SimonSkafar

My latest article on Portland General Electric (NYSE:POR) saw me changing my target for the company from a “HOLD” to a “BUY” based on a more attractive valuation. The “HOLD” was before the crisis in Ukraine and Russia, which has accelerated certain developments across the world.

As we move deeper into the crisis around the world, with rate issues, inflation, labor market pains, uncertainties, and other issues, the role of safe investments such as utilities has become more important for the conservative investor – and despite some risks and things I don’t particularly like about POR, there are still things to like about the company here. Things I have pointed out in the past, and things I intend to repeat here – in part, at least.

Portland General Electric

In my last article on POR, I made it clear that it’s time to shift investments to safer, cash-flow-heavy alternatives that see very little variance or volatility in their earnings. I do not care overly much about their share price development – I care about the cash flow and their ability to pay dividends.

The share price is only relevant in the sense that it gives us the valuation we invest at – and the relevant upside, but beyond that, I don’t put much judgment on it. It just needs to be enough to give me what I’m looking for.

So – POR remains an impressively-integrated utility in Oregon. The company’s operational segments encompass the generation, transmission, and distribution of power to around 900,000 retail customers while servicing a full 2M customers.

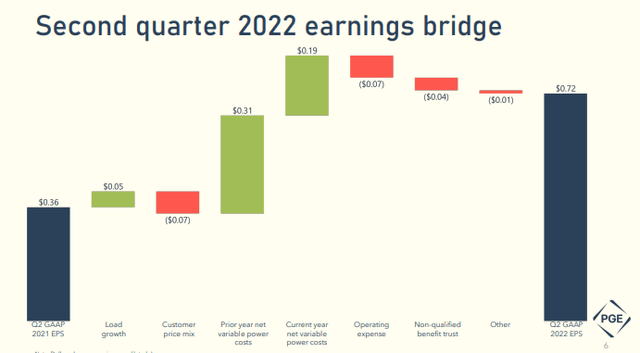

Q2 22 saw impressive overall results, all things considered, with EPS up YoY, and a revised earnings guidance for the full year calling for a $2.6/share EPS at the lowest. There are also advancements or forward movements when it comes to the company’s wildfire protection plans, ESG plans, and soft qualities for the business like being the “number 3” in customer experience in all of the US.

The company wants to continue to present itself as investing in a clean and reliable energy future, through its adopted framework and strategy which calls for 100% greenhouse gas emissions by no later than 2040, with an 80% reduction in 2030.

The company’s recent confirmed bump in earnings for the year, as well as the confirmed long-term dividend growth target gives us something to shoot for with POR.

CapEx forecasts for the company are solid as a rock – $650M per year until 2026, including generation, transmission/distribution, and general CapEx investments. The company has current liquidity of $870M, so plenty of cash on hand to handle debt. The company retains a BBB+ for the senior unsecured, and A for the senior secured debt.

I have been clear in my past articles. The problems that POR faces is related to the generation shortfalls due to legacy asset turnoffs (oil, fossil), while essentially trying to replace this with at least 1,000 MW of renewable energy and non-emitting resources, mixing both pure green energy and things like nuclear and energy importing.

The company has shown repeatedly that it is unprepared for the impact of heat issues and the corresponding high-load periods that come from such times when customers are using more power during exactly the time when POR doesn’t have much to spare from its own generation capacity.

The lack of flexibility the company has in its assets, coupled with its plans to dial down CO2, gives me a picture of a utility that continues to be in a position of higher risk in terms of flexibility during times of higher generations.

This is really the core characteristic of the utility that I do not like. It feels like a company that has taken ESG a step too far, simply on the basis of wanting to claim to be green, but at the expense of logic and the capacity to serve its own customers.

POR is already, by its own targets, below where it should be to meet its targets, and instead of improving its own or planning for its own asset base, uses a combination of external sourcing reliance with reliance on its own customers. You should not be relying on your own customers to put up solar panels to service your grid and capacity.

In studies of companies, it’s been clear that no company or management is really that adept at forecasting the future, even in its own segments and entire industries.

What instead differentiates successful companies and companies that manage well through hardships from the rest is the measure of preparation/overpreparation that a company engages in.

This shouldn’t really come as a surprise to anyone, but it’s surprising how many investors overlook such simple points in businesses they invest in.

I still don’t see POR planning perhaps in a way that I would like to see the company doing – but at the same time, I need to state that with the changes in the world that we’ve been seeing, companies like POR have become more attractive simply on the basis of them being utilities.

However, the way that some utilities are handling their business at this time – from what things are happening in Europe, to what we’re seeing in parts of the US here, makes it clear that we need to be careful in what utilities exactly that we’re allocating capital.

That’s my issue with things here – and that’s why I’m not as “hot” on POR as some might expect me to be.

Portland General Electric’s Valuation

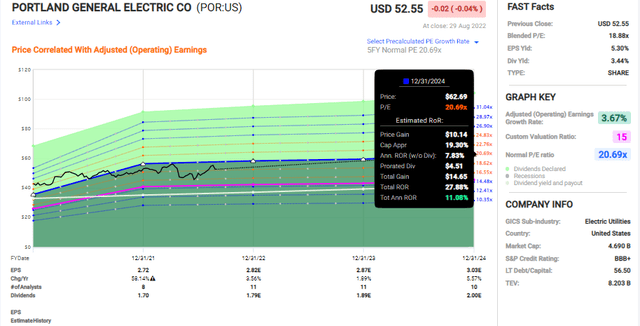

That being said, we do have an attractive company at an attractive valuation here. The upside to POR is, as I said in my last piece, no longer negligible. While having recovered somewhat from its valuation troughs a few weeks and months back, POR is still trading below 19x P/E. Remember, the most premium utility trade is about the 20x P/E mark, with Fortis (FTS) a good example of one that I have recently written on.

POR averages a similar estimated EPS growth rate – about 4-5%, but it only yields 3.44%, which is even less than Fortis. However, the upside based on a 5-year average P/E, that one is higher for POR.

Because we can realistically expect a double-digit upside from POR based on a 20-21x P/E range, which I do believe that the company can achieve, i am hesitant to be completely negative or “HOLD” when it comes to POR here. The upside is also improved from my last article due to improved guidance from the company. My PT change at the time might have come as a very low sort of change, but like before, it did and it does push this company from a “HOLD” to a “BUY” in a way that reflects my risk-off stance in this stock market environment. I believe the time has come to align yourself to a higher degree with conservative investments to ensure that coming volatility and risk don’t impact you quite as much.

While it’s impossible to completely mitigate overall risk, I believe there are allocations that will work to provide a sense and a structure of stability in a volatile environment. Utilities, Consumer Staples, certain real estate companies, all of these investments are part of this.

That is also why my portfolio shifts over the past few months have been to increasingly align myself with conservative and well-funded investments and businesses.

Even if I don’t like some of the things about POR, I do believe it to be a solid and well-funded business.

S&P Global still has a marginally more positive view of POR than I do.

An analyst average of $48-$58/share now gives us an average of $53.6, around $0.1 higher per share, no doubt discounting the company’s demand risk less than I do. Still – analysts are split with a 4/6 BUY/HOLD rating for the company – like the last time I wrote about the business.

It’s therefore not that easy – and this does reflect the relatively slim 1% upside we currently see. So while I am at a “BUY”, that buy comes at a very low upside – which is also why I’m personally not adding POR here.

However, I think it’s very important that contributors and analysts stick to their guns in times of volatility. An analyst shouldn’t change his stance according to what nuances seem to be driving the market- at least a long-term investor shouldn’t be doing this.

I stick to my target and say POR is worth $53.5 here. That gives it an upside, and a “BUY”.

Thesis

My thesis for Portland General Electric is simple.

- At a lower price of below $50/share, this becomes an interesting utility play in a potentially strong state. However, the lack of asset flexibility and company-stated plans for its future still does not encourage me to invest further here.

- It’s my view that the company’s plans lack proper context and forecastability, allowing us to easily account for potential provisions for extra costs or income effects, influencing margins and income.

- Because of this and despite good fundamentals, heavy discounting is needed. Energy trading losses during 3Q21 alone accounted for $1.09 per share, as well as $0.39 per share of what the company considers “unfavorable power cost” due to higher temperatures.

- Improved forecasts and more problematic macro do call for a continued premium for utilities though – so I stick to my PT of $53.5.

- This makes POR a “BUY” here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Bolded):

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment