Dilok Klaisataporn

As the stock market has entered a painful bear market, some stocks with solid business fundamentals have been punished along with the weak ones. This is certainly the case for PNC Financial Services (NYSE:PNC). Due to its 27% decline this year, the stock is currently offering a nearly 10-year high dividend yield of 4.0% and is trading at a nearly 10-year low price-to-earnings ratio of 10.4. As PNC will benefit from rising interest rates, which will greatly enhance the net interest margin of the bank, it is likely to highly reward investors when the market returns its focus on the solid business fundamentals of the company.

Business overview

PNC is one of the largest diversified financial services companies in the U.S., with a market capitalization of $61 billion. It offers retail banking services as well as corporate and institutional banking and asset management. Its retail branches are located primarily in markets across the Mid-Atlantic, Midwest and Southeast regions.

Last year, PNC acquired BBVA USA Bancshares from BBVA, a major Spanish financial group, for $11.6 billion in cash. As the deal value is 19% of the market capitalization of PNC, this acquisition will obviously be a major growth driver in the upcoming years. Thanks to this acquisition, PNC added more than 600 branches in Texas, Arizona, Alabama, California and other areas and became the fifth-largest bank in assets in the U.S.

PNC proved vulnerable to the coronavirus crisis. Due to the fierce recession caused by the lockdowns in 2020 and the resultant steep increase in provisions for loan losses, the bank incurred a 45% slump in its earnings per share in 2020. However, PNC recovered swiftly from the pandemic thanks to the unprecedented fiscal stimulus packages offered by the government and the aforementioned acquisition. It more than doubled its earnings per share, from $6.21 in 2020 to an all-time high of $14.18 in 2021.

Moreover, PNC has exhibited a solid business performance over the last decade. During this period, the company has grown its earnings per share at an 11.6% average annual rate thanks to its expansion in new areas, the acquisition of other banks and solid loan growth.

PNC is currently facing a headwind from the increasing risk of an imminent recession. The Fed is raising interest rates aggressively in an effort to keep inflation under control, and thus, it is likely to cause a recession. As PNC has proved vulnerable to recessions, this is a risk factor to consider. On the other hand, just like all the other banks, PNC has incurred depressed net interest margins over the last decade due to the nearly all-time low interest rates that have prevailed throughout this period. Now that interest rates are rising at a fast clip, the bank will greatly benefit from a major expansion of its net interest margin. An analyst of Wells Fargo (WFC) recently emphasized this point.

Analysts seem to agree on the promising growth prospects of PNC. They expect the bank to achieve nearly all-time high earnings per share this year and grow its earnings per share by 13% next year. The nearly all-time high earnings this year are a great achievement, as the bank does not benefit from the reversion of loan loss provisions from the pandemic anymore. To cut a long story short, PNC has a solid growth record, and it has promising growth prospects ahead, partly thanks to the expansion of its net interest margin amid rising interest rates.

Valuation

Due to its 27% decline this year, PNC is trading at a nearly 10-year low price-to-earnings ratio of 10.4, which is lower than the 10-year average of 12.6 of the stock. It is also important to note that the stock is trading at only 9.2 times its expected earnings in 2023.

The exceptionally cheap valuation level has resulted primarily from the impact of inflation on the valuation of stocks, especially growth stocks. High inflation reduces the present value of future cash flows, and thus, it exerts pressure on the price-to-earnings ratios of stocks. However, the Fed is doing its best to restore inflation to its long-term target of 2%, even at the expense of economic growth. As the Fed has prioritized the normalization of inflation, it will almost certainly achieve its goal in the upcoming years. As soon as inflation begins to subside, the valuation of PNC will likely begin to revert towards its historical average.

Dividend

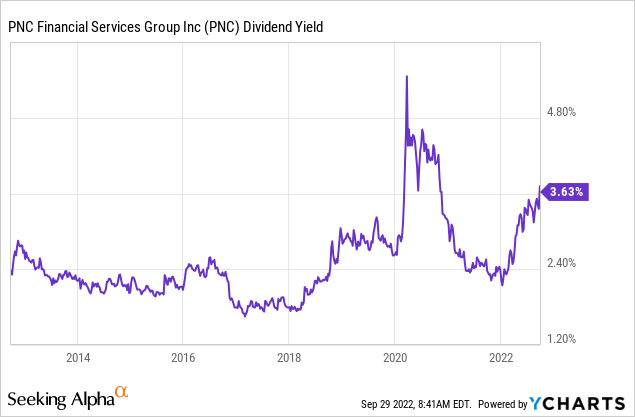

PNC has always passed under the radar of most income-oriented investors due to its lackluster dividend yield. However, due to the decline of its stock price this year, the stock is currently offering a nearly 10-year high dividend yield of 4.0%.

PNC has raised its dividend for 12 consecutive years. Thanks to its solid payout ratio of 39% and its reliable growth trajectory, PNC is likely to continue raising its dividend for many more years. The company has grown its dividend at a 14% average annual rate over the last decade and at an 18% average annual rate over the last five years. These growth rates are much higher than the 8% median dividend growth rate of the financial sector. Overall, investors can lock in the nearly 10-year high dividend yield of PNC and rest assured that the bank will continue raising its dividend meaningfully for many more years.

Risk

The primary risk for PNC is the adverse scenario of a prolonged recession. In such a case, the bank is likely to incur a significant decrease in its earnings due to high provisions for loan losses. PNC has proved vulnerable to fierce recessions in the past, as evidenced by its performance in the Great Recession and in 2020. However, the Fed is unlikely to allow a prolonged recession to occur without intervening. Therefore, even if a recession shows up, PNC is likely to endure such a downturn and emerge stronger during the subsequent recovery.

Final thoughts

PNC is offering a nearly 10-year high dividend yield and is trading at a nearly 10-year low price-to-earnings ratio due to the increasing risk of an upcoming recession and the impact of 40-year high inflation on the valuation of the stock. However, these headwinds are likely to prove short-lived while the bank will greatly benefit from rising interest rates. As a result, the stock is likely to highly reward investors in the long run. Nevertheless, due to the exceptionally negative market sentiment prevailing right now and its steep downtrend, the stock is likely to remain in a downtrend in the short run. Therefore, the investors who want to enhance their future returns may wait to purchase the stock when it approaches its technical support around $125.

Be the first to comment