sanfel

It is a very rare occasion that I rate a company that I view as being excellent as a ‘sell’. The reason why is because an excellent company can only warrant that kind of rating if it is drastically overpriced. And with a company that is truly quality, and growing at a nice clip, it’s always possible that the firm can grow into that lofty price. But when the picture just starts to look absurd, I cannot help but to downgrade the business in question. And that is precisely what transpired when I wrote an article earlier this year about fitness company Planet Fitness (NYSE:PLNT). Since then, shares have declined alongside the broader market and, simultaneously, fundamental performance has improved drastically. Moving forward, I suspect that this performance will continue. On top of that, shares are starting to come down in price. But they aren’t quite at the point yet that I feel my ratings should change. As such, I am retaining my ‘sell’ rating on the firm with the idea that another 10% to 20% decline could present a good buying opportunity for long-term, value-oriented investors moving forward.

Rapid Growth Continues

Back in January of this year, I wrote an article detailing the investment worthiness of gym operator Planet Fitness. As I mentioned already, I called the company an excellent business, and I even claimed that it likely had a bright future ahead for itself. At the same time, however, I said that it did not make for a compelling investment opportunity because shares of the enterprise were drastically overpriced. Ultimately, this led me to rate the business a ‘sell’, reflecting my belief that it would underperform the broader market for the foreseeable future. So far, that call has played out nicely. While the S&P 500 has dropped by 13.7%, shares of Planet Fitness have generated a loss of 17%.

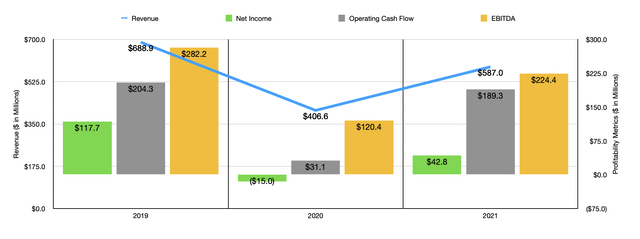

This drop in price seems to have been in response to the market coming to terms with the fact that the stock was overpriced. Of course, the general market falling significantly also certainly played a role. But none of this means that the quality argument that I made in my prior article is any different. To see what I mean, we should probably start with how the company ended its 2021 fiscal year. For that year, sales came in at $587 million. That represents an increase of 44.4% over the $406.6 million the business generated in 2020. This increase was really driven by a couple of factors.

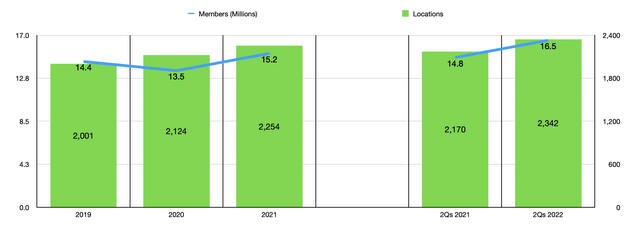

First, the company saw the number of locations that it has increased, rising from 2,124 in 2020 to 2,254 last year. Second, as the pandemic showed signs of ending, the number of members the company had rose significantly, climbing from 13.5 million to an all-time high of 15.2 million. Some of this increase was undoubtedly because of the new locations in operation. But a significant portion was likely attributed to prior customers coming back after previously canceling their memberships during the height of the pandemic. Profitability for the company also improved markedly. Net income of $42.8 million dwarfed the $15 million loss generated in 2020. Operating cash flow rose from $31.3 million to $189.3 million. Meanwhile, EBITDA for the company also increased, climbing from $120.4 million to $224.4 million.

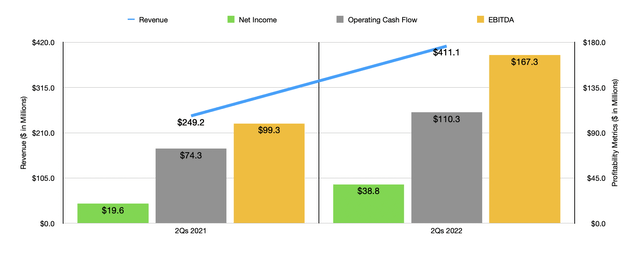

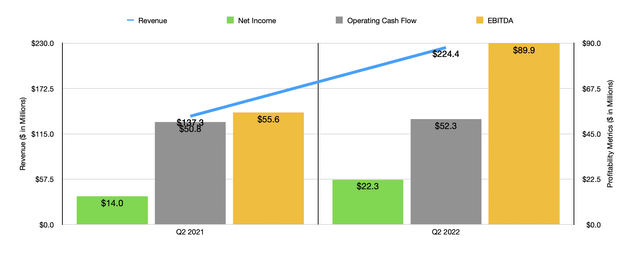

Growth for the company has continued into the 2022 fiscal year. In the first half of the year, for instance, revenue came in at $411.1 million. This represents an increase of 65% over the $249.2 million generated the same time last year. The same factors driving growth from 2020 to 2021 also played a role so far this year. Today, the company currently has 2,324 locations in operation. This compares to the 2,170 it had just one year earlier. Over that same time, the company’s membership ballooned to $16.5 million. That’s 1.7 million higher than the 14.8 million it reported for the second quarter of 2021. Profitability for the company has also improved. Net income has risen from $19.6 million to $38.8 million. Operating cash flow grew from $74.3 million to $110.3 million, while EBITDA increased from $99.3 million to $167.3 million.

When it comes to the 2022 fiscal year as a whole, management has high expectations for the company. Management currently expects revenue to come in at the mid-50 % range, higher than with the company generated in 2021. If we assume that this translates to an increase of 55%, that would imply revenue of $909.9 million. The company anticipates adjusted net income rising in the low 90% range, likely taking net profits up to about $82.4 million. Meanwhile, EBITDA is expected to rise at the high 50% range. That should translate to roughly $353.4 million. No guidance was given when it came to other profitability metrics. But if we assume that operating cash flow would increase, on an adjusted basis, at the same rate as EBITDA, then we should anticipate a reading of $298.1 million.

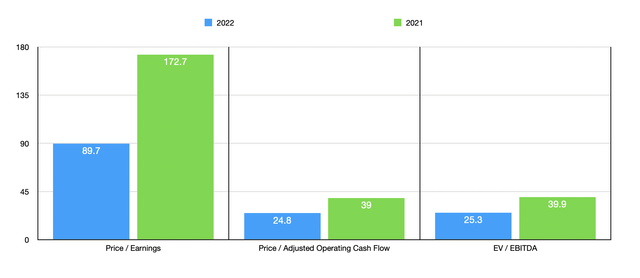

Taking this data, it’s quite easy to value the business. On a forward basis, the company is trading at a price-to-earnings multiple of 89.7. Although astronomically high, this is still lower than the 172.7 multiple that it was trading for if we use 2021 results. The price to adjusted operating cash flow multiple should drop from 39 to 24.8, while the EV to EBITDA multiple should decline from 39.9 to 25.3. Unfortunately, there aren’t very many good companies to compare Planet Fitness to. Perhaps the single most appropriate comparable would be Life Time Group Holdings (LTH), which focuses on luxury workout experiences. The company does not have positive earnings, so the price-to-earnings approach to valuing it is impossible. However, it is trading at a forward price to operating cash flow multiple of 30, while its EV to EBITDA multiple is 23.1. So in one respect, Planet Fitness is cheaper than it, while in another, it is more expensive.

Takeaway

Based on the data provided, I do think that Planet Fitness is still an excellent company. Management is doing an extraordinary job growing the company’s top line. However, shares of the business were tremendously overpriced previously. On a forward basis, that picture has improved considerably, driven in part by the share price decline and also by the improved outlook for the company. For somebody wanting to buy for the very long term, I don’t think buying now or waiting until the stock drops further will make that much of a difference. However, to truly reach a more appropriate value, I do still think that a ‘sell’ rating is warranted since the company looks rather pricey at this moment. We have to remember that while recent growth has been tremendous, this has been driven in large part by a recovery following the pandemic. Customer additions were easy to get as a result, and we are also nearing economically uncertain times. That could also put a damper on things and slow growth moving forward.

Be the first to comment