chonticha wat

Different quotes

When discussing Polymetal (LON: POLY) (OTCPK:AUCOY) (OTCPK:POYYF), it’s necessary to have a quick diversion into which quotations and listings are still valid. Polymetal’s own ADR program, AUCOY, is suspended. The broker-driven US quote, POYYF, is suspended. This was explained here. There’s the AIX quote (Almaty in Kazakhstan) which trades as with London but has very little liquidity. There’s the MOEX, that is Moscow, quote which is wildly different. That Moscow quote is of no great use to any of us out here as it’s not possible for us to really trade it. As a non-Russian citizen we can’t sell there – the obvious trade, given prices, is to buy London, sell Moscow – and while the shares are all fungible in normal times they’re not now. Euroclear doesn’t speak to NSD, the Russian registrar.

So, leaving aside that Russian quote that we can’t access we’re really left with London, POLY. Well, OK. But this will become important later here. That the quotes are not one market is at the heart of current problems. Well, at the heart of attempted solutions to problems.

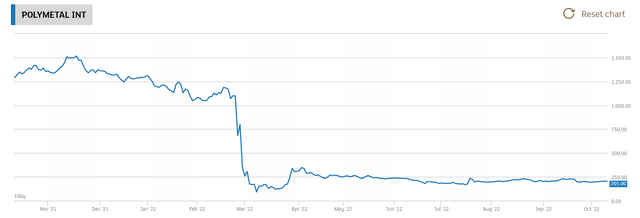

Polymetal share price (London Stock Exchange)

Clearly, I was a little early in saying that the fall was much too large back in February. It’s fallen again since then. And then roughly, and around and about, flatlined. On the basis that everyone knows this is risky, for who knows how a war will turn out? On the other hand, Polymetal is a very nice little collection of gold mines and processing plants, free of the usual problems that accompany oligarch-owned companies over there. We’ve not had worries over material or money being tunneled out and so on unlike some other quoted companies that I’ll not name here.

We also all know that the business is split – there’s a Russian business and a Kazakh one. Given current difficulties perhaps a split of them into two different ones might work as a solution.

Operating results

We’ve had a set of operating results and they were not, on the face of it, good. However, the problems were more about timing than underlying. For example, this line stands out: ” Gold equivalent (“GE”) production was 697 Koz, a 7% decrease year-on-year. Gold sales decreased by 23% year-on-year to 456 Koz,” It’s difficult to sell Russian bullion at present (neither London nor Chicago will accept it as good delivery) so efforts are being made to market in East Asia and so on.

It’s also true that a high ruble, combined with ruble inflation, has pushed up costs. Then there’s the necessity of using local – and thereby almost by definition less efficient – contractors and so on.

And yet, still really a very nice collection of gold mines. The problem is really related to the structure of the company.

Yes, the half-year shows a loss but that’s largely because of non-cash write-downs (” As a result of lower EBITDA and non-cash impairment charges (the post-tax amount of US$ 564 million), the Group recorded a net loss for the period of US$ 321 million in 1H 2022, compared to a US$ 419 million profit in 1H 2021. “). There’s still a great little business in there. Actual gold mining is profitable.

So, what’s the real problem?

The real problem is that there’s a gold mining business in Russia. Polymetal is roughly – roughly – 40% Kazakh, 60% Russian. The shareholder base is roughly 80% outside Russia. We can imagine all sorts of things, the most obvious of which is to split the company. At current valuations, it’s near certain that the stand-alone Kazakh business would be worth more than all of Polymetal at present (although that would depend on who had to carry the extant debt load after the split).

That background problem is that Petropavlovsk wasn’t directly sanctioned at all. Yet it still went bust. We’re simply not sure what is going to happen to gold mines in Russia.

So, what can be done

The next big valuation point for POLY is going to be when they announce – if they can – that they’ve managed to thread through all of the varied restrictions and come up with a solution. The aim will be to have a split company, one owning the Russian assets (which are nicely valued on MOEX, at about 1.7x the London valuation) and another the Kazakh assets. Those Kazakh assets, as above, might well be valued at more than the current valuation of all of them – free of political problems as it would be.

There are problems. They’re all detailed ones and whether there’s a path through them, that’s the question.

For example, it’s not possible to pay a dividend because Euroclear doesn’t speak to NSD. Therefore that 20% or so of the shareholder base that is in Russia can’t be paid out. One possible answer there is that the stock be replaced with certificated shares. That is, not reliant upon NSD. That’s actively being tried and we’ll see how that goes at some point.

As the board says, it’s not possible to really take any major corporate actions while such a large portion of the shareholder base (they say 22%) can’t take part.

So, umm, what?

That’s the thing. POLY can’t in fact sell the Russian gold mines and bank the cash. Any company based in an “unfriendly” jurisdiction cannot sell a Russian gold business – that’s a new Russian law. Jersey is defined as unfriendly. They’re looking into relocating the jurisdiction of incorporation to try and get around that.

Unless and until some very substantial portion of that 22% Russian-owned holding picks up their certified shares, thus getting around NSD, then even a corporate restructure, let alone a dividend, isn’t possible.

By the way, that not selling mines issue also means that a split of the company can’t take place, not without a specific permission from the government in Moscow.

It’s not obvious that there is a solution

The Polymetal price has been chugging along a bit below or a bit above £2 since the varied war-related problems became apparent. The actual performance of the business itself makes that a seemingly very low price. If it were all over next week then we’d expect to see a very strong recovery.

POLY isn’t – by their own statement – going to pay a dividend or even make major corporate changes until they can sort out that communication with Russian shareholders by getting around the NSD.

Even if they can do that it’s not obvious that there’s a path to the most obvious action which would unlock value – splitting the company into Russian and Kazakh portions.

The only other value-generative action would seem to be the end of the war and associated conditions. Which is a pretty poor bet to be making with a stock market investment. Given the human ability to keep such things going far longer than is sensible – if they ever are sensible in the first place.

I tend to see – now – there being only two things that might juice the Polymetal price. One is finding some cute way through this maze that actually works. That allows the corporate split. The other is an end to the whole situation that makes one even desirable.

Why I’m wrong

Obviously, I don’t think I am wrong. But it is possible that they’ll be able to solve this conundrum. If they do then I would expect a considerable jump in the joint valuation of the two to be separated companies. So, that’s really a restatement of the above rather than a method by which I’m wrong. The difference is that I tend to doubt that they are going to find a manner of dealing with this – my experience of Russian bureaucracy is that if they do find a way then someone will tell them that’s not allowed all over again (and yes, my experience is extensive, even if a little bit old).

My view

I had thought that this was all going to be over by now, one way or the other. That proved wrong, obviously. My expectation now is that the Polymetal share price will bumble along roughly where it is until there’s a clear decision. Either on a corporate split, or the end of hostilities and economic sanctions. I think one of the two will happen eventually but eventually is a long time.

The investor view

Polymetal has now become, to my mind, this speculation on those two points. Either or both will produce a significant revaluation of Polymetal shares. So, the question for any position in POLY becomes when we think either of those will happen. I think it will be true that it’s over at some point but the timing, well, months or years?

Be the first to comment