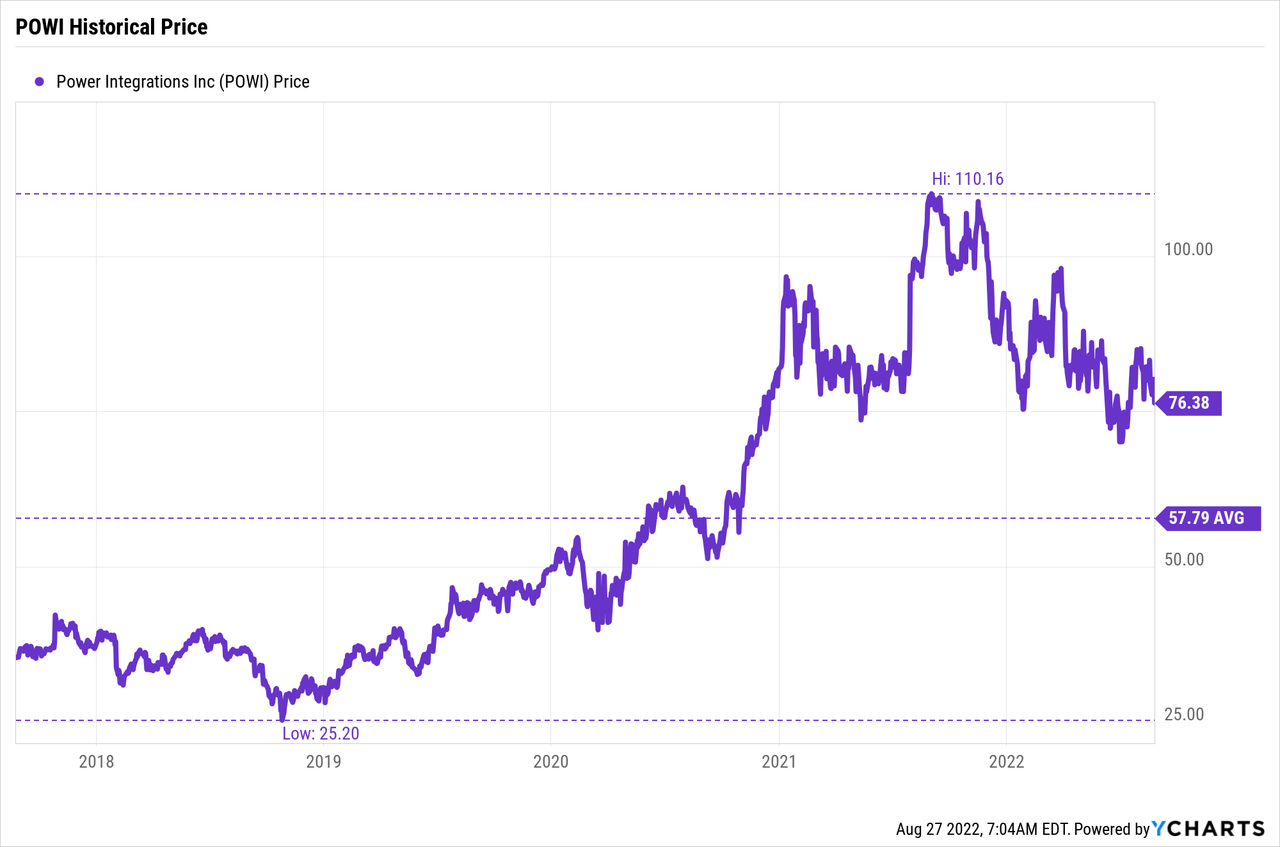

Or on a historical price basis.

What do the pro’s think? According to this article in American Banking News, three analysts updated price targets for POWI in recent weeks, setting targets of $90, $95, and $98. Seeking Alpha posts an average price target of $92.

POWI management voted with their checkbook in the first two quarters this year to spend almost $300 million to repurchase 3.5 million shares at about $83. It’s probably fair to say they believe that’s near fair value.

Risks

There are a couple of risks to this investment thesis worth noting.

POWI faces geopolitical risks. In their case, it primarily involves customers rather than manufacturing, as their fabs are outside of China and Taiwan.

POWI faces significant competition. Several larger competitors are aggressively ramping up SiC capacity. Smaller GaN focused competitors will aggressively press GaN’s technical advantages. The auto market – a big prize in many eyes – will be hotly contested. I wrote recently about some of the competitors in the power electronics space.

Investor Takeaway

POWI is a well-established and successful mid-cap semiconductor company, with a focus on efficient power management that is broadly applicable to many end uses. While the overall market is growing, they face significant competition.

They have shipped ~ 20 billion chips, have no debt and cash in the bank, and have been cash flow positive for many years.

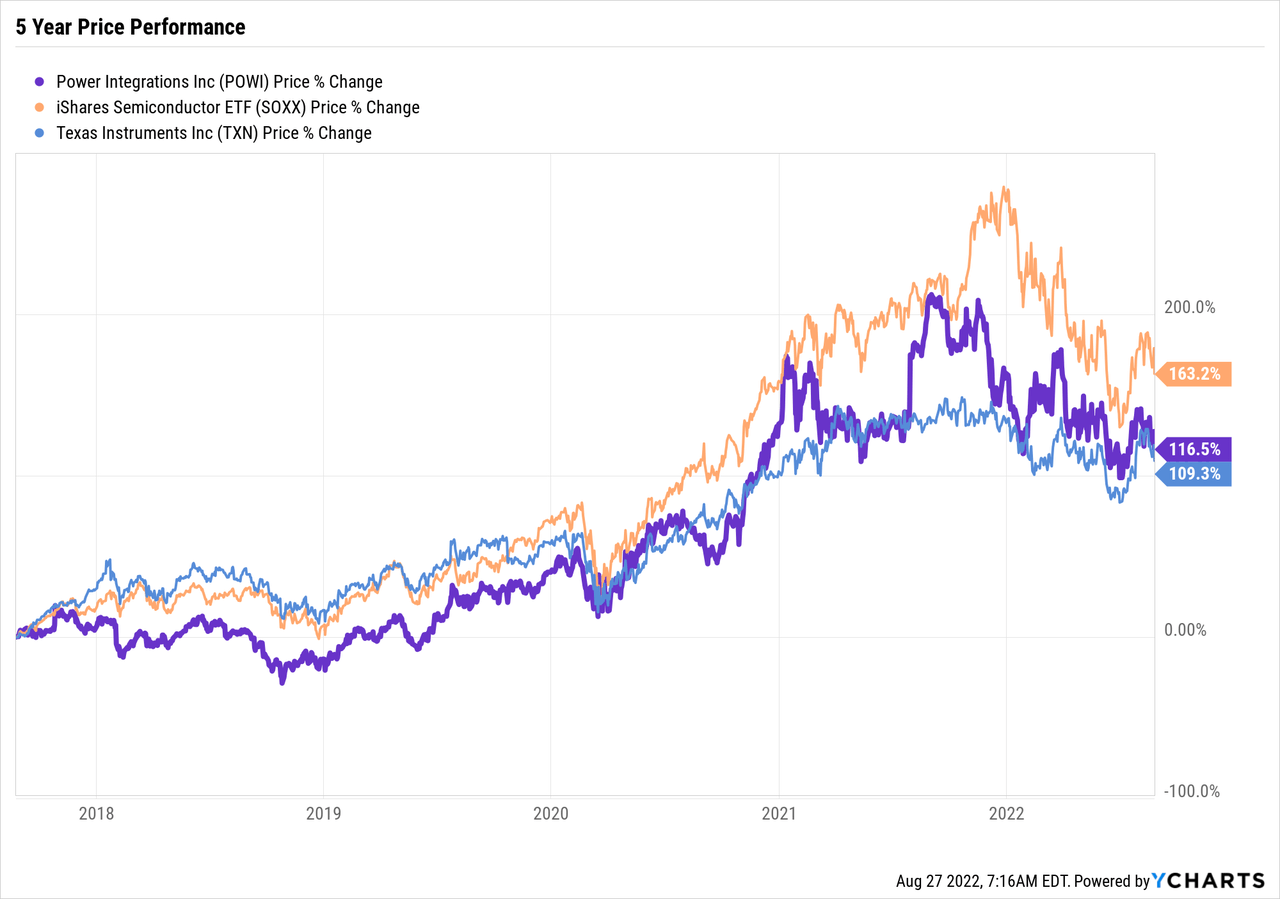

POWI pays a small dividend (< 1% yield), so returns are going to have to come largely from capital gains, but those have not been exceptional with respect to the semiconductor sector or larger competitors in recent years.

For an investor looking for increased exposure to the semiconductor space, POWI currently looks like a solid, if not compelling, choice. I would expect the fairly consistent past performance to continue.

Personally, I have no current position in POWI. As a long-term investor, with an already fairly full allocation in the semiconductor space, I would consider an investment at a significantly lower entry price. On the Seeking Alpha system, I will rate it a Hold.

Be the first to comment