MF3d

Power Integrations (NASDAQ:POWI) is a fascinating company with very unique semiconductor products, and we like analyzing its results since they tend to give an idea of where the economy is heading. Two quarters ago the company called attention to a slowdown in the smartphone market and signs that other markets were beginning to fade after the strong demand of the prior two years. Last quarter it noted that distribution sell-through had in fact slowed across all of its end market categories, likely signaling a broad-based downturn in demand. As it turns out, the company was right and now we are hearing from others the same things, that the economy is cooling off and demand is weakening. In other words, Power Integrations has historically been among the first in its industry to experience cyclical and macro driven slowdowns. The good news is that it is also one of the first to see signs of a recovery, so we are going to be paying a lot of attention to what the company has to say about green shoots.

So far the company has seen the summer slowdown give way to a more rapid deterioration in the business environment over the past couple of months. End demand appears to have declined significantly, particularly in the consumer category, which is about a third of the business and is dominated by appliances.

Fortunately there are indications that the business is likely to hit bottom over the December and March quarters. The communications category, which was the first category to experience the downturn, was sequentially higher in Q3 and channel inventory fell significantly during the quarter. Across the entire business cancellations were lower in Q3 than in Q2, and the company has seen a modest uptick in orders in recent weeks with many customers already having eliminated much of their excess backlog.

The company even sounded optimistic in that it expects recent market share gains and contributions from new products to enable outperformance compared to its competitors as it comes out of the downturn. Another positive is that infrastructure projects have come back nicely this year. Things like renewables, solar and wind, high-voltage DC transmission systems, electric locomotives have been doing very well. This optimism is reflected in the new share buyback authorization of $100 million.

Q3 2022 Results

Revenues for the quarter were $160 million, which means they were 13% lower than the prior quarter. Consumer revenues fell more than 25% sequentially, with China continuing to be the prime source of weakness in the appliance market. Communication revenues were down more than 20% sequentially reflecting continued weakness in the smartphone market. Computer revenues were up slightly from the prior quarter, driven by strength in tablet charges, as well as recent design wins in notebooks. Industrial revenues also increased slightly from the prior quarter, driven by strength in a range of applications including solar, wind, and rail. Revenue mix for the third quarter was 41% industrial, 32% consumer, 16% communication, and 11% computer.

Non-GAAP gross margin was sequentially lower at 57.8%. The sequential decrease was driven by less favorable pricing environment as well as lower back-end manufacturing volumes. Non-GAAP operating margin for the quarter was 32.4% and non-GAAP earnings were $0.84 per diluted share.

Balance Sheet

Power Integrations has one of the strongest balance sheets in its sector, with $363 million in cash and investments at quarter end, an increase of $36 million during the quarter. Cash flow from operations for the quarter was just under $50 million, and they used $5.5 million during the quarter for CapEx and paid out $10.3 million in dividends.

The net cash and equivalents position is roughly 10% of Power Integration’s market cap, it is therefore something to take into consideration in the valuation. In any case, we are not worried about the financial strength of the company with the profit margins it has, and the cash and equivalents that it holds.

Inventories

Inventories rose 29 days from the prior quarter to 161 days. The long lives and flexibility of its products allow the company to build wafer inventory during a downturn ensuring continued access to capacity at its foundry partners. Inventories are expected to remain elevated through the first half of 2023, and then begin to taper back towards its target level in the second half of the year.

Importantly, distribution inventory for communications category decreased significantly during the quarter and sell-through was up sequentially, indicating that the worst of the inventory correction in smartphones may be behind.

Competitors

Something quite interesting that we learned from the earnings call is that some competitors are exiting, or at least temporarily withdrawing from the market. An analyst asked how easy it would be for these competitors to reenter if they wanted, or if switching cost are too high for the customer to move back to them. This is what CEO Balu Balakrishnan responded:

I think that the level of integration, level of innovation we bring makes it very difficult for western competitors to compete with us and make good margins. So it’s a question of – they can make more margins elsewhere. They would rather go elsewhere. That’s what is happening right now. In some cases, they’re completely decided to close down, like Panasonic has closed down, but many others are retreating from this market. Basically, they’re shipping what they have, but they’re not building new products.

They look at our product and they, it’s very difficult for them to think about how to compete with us without infringing on our IP. And as you know, we have been extremely protective of our IP, and we’ve been very successful protecting our IP. So, I think we are in such a strong position in terms of being years ahead of our competition, and we will continue to innovate. I mean, that’s never going to stop. So, I am pretty confident that this is not a reversible situation.

Outlook

Clearly the headwinds are going to continue impacting the next quarter, with the company guiding revenue for the December quarter to be $125 million plus or minus $5 million. This is down more than 20% sequentially at the midpoint of the given range.

Non-GAAP gross margin for Q4 are expected to be between 56% and 56.5% with a sequential decrease driven by lower back-end manufacturing volumes and a less favorable end market mix.

For the Q1 2023 quarter their best estimate is that it would be similar to Q4 2022, and then Q2 2023 should see incremental growth. It is until the second half of 2023 that the company expects stronger demand, and for the downturn to turn into an upturn.

Valuation

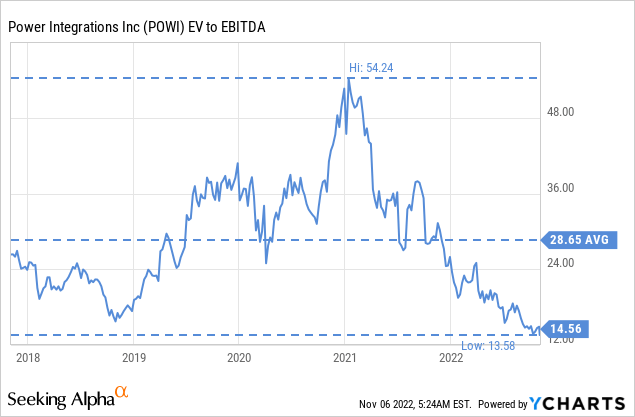

While clearly the company is facing multiple headwinds with much softer demand expected for the next few quarters, the upside of this is that the valuation has come down very significantly. As a growth stock, Power Integrations has historically commanded high valuation multiples. Its 5 year average EV/EBITDA multiple is ~28x, but currently shares can be purchased for about half this multiple. An EV/EBITDA multiple of ~14x might not be considered a bargain by everyone, but given its long-term growth potential and extremely strong balance sheet, we consider shares undervalued.

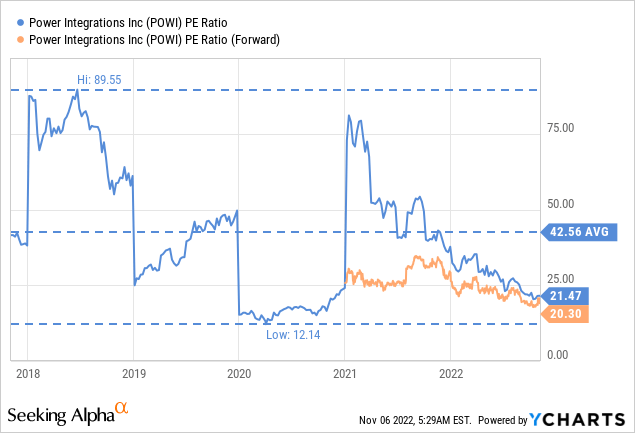

The price/earnings ratio is also at roughly half the 5 year average, and given the history of double digit revenue growth we believe a 21x p/e is quite reasonable.

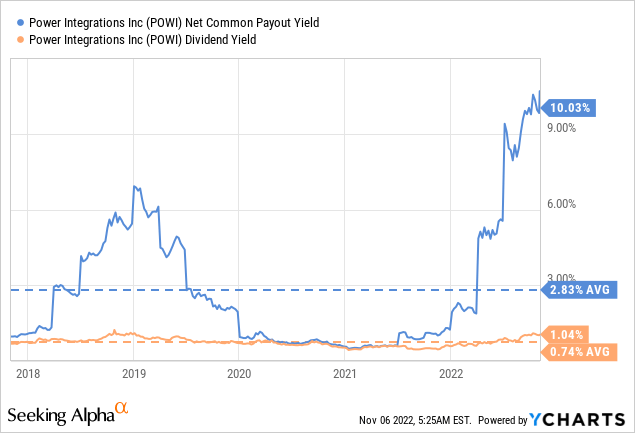

Another sign that shares might be undervalued is the very high net common payout yield, which combines the dividend yield and the share buybacks yield. It is close to the highest level in five years at ~10%, mostly as the result of significant share repurchases by the company.

Risks

Financially we view Power Integrations as extremely solid, with very high profit margins and a balance sheet with significant cash and equivalents. Our main concern is therefore the risk that a competitor might figure out a better alternative to their GaN technology. So far, however, it appears that Power Integration’s technology remains superior, and is extremely well protected by patents and trade secrets.

Conclusion

Despite the headwinds, and the expectation of a few weak quarters ahead, this could turn out to be a great time to buy Power Integration’s shares. We believe the market has over-reacted by reducing the valuation by approximately 50% compared to the historical multiples, despite the company having a track record of outperforming coming out of downturns. We view the weakness as simply cyclical, and continue to believe that the company has strong growth ahead and a very impressive technology that enables many important use cases.

Be the first to comment