La Su/iStock via Getty Images

The normalization of mobile gaming revenues has hurt a lot of the related stocks in 2022 such as Playstudios (NASDAQ:MYPS). The sector should face much easier comp sales in 2023 making the mobile gaming stocks more appealing to watch as the year ends. My investment thesis remains Bullish on the stock after a couple of tough years in the mobile gaming market, but the company needs to execute on organic growth following an important acquisition.

Damaged Business

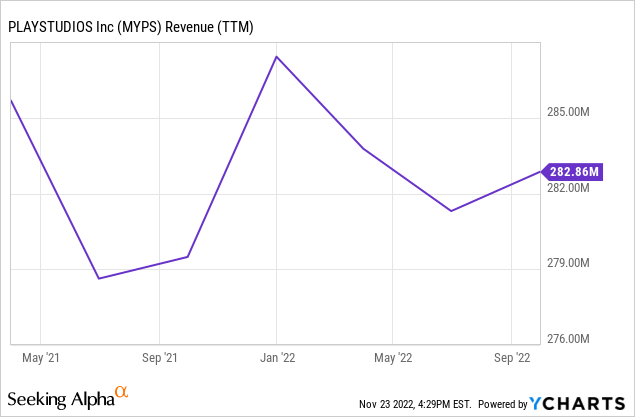

Since completing the SPAC deal back in 2021, Playstudios hasn’t generated any growth. The mobile gaming company has generally produced quarterly revenues right around $70 million.

The company had big goals for growth when closing the SPAC deal. The stock has fallen below $5 due to this recurring theme repeated in Q3’22 when revenues were $72 million for 2% growth despite the addition of the Tetris game and acquisition revenues.

Playstudios is a unique concept with an awards loyalty platform highlighting the mobile games. Unfortunately, the playAWARDS loyalty platform hasn’t contributed to any growth in the business.

The stock became compelling as other mobile game developers like Glu Mobile and Zynga were acquired in the last year or so. Investors looking for another stock in the sector might find Playstudios interesting.

The Q3’22 results weren’t so promising with updated revenue guidance for the year at $280.0 million and adjusted EBITDA at $33.5 million. The company mostly focuses on social casino games like myVEGAS blackjack or Bingo.

The guidance has Q4 revenues hitting just $69 million. The big concern is the ability of management to execute, though the mobile gaming environment has been a major headwind in 2022.

Acquisition Path

One of the compelling aspects of Glu Mobile and Zynga were the abilities of those companies to acquire smaller game developers at discounts and utilize their corporate scale to elevate the acquired games. Playstudios predicts similar outcomes with UA efficiencies and improved product monetization and optimization along with expanding the loyalty platform to an expanded user base.

In this manner, Playstudios recently closed the acquisition of Brainium for $70.0 million plus a continent consideration of up to $27.25 million. The company ended Q3 with a cash balance of $212 million, so the deal was completely handled with cash on the balance sheet while still leaving $140 million prior to paying any contingent liability.

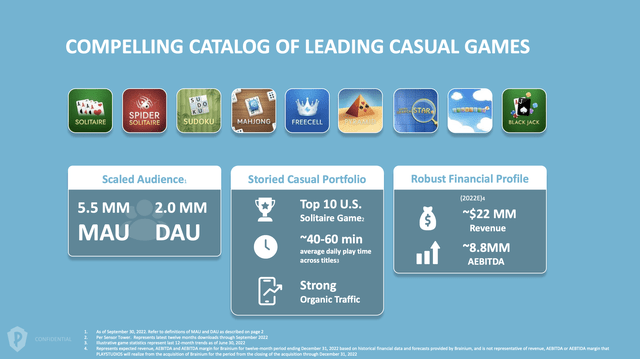

Source: Playstudios Brainium presentation

The deal provides a business with a casual game catalog with 5.5 million MAUs (monthly active users) with revenues of $22 million and adjusted EBITDA of $8.8 million. Technically, Playstudios is paying only 3x sales and 8x EBITDA for the business with 40% margins already.

Playstudios doesn’t appear to have gotten much of a bargain on the deal. Brainium does boost the MAUs to 12.1 million and should boost adjusted EBITDA to $41.3 million.

The stock only trades with a market cap of $550 million. Playstudios trades at just 13x adjusted EBITDA targets. In a more normalized mobile gaming market with solid growth in 2023, the company should drive an attractive valuation via producing growth from expanding the business of Brainium.

The problem is that Q4’22 revenue of $69 million is very weak considering Brainium should add $5 million in quarterly revenues. Playstudios guided to revenues actually dipping several million in the quarter despite the addition of Brainium.

Takeaway

The key investor takeaway is that Playstudios has a compelling valuation. The company needs to execute on the game plan to generate organic growth from the Brainium acquisition. The mobile gaming market has some easy comps in 2023 and the combination should boost revenues beyond the pro-forma 2022 revenues of nearly $300 million.

The stock is a compelling sector play, though a lot of questions exist regarding management executing on the plan after failing to meet the outlined goals following the SPAC deal. Playstudios has upside from here, but investors shouldn’t be overly aggressive.

Be the first to comment