Luftklick/iStock via Getty Images

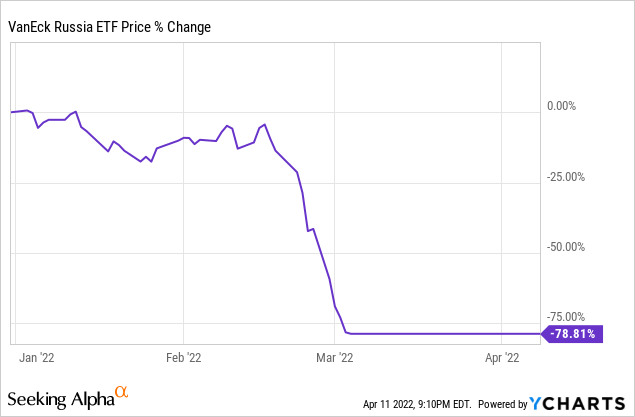

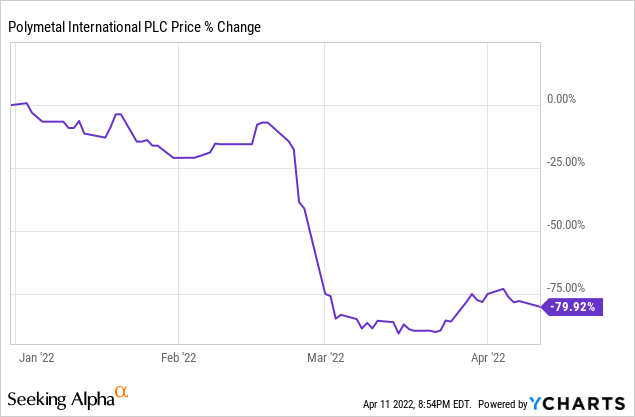

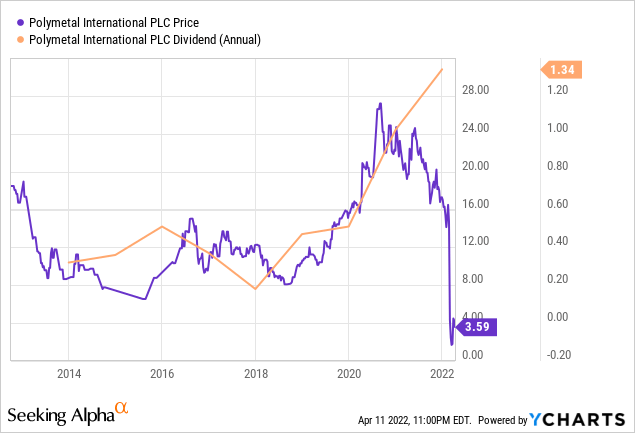

Since the beginning of the Russian invasion of Ukraine, the share price of Polymetal International plc (OTCPK:POYYF) has been whacked by over 75%. The RSX Russian Equities ETF fell over 70% before trading was suspended, along with trading of most Russian equities, due to sanctions. If it were not for the suspension they likely would have traded even lower.

Polymetal has avoided trading suspension, thus far, likely because the company is headquartered in Cyprus, not Russia. But most of its assets are in Russia. This presents an interesting investment thesis, but only for the bold and adventurous.

The company is a top 10 gold producer and top 5 silver producer worldwide. They own and operate mining operations, principally gold and silver, in Russia and Kazakhstan. The macro-environment for precious metals is strong. I’ve written about the reasons I am bullish on gold and silver in recent articles. This is supportive for Polymetal revenues. This is especially true because producing and selling commodities like gold and silver help to protect the company from currency exchange risk as the metals are demanded globally and traded in currencies worldwide.

The company is likely to experience increasing free cash flows and yet the geopolitical situation between Russia and Ukraine has punished the stock. The valuations and potential dividend of 26% are too tempting to pass up. I’m putting POYYF at the top of my “high speculation” portfolio.

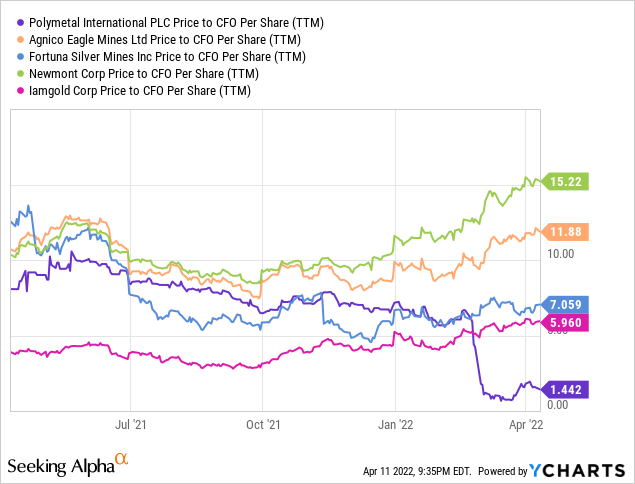

The Cheapest Gold Miner on the Planet

The elevated geopolitical risk for this stock has resulted in perhaps the cheapest gold miner on the planet. To be clear, there is a legitimate reason for the valuation. However, the opportunity is attractive for those willing to bear the risk. Compared to other miners the price to cash flow of 1.4 is very cheap. Newmont (NEM), the largest gold producer, has a P/CFO of 15.2. A riskier low-cost miner, Iamgold (IAG), sits at 5.96 P/CFO. Two of my favorites, Agnico Eagle (AEM) and Fortuna (FSM), arrive at 11.8 and 7.05 P/CFO.

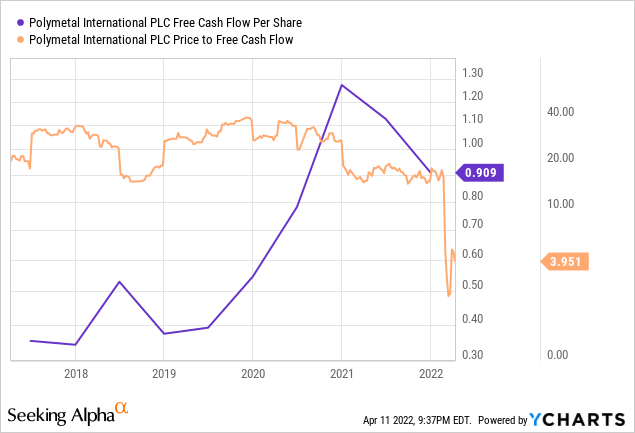

POYYF has been increasing FCF per share with the rise in gold and silver price over the last four years. During that time the price to FCF had been trading between 15 and 40x until the big sell-off. Today it trades at 3.95 P/FCF.

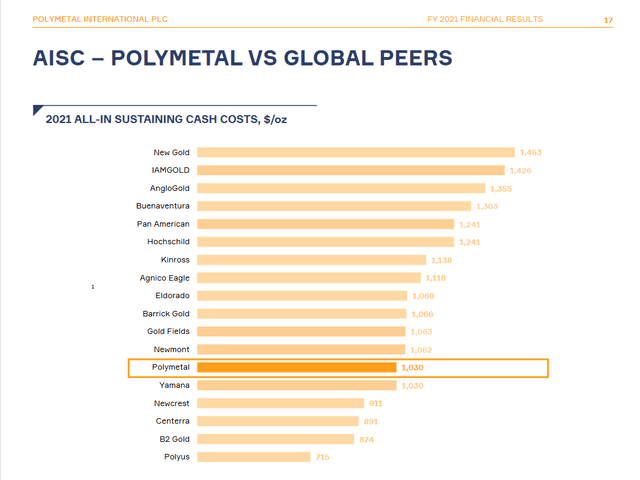

The company is not just priced cheap, it operates cheaply. Polymetal has some of the lowest costs of production globally with 2021 all-in sustaining costs of $1,030 per ounce gold.

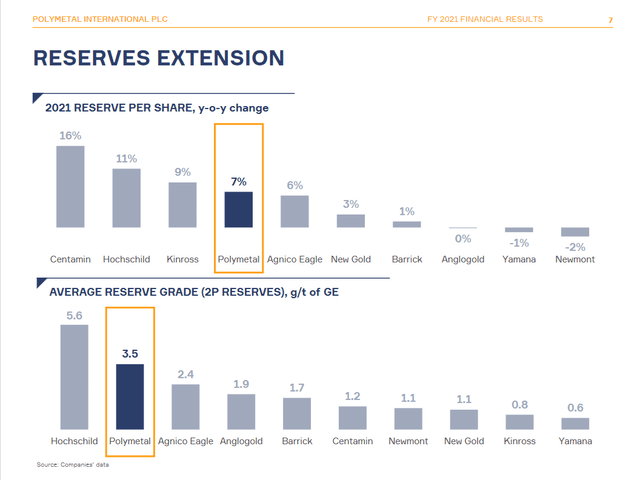

The company is also near the top in terms of growing its reserve resources. In 2021, reserves increased by 7% YoY while major gold miners Barrick (GOLD) and Newmont changed by +1 and -2%, respectively. Part of the reason for Poly’s low cost of production is their above-average ore grade of 3.5 grams per ton of gold equivalent.

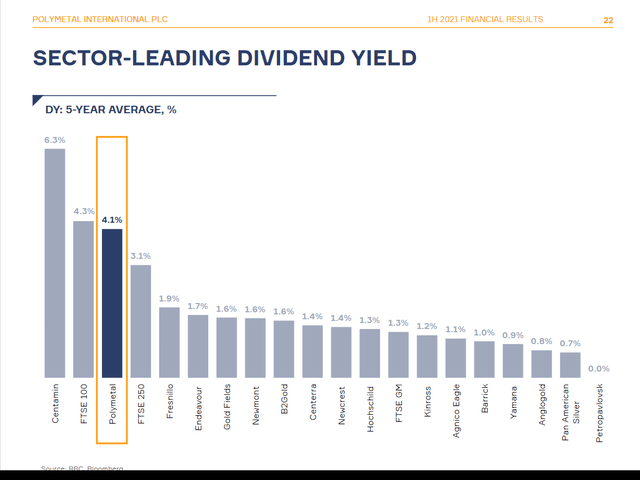

These material advantages coupled with effective management have resulted in a high average dividend yield of 4.1% over the past five years. That is based on stock prices prior to the 2022 crash. The average over the past 5 years at the current share price would be 20.3%.

Company Presentation, Seeking Alpha

The Risk Runs Deep

Valuations on POYYF are low because of the very high level of risk that comes with the company. Many risks have been priced into the stock during its fall from $14 to $3.50 per share. The threat of war is priced in because a war has now started. However, there are multiple risks that can roil U.S. investors:

- The war could escalate if other countries join the conflict

- The Ruble could fall against the dollar

- The company could have difficulty selling their inventory due to sanctions

- The company could have difficulty paying its dividend to U.S. investors due to sanctions

- Trading of the stock could be suspended due to sanctions

- Owning the stock could become illegal for U.S. investors

- Russia could confiscate and nationalize the mining resources owned by the company without compensation

- The company could have difficulty paying its debts due to reduced production or revenues from market disruptions and sanctions

These are only some of the risks that the company faces. The risk of investors losing all of their capital is very high. Before I share a few thoughts of my own I want to highlight what CEO Vitaly Nesis said on March 2 at the last earnings call:

In terms of the current situation, again, I would like to stress an unprecedented – for the team level of uncertainty. However, presently, all of the operations are continuing normally. The operating activities are continuing and the project execution is also ongoing. In terms of the financial and liquidity situation, the Central Bank of Russia has announced on Sunday that it will resume the domestic purchases of gold and silver volume. And we believe we have sufficient channels of sales from our Russian operations to ensure that we are both liquid and solid.

In terms of the direct sanctions impact, so far we don’t see any direct sanctions impact. Now, we believe that the sanctioned counterparties that we have dealt with can be discontinued and replaced, if needed, by non-sanctioned entities. In terms of the supply chain, we currently don’t see any threat to operations as we so far haven’t seen any sector-specific trade sanctions. And we also, already for several years, have backup plans to replace the imported consumables by domestic or Chinese consumables in case the sanctions will be expanded and will include the goods that are necessary for the continuation of our activities.

Currently, the largest challenge that we expect to face in the coming months is the logistical challenge related to significant disruption of containership service to and from Russia. The management is very busy evaluating different options. I would like to stress that this situation is not expected to have any impact on the current performance given pretty significant stock levels, which we have accumulated during the COVID pandemic, but also because we have backup plans in terms of consumables and critical equipment.

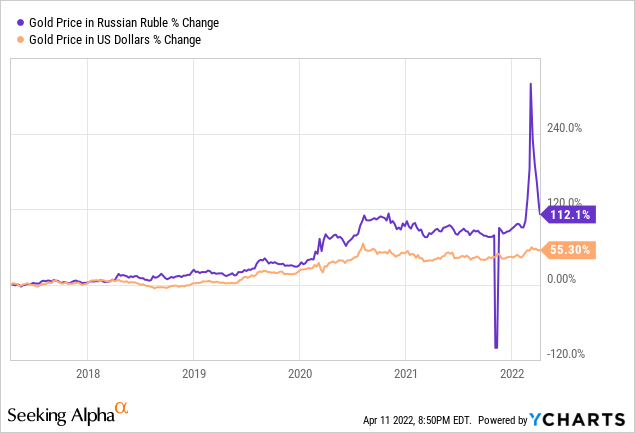

The Russian Ruble nearly lost 50% against the U.S. dollar after the start of the invasion. This has principally contributed to the decline in Russian equities traded on U.S. exchanges. The Russian government has since implemented measures to stabilize the currency which has nearly recovered to pre-invasion levels, see below.

The Bank of Russia did not implement a gold standard for the Ruble in March but they did implement a fixed exchange rate of gold for Rubles. This policy appears to have helped recover the gold price in Rubles, which spiked up in March, as well as the Ruble to U.S. dollar exchange.

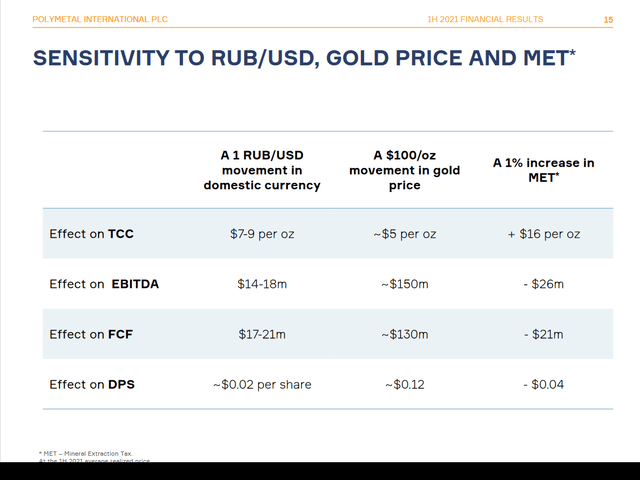

The currency exchange is important because it has substantial impacts on EBITDA and FCF:

Company Presentation, Seeking Alpha

It makes sense to me that if the U.S. was going to sanction Polymetal, for trading or owning, it would probably have done so by now. So far, the company has not reported any significant disruptions to production, and as of March 30, they continued to access markets for sales of gold bullion.

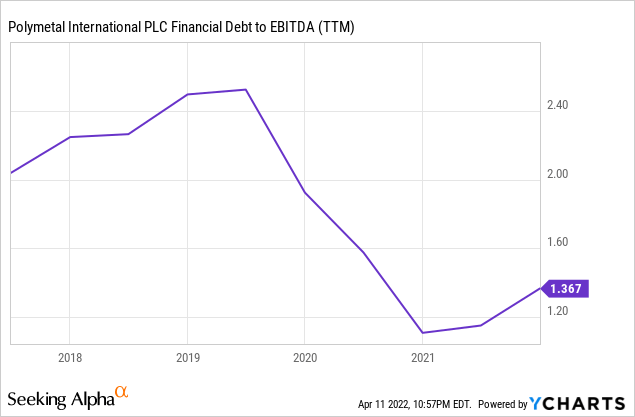

As of March 1, the company had $1.87 billion in net debt, mostly denominated in U.S. dollars. They have $400 million in cash in non-sanctioned financial institutions with $1 billion of credit lines from non-sanctioned financial institutions. The company claims they have enough capital to sustain operations for 12 months. At the end of FY2021, the company had a net debt to adjusted EBITDA of 1.13x.

Distributions of the dividend may face indefinite postponement until a ceasefire is reached in Ukraine. During the last earnings call CEO Vitaly Nesis spoke about the forward dividend policy:

And in terms of the outlook, last but not least, we currently plan to pay a regular annual dividend. And this will come for approval at the AGM at the end of April, to be paid by the end of May. However, citing again the aforementioned uncertainties, the management and the Board reserve the right to exercise judgment and discretion and to postpone or partially postpone or cancel the dividend if the political and sanction situation changes significantly.

He went on to add:

While we are being very cautious about the ability to pay dividends, this is not really about our ability to move money. This is more about the risk of increasing capital controls in Russia and the potential disconnect between the global gold price and the domestic gold price. Or, in general, a further tightening of the sanctions, which would lead to more significant trade bands, or logistical challenges. So this is, in essence, the risks and uncertainties, which underpin our cautious approach to dividends. In terms of liquidity and current ability to move money, this is not an issue.

And this:

The Russian entities are currently banned from paying dividends to offshore shareholders. So, Russian operational entities cannot pay dividends to our Cyprus-based holding company. Clearly, if this situation persists, we will be limited in our ability to raise money for dividend payment from Russia, but currently, not from Kazakhstan. How long the situation will persist is unclear.

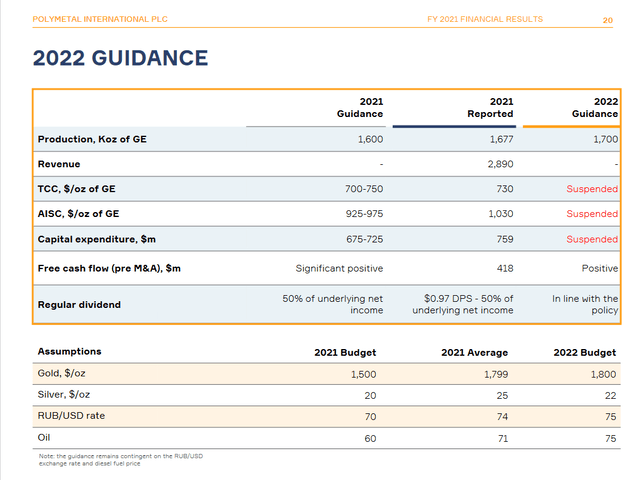

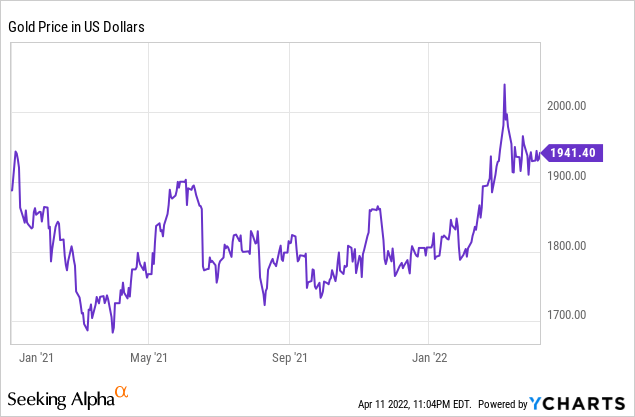

In 2021 the company paid out $1.34 in dividends which represents a yield of 37% at the current share price. The company has suspended guidance for 2022 but they expect higher production and free cash flow than 2021. The average gold price in 2021 was $1,798 per ounce and silver was $25.14 per ounce. Gold is currently trading at $1,950 per ounce and silver is at $25.18 per ounce. I fully expect higher average prices for 2022. Seeking Alpha has a forward dividend yield of 26% based on a dividend distribution of $1.04 per share in 2022. Barring a new negative development I think that distribution is more than probable.

Company Presentation, Seeking Alpha

Polymetal has three distinct advantages to deal with these ongoing issues. First, the company is not directly domiciled in Russia. Second, the company sells metals that have real value in every currency worldwide. Third, the company does business in non-perishable goods that can be stored indefinitely if needed. While these advantages do not immunize the company from potential risks, it does help to moderate them.

Summary

I am still of the belief that the war in Ukraine will be resolved soon. The reason, which I wrote about in February, is that the world depends on commodities from Russia and Ukraine. The lack of which is exacerbating global inflation issues and contributing to food shortages worldwide. Riots have emerged in Peru, Sri Lanka, and Pakistan. Unfortunately, I think it’s only the beginning.

Come December 2022 Europe is going to need Russian natural gas to make it through winter. The political pressure to avoid war and find peace is considerable. The U.S. is facing elections this Fall and price inflation is at the top of everyone’s mind. Overall, I think the probability of peace is fair.

I expect Polymetal to nearly return to its pre-war share price once peace is achieved. It could easily reach $14 per share if further financial damage is avoided. The risk on this one is very high, but so is the asymmetry. I could lose $3.50 a share or gain $10. This is why I opened long positions in POYYF at the average cost basis of $2.03 per share. There are gaps on the chart at $2.63 and $1.99 per share and I may add at those prices.

Be the first to comment