Oleh_Slobodeniuk/E+ via Getty Images

Investment Thesis: Playa Hotels & Resorts has seen impressive revenue growth, but earnings growth needs to accelerate if the stock is to see further upside.

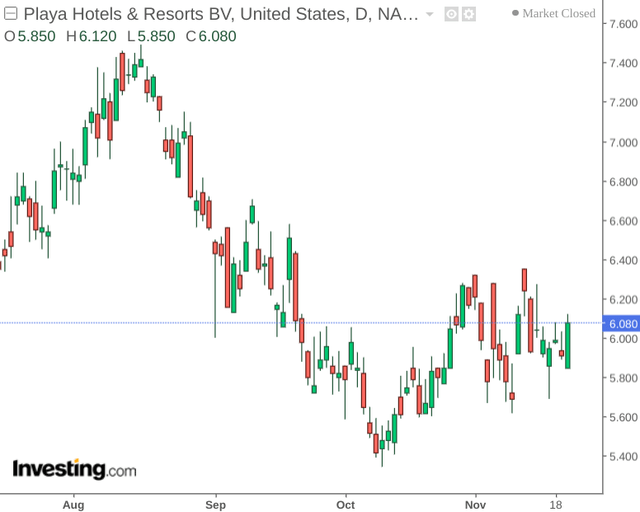

In a previous article back in September, I made the argument that Playa Hotels & Resorts (NASDAQ:PLYA) could see a short-term decline going forward, as travel demand sees a seasonal decline as the winter months approach.

While the stock remains significantly below levels seen last August, price is up by just over 6% since my last article:

The purpose of this article is to assess whether Playa Hotels & Resorts could have scope for upside from here, particularly taking recent financial performance into account.

Performance

From a balance sheet perspective, we can see that the company’s cash to total liabilities ratio has improved since last December:

| Dec 2021 | Sep 2022 | |

| Cash and cash equivalents | 270,088 | 371,688 |

| Total liabilities | 1,426,742 | 1,435,516 |

| Cash to total liabilities ratio | 0.19 | 0.26 |

Source: Playa Hotels & Resorts N.V. Reports Third Quarter 2022 Results

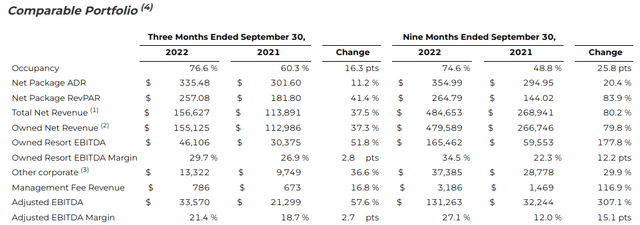

When looking at Q3 2022 results for the comparable portfolio of Playa Hotels & Resorts – we can see that net package RevPAR (or revenue per available room) is up by 41% on that of last year on a three-month basis.

Playa Hotels & Resorts N.V. Reports Third Quarter 2022 Results

Moreover, we can also see that RevPAR has continued to increase in spite of an 11.2% increase in ADR (average daily rate) over the same period.

While the RevPAR figure of $257.08 for this quarter was lower than the $271.40 seen for Q2 – overall growth has been highly encouraging. As mentioned, the fact that revenue has continued to grow while average prices have continued to rise is also welcoming and reflects that inflationary pressures are not having a significantly dampening effect on demand.

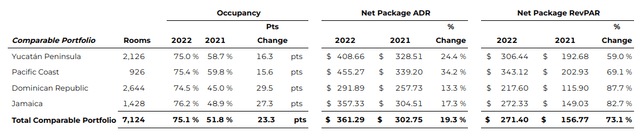

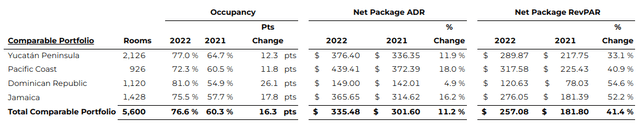

Additionally, we can also see that the Yucatan Peninsula segment of the portfolio – which was the largest in terms of rooms for Q3 2022 – showed a 33% increase in RevPAR from that of the same quarter last year and also demonstrated the second-highest RevPAR for the quarter overall. While RevPAR for the segment was slightly lower than that of Q2 2022 – it is still significantly higher than that of Q2 2021.

Second Quarter 2022 Results

Playa Hotels & Resorts: Second Quarter 2022 Results

Third Quarter 2022 Results

Playa Hotels & Resorts: Third Quarter 2022 Results

Additionally, the Pacific Coast portfolio – which saw the highest increase in ADR by 18% in the third quarter – also saw a 40% increase in RevPAR as compared to the same quarter last year.

In spite of continually strong revenue growth – earnings growth for Q3 was significantly less than that of the previous quarter, with Playa Hotels & Resorts reporting an adjusted (diluted) earnings per share of $0.04 for the quarter as compared to $0.15 for Q2. Additionally, Q3 earnings came in at $0.38 on a nine-month ended basis, which is just marginally higher than earnings of $0.34 as recorded in the previous quarter.

While revenue has seen significant growth, this has also been accompanied by growth in direct and selling, general and administrative expenses of 33% as compared to last year on a nine-month ended basis.

As such, while Playa Hotels & Resorts has benefited significantly from the boost in revenue post-pandemic – investors are likely to increasingly look for significant earnings growth to justify further upside from here.

Looking Forward

Going forward, the fact that inflationary pressures has not significantly harmed revenue growth is quite encouraging. While there might be some decline in seasonal demand during the winter months which might be reflected in Q4 results – I take the view that revenue growth can reasonably be expected to continue going forward.

However, we have also seen that inflationary pressures have significantly increased the company’s expenses which have been placing an upward ceiling on revenue growth.

From this standpoint, I take the view that the company will need to demonstrate more meaningful earnings growth before we see further upside.

Conclusion

To conclude, Playa Hotels & Resorts has seen impressive revenue growth. However, earnings growth still remains modest and I take the view that earnings will need to rise significantly before price starts to do so in tandem.

Be the first to comment