IURII BUKHTA/iStock via Getty Images

PolyMet Mining Corp. (NYSE:PLM) recently signed a joint venture with a large multinational company, and has also ties with Glencore (OTCPK:GLCNF). With this information, I wouldn’t expect a lot of problems to finance the company’s NorthMet project. In my view, if the company continues to explore, and the total amount of proven reserves increases, the company’s fair value will likely increase. Under my own assumptions and some information taken from PLM, my DCF model resulted in a valuation of $4.33 per share.

PolyMet

PolyMet focuses on the exploration and development of natural resource properties. The company’s main asset is the NorthMet Project located in northeastern Minnesota, which is expected to deliver copper, nickel, cobalt, gold, silver, and platinum group metal mineralization.

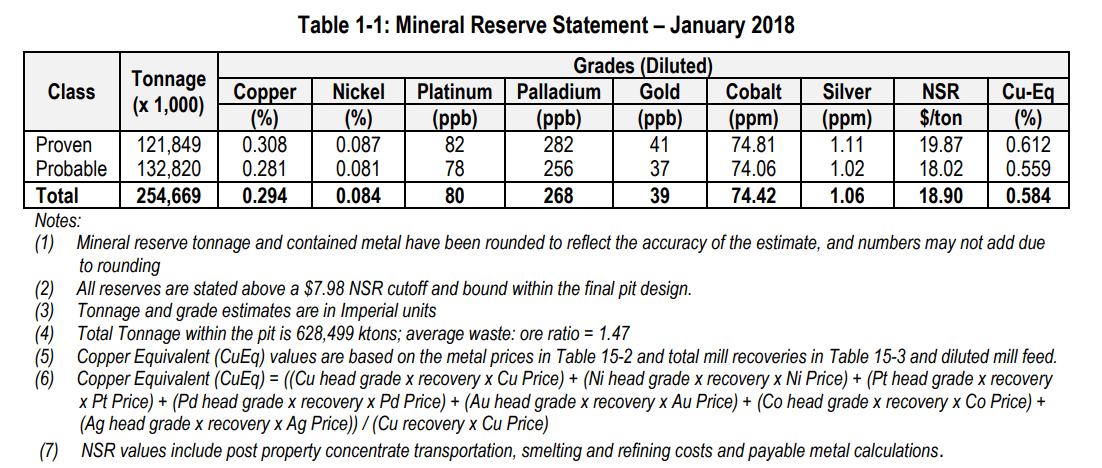

I believe that investors will do good by checking the technical report issued in 2018, where engineers delivered the concentration of metals in the project.

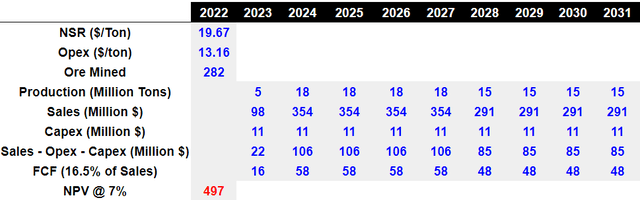

We are talking about a mine with more than 121 million tons of provable mineral reserves and 132 million probable reserves. The project is expected to produce minerals for about 20 years. The net Smelter return or NSR would stay close to $20-$18 per ton. Have a look at the figures delivered by management because I used some of these estimates to assess the valuation of the mine.

The net smelter return refers to the revenues expected from the mill feed, taking into consideration mill recoveries, transport costs of the concentrate to the smelter, treatment and refining charges, and other deductions at the smelter. Source: QueensMineDesignWiki

Technical Report

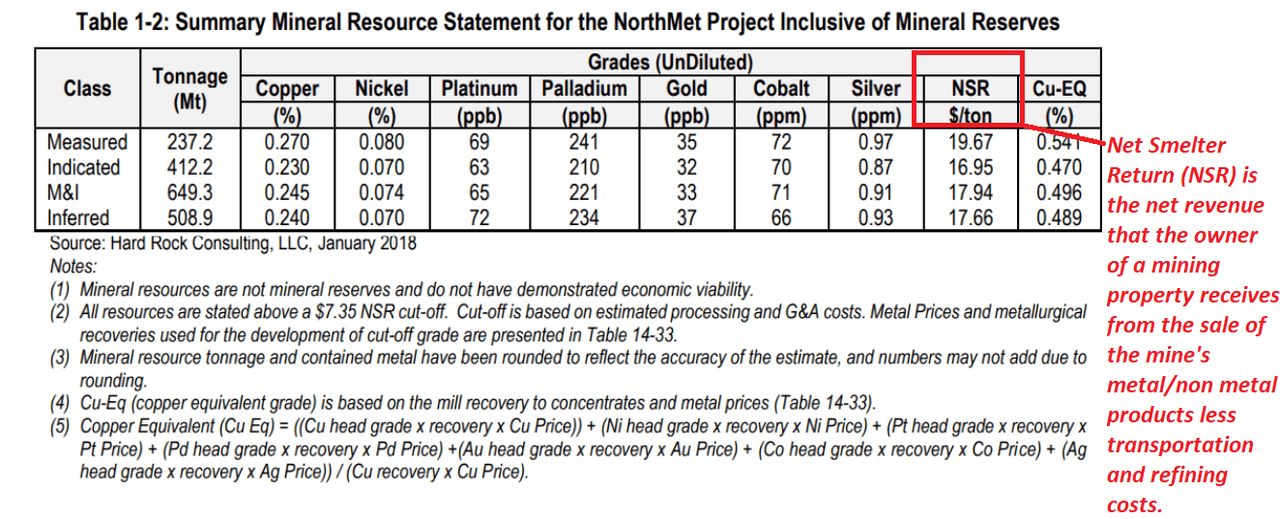

In another table, the technical report noted a measured tonnage of 237 million tons with a NSR of $19.67 per ton. Determining the net revenue that PolyMet Mining may receive is quite complicated. Price of metals may change, and the company may deliver less production than expected. With that, making some forecasts to understand the valuation of the company will not hurt us.

Technical Report

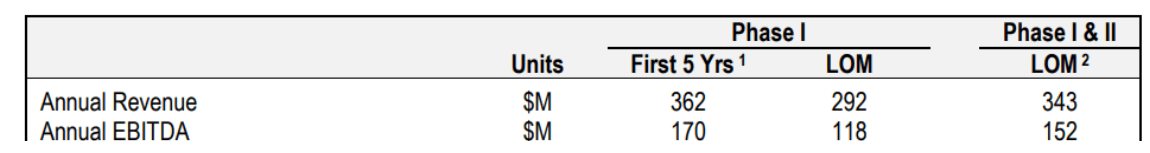

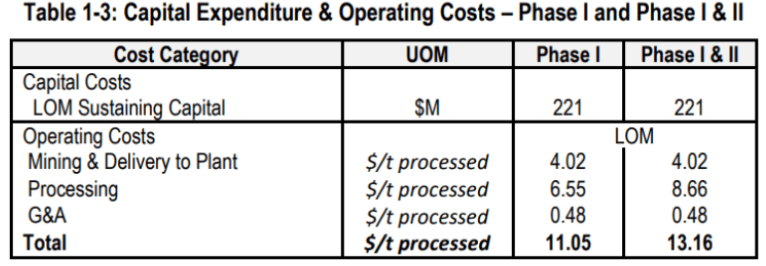

Management believes that capex required would stand at more than $1.2 billion, and opex would come at $13 per ton. I used some of these assumptions in my DCF model.

Technical Report

Technical Report

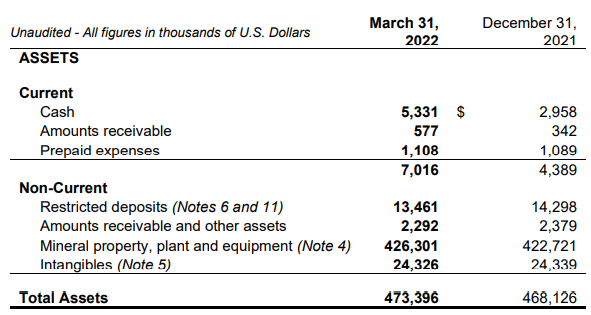

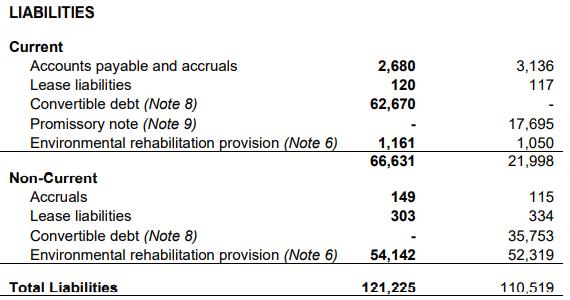

Solid Financial Situation, But PolyMet Needs More Cash To Finance NorthMet

As of March 31, 2022, PolyMet Mining reported $5.3 million in cash, total assets worth $473 million, and total liabilities worth $121 million. I am not concerned about the total amount of contractual obligations. However, in my view, PolyMet needs more financing to finance the development of its main mining project.

Quarterly Report

Management financed its activities through convertible debt, which is worth $62 million. The company does not have cash in hand to pay convertible debt holders, so I believe that we could expect new debt issues, or capital would raise soon.

Quarterly Report

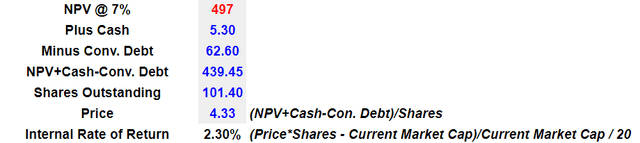

My DCF Model With Approximately 15-18 Million Tons Per Year Implied A Net Present Value Of $497 Million And $4.33 Per Share

I expect PolyMet Mining to continue further exploration activities, which would increase the amount of measured mineral properties:

Further engineering, environmental studies and permitting would be required to prove the economic viability of these potential scenarios and to improve the economic uncertainties associated with these estimates. Further delineation drilling to move inferred resources into measured and indicated resources is also required in the 59,000 and 118,000 STPD cases. Source: Technical Report

PolyMet Mining changed the amount of mineral resources in the past. Hence, I would be expecting further increases in the future. In November 2019, the company reported 290 million short tons of proven and probable mineral reserves:

In November 2019, PolyMet published an updated Mineral Resource and Reserve statement which increased Proven and Probable mineral reserves by 14% to 290 million short tons grading 0.288% copper, 0.083% nickel, 75 ppb platinum, 264 ppb palladium, 39 ppb gold, 73.95 ppm cobalt and 1.06 ppm silver. Source: 2022-03-31-MDA

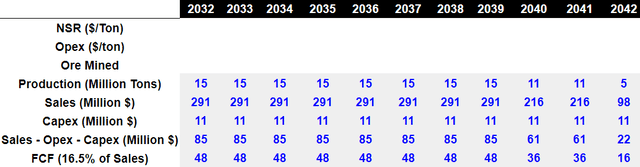

With 282 million ore mined, a NSR at $19.67 per ton, and FCF/Sales close to 16.5%, I obtained free cash flow close to $58-$48 million from 2024 to 2039. I also used a discount of 7%. I added cash of $5 million, and subtracted the convertible debt worth $62 million. Finally, dividing by the shares outstanding, I obtained a fair valuation of $4.33 per share.

My DCF Model My DCF Model My DCF Model

Risk: Forecast Of Reserves Is Quite Complex

The most clear risk for PolyMet Mining and shareholders is failing to measure reserves properly. Let’s note that the company is investing millions of dollars to measure the total amount of reserves. The more reserves the company can find, the larger the potential future production. With that, if engineers overestimate the reserves, future production would be lower than expected, and may lead to less earnings than previewed. In the worst case scenario, I would expect a decline in the company’s fair valuation:

Estimating the quantity of reserves requires the size, shape and depth of deposits to be determined by analyzing geological data. This process may require complex and difficult geological judgments to interpret the data. In addition, management will form a view of forecast prices for its products, based on current and long-term historical average price trends. Source: 2022-03-31-MDA

Risks From Using Mineral Reserves That Are Not Proven

In this article, I assumed that management will continue to explore, and will increase its proven reserves. It means that I used probable reserves, which may not have demonstrated economic viability. Conservative investors will likely use only proven mineral reserves to obtain the company’s fair valuation:

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability and there is no certainty that Mineral Resources will become Mineral Reserves. Source: 2022-03-31-MDA

Not Securing All The Permits Will Most Likely Delay The Ore Production

PolyMet will likely have to start production a bit later if management does not receive all the necessary permits. The State of Minnesota already gave its permit to mine, however there are several regulatory bodies, which still need to give their approval. In my view, once the company receives satisfactory information from authorities, the stock price will eventually reach higher marks:

PolyMet received its Permit to Mine from the State of Minnesota in November 2018, a crucial permit for construction and operation of the Project.

All legal challenges that have reached a final determination have been in favor of the Company and of the more than 20 permits issued, only three (Permit to Mine, NPDES/SDS Permit, Section 404 Permit) remain on hold. Source: 2022-03-31-MDA

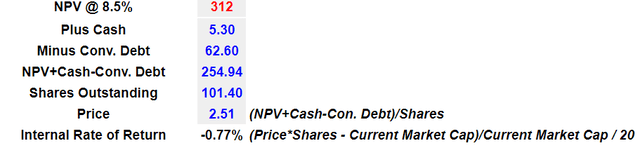

Under Detrimental Circumstances, The Valuation Could Go Below $2.51 Per Share

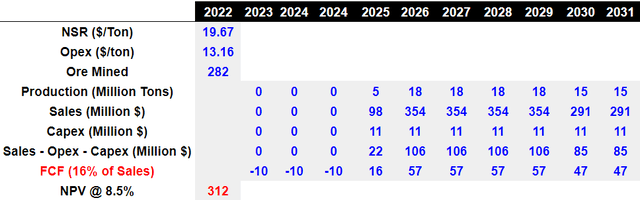

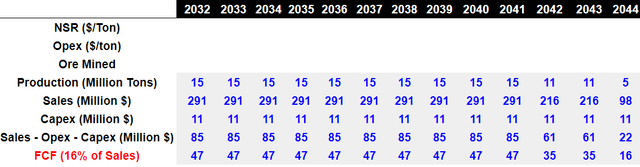

Under another case scenario, I assumed that production would start in 2025. The total amount of ore mined would equal 282 million, and the FCF/Sales ratio would be 16%.

With these figures, if we add $5 million in cash, and subtract convertible debt worth $62, the figure would be equal to $254 million. If we divide by the share count of 101 million, the implied stock price would be $2.51 per share.

My DCF Model My DCF Model My DCF Model

Management Believes That Glencore Will Offer More Financing, And The Joint Venture With Teck Resources Is Also Promising

In my view, the most relevant is whether management will obtain sufficient financing to run its main mining projects. In this regard, it is worth mentioning that Glencore financed its convertible debt. Besides, management noted in a recent report that it is expecting further financing from the same multinational company. I believe that many investors will become buyers of PolyMet stock once they know that GLCNF is behind.

The company believes it is probable it will continue to receive funding from Glencore or other financing sources, including funding from the issuance of unsecured convertible debentures, allowing the Company to satisfy future financial obligations, to complete development of the Project and to conduct future profitable operations. Source: 2022-03-31-MDA

It is also worth noting that PolyMet signed an agreement with Teck Resources Ltd (TECK) to develop mining projects in Minnesota. With a market capitalization of more than $14 billion, TECK will likely offer support to PolyMet’s NorthMet project.

PolyMet Mining Corp and Teck Resources Ltd said on Wednesday they will form a joint venture to develop their Minnesota copper and nickel mining projects. Source: PolyMet and Teck form JV to develop Minnesota mining projects

Conclusion

PolyMet is currently launching a new mining project with financing obtained from Glencore. Considering the amount of dollars already invested to measure the reserves, and with management expecting money from Glencore, money doesn’t seem such a large problem here. I believe that the company’s fair price could reach $4.3 per share thanks to further exploration and development. Besides, if the company receives the last permits from authorities, in my view, the stock price could reach higher marks. In sum, I don’t think that the current price mark is enough to represent the total value of the NorthMet project.

Be the first to comment