Bet_Noire

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 20th.

Real Estate Weekly Outlook

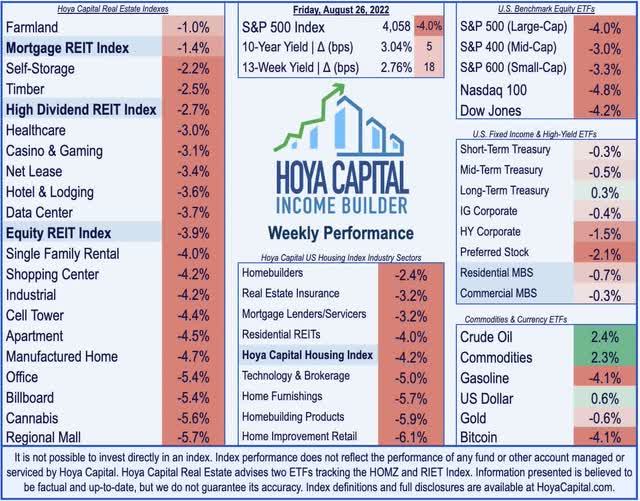

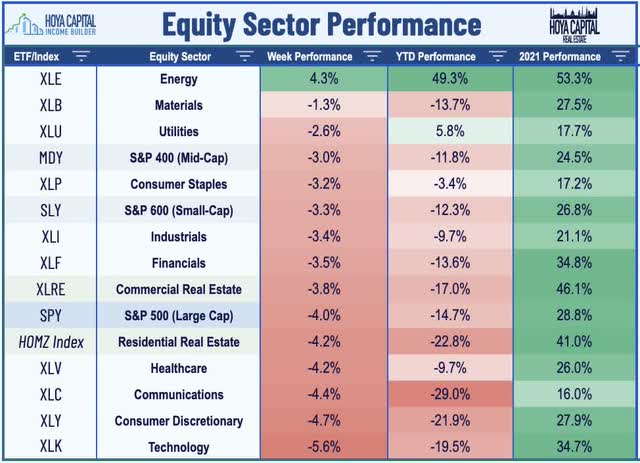

U.S. equity markets were slammed after Federal Reserve Chair Powell made clear the Fed’s intentions to raise interest rates and accept “some pain” for U.S. households in its battle against inflation. Seemingly unfazed by the mounting signs of global economic weakness, the comments came after a particularly bleak week of economic data which included PMI data showing a synchronized global contraction in July across the four major developed economic regions – US, Eurozone, Japan, and Australia – and revised GDP data that confirmed that the U.S. entered a technical recession in early 2022.

Hoya Capital

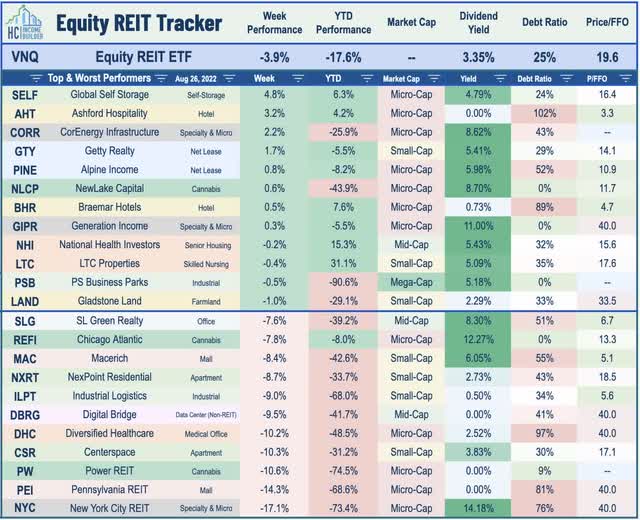

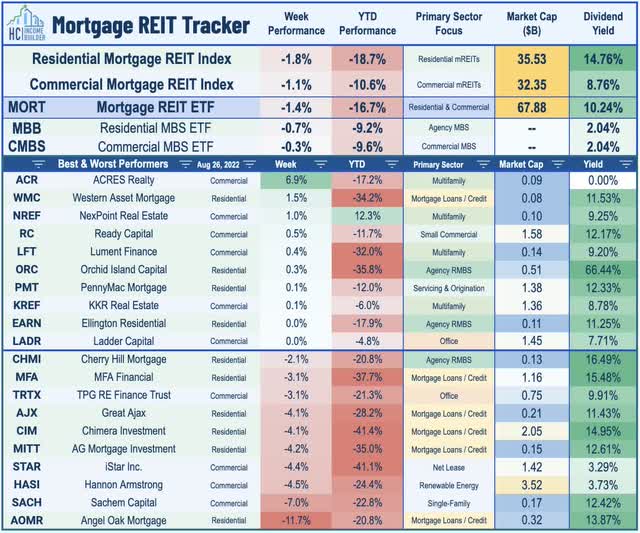

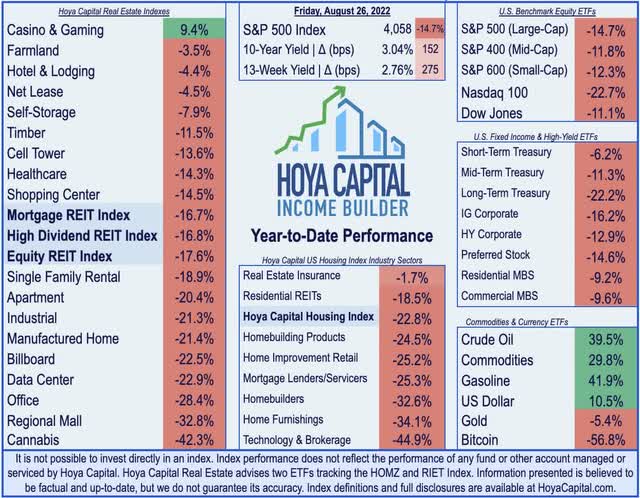

Declining for the second-straight week and posting its worst weekly losses since June, the S&P 500 dipped 4.0% – pushing its year-to-date declines to back to roughly 15% – while the tech-heavy Nasdaq 100 dipped nearly 5% to push its declines back below the “bear market” threshold of 20%. The more domestic-focused Mid-Cap 400 and Small-Cap 600 posted more modest weekly declines as the U.S. Dollar set fresh 20-year highs as economic conditions weakened more significantly in Europe amid an intensifying energy crisis. Real estate equities were broadly lower as well with the Equity REIT Index finishing lower by 3.9% on the week with all 18 property sectors in negative territory while the Mortgage REIT Index slipped 1.4%.

Hoya Capital

The concise speech by the Fed Chair left little room for a dovish interpretation with Powell invoking the “successful Volcker” policies of the 1980s and indicating that “moderating demand” through “forceful and rapid steps” is necessary until the Fed is “confident the job is done.” Clashing with the soft economic data throughout the week, the hawkish comments fueled a sell-off across global assets consistent with the “stagflation trade” pattern with economically-sensitive segments of the equity and bond markets hit particularly hard. Brent Crude oil prices climbed back above $100 per barrel, lifting the Energy (XLE) sector to 4% gains on the week -the lone GICS equity sector in positive territory. Notably, while the short-end of the curve surged to the highest levels since June, the moves on the longer-end of the curve were more muted with the 10-Year Treasury Yield closing the week at 3.04% – still well below its June highs of 3.50%.

Hoya Capital

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Hoya Capital

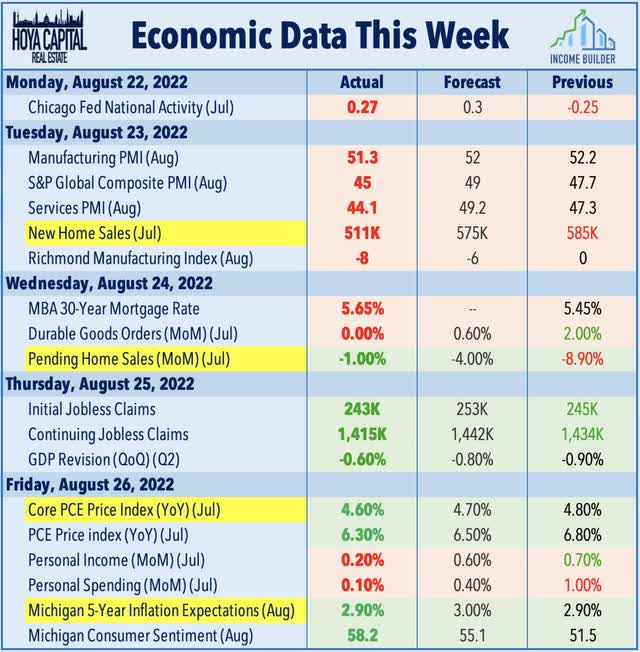

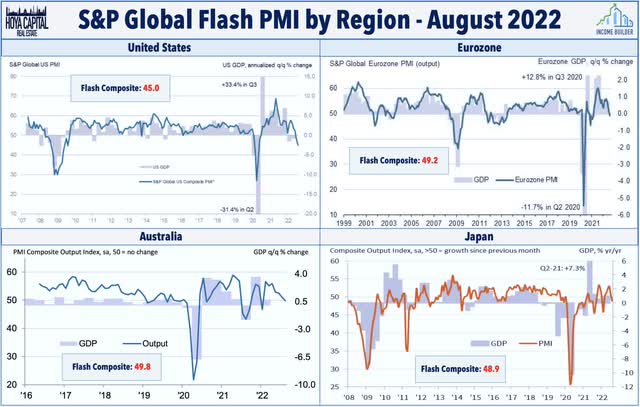

Clashing with the Fed’s view that the “economy continues to show strong underlying momentum,” a series of PMI and manufacturing surveys throughout the week showed a notable and synchronized decline in global economic activity in August across major developed economies. Kicking off with a New York Fed manufacturing survey showing a “plummet” in general business conditions, the bigger surprises were seen in the S&P Global US Composite PMI, which dipped to a 27-month low of 45 in August which “signaled further disconcerting signs for the health of the US private sector” per S&P economists. Eurozone business activity, meanwhile, declined for the second month in a row to an 18-month low while S&P Global also reported that activity declined in Japan and Australia for the first time early this year.

Hoya Capital

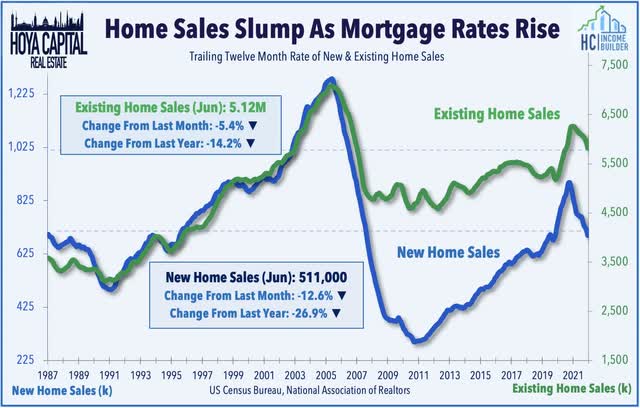

New Home Sales data was similarly soft this week with the BLS reporting that sales in July dipped to their lowest level since January 2016 as potential buyers have been priced out of the market by the historic surge in mortgage rates through the first half of this year. Sales declined 12.6% from the prior month to a seasonally adjusted annual rate of 511k units – below the 575k units expected. Sales rose in the Northeast, but declined in the other three Census regions. Notably, the median sales price did rebound after two months of sequential declines to $439k – but the year-over-year rate has moderated to 8.2% – below the CPI inflation rate for the first time since August 2020. Pending Home Sales was better-than-expected, however, as the magnitude of the year-over-year decline improved for the first month since February. Mortgage market data was also a bit stronger than expected with the MBA reporting that applications for government-backed loans – viewed as a proxy for first-time homebuying activity – increased 4% in the most recent week.

Hoya Capital

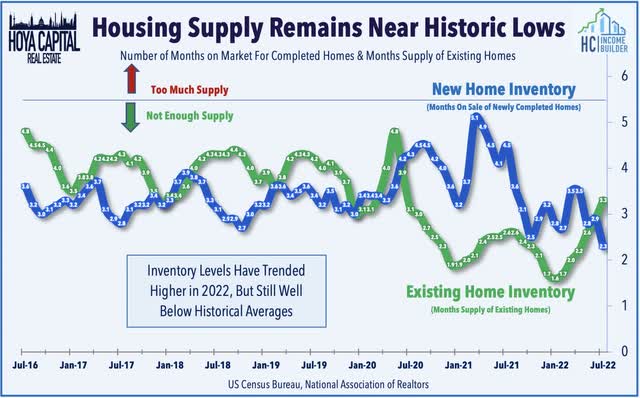

While one measure of inventory levels that includes units under construction and homes that are ordered but not yet started – Months Supply of New Homes – rose to its highest level since March 2009, the inventory measure that tracks units that are actually completed and available for sale – Months on Sales Market for Newly Completed Homes – actually declined to the lowest levels on record at just 2.3 months in July. Completed houses accounted for just 9.7% of the inventory, well below a long-term average of around 30%. Houses under construction made up 67.2% of the inventory, with homes yet to be built accounting for 23.1%. The wide divergence reflects the elongated construction timelines related to supply chain constraints and record-high backlogs at many of the largest homebuilders in 2021 as these companies were unable to keep up with demand.

Hoya Capital

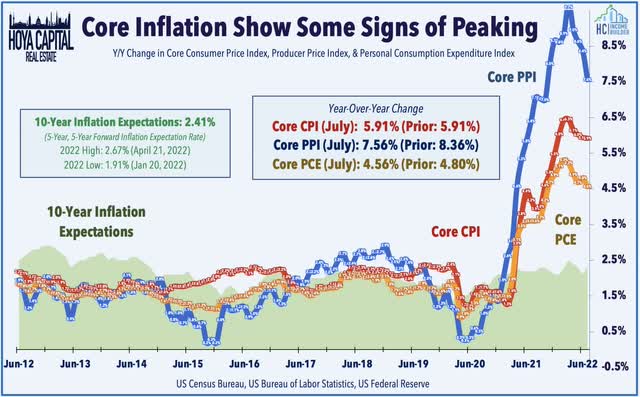

There was some positive inflation news late in the week as the Core PCE Price Index, the Federal Reserve’s preferred inflation metric, cooled in July with a month-over-month increase of just 0.1% – and 4.6% from a year earlier – below consensus estimates of 0.3% and 4.7%, respectively. The headline PCE Price Index – which includes food and energy – actually declined 0.1% in July. Contributors to the increase were spending for housing and utilities while gasoline prices were the leading contributors to the decrease. Gas prices have declined 23% from their peak above $5/gallon in June and should put similar downward pressure on the August inflation data as well – a report that will be released a week ahead of the Fed’s September rate hike decision. Also released on Friday, the Michigan Consumer Sentiment survey showed that consumer inflation expectations moderated in the revised August report with the 5-Year Inflation Expectation – a metric that the Fed watches as a gauge of “entrenched” inflation – was revised to 2.9% from 3.0%.

Hoya Capital

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

Hoya Capital

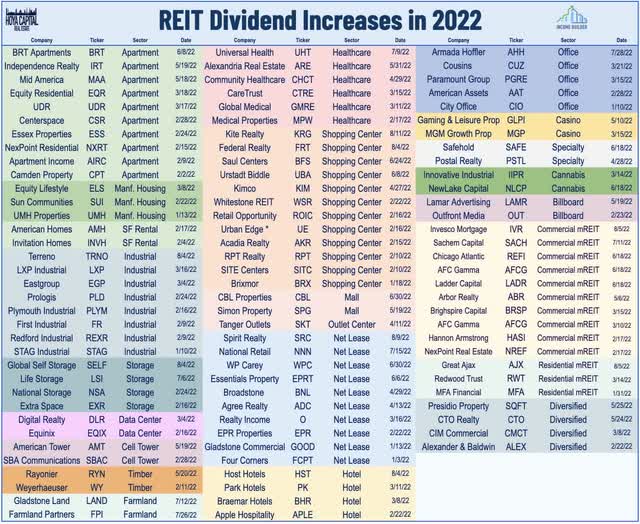

Overshadowed by the market carnage this week, a trio of REITs hiked their dividends – CTO Realty (CTO), Alpine Income (PINE), and EastGroup Properties (EGP) – bringing the full-year total in the REIT sector to 100. As discussed this week in 100 REIT Dividend Hikes – our quarterly State of the REIT Nation Report – property-level fundamentals have been quite strong – and strengthening – for most property sectors in recent quarters despite the broader economic slowdown this year. Dividends per share rose by 15.1% in Q2 from last year, but total dividend payouts remain roughly 13% below pre-pandemic levels as many REITs have been exceedingly conservative in their dividend distribution policy. REIT dividend payout ratios declined to just 65.3% in Q2 – well below the 20-year average of 80% – leaving ample cushion to maintain distributions in the event of a deepening recession.

Hoya Capital

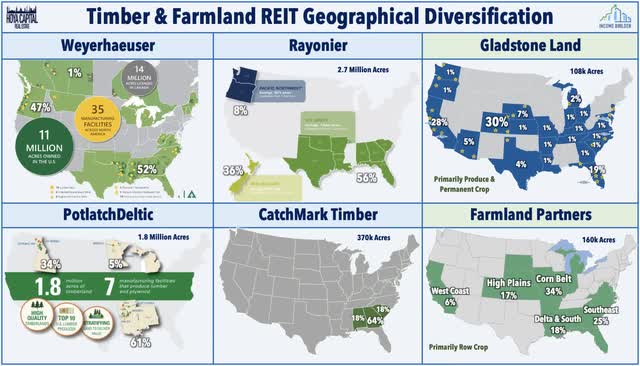

Farmland: The best-performing asset class this week, farmland REITs were in focus as a potential beneficiary of the solar and wind energy subsidies in the recently-signed Inflation Reduction Act. On that note, Farmland Partners (FPI) announced that a tenant plans to begin construction of a new solar power project in Clark County, Illinois, by the end of the month. The development, which extends across six FPI properties spanning 1,542 acres, will result in rents that are “nearly 50% higher than current farm rents once construction is completed.” Elsewhere, Gladstone Land (LAND) announced this week reduced the size of its 6.00% Series C Preferred Stock offering from $500M to roughly $255M, citing “the rising cost of capital, cap rate compression, and uncertainty surrounding the overall economy has led to a slowdown in acquisition activity this year.” LAND has sold approximately $213M of its Series C Preferred Stock since it launched the offering on April 3, 2020. The company noted that while overall farmland values continue to increase, rental rates in certain areas are “not increasing quite as fast, and we believe it may take some time for rents to adjust to current land prices.”

Hoya Capital

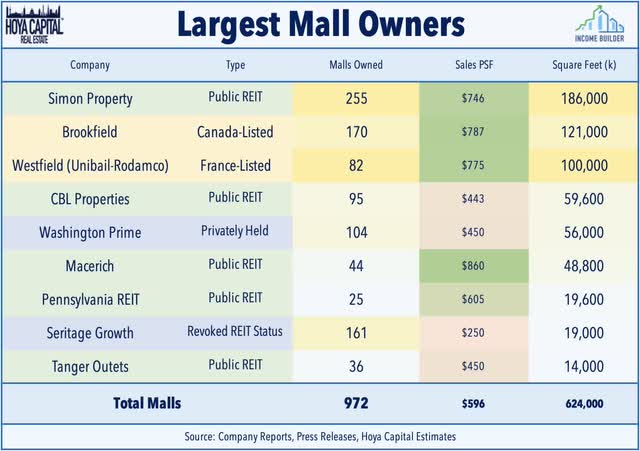

Malls: French-listed Unibail-Rodamco-Westfield (OTCPK:UNBLF) announced yesterday afternoon that it sold the Westfield Santa Anita mall in California for $540m to an unnamed buyer at a sub-6% cap rate – the largest mall transaction since 2018 – an illuminating valuation read-through for Simon (SPG) and Macerich (MAC). The deal closed at a 10.7% discount to the asset’s December 2021 appraisal – a relatively modest discount compared to the 35% decline in mall REIT shares this year. Back in April, URW unveiled a plan to sell its 27 malls in the U.S. – most of which are A-rated malls that operate under the Westfield brand – as it seeks to shore up its balance sheet and pivot its focus back to European assets. The Santa Anita mall is an “A-” rated mall with tenant sales PSF of $611 – towards the lower-end of Westfield’s portfolio – shy of the $750+ average in malls owned by Simon and Macerich. This weekend, we’ll publish an updated Mall REIT report on Income Builder that will discuss our updated outlook and recent allocations in the mall sector.

Hoya Capital

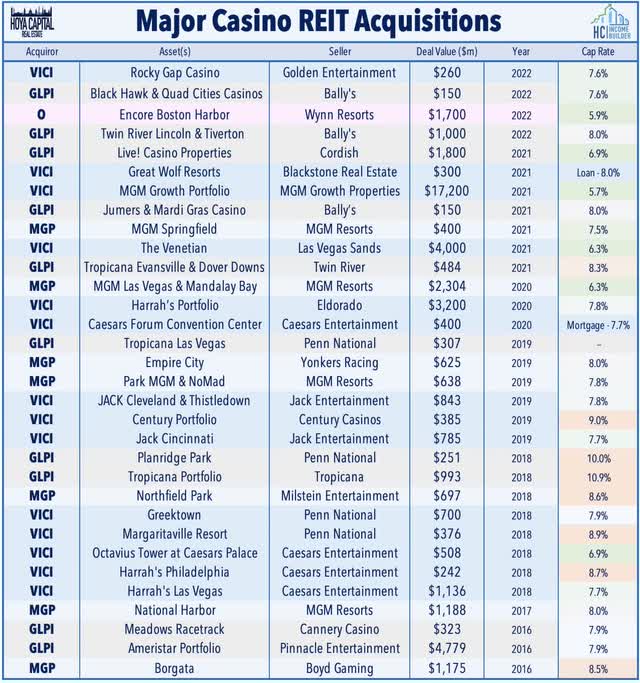

Casino: VICI Properties (VICI) was among the better performers this week after announcing it will acquire the land and buildings of Rocky Gap Casino in Maryland from Golden Entertainment (GDEN) for $260M in cash at a 7.6% capitalization rate in a deal that is expected to be accretive immediately upon closing. Century Casinos will acquire the operating assets for approximately $56M million. Simultaneous with the closing, Rocky Gap will be added to the existing triple-net master lease agreement between VICI and Century and annual rent will increase by $15.5 million. Additionally, the term of the Century Master Lease will be extended such that, upon closing of the transaction, the lease will have a full 15-year initial base lease term, with four 5-year tenant renewal options. The deal is VICI’s largest acquisition since announcing its deal to acquire MGM Growth Properties last year.

Hoya Capital

Mortgage REIT Week In Review

Mortgage REITs were among the better performers this past week on a relatively slow week of newsflow, shaking off the hawkish Fed commentary and pressure on mortgage-backed bond (MBB) valuations. ARMOUR Residential (ARR) finished flat on the week after holding its monthly dividend steady at $0.10/share – representing a forward yield of roughly 16.5%. Elsewhere, Great Ajax (AJX) was among the laggards on the week after closing on a $110M private offering of 8.875% senior unsecured notes due September 2027. Sachem Capital (SACH) also lagged after closing on a $35M offering of 8.00% unsecured, unsubordinated notes due 2027.

Hoya Capital

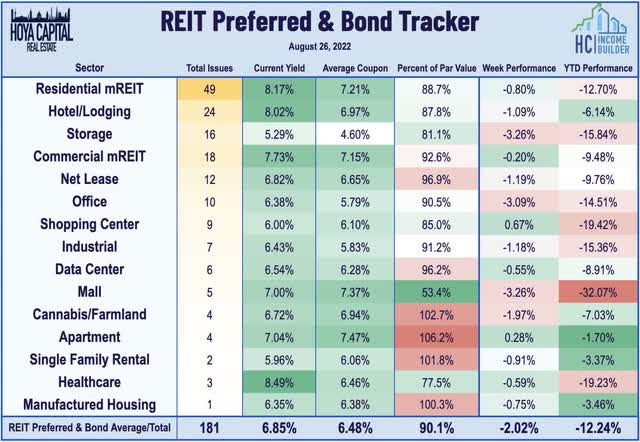

REIT Capital Raising & REIT Preferreds

The Hoya Capital REIT Preferred Index finished lower by another 2% this week – roughly in-line with the broader iShares Preferred ETF (PFF) – pushing its year-to-date declines back to roughly 9% on a total return basis. This week, Wheeler Real Estate (WHLR) completed its controversial deal to acquire Cedar Realty under which Cedar’s two outstanding preferred issues – its 7.25% Series B and 6.50% Series C – will remain outstanding but are expected to have their dividends suspended. Wheeler has not paid distributions on its two preferred issues since 2018 – one of two REITs alongside Pennsylvania REIT (PEI) that is not current on their preferred distributions. Elsewhere, Plymouth Industrial (PLYM) announced that it will convert its remaining Series B Preferred Stock held by Madison International Realty into roughly 1.9B shares of common stock on a leverage-neutral basis. Despite the early conversion, Plymouth reaffirmed its full-year guidance.

Hoya Capital

2022 Performance Check-Up

Halfway through the third quarter, Equity REITs are now lower by 17.6% on a price return basis for the year while Mortgage REITs have slipped 16.7%. This compares with the 14.7% decline on the S&P 500 and the 11.8% decline on the S&P Mid-Cap 400. Within the real estate sector, casino REITs are now the lone property sector in positive territory for the year while eight REIT sectors are lower by at least 20%. At 3.04%, the 10-Year Treasury Yield has climbed 152 basis points since the start of the year, but remains well below its recent June intra-day highs of 3.50% and below its prior post-GFC-highs of 3.25% seen back in late 2018.

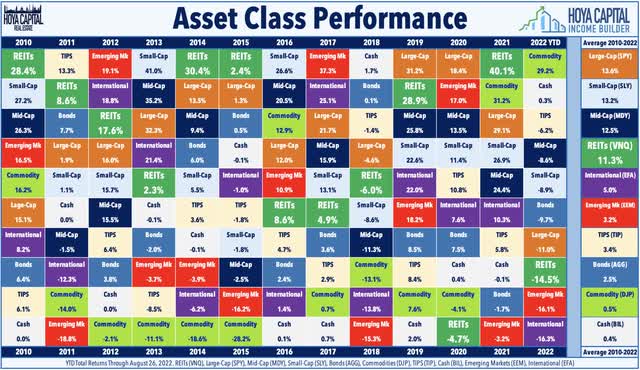

Hoya Capital

With the outperformance over the past month, REITs managed to climb out of the basement of the performance tables among the ten major asset classes, leapfrogging over Emerging Market (EEM) and International (EFA) stocks, and are still within five percentage points of the small-, mid-, and large-cap indexes as well. Among these ten asset classes, Equity REITs (VNQ) finished 2021 as the best-performing asset class with total returns of 40.1% – the best year of returns for REITs since 1976 – which came after a rough 2020 in which REITs were the worst-performing asset class with total returns of -4.7%. REITs are now the fourth best-performing asset class since the start of 2010, producing superior total returns to Bonds (AGG), TIPS (TIP), Commodities (DJP), Emerging Markets (EEM), and International (EFA) stocks.

Hoya Capital

Economic Calendar In The Week Ahead

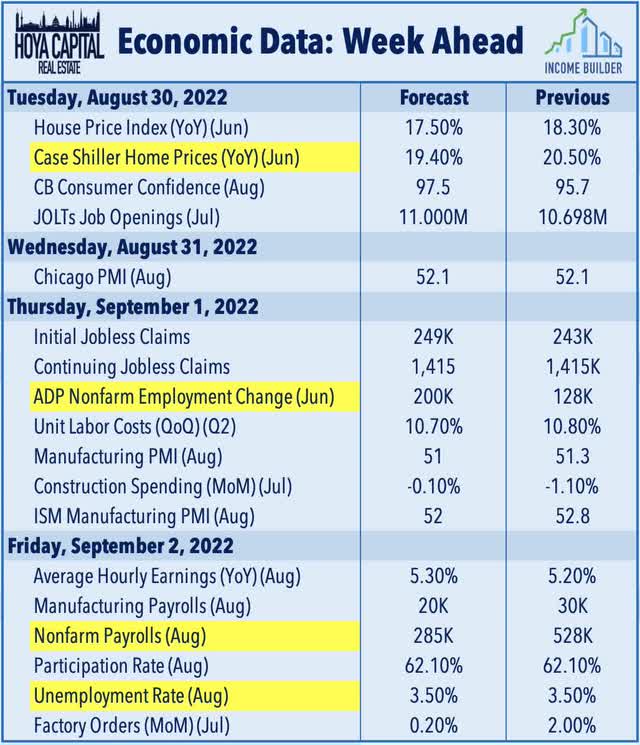

Employment data highlights another busy week of economic data and corporate earnings reports in the week ahead, headlined by JOLTS data on Tuesday, ADP Payrolls and Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in August but several sell-side firms project that we’ll see the first month of job losses since 2020. The unemployment rate, meanwhile, is expected to stay steady at 3.5%. We’ll also see home price data on Tuesday with reports from Case Shiller and the FHFA but due to the significant lag in these indexes, the effects of the recent cooldown won’t be fully reflected for several more months. Purchasing Managers’ Index (“PMI”) data will continue to be a major market focus – particularly in Europe and Asia.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment