5./15 WEST/iStock Unreleased via Getty Images

Investment Thesis

Pinterest (NYSE:PINS) is changing captain. This news was welcomed by investors with the stock rallying overnight. Shareholders are hopeful that the president of commerce at Google, taking the reins is an indication of Pinterest’s intention to double down on its commerce opportunity.

However, with Pinterest in the state that it is, I don’t believe that this new hire will have a meaningful impact in 2022 or 2023.

Here I explain why I believe that Pinterest’s 2023 EPS figures could be downwards revised.

In sum, I rate this stock a sell.

My Unforced Error

With Pinterest down 75% in the past year, there’s a lot of interest in being able to chase the stock and buy at the absolute bottom. After all, we have all been acclimatized to ”buy-the-dip” strategies that worked so well in the past +5 years.

But this time it’s different. Yes, those are indeed very expensive words. And so that you don’t feel like I’m ridding myself of the responsibility that I too had in driving those sentiments, I wish to highlight the following:

I made an error in my position on Pinterest. That being said, I’m only human. And I’m error-prone and made a blunder. Now the question is how many more times do I need to keep repeating this same error?

If I wish to survive in this market, it’s not good enough to be eventually right. I need to be positioned to survive. And to survive, I need to be capable of learning new ideas. Evolve. Or be left behind.

Thinking Through Post Invasion Environment

In the same way that there was the pre-financial crisis or pre-covid period, the was the pre-Russian invasion period.

Each period is delineated by a substantial change. I believe that holding onto Pinterest in 2021 was justified. Even though I turned out to be wrong. I went in with what I believed was a good thought process, but the outcome was poor.

And I’m not just saying that because I was bullish on the name. But I believed that were fundamental reasons at the time that justified this investment.

So to anyone that looks back and makes the case that in 2021 Pinterest ”obviously” overvalued, I would push back and remind them that both Microsoft (MSFT) and PayPal (PYPL) were very eager and willing to pay more than $45 billion for Pinterest. Multiples higher than the current valuation.

Why Pinterest’s 2023 EPS Estimates May Come Down

Pinterest is essentially an advertising company that has for years attempted to migrate its operations towards monetizing intent-based search. Users see adverts within their chosen pins, and as such it’s not a disruptive user experience. But being able to monetize that action has so far not gained sufficient traction.

While the new CEO has a strong commerce background, I am not sure that Ready will have enough time over the next 18 months at the helm to meaningfully change what is at its core an advertising platform.

In essence, I believe that in this upcoming recession, smaller businesses that use Pinterest for advertising will be forced to cut back on their advertising budgets, which will start to impact Pinterest in the back half of 2022 and early 2023.

PINS Stock Valuation – Little Value Left on the Bone

The problem with investing in tech companies is that a large portion of their inflationary expenses does not come from hosting services, technology infrastructure, or even customer retention costs.

A substantial portion of its costs comes in the form of stock-based compensation. And what happens here is that when the share price is flying high, you can hand out stock-based compensation and that has a lot of value. Everyone is happy and morale is high.

But once the stock is down 75% in a year, the value of that stock-based compensation moves inversely with the share price.

That means that as we look out for the remainder of 2022, we should expect to see Pinterest’s stock-based compensation increase by at least 60% to sufficiently compensate executives and retain talent.

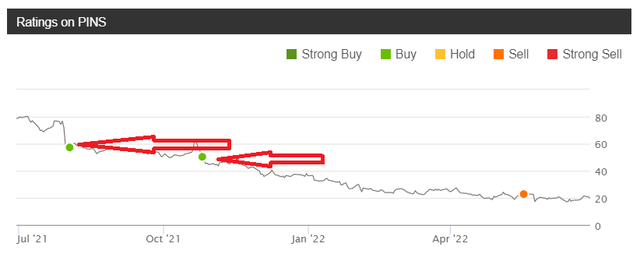

Presently, investors are willing to pay 18x next year’s EPS for Pinterest. However, I believe that as we go through this upcoming earnings season, we are going to see a lot of downgradings and EPS estimates will come down to adjust for the increasing number of shares outstanding.

Consequently, what starts out as 18x next year’s EPS could end up being closer to 25x next year’s EPS.

Investment Risk

There are two notable risks to my sell rating.

In the first instance, if interest rates do not continue to go higher, this will likely lead to an upwards re-rating in the share price. After all, PINS’ multiple has come down substantially already as investors are pricing in higher interest rates in 2022.

The other notable risk could be if one of the bigger tech companies made a new bid for Pinterest.

The Bottom Line

A good rule of thumb is typically to buy stocks priced at a lower multiple than their growth rates.

What Peter Lynch popularized as the PEG ratio. This sounds a bit primitive and even pointless to discuss the PEG ratio at this stage in the game.

But I do not believe it’s too late to have this primitive argument. Clearly, we went through a period where valuations didn’t matter.

But we are now in a new environment where valuations do matter. What’s more, when so many stocks are down so significantly, there’s a substantial opportunity for investors that are willing to question, which stocks actually have value left? As well as, is it OK to change one’s mind?

Be the first to comment