Thomas Barwick/DigitalVision via Getty Images

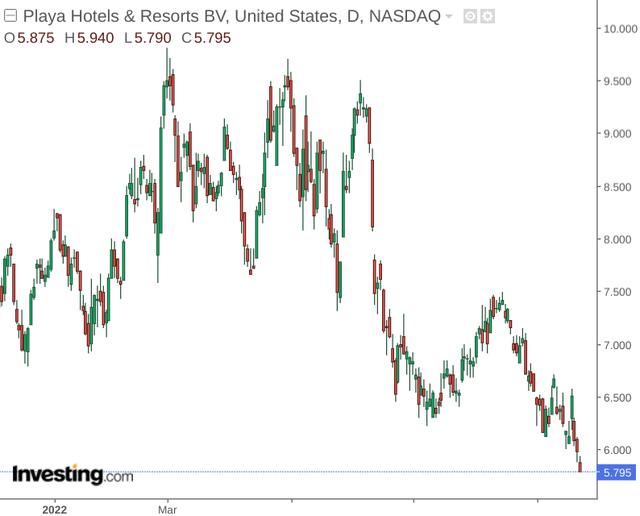

Investment Thesis: While I take the view that the stock might see some downside ahead – the stock could see a significant rebound next year if sales and bookings remain resilient.

In a previous article back in July, I made the argument that Playa Hotels & Resorts (NASDAQ:PLYA) has seen encouraging RevPAR growth across its portfolio, and is in a favourable cash position to handle a potential slowdown in revenue growth.

In spite of my prior assertions, the stock has been seeing significant downside.

The purpose of this article is to evaluate whether Playa Hotels & Resorts could see scope for a rebound – particularly taking recent earnings performance into account.

Performance

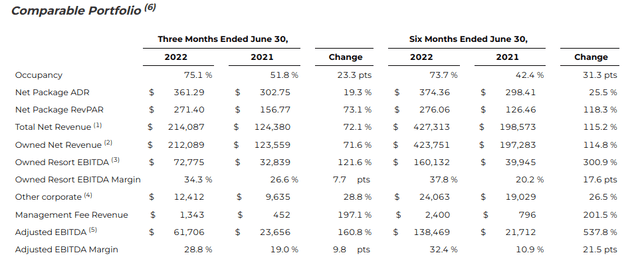

When looking at the company’s comparable portfolio performance over the most recent quarter (which excludes the sale of the Capri Resort and Dreams Puerto Aventuras), we can see that both RevPAR and adjusted EBITDA are up strongly on that of last year – both on a three-month and six-month ended basis:

Playa Hotels & Resorts N.V. Reports Second Quarter 2022 Results

Moreover, the company saw an improvement in its ratio of cash to total liabilities:

| December 2021 | June 2022 | |

| Cash and cash equivalents | 270,088 | 348,797 |

| Current liabilities | 1,426,742 | 1,386,747 |

| Cash to total liabilities ratio | 0.19 | 0.25 |

Source: Figures ($ in thousands) sourced from Playa Hotels & Resorts N.V. Second Quarter 2022 Results. Cash to total liabilities ratio calculated by author.

From this standpoint, there does appear to be somewhat of a disconnect between company performance and the recent decline in stock price.

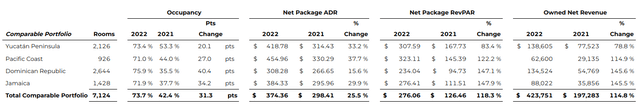

I also noted in my last article that the Yucatan Peninsula showed the highest average RevPAR for the year 2021 and accounted for just under 30% of total revenue in that year.

Additionally, we can see that growth continued strongly into 2022 – with the Yucatan Peninsula remaining the largest in owned net revenue, while RevPAR across the company’s other three geographies showed triple-digit percentage growth.

Playa Hotels & Resorts N.V. Reports Second Quarter 2022 Results

From this standpoint, Playa Hotels & Resorts showed a strong second quarter and the company has also been able to raise its cash levels relative to total liabilities which will aid the company in withstanding a potential decline in revenue during the winter months.

Looking Forward

Going forward, the stock might see a decline in what is currently a risk-averse macroeconomic environment. Playa Hotels & Resorts is ultimately a company that operates in emerging markets and the travel industry is set to see a seasonal drop in demand heading into the winter months.

As a result, investors may be cautious and could look for more evidence that Playa Hotels & Resorts can withstand the winter months without seeing too big a drop in revenue or having to incur further debt to fund operations.

The company did manage to reduce its debt load from $944.8 million in December 2021 to $915.4 million in June 2022. Should we see further debt reductions over the next couple of quarters, then this will be quite an encouraging sign as it indicates that the company is still generating sufficient revenue to pay off its liabilities.

Playa Hotels & Resorts N.V. Reports Second Quarter 2022 Results

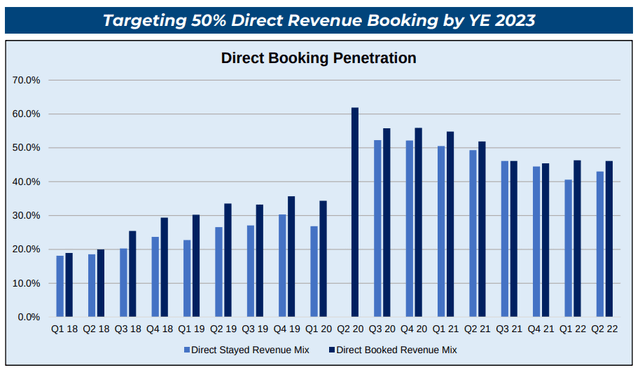

Additionally, Playa Hotels & Resorts also saw a significant boost in direct bookings after the pandemic – this was particularly driven by demand from the United States as a greater share of American tourists sought travel across Latin America due to border restrictions across Europe at the time.

Playa Hotels & Resorts Overview August 2022

While such bookings have seen a steady decline since then – we can see that they still remain above pre-COVID levels. Should the company see direct bookings at 50% by 2023 – then this will also be an encouraging sign as direct bookings lower the cost of customer acquisition.

Of course, inflation remains a risk for the company and should we see an official recession heading into 2023 – then this is expected to dent demand for international travel and we could see revenue growth stall. I expect that investors will be inclined to tread cautiously until the macroeconomic picture becomes clearer in this regard.

Conclusion

To conclude, Playa Hotels & Resorts has seen a strong previous quarter. However, the stock appears to be declining due to the effects of potential inflation on travel. While I take the view that the stock might see some downside ahead – the stock could see a significant rebound next year if sales and bookings remain resilient.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment