Douglas Miller/Hulton Archive via Getty Images

Investment Thesis

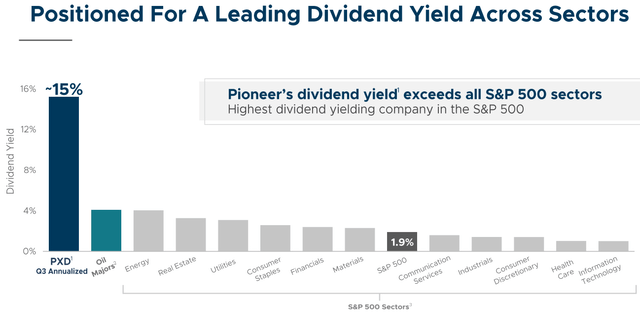

Pioneer Natural Resources Company (NYSE:NYSE:PXD) deployed the equivalent of a 15% annualized yield in September. For investors that believe that today we are an oil economy and, irrespective of all news flow, we’ll still be an oil economy in 2023, PXD is a very compelling high dividend paying stock.

For the old guard that believes that only tech is the place for high returns, I argue that that’s categorically not the case.

There’s a lot to be bullish about PXD. Let’s get to it.

Why Did The Energy Trade Die?

Before the Russian invasion, PXD traded at $226 per share. Today, PXD trades for $217. Yes, there have been some dividends along the way that push this trade to breakeven, but for all intents and purposes, anyone that has been bullish on oil since the Russian invasion hasn’t had much to show for it by holding PXD.

This assertion puts aside the most nimble of investors that somehow managed to pick the bottoms and the top in real-time. So what’s happened to the energy trade?

There have been two driving forces that have substantially impacted the bull case here. The ”buy the dip” story and the demand destruction fear. I’ll discuss these in turn.

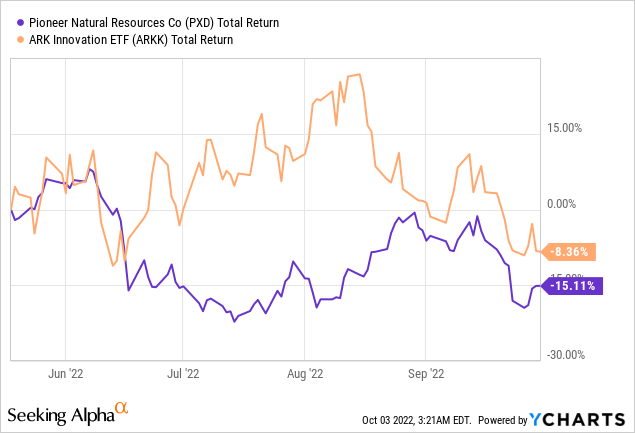

In the first case, we are going to compare PXD with a proxy for technology stocks, the ARK Innovation ETF (ARKK).

What you can see above is that during the summer, investors were so eager to ”buy the dip” on tech stocks that they couldn’t quickly enough abandon commodity stocks, such as PXD, and deploy capital into ARKK-like stocks.

As you can see above, during July and August there’s a near-mirror image between these two sectors. Investors wanted to believe that the playbook of the past decade was bound to repeat in the next decade.

And this leads me to highlight Max Planck’s quote (emphasis added):

A great scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Investors have doggedly come to believe that since tech was the winner of the previous decade, any selloff is an opportunity to buy something that they liked at a cheaper valuation.

If investors liked something at 2x a silly valuation, therefore now that’s it priced at 1x a silly valuation, it must offer investors a compelling entry point.

And until a new generation of investors comes to understand that a silly valuation is just that, a silly valuation, we will stay in these bear market rallies.

Now onto the second, and the more pernicious, theme, that of “demand destruction.” Investors believe that with the U.S. about to embrace a prolonged recession, the demand for the engine driver of our economy, namely oil, is about to be substantially curtailed.

However, I simply can’t see how that’s the case. For WTI prices to get substantially lower to the point where many oil companies will struggle to reach break-even, in most cases WTI needs to get below $50. And today, at approximately $80, we are far from that level.

And given all the high fixed costs, on the back of strong operating operations, this means that anything above $50 is pure gold. Or oil. Or dividends. Whatever your religion.

Ultimately, the only way to get oil prices to come down significantly is for there to be an oversupply in the market. And the facts on the ground don’t echo that sentiment.

Indeed, just today it appears that OPEC+ is looking to announce cutbacks in demand in the coming weeks.

With those two in mind, let’s turn our focus to PXD’s shareholder return program.

Capital Allocation Policy

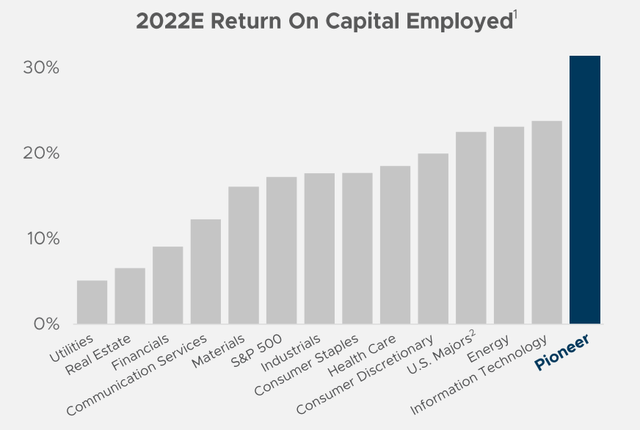

Before drilling down its dividend yield, I believe that it’s worthwhile discussing PXD’s returns on capital employed.

Investors have been so heavily indoctrinated to believe that only tech with its ”asset-light” business models could ever deliver investors with a business model with high ROCE, that few investors today would seriously think of the oil and gas sector as an area with potentially high ROCE.

However, the graph above clearly dispels that myth. We can see that energy clearly matches its ROCE, with PXD reaching around 30% ROCE.

What’s more, PXD has been very clear with its stakeholders that it’s looking to return more than 75% of its post-base-dividend free cash flow. Meanwhile, last quarter actually saw more than 95% of PXD’s free cash flow being returned to shareholders.

PXD’s October 2022 Presentation

The point that I’m making is that the good times are here to stay. Even if PXD isn’t able to offer a ”guaranteed” dividend yield, it’s clearly focused on returning capital to shareholders above all else.

PXD’s October 2022 Presentation

The graph above shows a 15% annualized yield to shareholders on record on the 6th of September.

So again, the bearish thesis is that if WTI was to trade lower, PXD wouldn’t be able to have a near-term repeated high yield going forward.

The Bottom Line

In investing, everything changes, every day. There are new stocks, new valuations, and new concepts. However, one thing doesn’t change, namely investors’ behavior.

Until investors understand that we can’t live in a world without cheap energy, patient investors that ”get it” will continue to be rewarded with compelling returns.

The only problem is that there are going to be prolonged periods of pain, such as what we’ve seen in the past several weeks when PXD sold off.

Today, investors are living through an echo of 2001. Tech stocks are in the process of blowing up, and there’s still a lot of skepticism around the likely demand for energy.

However, I believe that, difficult as it may be, investors that stick with the energy trade will be rewarded. Because the old guard came to believe that only digital innovation companies would be needed in this brave new world.

When reality couldn’t be further from the market’s perception. It’s true, that the more things change, the more they stay the same. Today we are living through a repeat of the early 2000s. There’s widespread disbelief over how much we are an oil economy. And this disbelief is the reason why oil prices will remain elevated.

And throughout all these changes in sentiment, PXD investors will continue to get their base dividends, plus their variable dividends, plus their share price appreciation.

Be the first to comment