jroballo/iStock via Getty Images

Thesis

Plug Power Inc.’s (NASDAQ:PLUG) Q3 earnings release had already been de-risked after it released a preliminary update, which we discussed in our previous article.

PLUG buyers have demonstrated tremendous resilience after a well-deserved pullback from its August highs, as sellers digested the optimism spurred by the Inflation Reduction Act (IRA).

Notwithstanding, we postulate that Plug remains well-positioned to leverage the production tax credits (PTC) embedded in the IRA, even though near-term production ramp headwinds remain. Also, its third-party hydrogen fuel costs have risen markedly through Q3, given the surge in natural gas prices.

However, Plug highlighted its confidence that we could have seen the peak in natural gas prices in 2022. In addition, our analysis of the NYMEX natural gas futures (NG1:COM) suggests that natural gas bulls have attempted to prevent further downside from October lows. But, it seems unlikely for NG1 to revisit its August/September highs, despite the impasse in Europe over the finalization of natural gas price caps.

Plug Power remains committed to achieving scale efficiencies and profitable growth. The company highlighted its ability to lower its fuel costs in 2023, which should lift margins markedly. Notably, the company committed to exiting 2023 “with operating break-even margin run rate.”

Hence, we believe management’s confidence is consistent with what we have observed in PLUG’s price action. It’s also in line with what we believe is a sustained broad market bottom that occurred in October (discussed in a recent S&P 500 ETF article). Coupled with a potentially slower rate hike cadence by the Fed through H1’23, it augurs well for Plug Power’s external financing outlook on its ambitious green hydrogen projects while leveraging the PTCs.

Maintain Speculative Buy with a reduced medium-term price target (PT) of $21 (implying a potential upside of 34%).

Plug Guides Toward Operating Breakeven Exiting Q4’23

Over the past year, production ramp challenges and higher natural gas costs have afflicted Plug Power. However, management was confident that these headwinds would be less significant in 2023, as CEO Andy Marsh accentuated:

We’ve already demonstrated [our green hydrogen platform] in Tennessee. We can generate hydrogen at 1/3 of the cost we’re paying from industrial gas companies today. We won’t be discussing this issue within a year. They’ll be in the rearview mirror and the issue will be how to accelerate the plans. And we’re just starting to scale. We’ve made fuel cells profitable and material handling and now doing this again in electrolyzers and stationery. You put these 2 items together with the real improvements in service, the 2023 targets of $1.4 billion in revenue, and exiting the year at breakeven operating margins is achievable. (Plug Power FQ3’22 earnings call)

While we applaud management’s confidence in its path toward profitability, we remain cautious, given its execution track record. However, the secular growth drivers in green hydrogen are unquestionable, as discussed in our previous article. Coupled with the IRA’s tax credits, it should lift Plug’s ability to achieve profitability if it could scale accordingly.

Hence, the critical question remains whether Plug Power could execute its ramp to achieve the necessary scale efficiencies. However, we remain optimistic as two critical headwinds impacting Plug’s ability to ramp could be less significant in FY23.

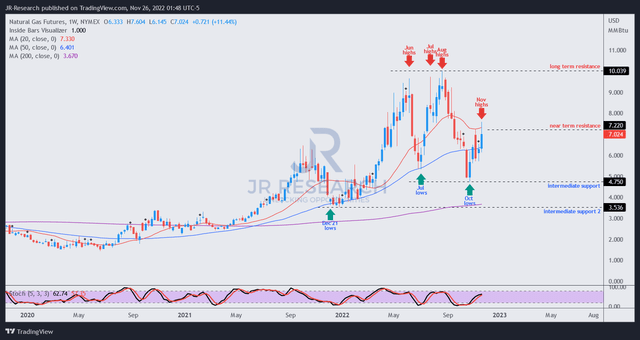

NG1 price chart (weekly) (TradingView)

NG1 has recovered remarkably from its October lows after the capitulation move from its August highs. While natural gas bulls remain in control, given NG1’s medium-term uptrend, we parse that buyers’ momentum has weakened considerably.

Hence, it forebodes well with Plug’s assessment that “the second half of 2022 likely [represents] the peak of hydrogen molecule costs for Plug.”

Moreover, Plug highlighted that it sees the opportunity for external financing to help scale its green hydrogen buildout over the long term. Notably, the company sees the potential for up to 20% self-financing, allowing it to leverage up to 5x its current financing capacity.

However, the third-party financing market has been thrown into disarray with the Fed’s rapid rate hikes. Notwithstanding, with the Fed likely tempering its forward hikes cadence and possibly moving into data dependency mode in H2’23, it should provide much more clarity for Plug’s financing partners.

Therefore, we believe significant financing headwinds should abate from FY23, allowing Plug and its partners to assess better their cost of capital and project hurdle rates with much more confidence moving ahead.

Is PLUG A Buy, Sell, Or Hold?

PLUG’s NTM Revenue multiple of 5.7x trades at a discount against its peers’ median of 6.4x. However, assessing PLUG’s valuation accurately is challenging, given its unprofitability. Hence, investors are urged to consider any opportunity speculative (therefore requiring appropriate risk management plans).

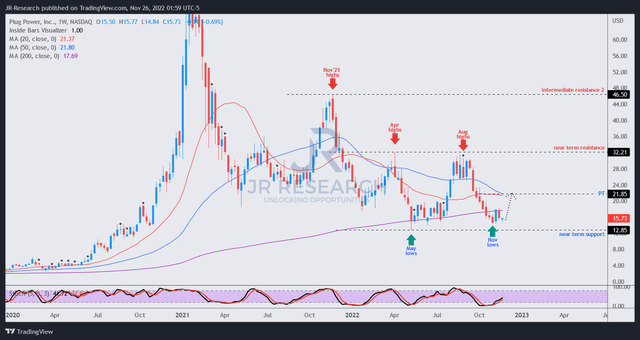

PLUG price chart (weekly) (TradingView)

PLUG’s bottoming process in November is constructive. Therefore, the market has likely anticipated its tepid Q3 performance, given the nearly 55% decline from its August highs to its November lows (pre-Q3 release). The market is a forward-discounting mechanism.

Notwithstanding, PLUG remains in a medium-term downtrend but appears to be supported along its 200-week moving average (purple line). Hence, a mean-reversion rally could potentially occur if buyers could hold the current levels robustly.

Maintain Speculative Buy with a PT of $21.

Be the first to comment