imaginima

Pioneer Natural Resources (NYSE:PXD) stock price increased by more than 35% from the beginning of the year, as oil and natural gas prices hiked. Energy prices in the fourth quarter of 2022 will be higher than in the same period last year. The current market condition is not as strong as in a few months ago. Based on its recent developments and its 2022 guidance, I expect PXD to remain profitable and reward its shareholders. However, PXD’s upcoming financial results will not be as strong as in 3Q 2022. The stock is a hold.

Quarterly highlights

In its 3Q 2022 financial results, PXD reported oil and gas revenues of $4224 million, compared with 3Q 2021 oil and gas revenues of $3282 million. The company’s sales of purchased commodities increased from $1679 million in 3Q 2021 to $1833 million in 3Q 2022. PXD reported a net income attributable to common stockholders of $1984 million, or $7.93 per diluted share in the third quarter of 2022, compared with $1045 million, or $4.07 per diluted share in the same period last year. PXD’s cash, cash equivalents, and restricted cash at the end of the third quarter of 2022 were $1322 million, compared with $627 million at the end of 3Q 2021. The company’s net cash provided by operating activities increased from $1989 million in 3Q 2021 to $2951 million in 3Q 2022. Also, its net cash used in investing activities decreased from $991 million in 3Q 2021 to $846 million in 3Q 2022. Finally, PXD’s net cash used in financing activities increased significantly from $513 million in 3Q 2021 to $3368 million in 3Q 2022.

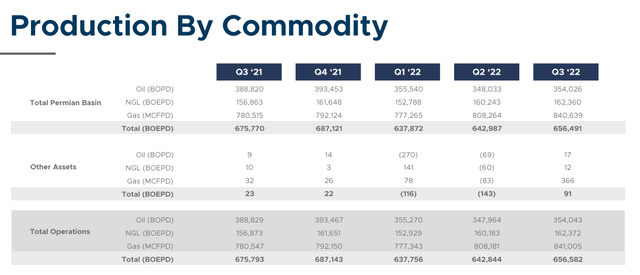

PXD’s total average daily sales volume decreased from 675793 BOE in 3Q 2021 to 656582 BOE in 3Q 2022, driven by lower oil sales, partially offset by higher NGL sales and gas sales. The company’s average realized prices increased from $52.79 per BOE in 3Q 2021 to $69.93 per BOE in 3Q 2022, driven by hiked oil and gas prices.

“Pioneer continues to execute on our investment framework that provides best-in-class capital returns to shareholders. This framework is expected to result in $7.5 billion of cash flow being returned to shareholders during 2022, including $26 per share in dividends and continued opportunistic share repurchases,” the CEO commented.

“Additionally, our current 15,000-foot lateral program, which we plan to expand in 2023, is delivering improved returns through lower capital costs per lateral foot. With an inventory of more than twenty years of high-return wells, our improved 2023 development program is highly repeatable and will deliver affordable energy to the world, with some of the lowest emissions as a result of the company’s high environmental standards,” he continued.

The market outlook

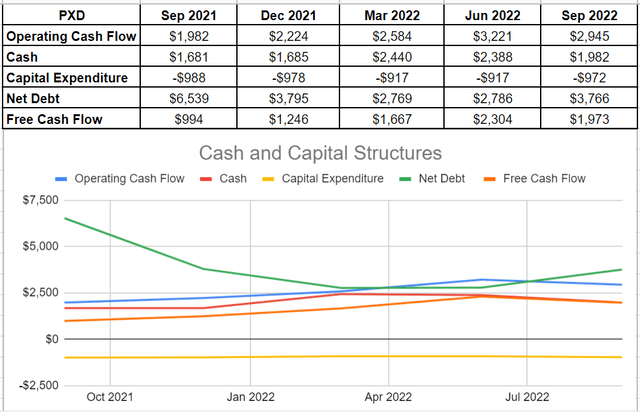

Figure 1 shows that oil and gas production levels in the Permian region have been increasing in the past years. EIA expects oil production in the Permian region to increase by 39 thousand barrels per day (MoM) in December 2022. Also, natural gas production in the Permian region is expected to increase by 125 million cubic feet per day (MoM) in December 2022.

Figure 1 – Permian region oil and gas production

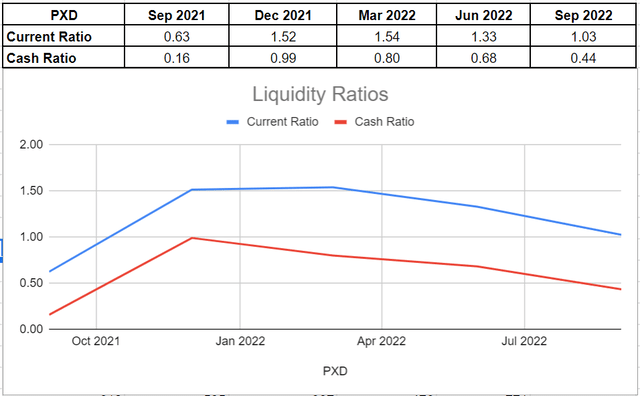

EIA expects the WTI crude oil spot price in 2023 will be $89.33 per barrel, compared with $95.88 per barrel in 2022. U.S. crude oil production in 2023 will be higher than in 2022. Also, EIA expects the natural gas price at Henry Hub to be $5.46/MMBtu in 2023, compared with $6.49/MMBtu in 2022. Figure 2 shows that U.S. crude oil production in 4Q 2022 is expected to be 12.15 mb/d, higher than in 3Q 2022. Also, U.S. dry natural gas production in 4Q 2022 is expected to be 100.10 Bcf/d, compared with 99.42 Bcf/d in 3Q 2022. On the other hand, WTI crude oil and Henry Hub natural gas prices in the fourth quarter of 2022 are expected to be lower than in 3Q 2022. However, the average oil and natural gas prices in 4Q 2022 will be significantly higher than in 4Q 2021.

Figure 2 – U.S. energy market summary

Pioneer expects its 2022 total capital budget to range between $3.6 billion and $3.8 billion. The company’s 2022 capital program is expected to place 475 to 505 wells on production. Pioneer expects 2022 oil production of 350 to 365 thousand barrels of oil per day and total production of 623 to 648 thousand barrels of oil equivalent per day. According to Figure 3, PXD’s oil production in the first nine months of 2022 is approximately 352 thousand barrels per day. Also, in the first nine months of 2022, PXD’s total production is 646 thousand barrels of oil equivalent per day. Based on the oil and natural gas production levels in the Permian region, estimations of the U.S. oil and natural gas production in 4Q 2022, oil and natural gas prices, Pioneer’s recent developments, and the company’s 2022 guidance, I expect the company’s oil production in 4Q 2022 to be higher than in 3Q 2022. However, I expect the company’s total production in 4Q 2022 to be lower than in 3Q 2022.

Figure 3 – PXD’s production by commodity

PXD performance outlook

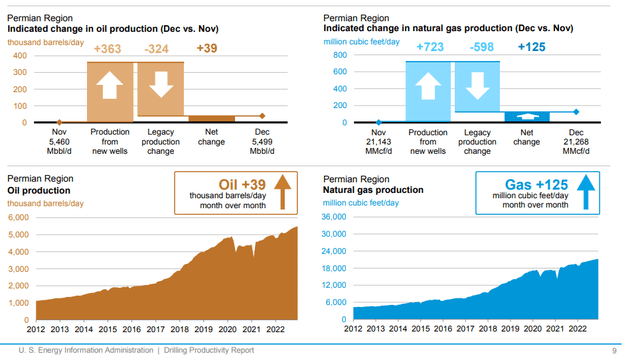

After the COVID-19 assault on the energy industry and the following drop in energy prices in 2020, Pioneer Natural Resources could recover in 2022 due to the Russian invasion of Ukraine and the following energy shortage. The company’s operating condition waned slightly notwithstanding being well above year-over-year compared with the same time in 2021. In other words, PXD’s cash flow performance represents that the company’s operating cash flow of $3.22 billion during the second quarter of 2022 declined by about 8% and sat at $2.94 billion in the third quarter of 2022. However, its operating cash flow is well above year-over-year versus its level of $1.98 billion in the second quarter of 2021. Moreover, albeit a slight decline in the cash generation in 3Q 2022 compared with the previous quarter, PXD’s $1.98 billion cash balance surged year-over-year compared with its level of $1.68 billion during the third quarter of 2021. In short, in light of their up-to-now performance, we can expect stronger cash and capital structure outlook for the future.

To shed more light on the company’s financial condition, the company’s operating cash alongside a $972 million capital expenditure, resulted in $1.97 billion free cash flow in 3Q 2022, which is far higher than its year-over-year level of $994 million at the same time in 2021.

Pioneer Natural Resources Partners’ net debt level of $3.76 billion in the third quarter of 2022 shows an eye-catching decrease year-over-year versus its previous result of $6.53 billion during the same quarter of 2021. Overall, PXD’s cash and capital structure illustrates a well-performed condition that can assure future benefits for stockholders (see Figure 4).

Figure 4 – PXD’s cash and capital structure

Author based on Seeking Alpha data

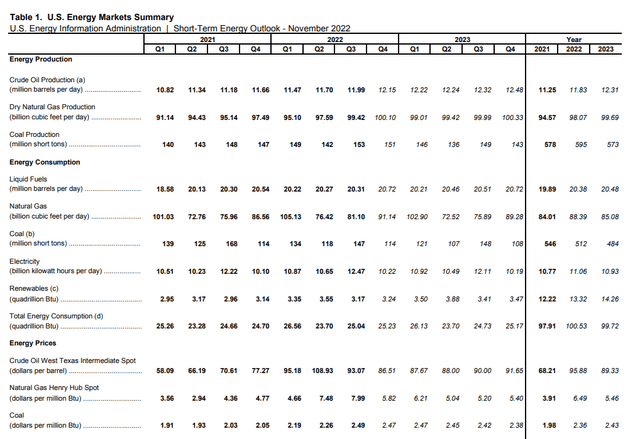

Following its cash and capital performance, it is not surprising to observe increases in its liquidity ratios compared with the same time in 2021. Despite declines in the quarterly current and cash ratios in the third quarter, PXD’s current ratio of 1.03 in 3Q 2022 is 63% higher than its result of 0.63 in 3Q 2021. the cash ratio of 0.44x in 3Q 2022 is much higher than its amount of only 0.16x at the same time in 2021. Thus, Pioneer Natural Resources Partners’ relatively healthy liquidity position is observable from its liquidity ratios (see Figure 5).

Figure 5 – PXD’s liquidity ratios

Author based on Seeking Alpha data

Summary

Oil and natural gas prices in 4Q 2022 are considerably higher than in the same period last year. According to the company’s oil and natural gas production levels in 4Q 2021 and my expectation of its 4Q 2022 production levels, I expect Pioneer’s 4Q 2022 financial result to be stronger than in 4Q 2021. PXD is still well-positioned to benefit from the market condition and reward its shareholders. However, as energy prices in 4Q 2022 are not as high as in 3Q 2022, the company’s 4Q 2022 financial results will not be as strong as in 3Q 2022. The stock is a hold.

Be the first to comment