shutter_m

Investment Thesis

Pioneer Natural Resources (NYSE:PXD) has been through a turbulent few weeks. I was bullish going into Q3 results, as I made the case that patient investors should be rewarded.

As it turns out, the overall idea was the right one. But even as the results come out in line with my expectations, and we saw all the positive financial elements that investors like, namely capital returns, the stock is still down since the day the Q3 report came out.

Nevertheless, I maintain that without any heroics, investors will be amply rewarded in 2023. Not only through strong dividends and share repurchases, but through the growth in PXD’s intrinsic value.

What’s Happening Right Now?

The oil market has every reason to go higher in the near term. Or perhaps, a more realistic framing could be that oil prices should not go lower in the near term.

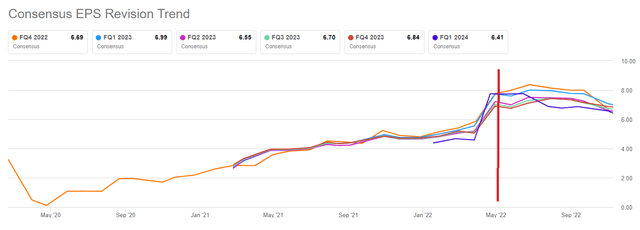

And yet, what the graphic above shows, is that since Ukraine’s invasion, analysts following PXD have been consistently downwards revising its EPS estimates.

I don’t believe that this lines up with the underlying fundamentals. Perhaps, what could happen as we get further into 2023 is that we start to recognize and appreciate that we are indeed an oil economy!

In the interim, let’s discuss PXD’s capital return program.

Capital Returns Program, 9.0% Yield

The figure to keep in mind is the $5.71 dividend per share. That breaks up as a special dividend of $4.61, plus the base dividend of $1.10. And therein lies one part of the bear case.

Investors want to back companies with a clear capital allocation strategy. Or better put, investors want to back companies with high base dividends.

For PXD, by having a lower base dividend, PXD can reduce or even stop its variable (sometimes called special) dividend and still declare that it’s returning capital to shareholders via sustainable dividends.

To get in front of this potential bearish argument, this is what PXD declares.

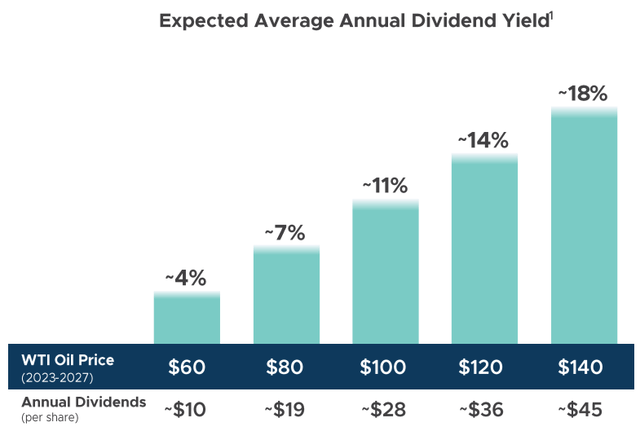

PXD lays out a framework for what it will return to shareholders in the form of dividends.

On top of that, PXD is also determined to repurchase its stock.

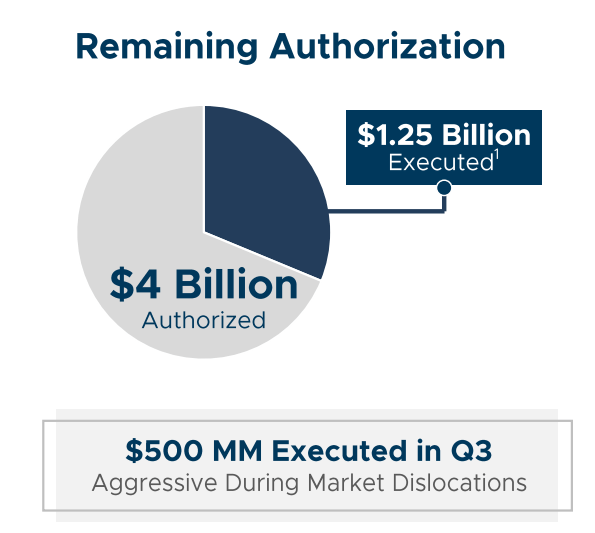

PXD Q3 2022

As a point of fact, PXD is looking to return capital to shareholders via buybacks, as well as dividends. As you can see above, during Q3 2022, PXD bought back $500 million worth of stock. This amounts to a further 3.3% annualized capital return.

This amounts to slightly over 12.3% total return. But there again, for investors that are anxious about the vicissitude of the oil market, these share buybacks don’t provide investors with a margin of safety. Why?

Because investors value high base dividends higher than special dividends, and stock repurchases as the least valued among the capital return strategies deployed. But why?

Because investors want control of when they get their capital return. Because investors in oil stocks know that there are good periods and bad periods. And giving investors their capital back along the way ensures that management won’t deploy their capital into empire-building projects at the wrong part of the oil cycle.

PXD Stock Valuation – 7x Next Year’s Free Cash Flow

PXD is expected to make approximately $8 billion of free cash flow in 2022. Can we expect oil prices to remain roughly equal with 2022? I believe that’s possible. Why?

Because you have two factors that will be a tailwind to 2023. China is expected to at some point reopen. As well as, the US will reduce and then stop its strategic petroleum reserve (”SPR”) unloading.

Hence, I believe that oil prices are highly likely to remain in the $85 to $95 WTI range in 2023. Not hugely different from the average of where 2022 is likely to end.

That is, of course, offset by concerns around a global economic slowdown. But I’m not a huge believer in putting too much weight behind the demand destruction thesis. Because even when the world shut down in 2020, we didn’t see demand getting substantially curbed.

Indeed, despite 2020 being an ”anomalous” year, global consumption only dropped by 10%. For my part, I believe it’s very much unlikely that demand is going to come down in 2023 by 10% as we saw in 2020.

The Bottom Line

Oil stocks often trade cheaply. The reason is that as soon as there’s news of increased supply, there are fears in the market that oil prices will tumble. We’ve become so accustomed to low oil prices, that we now struggle to believe that oil prices could actually remain higher for longer.

In the same way, energy markets took investors by surprise in 2022. I believe that 2023 will also surprise investors. Too few investors are still, even now, willing to believe in the sustainability of high oil prices.

And that’s why PXD continues to ooze free cash flow and return an approximately 9% dividend yield to shareholders. Stick with PXD. Get paid to see how the market will unfold.

Be the first to comment