andreafidone

With the latest Porsche IPO and different classes of shares and different price movements, there is a lot of confusion, and something does not add up. Today, we are deep-diving into Porsche Automobil Holding SE (POAHF; OTCPK:POAHY), but we will copy and paste some notes from one of our previous Volkswagen articles (OTCPK:VWAGY) (OTCPK:VWAPY).

- Volkswagen AG is a holding company with production facilities and many brands. The company known as “Porsche” is one of these entities;

- There is another listed company called Porsche Automobil Holding SE that has no manufacturing operations. This is a holding company, with its largest investment being Volkswagen AG;

- Both Volkswagen AG and Porsche Automobil Holding SE have two classes of shares – ordinary shares with voting rights and preference shares with no voting rights;

Going deeper into Porsche Automobil Holding SE, the entity is a holding with two different types of assets: 1) core long-term investment being Volkswagen AG shares (voting and non-voting shares) and 2) short/medium-term investment in order to maximize shareholder values. These latter investments are usually characterized by high growth generation and potential equity value appreciation. In both asset classes, the investment aims at enterprises in the areas of mobility, global transportation, and industrial technology. Even if there is some value, today we are focusing on Volkswagen’s implications and the latest IPO.

Porsche Automobil Holding SE Current Investments (Porsche Automobil Holding SE corporate website)

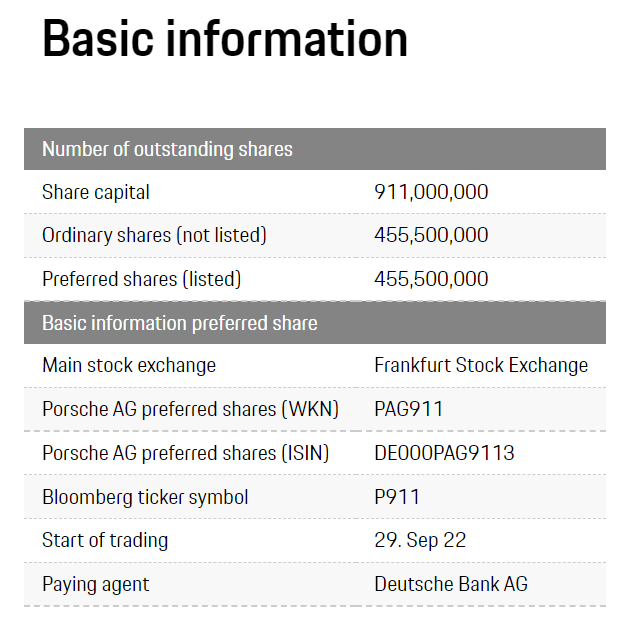

911 IPO Details

Once again, using Volkswagen analysis, we already said that:

- With the usual two-shares approach, Porsche AG’s capital called 911 has been divided into 50% ordinary shares (voting) and 50% preference shares (non-voting).

- 25% of the Porsche AG preference shares are now listed on the Germany Stock Exchange.

- 25% plus one of the ordinary shares were sold to Porsche Automobil Holding SE at a premium of 7.5% to the IPO price of the preference shares.

- Whereas Volkswagen will (again) be the major shareholder of both Porsche AG’s ordinary shares (75% minus one share) and the preference shares (minimum 75% holding).

Porsche AG Shares Types (Porsche AG “as a reference 911” corporate website)

The acquisition of Porsche AG voting shares for a total amount of €10.1 billion, gives the Porsche heirs a blocking minority with effective control over key strategic decisions in the company’s board of directors and shareholders’ meetings.

Negative Comments From the Investor Community

Some investors have warned that the way in which the IPO was structured (with only the non-voting shares being sold to the public) could lead the core shareholders to continue to exercise control over the company at the expense of private investors. In addition, investors are also concerned that Blumès’ dual role as CEO of Volkswagen and Porsche’s newly listed company could lead to conflicts of interest. In late July, the Porsche-Piech family helped oust Herbert Diess, who had been CEO since 2018 and is credited with restoring VW’s reputation after Dieselgate and leading the company towards electric vehicles. With the departure of Diess, Porsche CEO Oliver Blume was called by the board to lead Volkswagen, irritating some Wall Street analysts who see a potential conflict of interest in the double assignment.

In late July, an investor survey conducted by Bernstein Research showed that 71% of respondents thought Blumès’ dual role would negatively impact Porsche’s IPO. A few investors are also switching between Volkswagen shares and Porsche Automobil Holding SE stocks towards the recent Porsche 911 IPO. This might explain the latest stock price development of Porsche Automobil Holding SE.

Conclusion and Valuation

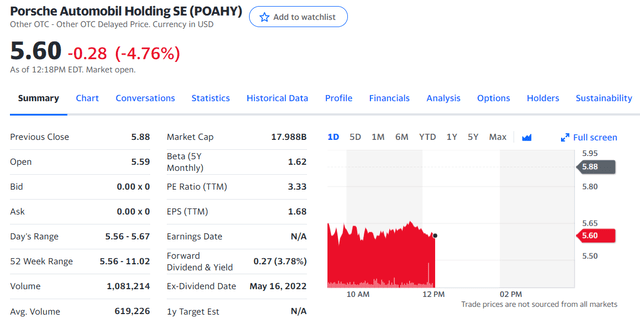

Aside from the contrarian comment, Porsche Automobil Holding SE currently owns 31.9% of Volkswagen AG with no voting rights shares (and it also holds the majority in the voting class shares), and now 12.5% of the newly listed Porsche 911.

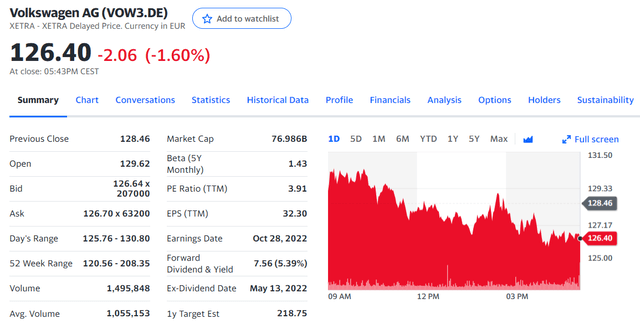

Just the 31.9% value of Volkswagen AG’s market cap is higher than Porsche Automobil Holding SE’s equity value. €24.5 billion versus €17.98 billion respectively. This already provides a buy target opportunity. In addition, here at the Lab, we believe that Volkswagen AG is really undervalued coupled with the voting right, hence this should support a premium valuation for Porsche Automobil Holding SE. Numbers in hand, Porsche Automobil Holding SE will raise debt on its balance sheet for the acquisition of Porsche 911 (also bought at a premium) and there is a dividend consideration to take into account that will be paid by Volkswagen to the current shareholders (so also to Porsche Automobil Holding SE that will get almost €1.5 billion). This totally neutralized the premium price paid by Porsche Automobil Holding SE.

Volkswagen AG Stock Price Evolution (Yahoo Finance)

Porsche Automobil Holding SE Stock Price Evolution (Yahoo Finance)

Be the first to comment