Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

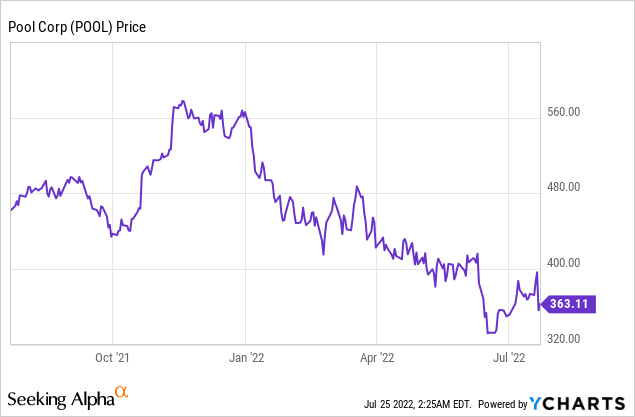

Pool Corp. (NASDAQ:POOL) reported its second-quarter earnings last week and shares plummeted by over 10% subsequently. The company is now down more than 37% from its all-time high due to worries about the slowing housing market and a weakening economy. However, I believe the fear is overblown and presents a great buying opportunity for long-term investors.

The company’s resilient business model is being discounted and recent financial earnings are solid despite very tough comps. Europe’s heatwave may provide an unprecedented headwind in the near term and the current valuation is also at a multi-year low after the significant drop. I rate the company as a buy at the current price and the sell-off post earnings is unjustified in my opinion.

Strong Business Model

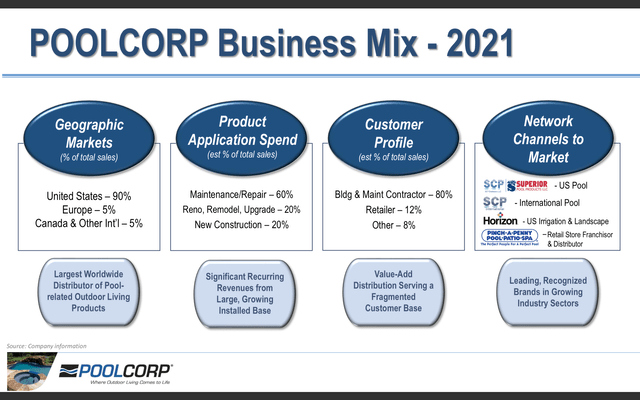

There is a lot of pessimism surrounding Pool Corp. as the housing market starts to weaken in recent months. However, I believe the company’s business model is often misunderstood and may not be as exposed to the housing market as many think. Pool Corp. is the world’s leading wholesale distributor of swimming pool equipment, parts and supplies, and related outdoor living products. It operates internationally with sales centers across North America, Europe, and Australia. It currently has over 410 sales centers worldwide with around 120,000 wholesale customers.

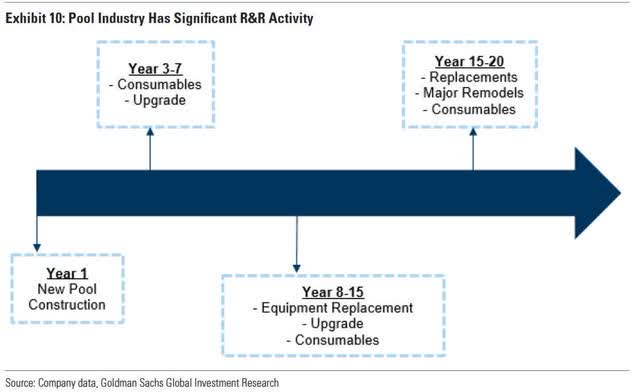

The company’s strategy is simple yet effective, it constructs a pool and acquires a lifelong customer. The high-maintenance asset then becomes an annual annuity for your neighborhood pool servicing firm once the significant discretionary investment of establishing a pool is made. Pool Corp. is then able to generate recurring revenue from maintenance, consumables (eg. chemicals), upgrades, remodeling, etc. Spendings on maintenance and consumables are essentially non-discretional for pool owners. Currently, only 20% of the company’s revenue is generated from new pool constructions, while 60% is generated from maintenance and repair and another 20% is generated from renovation, remodeling, and upgrades. This is why its exposure to the housing market is actually quite limited as most of its revenue comes from non-discretional services of existing pools.

Peter Arvan, CEO, on the company’s advantage:

Unlike most other building product distributors, Pool Corp. enjoys a unique advantage of essentially maintaining a lifelong relationship with every pool that is built and remains in service. We provide the construction material and the maintenance supplies and the remodeling products required during the entire existence of each pool, whether it is a DIY maintained pool or one that is serviced by one of our professional customers. It is an annuity industry and business model that grows upon itself as more pools are built or products are demanded forever.

Pool Corp

Europe Heatwave

The current unprecedented heatwave in Europe is also likely to benefit Pool Corp. in the near term. The region had been experiencing record high temperatures in the last two months with countries like the United Kingdom hitting 40 degrees for the first time in history. The heatwave is forecasted to continue and I believe will provide a tailwind for the company as demand for Pools is likely to surge. The growing installed base in Europe will also help generate more recurring revenue moving forward. The current revenue generated from Europe is only around 5% which provides a lot of room for growth in the near term.

Solid Financials

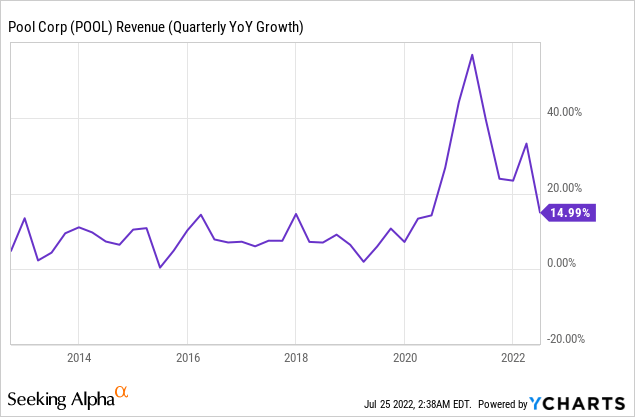

Pool Corp. reported its Q2 earnings last week and the results are solid considering the tough comps, as lockdowns significantly inflated the company’s revenue. The company reported revenue of $2.1 billion, up 15% YoY (year over year) from $1.8 billion. This is very impressive as it is lapping a 40% growth from 2021. The increase is driven by the strength in equipment, chemical, and building materials sales, which are up 35%, 25%, and 22% respectively. This demonstrates the resilience of the company despite an unfavorable backdrop in the housing market.

Gross profit increased 21% from $551.7 million to $666.8 million, with gross margin also up from 30.9% to 32.4%. Operating income was $418.9 million compared to $338.6 million, up 24%. Operating margin also increased from 18.9% to 20.4%. Margins benefited from better supply chain management, increased pricing due to inflation, and recent acquisitions. Given its strong market position, the company is able to easily pass the inflated cost on to customers.

Operating cash flow decreased from $187.2 million to $28.7 million. This is due to a $79.5 million federal tax payment in 2022, and an increase in inventory purchases. Current inventory levels are at $1.6 billion, up 77% compared to a year ago. This is in order to improve customer experience and minimize the impact of longer lead times from vendors.

Peter Arvan, CEO, on outlook:

We expect continued growth in the second half of the year, on top of the substantial growth that we experienced last year. We remain confident in the long-term stability of our business as 80% of our net sales activity is driven by the installed base of pools. Utilizing our industry-leading position, focusing on our operating priorities, and leveraging our well-established network will allow us to deliver solid growth for the year.

Compelling Valuation

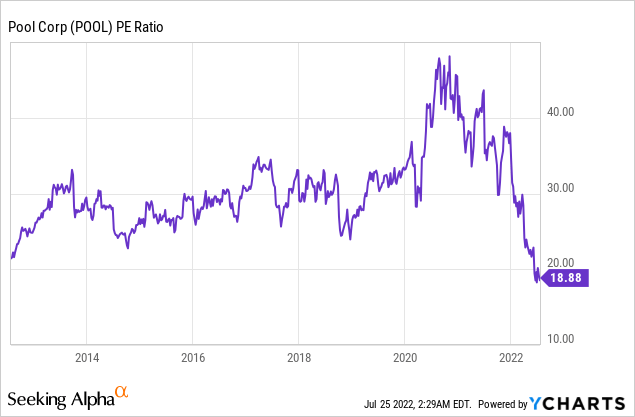

After the massive drop in share price over the last few months, Pool Corp. is now trading at a multi-year low valuation. From the first chart below, you can see that the company is trading at a 10-year low P/E ratio of 18.9x, compared to the average of around 30x. From the second chart, you can see that despite the below-average valuation, it is actually growing revenue faster than its 10-year average. The company has also matured a lot with profitability improving over the years. Operating margin increased from 7.5% in 2012 to 20.4% in the latest quarter, while the net profit margin improved from 4.4% to 14.9%. ROI (return on investment) also increased from 14.5% to 34.2%. Given the current revenue growth of 15% and much-improved profitability, I believe the company should be trading at its 10-year average P/E ratio of around 30x. A “reverse to the mean” valuation will give the company a 58.7% upside.

Conclusion

In conclusion, I believe the post-earnings dip provides a great buying opportunity for long-term investors. Pool Corp. had been a wonderful compounder in the last decade and will very likely continue to do so. The company has a very strong business model that allows it to generate recurring revenue over the lifetime of the pool. Its heavy sales mix toward maintenance and service revenue limits its exposure to the slowing housing market. The current heatwave in Europe may also provide an unprecedented tailwind. The company continues to put out decent earnings with solid revenue growth and improving margins despite tough backdrops. Its valuation is now very compelling, trading below its 10-year average while growing revenue in double digits and improving profitability significantly. Therefore, I rate the company a buy at the current price.

Be the first to comment