Editor’s note: Seeking Alpha is proud to welcome GoldStreetBets Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Vitoria Holdings LLC/iStock via Getty Images

Introduction/Thesis

Polymetal International (OTCPK:AUCOY, OTCPK:POYYF) is a well-run, low-cost, highly-profitable gold miner with its main operations in Russia and Kazakhstan. Unfortunately, it has been facing severe external challenges, which have caused the share price to collapse by up to 90% in the aftermath of the Russian invasion of Ukraine. It is my opinion that there is value in the current share price of around £2 per share. However, a significant amount of time may be required to realize this value. An investment in Polymetal is thus only suitable for value-driven speculators with a long time horizon. Given the fact that I do not see any immediate catalyst for the share price in the short term, and that it remains difficult to trade via most brokers, I anticipate better entry points in the future, when some of the uncertainties will be resolved.

My confidence in an eventual significant recovery of the share price is based on two facts: the current valuation is cheap and the management team is capable. One big uncertainty remains, concerning the “Potential Transaction”. Polymetal is evaluating a disposal of its Russian assets, in order to focus uniquely on its operations in Kazakhstan. The disposal could take the form of a spinoff, or an outright sale. On the one hand, this would allow the stock to re-rate and re-gain wider institutional ownership. On the other hand, a sale could probably be arranged only at a severe discount to fair value, as evidenced by the similar case of Kinross Gold (KGC).

For investors since before the invasion, with a significantly higher cost basis, the risk is to never be able to earn any return on their investment, if the assets are sold for pennies on the dollar. On the other hand, for more recent investors, this is not as big of a problem, since the current share price is already discounting the Russian assets at zero value. Given the comments during the Q2 production results conference call, I would not expect a final decision any time soon.

There are many moving pieces to this story. I will start with the production results from the July conference call, and then deep dive into more specific topics.

Polymetal International’s Q2 Production Results

Operational results were acceptable, in spite of severe challenges.

- Production: Q2 production decreased by 9% year-on-year to 326K ounces, but within guidance. The decrease was due to lower grades and planned maintenance shutdown at the Amursk POX, which reduced output from Kyzyl and Albazino, more than offsetting fresh contribution from Nezhda.

- Revenues: revenues were down 36% year-on-year to $433 million. This was mostly due to a build-up of bullion and concentrate inventories, which will partially reverse in H2 2022.

- Debt: debt increased to $2.8 billion, mostly because of the stronger ruble and the early purchase of spare parts and material.

The full-year guidance of 1.7M GE ounces was reiterated, with a warning of potential underperformance, should COVID-related lockdowns and logistical constraints persist in China. Unfortunately, financial results are yet to be disclosed, which will occur in September.

Overall, the impression I got from the conference call was that the last quarter was extremely challenging, but the worst may already be in the past. Sales were obviously a disappointment and the increase in debt is a reason for concern. However, it should be considered that Q2 was affected by several negative factors.

1. In Q2, bullion sales from the Russian mines were considerably slowed down, because of the company’s decision not to sell to the Russian Central Bank at a steep discount. This is a smart decision, but it led to a significant increase in bullion inventory. Bullion sales have resumed since the second half of June. Because of sanctions on Russian gold from the European Union, bullions are mainly sold to Asian customers (excluding China). The build-up in bullion inventory is expected to be fully unwound by the end of August, so there is no concern on this front.

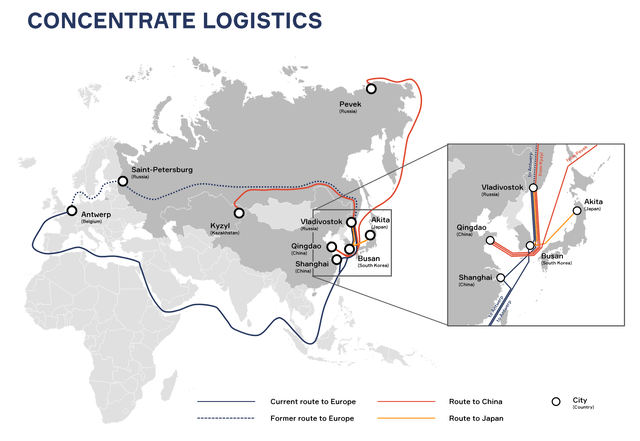

2. COVID-related restrictions and lockdowns in China have led to a slowdown in shipments of gold concentrates from Nezhda and Kyzyl. It should be noted that concentrates account for roughly 20% of sales and that they are mostly sold to China. Here, there is less reason for optimism, because the situation is totally dependent on political decisions. Management expects the concentrate inventory to remain roughly at the present level for the full year. However, this is also a temporary headwind.

Concentrate logistics (Company presentation)

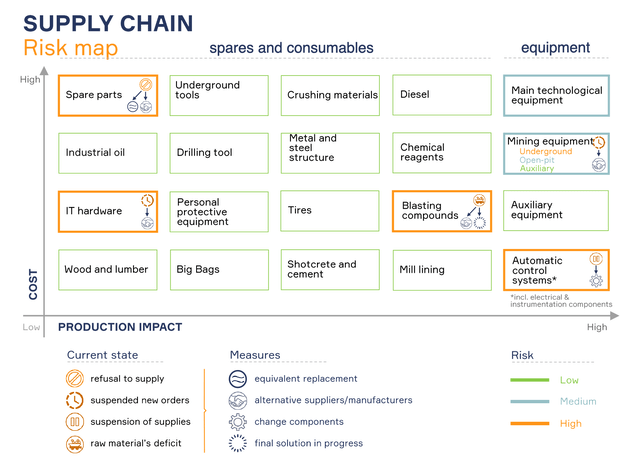

3. With several manufacturers leaving Russia, the company has chosen to bring forward expenses related to spare parts and materials. This build-up in inventories is partially responsible for the significant increase in the debt level, but it gives the company time over the next 18 months to find alternate supply lines. On the OPEX side, no particular difficulties are anticipated and production guidance for this year has been confirmed. On the CAPEX side, the situation is more complicated. The company intends to replace European manufacturers with Chinese manufacturers. Since China has a huge internal mining market, this is a very reasonable choice. In the meantime, however, new projects are going to be delayed, in particular POX-3 is probably going to be relocated to Kazakhstan.

Supply chain risk map (Company Presentation)

Dividends

Polymetal has long been generously returning capital to shareholders. Before the invasion, the company policy was to pay out 50% of net income as dividends, which could be increased up to a maximum of 100% of FCF at the Board’s discretion. As a result, the average dividend yield over the last 5 years has been larger than 4%, significantly above the industry’s average.

A proposal to pay a final dividend for H2 2021 of approximately $250 million (equivalent to 50% of net income) was put forward in March 2022. For comparison, the total market cap of the company now is roughly $1 billion. The proposal, however, was retracted in April, in the face of mounting operational difficulties.

The current status is that any decision about dividend payment for 2021 (and interim dividend for H1 2022) has been postponed to August 2022, before the publication of financial results in September. However, it is extremely unlikely that any dividends will be paid this year. First of all, because FCF is going to be severely impacted, mostly from the rise in operating costs (a result of inflation, logistical challenges and a stronger ruble). Second, because it is probably impossible to pay them, at least to all shareholders.

Even if Polymetal has its main listing on the LSE and has access to non-sanctioned banks, roughly 20% of all shares are registered via NSD (National Settlement Depository), and any transaction entailing payout to Russia’s NSD is subject to European sanctions. Given that such a significant fraction of shareholders would not be able to receive dividends (including company management and employees), it is a safe assumption that no dividends will be paid.

USD/RUB Weakness

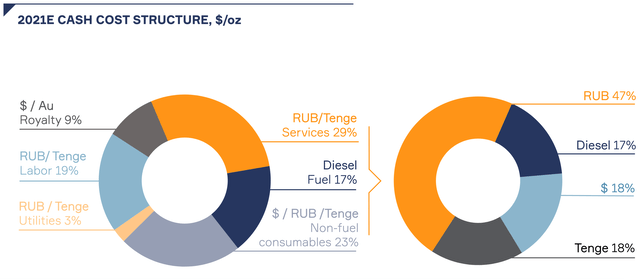

Most of the company’s expenses are priced in RUB, as shown by the following chart.

2021E CASH COST STRUCTURE (Investor Presentation, February 2022)

The USD/RUB pair has depreciated by about 20% since February 2022. At the moment, it stands at around 60. In its investor presentation of mid-February 2022, the company estimated a $25 million impact on FCF for every 1 RUB/USD movement in the exchange rate. Therefore, as a ballpark estimate, a roughly $350 million decrease in FCF is expected from FX changes alone.

To put this in perspective, a $100/ounce movement in the price of gold would bring a $130 million decrease in FCF. Effectively, the movement in the exchange rate has been equivalent to a $270 / ounce collapse in the gold price. Thus, the stronger ruble is having a significant impact on financial results. In any case, the company can still remain profitable, even at a rate as low as 50 RUB/USD, by increasing the cut-off grade, as remarked by the CEO Mr. Vitaly Nesis during the Q2 conference call.

Risks

Risk of delisting

The main listing is on the LSE (POLY.L). There are also listings on the Astana and Moscow stock exchanges. There were two US ADR quotations (OTCPK:AUCOY and OTCPK:POYYF); however, trading in them has been suspended since June 15, even if shareholders can still apply for conversion into the underlying shares.

In principle, Polymetal is registered in Jersey, so it is not a Russian company. In practice, the bulk of its operations is in Russia. After an initial period when it was still freely tradable, most brokers have reclassified it as a Russian-linked security and blocked all trading. While there are brokers that still allow trading, and in fact there is still some volume on the LSE (a few hundred thousand to a few million shares per day), liquidity is poor.

The situation is not much better on the MOEX, since foreign investors are not allowed to trade there. Interestingly, there appears to be an arbitrage between LSE and MOEX, with Russian shares trading for roughly ₽270 (or £3.50), vs. £2.00 for the UK listing. There is apparently no way to take advantage of it.

In any case, the good news is that Polymetal is not at risk of delisting from the LSE any time soon. First of all, the situation is quite different from other Russian stocks that are also quoted on the LSE, such as Polyus (OTCPK:OPYGY), which is Russian first gold miner. The UK listing of Polyus (PLZL.IL) is actually for depositary receipts, whose underlying are ordinary shares listed on the MOEX (PLZL.ME). Following Russian Federal Law No. 114-FZ, Russian companies have been ordered to stop their ADR programs (unless they receive a special exemption from the Russian government). No such problem however exists for Polymetal. Second, there was some turmoil in April about Deloitte resigning as the company’s auditor. However, Polymetal announced in June that a new auditor (MHA MacIntyre Hudson LLP, an independent member of Baker Tilly International Limited) has been found. Therefore, the company is in full compliance with UK corporate governance requirements.

Liquidity and debt

The company states it has sufficient liquidity to meet all its obligations, as well as to fund future projects. Just before the invasion, Polymetal had $0.4 billion in cash and $2.4 billion in undrawn credit lines. Total net debt was standing at $1.8 billion. At the end of Q2, net debt had ballooned to $2.8 billion. The company maintains $0.5 billion in cash and $0.4 billion in undrawn credit facilities with unsanctioned banks.

Therefore, since the beginning of the war, Polymetal has accumulated roughly $1 billion in debt and lost some credit access. Management is moderately optimistic that it will partially revert in H2 2022. The increase is due partly to a build-up of inventories and partly to a re-evaluation of ruble-denominated long-term debt.

Realized gold price

Another concern about Polymetal is that it might be forced to sell gold domestically at a much lower price than international ones, especially following the ban on Russian gold, which makes it impossible for the company to sell bullion at LBMA prices. Luckily, this does not appear to be the case.

The company has not yet disclosed precisely the average realized price during the quarter. However, it has remarked that currently bullions are sold to Asian customers at only a small discount compared to LBMA prices. The discount is possibly the smallest among Russian peers, and it is not really noticeable given the volatility in gold and silver prices.

Potential transaction

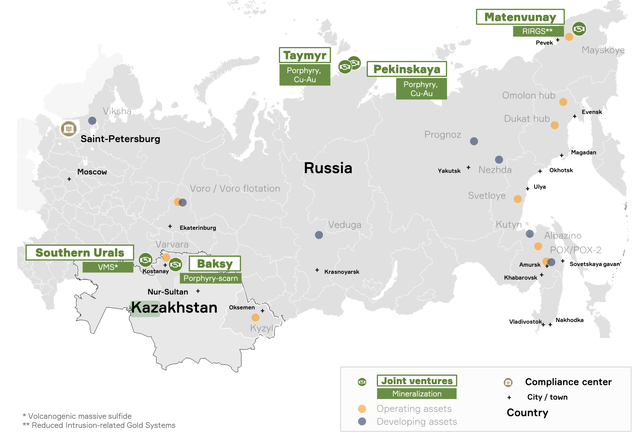

I consider the “Potential Transaction” by far the most important issue to be resolved in the coming months. The Kazakh assets (Kyzyl and Varvara) are an important part of the company. Based on H1 2022 production results, they are responsible for 35% of total revenues. Besides, they have on average higher grades and lower AISCs than the Russian assets.

To put this into perspective, at the beginning of the year, AISCs were projected to be around $1100-1200 / ounce for the overall portfolio, while around $800-900 / ounce for the Kazakh assets only. All these numbers are of course to be fully revised in September, but the fact remains that Kyzyl in particular has some of the lowest costs within the group, while being also the largest asset in terms of production.

Polymetal Portfolio Overview (Investor Presentation)

I see here three main options on the table:

- Do nothing: wait out the end of the war and then slowly rebuild value.

- Advantages: no sale of Russian assets at a deep discount.

- Disadvantages: the company would not be able to use the sale proceeds to reduce debt, plus it would remain at risk of further sanctions due to its Russian exposure. Dividends payment would probably be suspended indefinitely. The share price would remain depressed due to exclusion from indices and lack of institutional interest. The worst-case scenario is that the sanctions are not revoked for several years, and that in the meantime the company goes bankrupt, or the assets get expropriated by the Russian government. I consider these very low-probability outcomes in the short term.

- Sell the Russian assets.

- Advantages: this would allow to reduce debt quickly and eliminate any Russian exposure. The company could return to paying dividends. The share price would be positively impacted.

- Disadvantages: there are considerable bureaucratic difficulties due to both Russian and European regulators. The assets might be sold at a deep discount (e.g. 1x EBITDA). It remains unclear how the company could distribute the cash to shareholders locked in NSD due to sanctions.

- Spinoff of the Russian assets under a new company. This would personally be my favorite outcome.

- Advantages: The Kazakh assets would be allowed to rerate quickly and dividends could be paid. Investors might even be given the choice between selling their participation in the new company for cash, or keeping their shares, depending on their preferences and time horizons.

- Disadvantages: probably the most complex solution.

So what route is Polymetal going to take? During the conference call presentation, the CEO Mr. Nesis was quite explicit in stating that no decision has been taken: a Special Commission has been formed to evaluate the matter, but this is not going to be a speedy process. I see the lack of hurry as a good sign, especially because management is also heavily invested in the company, so interests are aligned with shareholders. Here are some relevant excerpts from the call:

I would like to commit personally that the Board and the management, first and foremost, will have in mind the protection of the rights of institutional shareholders, and that the protection of shareholder value, long-term shareholder value, will definitely be the priority in the decision-making process.

Mr. Nesis described the outright sale of the Russian assets as the most “natural” choice. However, in response to questions regarding the potential discount to fair value, he also emphasized that such discussions are premature, and that the option to do nothing remains on the table.

Doing nothing, potentially, is an option, but this option, if pursued, needs to be pursued consciously and as a result of a thorough process.

He also commented that they are not going to take a decision lightly just to allow the share price to recover:

The focus of the management and the board is not on restoring the share price short term. It is painful to see the share price at the current level, believe me: I am also a shareholder and the bulk of my personal wealth, even at this distressed valuation, is still in Polymetal’s stock. But, the focus is on restoring shareholder value, and it may take a long time, and I am not talking only about the “Potential Transaction”: the “Potential Transaction” may only be the first step.

My current guess is that at the moment there are formidable issues to the “Potential Transaction”, be it either a sale or a spinoff. Assuming that indeed management is not going to accept a solution that discriminates between shareholders (a reasonable assumption, since management itself is locked in NSD), I would expect nothing to happen until sanctions are at least partially walked back.

Valuation

With so many uncertainties, a precise valuation at the moment is very difficult, so I will just give a few reference numbers.

Right now, the company has a market cap of about $1.1 billion. Add to that $2.8 billion in debt, minus $0.5 billion in cash. I assume that the $1 billion increase in debt since the Ukraine’s war is mostly due to exchange rate effects and the build-up in inventories, which are going to reverse, giving an EV of around $2.5 billion.

I also take it as the base scenario that things are going to normalize: new suppliers are going to be found without impacting margins significantly, new sales channels are going to be established at international prices, gold is going to remain at around the $1800 / ounce level, and the RUB/USD exchange rate to stabilize at around 70.

Based on past results, we may expect a free cash flow of around $500 million per year. This might even be conservative going forward, since capital expenditures were expected to decrease significantly over the next few years. Roughly half of that is due to the Kazakh assets alone. So the company is currently valued at 5x EV /FCF. This is cheap, but not that crazy, considering all the uncertainties and assumptions. I would argue that, after divesting the Russian assets, the resulting company could well deserve at least a 10x multiple. Basically, the current share price is discounting the Russian assets at zero value.

Peer Comparison

There are two other publicly listed companies with main operations in Russia. One, as already mentioned, is Polyus (OTCPK:OPYGY). However, Polyus is incorporated in Russia. The main listing (PLZL.ME) is on the MOEX, where ordinary shares trade regularly, while the London listings are for the Depositary Receipts (DRs). Trading in the DRs has de facto stopped, because of sanctions, even if the company has obtained permission from the Russian government to maintain its program. The other is Petropavlovsk (POGR.ME), however this company is going bankrupt because of sanctions imposed on Gazprombank.

As a consequence, Polymetal is really the only Russian gold mining company available to Western investors.

Conclusion

Polymetal is at a turning point. The coming few months will be revealing, both regarding the profitability of the company under the new conditions, and the “Potential Transaction”.

Considering all present uncertainties, I do not see any sufficient margin of safety, even if at the current share price, one is getting the Russian part of the business for free. I have faith in the management and am moderately optimistic about the long-term prospects of the company. But, for new investors, I would just keep an eye on it and wait until more information is disclosed.

Be the first to comment