Kelvin Murray/DigitalVision via Getty Images

On Friday, one of the more interesting SPAC deals I’ve been watching closely finally closed. EV maker Polestar (NASDAQ:PSNY) completed its transaction with Gores Guggenheim, with the company making its official market debut today. While the company looks to have a strong growth profile for the next couple of years, there are a few reasons I’d wait before buying this stock.

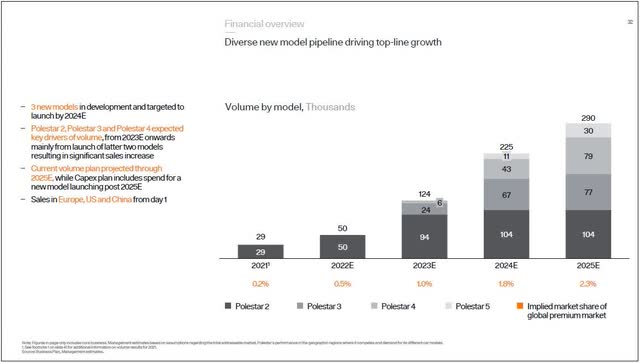

Unlike some of the EV makers that have gone public in recent years, Polestar is actually delivering more than just a token amount of vehicles currently. The company delivered just under 29,000 vehicles last year, and while it has reduced this year’s forecast due to supply chain issues and covid lockdowns in China, it still expects to deliver 50,000 units this year. The original forecast called for 65,000 deliveries. In the graphic below, taken from the company’s updated presentation last month, you can see the expected growth in deliveries through 2025.

Polestar Growth Plan (Company Presentation)

The first reason I’m hesitant to buy shares currently is that we haven’t seen a full slate of financial results from the company yet. All of these SPAC presentations are nice, but I want to see full financial statements before I can make an official judgment. We’ve seen from the likes of Lucid (LCID) and Rivian (RIVN) that production ramp issues can lead to lower-than-expected revenue growth, higher losses, and more cash burn. Given all the commodity inflation we’ve seen, I’m curious to see if management has to adjust its guidance after Q2 results are in and reported.

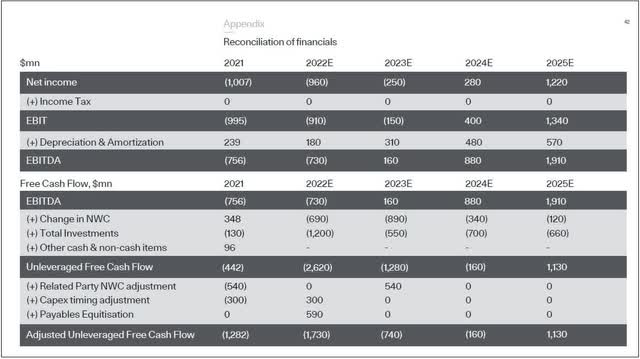

The second reason I’d pass for now is I want to see how much more capital this company will need to raise. Based on the redemption amount cited at the deal closing and cash on hand in April, there should be about $1.1 billion in pro forma cash available for the company. However, as the graphic below shows, management was looking to burn a lot more than that this year alone with at least two more years of negative free cash flow. Raising more capital will either be dilutive to investors, carry interest expenses that further impact profitability hopes, or a combination of both.

Cash Flow Forecast (Company Presentation)

The third reason I would wait currently is the uneasy market environment we are in. Markets have turned away from growth names that are unprofitable and cash-burning in recent months, and Polestar certainly fits that description. With the Fed likely to hike rates at least one more time, and quantitative tightening starting this month, we could easily see a retest of the recent lows. A name like Polestar would likely be one of the first to be hit, especially if investors are worried about a recession and its potential impact on auto sales.

As for valuation, Polestar currently trades at a little more than three times next year’s expected sales. That’s about half of what Tesla (TSLA) trades for, but Tesla currently has profits and cash flow. Investors are valuing Polestar more like Chinese EV makers Nio (NIO) and XPeng (XPEV), which are lower volume sellers currently looking for high growth in the years ahead. I should also note the valuation has come down a bit so far during Friday’s trading, as the stock rallied to more than $13.30 at its high before pulling back to less than $11.

In the end, I believe that investors should be a bit cautious on Polestar in the near term. Given the company’s reduced delivery forecast for this year, I’d really like to see a full set of financial results before making a complete opinion. The EV maker has guided to some nice growth ahead, but it will also need more capital to fund that plan. This is the type of stock the market isn’t favoring right now, so it wouldn’t surprise me to see this name in the single digits before too long.

Be the first to comment