Edwin Tan/E+ via Getty Images

Investment Thesis

Pinduoduo Inc. (NASDAQ:PDD) is putting out sizzling numbers. But they require a little bit of interpretation.

What you need to know is that the core business is growing at a 25% CAGR. And that Pinduoduo is generating very robust and clean GAAP profitability. After stock-based compensation!

Yes, it is a Chinese business. And there’s always the “China risk.” But being selective, where one is positioned, and being valuation-sensitive, allows patient investors to benefit from Pinduduo.

As you know, China is easing lockdowns. And that has made Chinese battered stocks look very attractive. Indeed, you can see China’s most-followed index, KraneShares CSI China Internet ETF (KWEB), already starting to revert higher.

Consequently, I make the case that, according to my own estimates, Pinduoduo is priced at approximately 20x GAAP operating profits. Note, this includes stock-based compensation.

I believe this to be an attractive valuation. You won’t find many growth opportunities that are priced as cheaply as Pinduoduo.

Revenue Growth Rates Are Still Strong

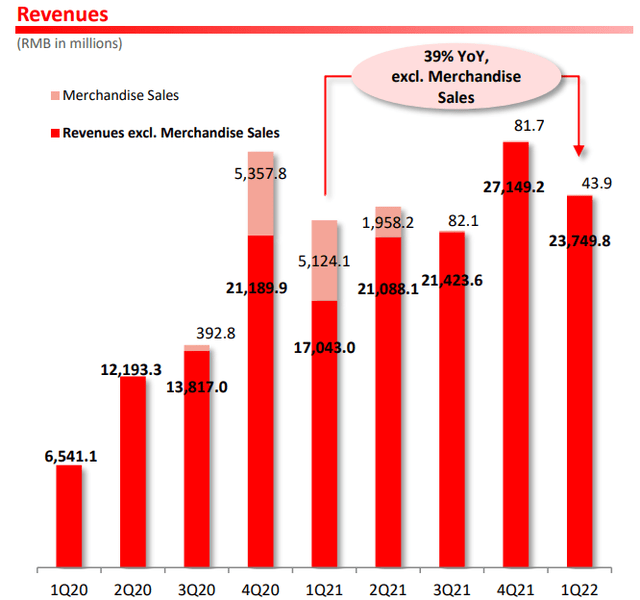

Pinduoduo Q1 2022 presentation

Pinduduo grew its revenues at 39% y/y excluding its merchandise sales.

Remember, Pinduoduo had no intention of running a merchandising business and it did so only during Covid-19, to aid merchants. Its merchandise business was discontinued several quarters ago.

Looking ahead to the next quarter, Q2 2022, Pinduoduo will have even easier comparisons, as the merchandise business had already largely been reduced.

Consequently, I believe that looking ahead, Pinduoduo could easily continue growing at a 30% CAGR.

Why Pinduoduo? Why Should I Care?

Pinduoduo is a mobile-first e-commerce platform. For Westerners, we go on Amazon (AMZN) and pick up whatever we want and get it delivered as quickly as possible.

What Pinduoduo does is slightly different. It’s a fun and interactive experience, where certain products are promoted to its users based on value.

Pinduoduo investors relations

Thus, rather than seeking out the product you want, you get fed the product you may not have thought about. And more importantly, there’s a group-fun element to it.

Users go on social media such as Weixin (WeChat) of Tencent (OTCPK:TCEHY) and discuss the product and form a group purchase.

For the consumer, by purchasing together as a team, you end up bringing down the price of your purchase massively.

In essence, the core value proposition for Pinduoduo’s customers is its value-for-money products.

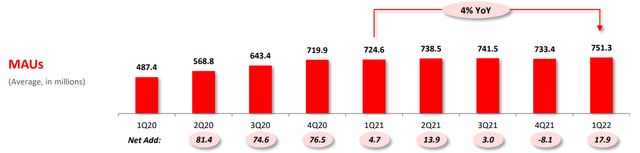

Pinduoduo investor presentation

What’s more, I find it astonishing that Pinduoduo’s MAUs (monthly active users) are still growing. They were already at more than 740 million, and when last quarter it dipped lower, I thought it was game over for the company. I thought we would start to see Pinduoduo’s MAUs falling by 10% or even 15% y/y. That would have been seriously troublesome. In fact, the opposite happened, and MAUs jumped higher by 18% y/y.

And this is what I’ve argued for so long. Pinduoduo doesn’t need to rely on coupons to get users to stay on its platform. Pinduoduo can be profitable and still have a very large number of MAUs.

If you think about how difficult it is for the likes of Etsy (ETSY) or even Twitter (TWTR) to grow their user base, here is a business that has more than 700 million users.

This is the truth of the matter. You don’t get 700 million on your platform, every month, unless you provide them with value. You don’t need to overcomplicate what is simple.

And if you can get 700 million on your platform, and you run the business profitably, that’s a moat.

Profitability Profile Rapidly Improving

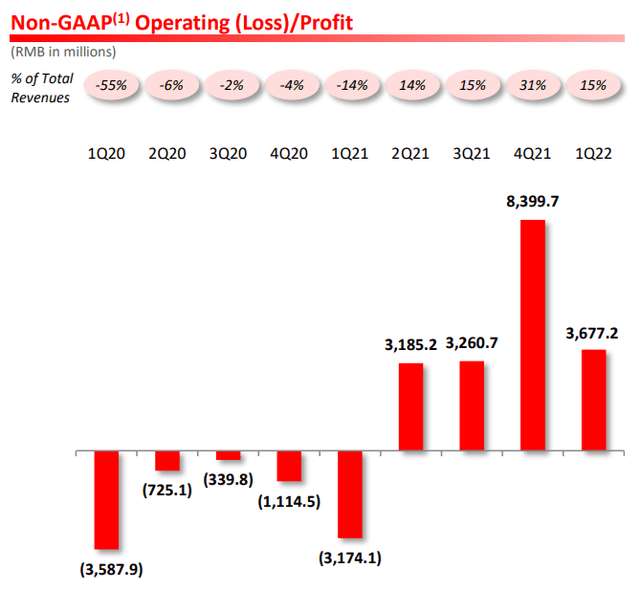

Pinduoduo Q1 2022 presentation

The graphic above speaks for itself. You have a business that this time last year was unprofitable at around $500 million of non-GAAP operating profits. And this time around, the business has swung its profitability to approximately $580 million.

There’s absolutely no doubt that the company is moving in the right direction.

PDD Stock Valuation – Priced at 20x GAAP Profits

Pinduoduo doesn’t provide any forward guidance of any sort. What I do know is that Pinduoduo has 700 million active users, and it has shown that it can categorically monetize its users. We can see this, beyond any doubt.

On a trailing basis, Pinduoduo saw its non-GAAP operating profits reach approximately $2.8 billion. Now recall, Pinduoduo is a highly seasonal business. Q1 is always really weak, while Q4 Pinduoduo makes a lot of cash flows.

Looking ahead, if we estimate that Pinduoduo grows its bottom-line profitability by 30% y/y, this puts Pinduoduo on a target to reach $3.6 billion of non-GAAP operating profits.

Furthermore, remember that Pinduoduo has close to $1 billion in stock-based compensation in a year. This means that on a clean GAAP basis, Pinduoduo will make approximately $2.6 billion of clean GAAP profits over the next twelve months.

This means that, very conservatively, Pinduduo is priced at 20x forward GAAP operating profits. This is a very fair multiple for new investors coming to the stock. Given that the business is growing at a 30% CAGR.

The Bottom Line

Investing in China is always very tough and you should position-size this stock in your own portfolio accordingly. Chinese stocks are always super volatile and I expect this to continue being the case.

I believe that there’s a lot of pessimism in this stock and that the risk-reward here is attractive.

With that consideration in mind, while I recognize that investing in China always has risks, I passionately believe that it’s in China’s interest to keep its financial markets ticking forward.

I believe that China will do whatever it takes to ensure that its financial markets are investor-friendly.

In fact, you can see from the market’s reaction these past few days, that since China lifted its lockdowns, investors have come clambering back to Chinese stocks. And why shouldn’t they? After all, many of these companies have been hit to a pulp and are down more than 50% to 75% from their highs.

Consequently, paying 20x GAAP profits for Pinduoduo makes sense to get upside potential. I would like to get at least $70 for each of my shares over the coming year.

If the multiple doesn’t compress further, and the business continues to grow at roughly 25% to 30% CAGR, I believe this is a reasonable estimate. It’s not going to be a home run. But a steady as you go investment.

Be the first to comment