JamesBrey

Introduction

Upon entering 2022, it saw a new era of distribution growth beginning for Plains All American Pipeline (NASDAQ:PAA), as my previous article highlighted. Thankfully, they did not disappoint with a large 21% increase following soon after publication, which helped create their high distribution yield of 8.17%. Whilst already desirable, it seems that unitholders such as myself can now get ready for a very high 10%+ yield on current cost with more increases almost certainly on the horizon.

Executive Summary & Ratings

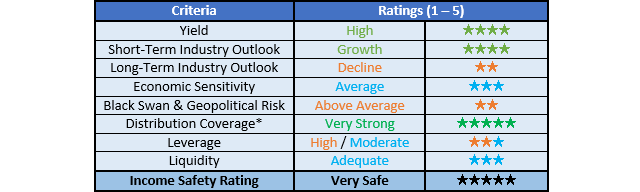

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

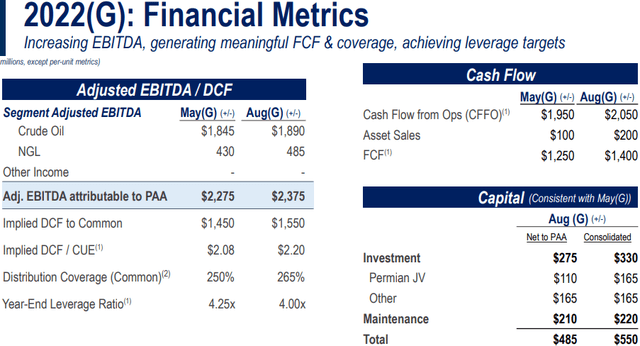

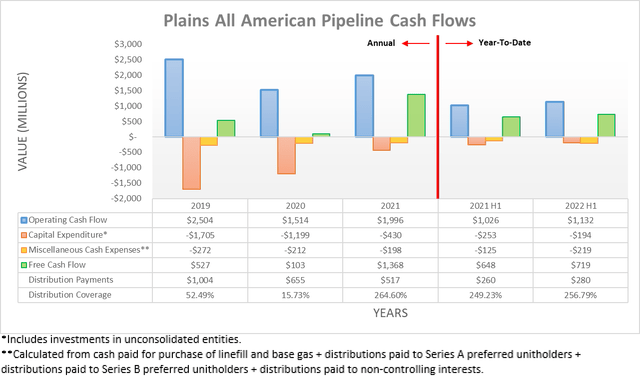

Even though the outlook heading into 2022 was less than stellar with essentially flat guidance versus 2021, their cash flow performance during the first half was actually solid. As a result, their operating cash flow increased to $1.132b and thus 10.33% higher year-on-year versus their previous result of $1.026b during the first half of 2021. Admittedly, this drops to only 4.27% higher year-on-year if removing their temporary working capital movements with their underlying results landing at $1.1b and $1.055b for the first halves of 2022 and 2021 respectively. After this solid start to the year, they have increased their guidance slightly when looking ahead into the remainder of 2022, as the slide included below displays.

Plains All American Pipeline Second Quarter Of 2022 Results Presentation

It can be seen their guidance for 2022 now sees adjusted EBITDA of $2.375b, which represents an increase of 4.40% versus their previous update of $2.275b in May and further builds upon their original guidance for $2.2b upon entering the year, as per my previously linked article. This now makes for a total forecast increase of 8.15% versus their result of $2.196b for 2021 and thus indicates that the second half of 2022 should at least be roughly as good as the first half, if not slightly better. Their latest guidance also flags $200m of divestitures, most of which should fall during the second half as the first only saw $57m and thus implies $143m should be seen during the second half. Even without stronger cash flow performance, they are still generating ample free cash flow that landed at $719m during the first half of 2022 and thereby provided very strong coverage of 256.79% to their distribution payments of $280m and thus unsurprisingly, this sees higher distributions on the horizon, as per the commentary from management included below.

“…the real question on capital allocation is the split between distribution increase and buybacks. And I think you’ll see that we will continue to support distribution increases.”

– Plains All American Q2 2022 Conference Call.

Apart from the very clear signal that higher unitholder returns are coming, it was also very positive to see they are planning to favor higher distributions instead of unit buybacks. Whilst the latter is not necessarily a poor choice, I feel the former better suits those in very mature industries, especially when they face a long-term challenge as the world transitions to clean energy. It obviously remains to be seen how much higher they will push their distributions, although given their very strong over 200% coverage, they have ample free cash flow and thus a sizeable double-digit increase is definitely realistic, especially given the precedence of their near 21% increase earlier in 2022.

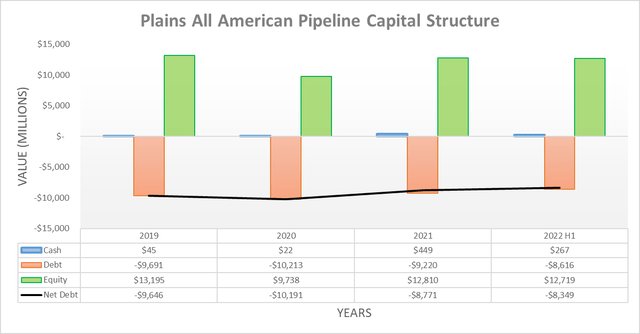

Thanks to their solid free cash flow during the first half of 2022, their net debt dropped $422m or 4.81% lower to $8.349b versus where it ended 2021 at $8.771b. When looking into the second half of 2022, their free cash flow should result in another similar improvement by itself, thereby dropping their net debt down below $8b for the first time in many years. Whilst this may be partly impacted if their $230m lawsuit settlement is paid before the year ends, it should be mostly offset by their divestitures, as their guidance that implies another circa $143m concurrently.

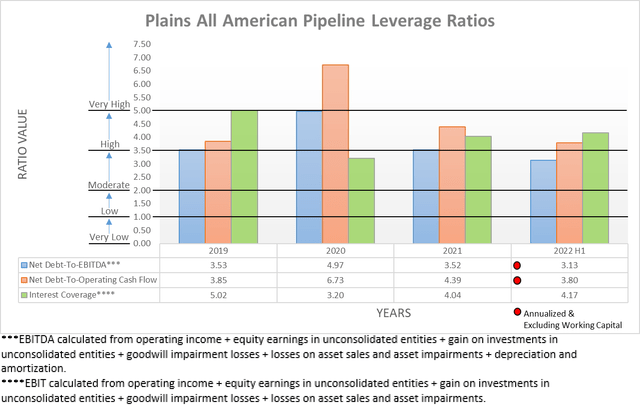

Thanks to their lower net debt, their leverage also saw an improvement with their respective net debt-to-EBITDA and net debt-to-operating cash flow down to 3.13 and 3.80, versus their previous results of 3.52 and 4.39 at the end of 2021. This now sees the former out of the high territory and down into the moderate territory of between 2.01 and 3.50, whilst the latter edges closer to this point.

If looking at their leverage ratio as utilized by management, it also saw a comparable decrease to 4.10 from 4.50 across these same points in time, as per slide eleven of their second quarter of 2022 results presentation. As this same slide also shows, they have now achieved their leverage target of between 3.75 to 4.25 with further improvements expected to be forthcoming as their net debt slides lower, as per the commentary from management included below. Apart from obviously increasing their fiscal resilience, achieving their target also provides a push for management to follow through with higher distributions.

“As a result, we now expect to achieve the midpoint of our leverage target range of 4.0x by year-end 2022.”

– Plains All American Q2 2022 Conference Call (previously linked).

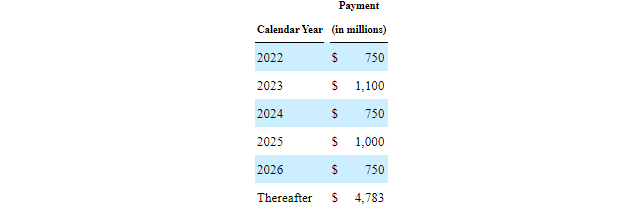

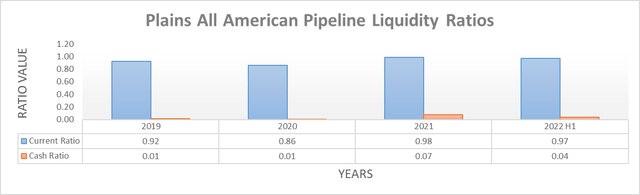

When turning elsewhere to their liquidity, it saw a relatively quiet time during the first half of 2022 with their respective current and cash ratios barely changing to 0.97 and 0.04 versus their previous respective results of 0.98 and 0.07 at the end of 2021. Meanwhile, they also repaid their $750m of debt maturities that were due during 2022, whilst only incurring an immaterial $115m of new borrowings under their commercial paper program. Since they did not touch their credit facility nor inventory facility during the first half of 2022, they should retain their respective availabilities of $1.296b and $1.306b, which will help smooth out their coming debt maturities during 2023 and beyond, as the table included below displays.

Plains All American Pipeline 2021 10-K

Conclusion

It remains uncertain whether unitholders will be fortunate enough to receive higher distributions later in 2022 or will be waiting until early 2023, one year after their latest increase. Regardless, given the very supportive commentary from management, ample free cash flow and now achieved leverage target, it seems almost certain that higher distributions will be forthcoming. Since this could very easily see their existing high 8%+ distribution yield transform into a very high 10%+ yield on current cost, I believe that upgrading to a strong buy rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Plains All American Pipeline’s SEC filings, all calculated figures were performed by the author.

Be the first to comment