FreshSplash/E+ via Getty Images

A Quick Take On Poshmark

Poshmark (NASDAQ:POSH) went public in January 2021, raising around $277 million in gross proceeds in an IPO that was priced at $42.00 per share.

The firm operates an online marketplace that enables users to resell used or sell new clothing and accessories.

I’m on Hold for POSH until we see management making progress toward operating breakeven while reigniting revenue growth.

Poshmark Overview

Redwood City, California-based Poshmark was founded to create a marketplace for the sale of new and used apparel, accessories and other products.

The site acts as a form of social commerce, encouraging users to connect with each other in a safe manner.

Management is headed by co-founder, president and CEO Manish Chandra, who was previously co-founder of Kaboodle, an online shopping website acquired by Hearst Communications.

The company’s primary offerings include:

-

Buy

-

Sell

-

Analytics

-

Logistics

-

Social Commerce

The firm acquires buyers and sellers via online marketing efforts and its mobile apps, which it advertises on the major app store platforms.

Poshmark’s Market & Competition

The global market for selling clothing online is extremely large, in the hundreds of billions of dollars and has been growing quickly.

The industry continued to grow during the main part of the Covid-19 pandemic, although it has been hampered to some degree by logistical challenges.

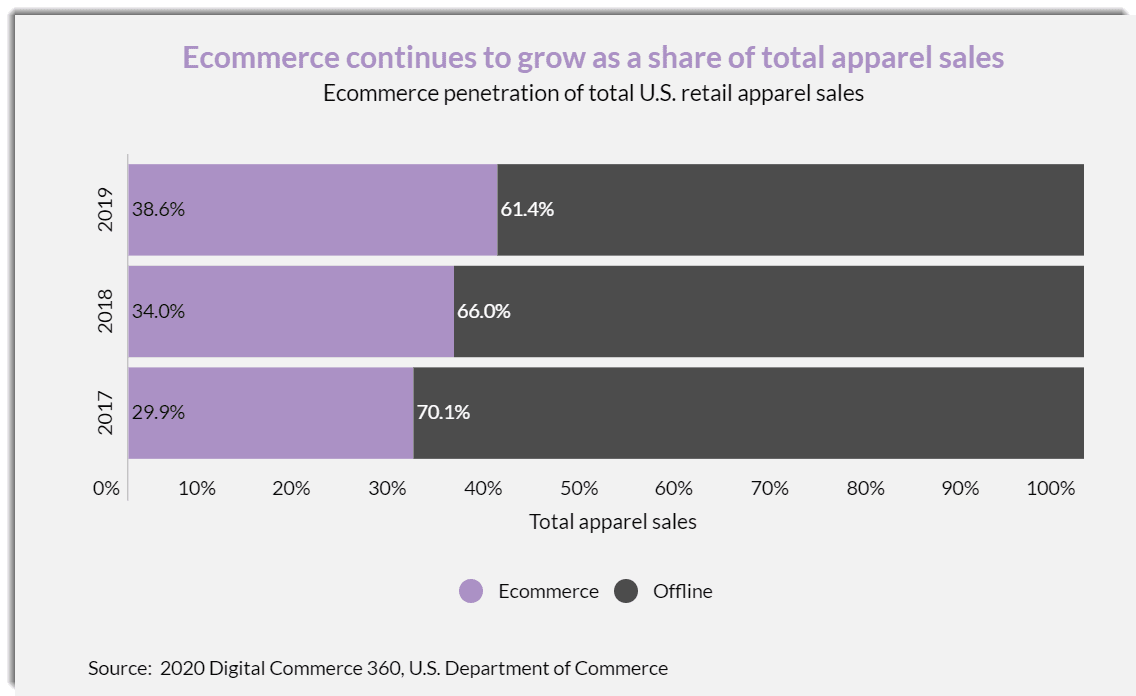

According to a report by Digital Commerce 360, online apparel sales represented 38.6% of total U.S. apparel sales in 2019 and accounted for all of the growth in retail clothing sales.

The market share of the industry has grown steadily in recent years, as the report chart below shows:

U.S. Apparel Ecommerce Market (Digital Commerce 360)

Major competitive or other industry participants include:

-

Amazon (AMZN)

-

eBay (EBAY)

-

Etsy (ETSY)

-

Facebook (FB)

-

Mercari (OTCPK:MRCIF)

-

Shopify (SHOP)

-

T.J. Maxx (TJX)

-

Walmart (WMT)

Poshmark’s Recent Financial Performance

-

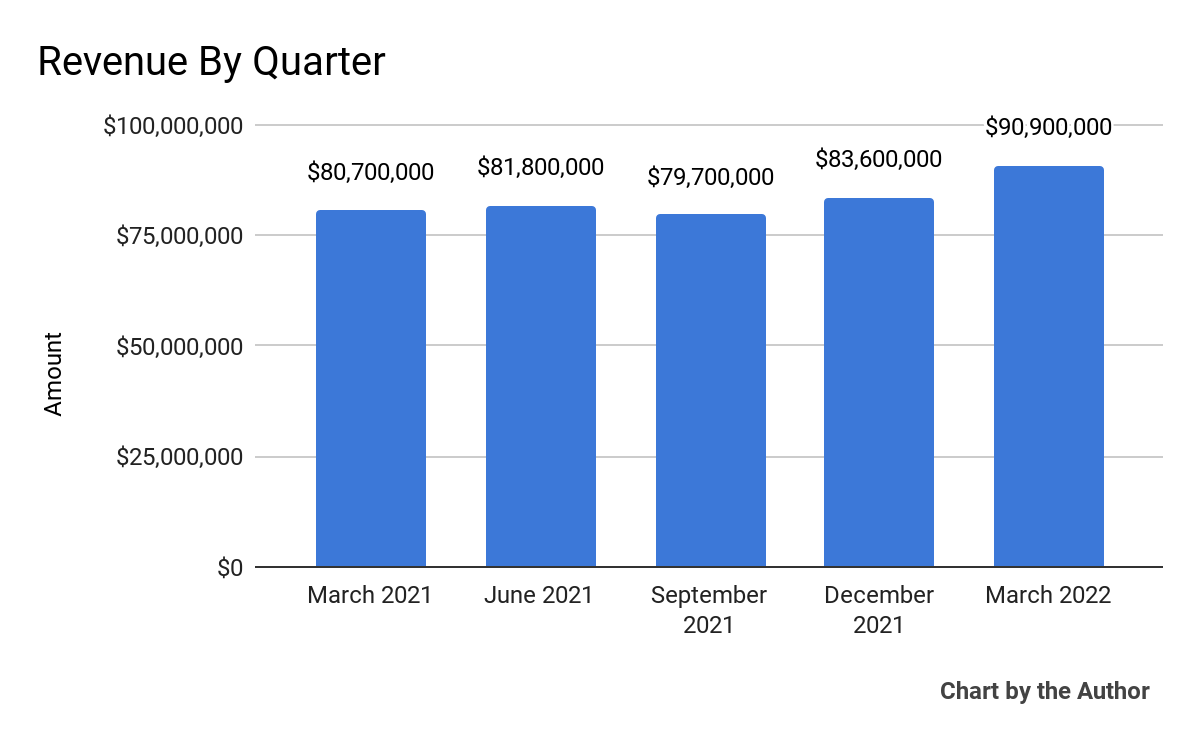

Total revenue by quarter has grown unevenly in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

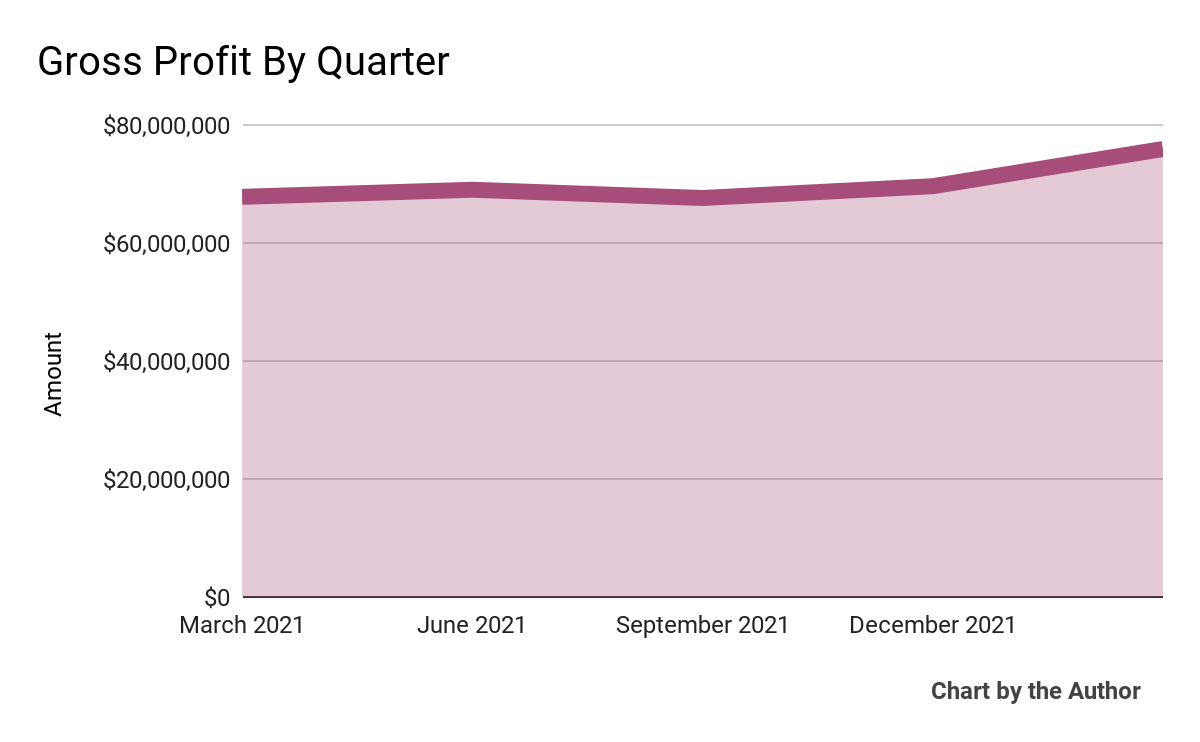

Gross profit by quarter has followed a similar trajectory to that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

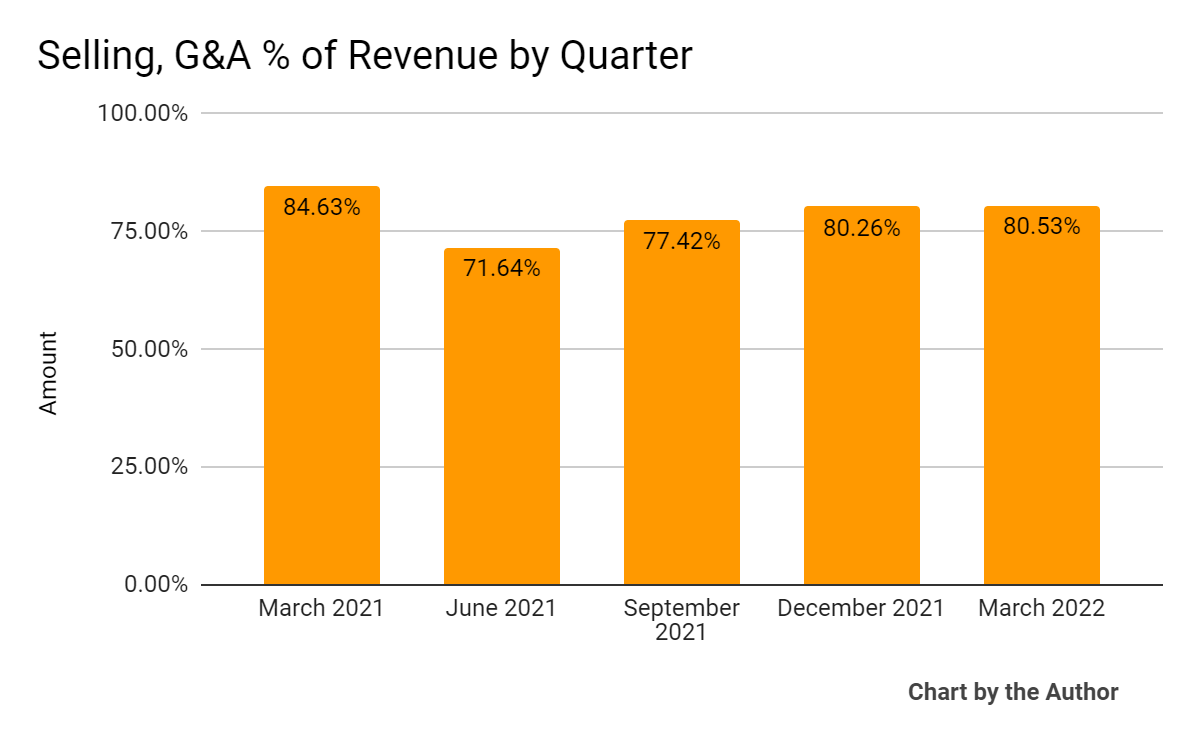

SG&A expenses as a percentage of total revenue by quarter have remained fairly high over the past 5 quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

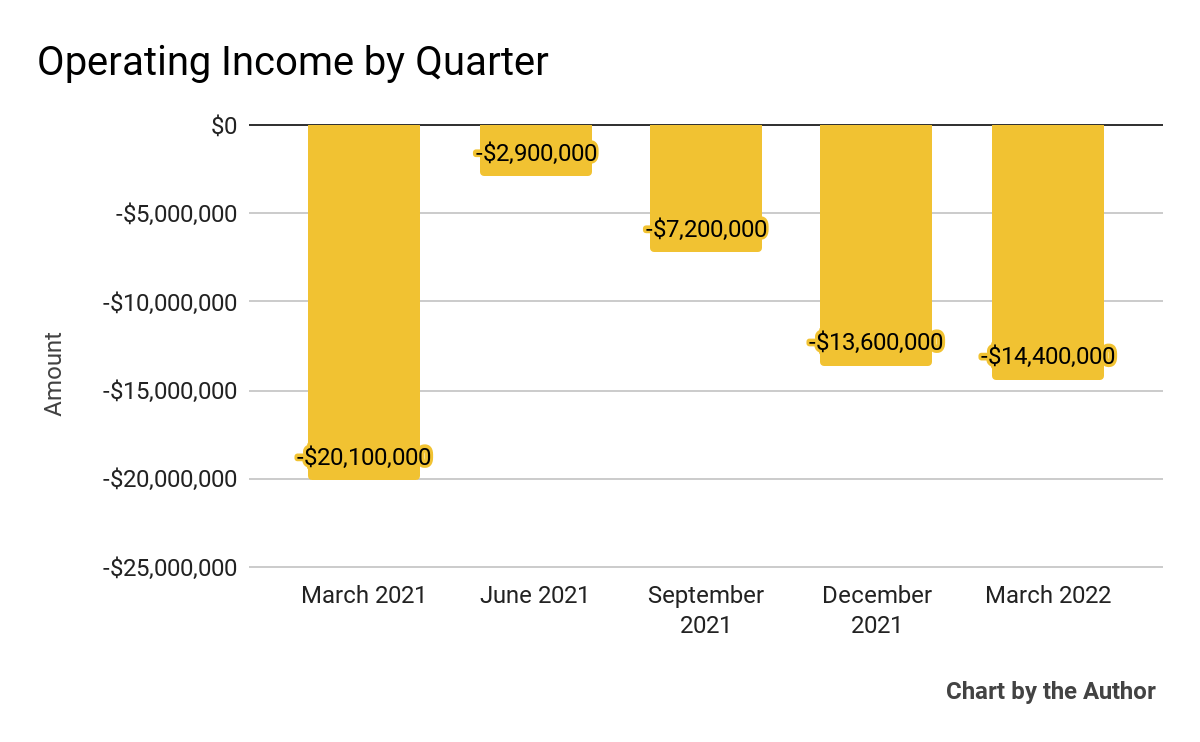

Operating losses by quarter have worsened in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

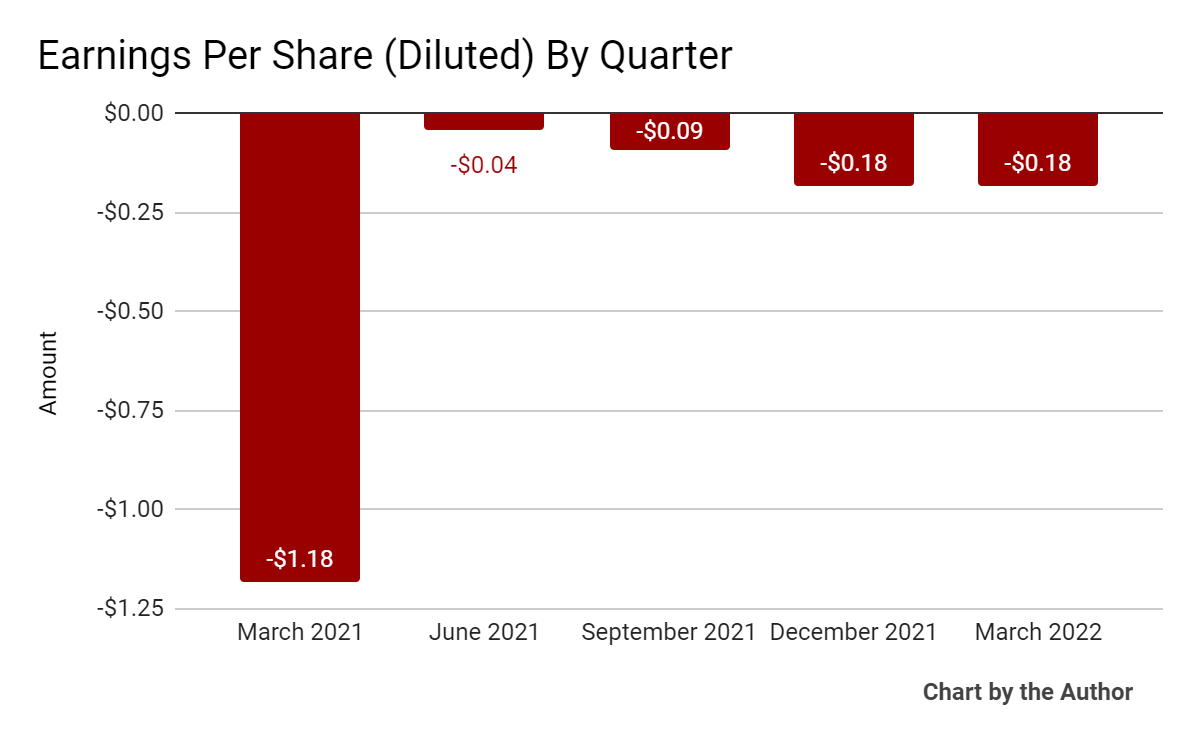

Earnings per share (Diluted) have also trended further into negative territory:

5 Quarter Earnings Per Share (Seeking Alpha)

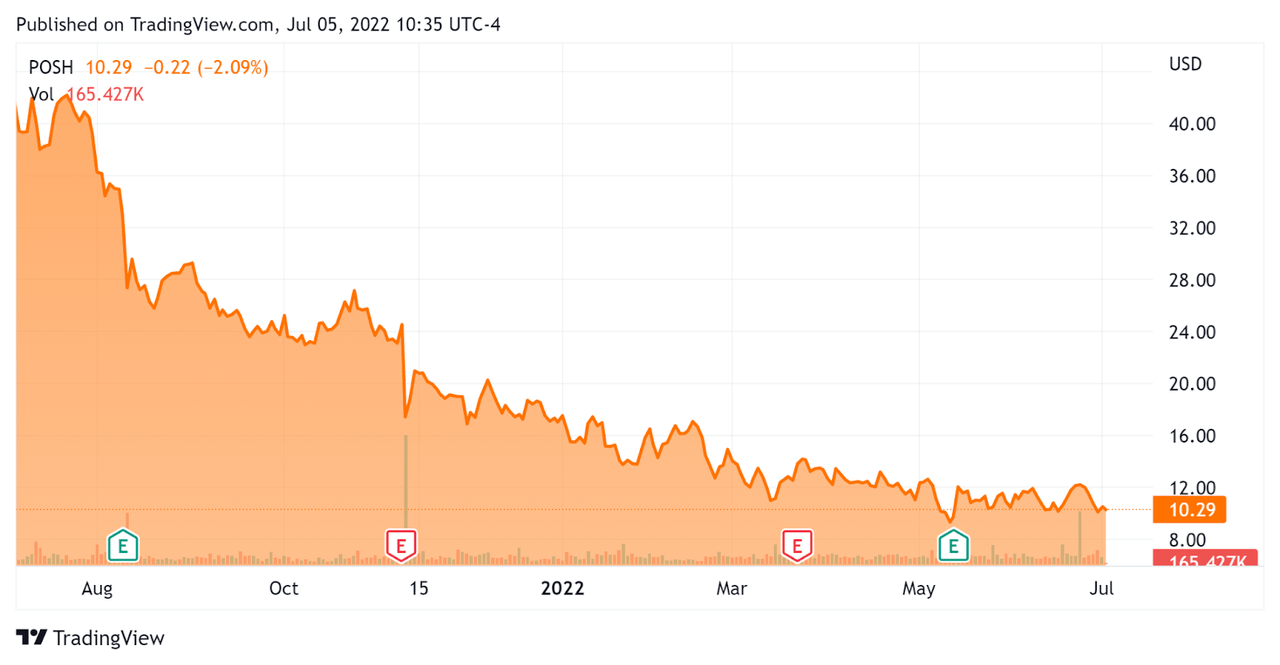

In the past 12 months, POSH’s stock price has dropped 75 percent vs. the U.S. S&P 500 index’ fall of around 13.4 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Poshmark

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$820,550,000 |

|

Enterprise Value |

$237,030,000 |

|

Price / Sales [TTM] |

2.40 |

|

Enterprise Value / Sales [TTM] |

0.71 |

|

Operating Cash Flow [TTM] |

$22,450,000 |

|

Revenue Growth Rate [TTM] |

17.87% |

|

CapEx Ratio |

13.20 |

|

Earnings Per Share |

-$0.49 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Etsy; shown below is a comparison of their primary valuation metrics:

|

Metric |

Etsy |

Poshmark |

Variance |

|

Price / Sales [TTM] |

4.31 |

2.40 |

-44.3% |

|

Enterprise Value / Sales [TTM] |

4.90 |

0.71 |

-85.5% |

|

Operating Cash Flow [TTM] |

$562,630,000 |

$22,450,000 |

-96.0% |

|

Revenue Growth Rate |

15.1% |

17.9% |

18.3% |

(Source – Seeking Alpha)

Commentary On Poshmark

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the firm’s gross merchandise value [GMV] growth of 12% despite a high comparison quarter in 2021 due to the pandemic period.

Co-founder and CEO Chandra believes the company is well positioned at the intersection of online, social and sustainable shopping trends.

The company is also restarting its in-person community events, which should help to reignite the growth of new consumers while keeping existing users more engaged.

Notably, POSH has further plans to focus on new seller tools & product innovation along with international growth initiatives, especially in Canada.

As to its financial results, total revenue grew by 13% year-over-year, slightly higher than previous guidance due to a higher take rate.

However, operating losses worsened, in part ‘due to a planned increase in hiring…as we continue to invest additional resources across a number of strategic initiatives.’

Technology companies with worsening operating losses have been severely punished in the current rising interest rate environment due to a projected higher cost of capital.

Additionally, the changes in online advertising by IDFA changes will continue ‘to maintain pressure’ on its revenue growth, a worrying trend for many online advertisers.

Looking ahead, management appears willing to continue investing in its initiatives despite a potential recession (which we may already be in).

While recession conditions may help to increase the supply of items for sale, it may reduce buyer activity or at least produce lower average transaction sizes as buyers become more cost conscious.

Regarding valuation, the market has pushed POSH’ EV/Sales multiple down to around 0.71x, an extremely low figure.

While patient investors with a long-term horizon may consider POSH to be a value at this level, I have more of a ‘wait and see’ approach.

I’m on Hold for POSH until we see management making progress toward operating breakeven while reigniting revenue growth.

Be the first to comment