ArtistGNDphotography

Dear readers/followers:

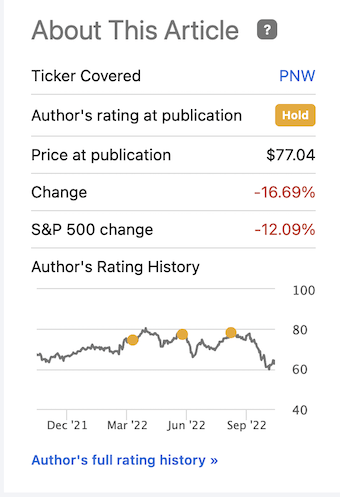

In my previous article, I made it clear that I viewed Pinnacle West Capital Corporation (NYSE:PNW) had gone from cheap to overvalued in a relatively short time. When the company struck just above $77 again, combined with a significant drop-down in valuation in another utility, I made the decision to shift around 75% of my invested capital into another utility, thus preventing the loss you see here.

Seeking Alpha PNW Article (Seeking Alpha)

Active conservative portfolio management is, to my mind, one of the reasons I outperform most comparative broader indices YTD. Though far from perfect, I am happy with the shift and will explain my logic in this article.

Also, I’ll show you that as things stand now, PNW actually has a double-digit upside and may be suitable for investing, if you want more utility in your portfolio.

An update on Pinnacle West

As I’ve mentioned, one of the positives with utility investments is that they rarely shift their fundamentals. They’re fairly forecastable businesses with generally good operations based on attractive assets and providing a non-optional service region-wide.

What can change, given their regulated nature, is that regulators decide that their margins are too high, or that they are no longer allowed to earn as much as they previously expected – this is what happened to PNW. Despite all of this, we still have a sound set of fundamentals for the business. The company is BBB+, it has a 5%+ yield that’s still well-covered, and the company’s operational geography is one of the fastest-growing areas in all of the United States, which makes for an excellent backdrop for the company.

The rate case issues actually simplify the thesis for PNW a great deal. Why? Because it really caps the potential upside, we can get from this investment for the coming few years.

The combination of the company-forecasted required capital investments, combined with PNW’s clear statement that it won’t be tapping equity as a funding source until the end of the next (not this recent) rate case, means that the business needs to fund these costs from operational cash flow and debt either from holding or PNW itself.

We don’t have 3Q22 results just yet – and I covered the 2Q22 results in my last article. They weren’t all that great, seeing significant EPS drawdowns due to fuel price increases, D&A, and other effects, but the company’s main growth thesis is intact, together with the overall capital plan.

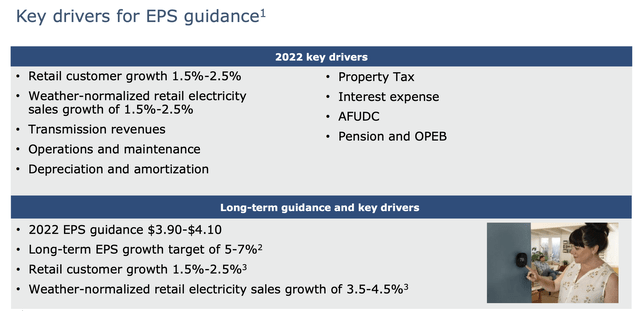

Despite the rate case loss, the company does forecast its ability to raise growth here by around 5-6% annually, with a $13.6B rate base case forecast in 2024. The EPS is down to $1.45/share, impacted in part by a base rate impact of around a quarter of a dollar or so. Guidance for the year remains at $3.9-$4.1, which more than covers the company dividend, and the EPS growth guidance is very much intact.

One of the main worries investors may have until the next rate case is whether the company is going to dilute current shareholders given the investment plans. The company is assuaging fears here and is clear in the communication that there are no plans to issue any equity whatsoever.

Instead, investments will be funded with operational cash flow, APS debt, PNW debt, and equity alternatives, fulfilling the $4.7B in capital requirements. No maturity or other debt impacts are currently expected either.

A company like PNW is a good example of why utilities remain excellent investment possibilities for conservative investors. Even after a 16-17% drop in valuation, this company remains a solid investment with a great yield and potential upside.

I would argue that at any price, as I’ve communicated in my articles, of below $70/share, you can consider this business a “BUY” and probably get a double-digit combined upside and a 5%+ yield. That, in this environment, is a good deal.

Reinvesting into Enel

However, for myself, I’m looking for better upsides. Because my cost basis for PNW was relatively low and FX has been positive, I was able to at a decent profit rotate a good share of my capital into what I viewed as a better investment – Enel (OTCPK:ENLAY).

Enel is one of the largest in the world – not just in its sector, but in any sector. With revenues of over €85B on an annual basis, this is one of the largest companies on earth – at least top 100. The company is also one of the largest power companies in the entire world. Its native listing is on the Milan Stock Exchange, under the symbol ENEL, and it’s a solid component of the Borsa Italiana.

Enel, despite some of the challenges I’m going to mention, is no different. Its assets are rock-solid, it’s going nowhere. It’s investment-grade rated by S&P Global, and A-rated by Fitch.

Its yield is also close to 10% – and that yield is well-covered and confirmed by the company in recent communications.

Being an integrated utility and one of the largest of its kind on earth, Enel owns all levels of the power supply chain – from generating its electricity to transmitting it, to distributing it. I’ve already described that in Enel you’ll find a large part of LATAM operations – over 20% of operations and sales are found in Latin-American geographies.

Enel is currently trading down due to the size of its capital spending plan and the current macro and uncertainties, which presents an opportunity, if you share my positive view on the business.

The company’s new assets will primarily be focused on what the company calls “tier-1 asset nations/countries”, with geographies such as Italy, USA, Mexico, Brazil, Spain, and others. The company wants to have the potential for an integrated presence before deploying significant amounts of capital into the countries.

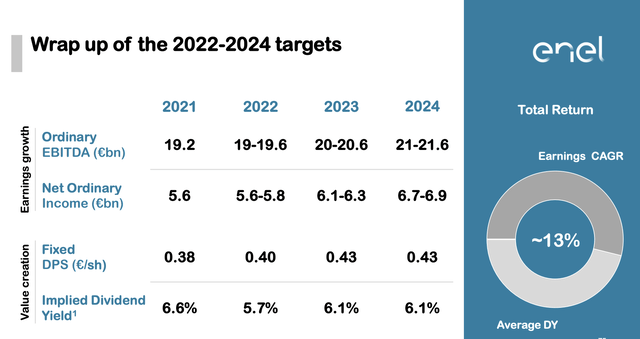

The expectation for this is to generate, in the long term, 5-7% CAGR in income and company EBITDA, increasing the dividend by 13% going forward. The dividend that the company pays is, therefore, very safe here. Take a look at how the company expects EBITDA to develop over the next few years.

Enel IR (Enel IR)

For the 2023/2024 period, the yield now is closer to 10.5% – by investing in one of the largest utilities on earth. While there are forward risks, none of those risks make this company in any way uninvestable.

Enel still has coal assets and seeks to exit these by 2027-2030. Enel has the underlying customer base to push some of these changes, given that they have the world’s largest customer base in the power market, with 95% of even its LATAM customers in Urban areas.

That means that the company is a 9-10% “guaranteed yield” on an annual basis.

Enel has both strong upsides and a few risks that should be accounted for. Its latest annual (2021) performance delivered a strong recent beat, tilting things in favor of the positive. However, much of this beat is due to legacy gas-related activities. Enel delivered record-high historical revenues, almost reaching the €90 billion mark, which is nearly a €30 billion YoY revenue increase.

On the basis of this, I push capital into Enel and recently did a reinvestment here.

Let me show you the valuation for both PNW and for Enel.

The Valuation

PNW is in a pretty great position at this time. The company is trading down, meaning we can buy it at below 15x P/E. Such a valuation spells an upside of no less than 17% annually with a 5.4% yield based on a 2024E upside of 18.4x normalized P/E.

And this is still a BBB+ rated company with excellent overall trends. In terms of the rate case specifics, 2022 is expected to be the heaviest impact of all. The current forecast lies at the midpoint of the company’s own guidance, with 15 analysts forecasting a $4/share average.

I said in my last article that I’m not thrilled about investing in PNW at the price it was – which was well over $70/share, due to the expected EPS decline and what that meant in terms of multiples for that specific price.

However, some of the advantages of a utility remain here. Take forecast accuracy for one. Historical forecast accuracy with a 10% MoE is 100%. 100%. The company doesn’t beat forecasts, it doesn’t fail them, and they’re very clear in what happens. Other utilities are very similar. Yields and dividends are typically very stable.

PNW also has very positive targets at this time. S&P Global, while lowering their targets by more than $12/share in less than a year, now is at an average of $69 with 14 analysts at ranges from $56 to around $90/share. Most analysts are still leery of the company after the rate case cut, and consider the company a “HOLD” or underperform at these multiples – only 5 are at “BUY” ratings.

Still, the upside in PNW is there, and I’m shifting to a “BUY” here for the company. The price target for PNW is $70/share for me.

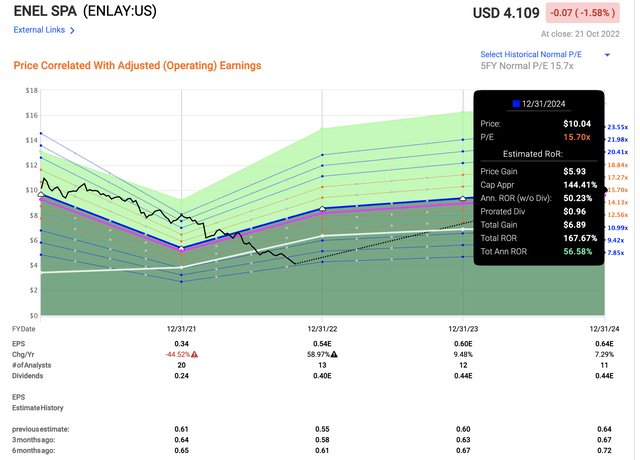

But, I view Enel as a better investment here due to valuation and upside.

The market is essentially completely ignoring what this company’s assets offer in terms of safety, earnings visibility, and dividend payments. Even estimating only a conservative upside here, you get easy annualized rates of return of over 26% by just expecting a 10.6x forward P/E. A full normalization promises an RoR of 175% in less than 3 years, or 58% per year, in the case of a full 15x P/E, which is where the ENLAY ADR typically trades.

This is significantly better than PNW, at a higher yield, higher conservative safety, and a higher upside.

I’ve written full investment articles on Enel where I go through the company’s case and fundamentals more in detail.

For now, this is a Pinnacle West article – and Pinnacle West is a “BUY” here as well. My point for this article is for you to be careful with your utility investments. You can’t buy this too expensively, and you need to be aware of the rate case impacts that are possible in these kinds of investments.

What you want here is income stability with the potential of some upside or reversal.

PNW did not offer this before – but it does now. It doesn’t mean, however, that you shouldn’t compare the upside to other upsides available on the market today.

Thesis

My thesis for PNW is as follows:

- While there is no easy way for PNW to turn or twist this around, the company remains a simple thesis/simple math. The simple math of growing demand and need for servicing of infrastructure not being possible at the same RoR/profits without an increase in rate – which the company hasn’t gotten due to the rate decision.

- That’s what I like about quality companies such as this. It usually comes down to simple math. And the simple, current math for PNW is that the future, unfortunately, isn’t as rosy as it once was.

- In the most positive of cases, this is now a 15-17% annualized RoR investment. That makes it a “BUY” with a $70/share PT – though I would point out carefully here, that there is significantly better upside on the market and you owe it to your portfolio to look at other companies as well.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria, with the fulfilled demands in italic.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic attractive upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment