koya79/iStock via Getty Images

Chinese eCommerce giant Pinduoduo (NASDAQ:PDD) reported robust results for its latest quarter (Q2 2022, ended June 2022).

Revenues for the quarter reached CNY 31.4 billion, up 36% compared to the same quarter a year earlier. The increase was driven by revenue increases from its two biggest business segments (online marketing services and transactions services), partially offset by a drop in revenues from merchandise sales (its smallest business segment). Online marketing services revenues increased 39% YoY to CNY 25.1 billion driven by increased sales activity (particularly during the June 18 shopping festival) driven by a recovery in consumption as lockdowns ease in China, following a sharp drop in COVID cases towards the end of June.

Revenues from transaction services, Pinduoduo’s second biggest business segment, rose 107% YoY to CNY 6.2 billion while merchandise sales revenues dropped 97% YoY to CNY 50.7 million.

Profitability continued its positive momentum with the company seeing quarterly net income soaring 268% YoY to CNY 8.9 billion from CNY 2.4 billion the same quarter a year earlier.

Cloudy near-term prospects as post-pandemic consumption recovery may be hampered by renewed lockdowns

Although COVID cases in China were brought under control after a steep rise in May, they have been creeping up again and China, with the government’s zero-COVID policy, may reimpose lockdowns hurting consumer sentiment and spending.

Long-term growth opportunities from agtech initiatives and international push

With CNY 119.4 billion (USD 17.8 billion) in cash as of June 2022, and relatively decent debt position (Pinduoduo’s total debt to equity was 17.4 for its most recent quarter, on par with rivals such as Alibaba (BABA) with a total debt to equity of 16.91, and JD.com (JD) with a total debt to equity of 23.45), the company has been busy allocating capital towards long term growth initiatives.

Over in its home market where eCommerce penetration is reaching saturation and domestic eCommerce players such as Alibaba to JD.com are in search of new growth opportunities such as cloud, Pinduoduo is making heavy investments in research and development towards developing agricultural technologies to enhance agricultural productivity (Pinduoduo announced that it would allocate profits and any potential future profits to its ’10 Billions Agriculture Initiative’ which aims to “address critical needs in the agricultural sector”). Concerns over food security, a favorable regulatory environment (the Chinese government is looking to achieve self-sufficiency as part of its food security goals), and resource constraints (China has 20% of the world’s population but just 7% of the world’s land) is driving the country’s agtech sector which appears to be on the cusp of a “Golden Era“; in 2021 China was the second biggest destination for agrifoodtech funding, second only to the U.S.

Although Pinduoduo says its agricultural program won’t be profit-driven, the initiative nevertheless could deliver economic benefits. Unlike Alibaba or JD.com, most of Pinduoduo’s customers are located in rural China, home to most of China’s farming population and where per capita incomes are compared to urban residents (which partly explains why Pinduoduo’s per customer spending is considerably lower than rivals; Pinduoduo’s GMV per active buyer is around CNY 1,127, compared with CNY 5,760 for JD.com, and CNY 8.447 for Alibaba). Introducing productivity-enhancing technology could in turn boost farmer incomes, and thereby support their purchasing power, benefiting Pinduoduo in the process.

Pinduoduo’s agtech focus could also serve as a differentiation in China’s crowded eCommerce space. Pinduoduo already boasted several differentiation points that helped the company rise from fledgling upstart to top three player, notable ones include its group buying feature (which Pinduoduo pioneered), and gamification elements (through its addictive mini game – Duo Duo Orchard) to create a fun, gamified shopping experience. Doubling down on agriculture could add another differentiation point to Pinduoduo’s marketing strategy and positioning. It could also improve user retention (since agriculture products such as fruits and vegetables are daily necessities). Although eCommerce rivals Alibaba and JD.com have also jumped into the agriculture eCommerce arena, Pinduoduo, who claims the be China’s biggest agriculture platform, may have a slight advantage as a first mover (Pinduoduo started off selling fruit online before branching out into other product categories) which may give the company an operational advantage for instance in terms of navigating and innovating around China’s under-developed cold-chain logistics infrastructure.

International push

With about 890 million active buyers and rising competition, long term growth opportunities in its home market China may be limited and not surprisingly the company is pushing into new markets overseas.

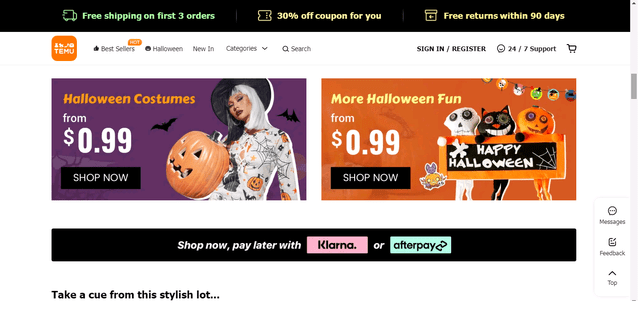

Pinduoduo’s new online shopping platform – Temu – launched in the U.S. in September this year, peddling wares across a broad selection of categories, from clothing, jewelry, pet supplies, seasonal items, and kitchen utensils, with free shipping for orders over USD 49 and returns.

Although Temu is a latecomer to America’s eCommerce space, the company appears to be leveraging on the same marketing strategy – group buying, and rock-bottom prices, as reflected in Temu’s slogan “Team Up, Price Down” – that helped parent company Pinduoduo emerge as an eCommerce behemoth in China where Pinduoduo had also been a latecomer when it was founded less than a decade ago in 2015. Pinduoduo’s advantage of having direct connections to manufacturers in China gives them a supply chain advantage to support such a strategy (a supply chain advantage Temu’s Western rivals such as Amazon (AMZN) and Walmart (WMT) may not enjoy).

The timing of Temu’s entry into the U.S. market is also opportune; U.S. inflation is at its highest rate in 40 years, and almost half of U.S. households find the recent rise in consumer prices to be “very stressful” according to a survey by the U.S. Census Bureau, opening opportunities for low-cost marketplace platforms like Temu.

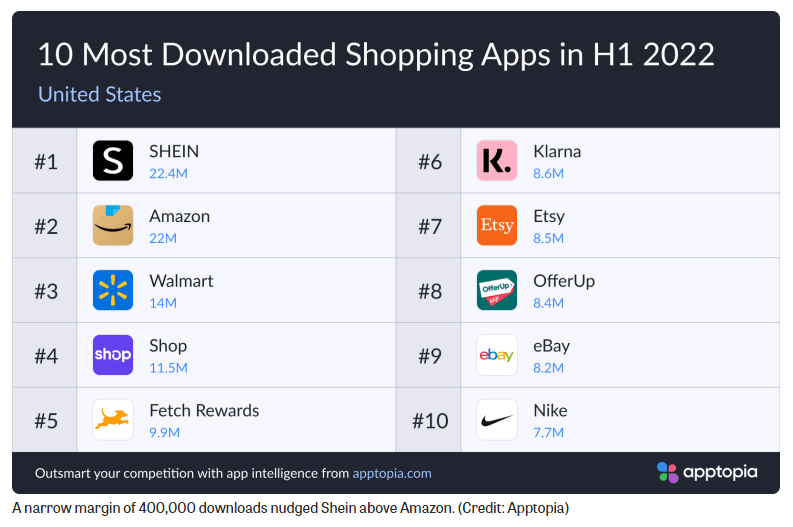

Although Temu does have the disadvantage of longer shipping times (customers will have to wait as long as 7-15 days or even longer, versus Amazon who delivers in 5-8 days), price-sensitive shoppers may find it worth the wait if the success of Chinese fast fashion marketplace SHEIN in the U.S. is anything to go by; SHEIN’s U.S. shoppers have to wait 10-15 days for their delivery, far longer than delivery times from retailers such as Amazon, Zara and H&M, but that hasn’t stopped SHEIN from dethroning Amazon as the most downloaded shopping app in the U.S. in the first half of 2022, after surpassing Amazon in terms of global app downloaded in 2021, a noteworthy feat for a company founded more than a decade after Amazon. UBS analysts believe SHEIN is a threat to U.S. specialty retailers such as American Eagle (AEO), Abercrombie & Fitch (ANF), Urban Outfitters (URBN), Victoria’s Secret (VSCO), The Gap (GPS) “as well as Department Stores and Off-Price retailers.”.

With sales roaring in the U.S., SHEIN is looking to build distribution centers to cut delivery times and thereby increase its competitiveness in the country. Temu likely will follow a similar strategy in its ambition to carve out a share of America’s online retail market for itself.

PCmag.com

Financially, the expansion could increase Pinduoduo’s total addressable market and revenues, and given higher consumer spending power in the U.S. relative to its home market China, could also boost its per customer spend as well. The revenue potential for Pinduoduo is meaningful. America’s online sales were valued at around USD 876 billion in 2021, less than 15% of the country’s total retail sales of USD 6.6 trillion. Capturing just 5% of America’s online retail sales could generate about USD 44 billion, about 11% of Pinduoduo’s FY 2021 GMV which amounted to USD 383 billion (Pinduoduo has a market share of around 13% in China).

With low-cost retailer Walmart wielding an advantage over Temu with its unrivaled network of stores in the U.S., Temu might lure Amazon’s non-Prime customers instead (since Amazon’s Prime customers are generally found in wealthier households, are likely more demanding i.e., for instance in terms of faster shipping, and are not price-sensitive). At an estimated 153 million in 2021, Amazon Prime members account for roughly 65% of Amazon’s customer base in the U.S., which means about 82 million Amazon shoppers are not Prime members. Amazon Prime members spend roughly USD 1,968 per year on Amazon on average, roughly four times as much as non-Prime shoppers. This suggests Amazon’s non-Prime shoppers spend about USD 41 billion annually.

Heavy marketing expenses however could potentially eat into profits, and investments in building out a fulfillment network could continue keeping a lid on profitability in the foreseeable future. After years of losses, Pinduoduo turned profitable only last year, and it remains to be seen if the company will swing back into the red as costs rise as a result of their international expansion efforts.

Risks

Pinduoduo was added to America’s counterfeit blacklist in 2019 and a delisting list in 2022. Although China and Washington struck a preliminary deal in September allowing U.S. regulators to audit US-listed Chinese companies, with political tensions simmering between China and the U.S., the possibility of the deal falling through or unexpected adverse actions by the U.S. against Chinese companies such as Pinduoduo cannot be ruled out. Unlike many other Chinese companies such as Alibaba or JD.com, Pinduoduo’s primary listing is in the U.S., and the company has no listing elsewhere.

Summary

Pinduoduo delivered strong quarterly results on the back of a recovery in consumption and merchant activity as lockdowns ease in China. Near term prospects however are cloudy, as China’s COVID cases have been creeping up and the possibility of new lockdowns cannot be ruled out.

Longer term, as China’s eCommerce penetration reaches saturation, Pinduoduo is pursuing new growth opportunities, notably agriculture technology and a U.S. expansion. Pinduoduo enjoys competitive advantages in both areas – a first mover advantage and market leading position in China’s agriculture eCommerce space, and direct connections to Chinese manufacturers which could help the company undercut American rivals such as Amazon and Walmart.

Both efforts could potentially add to long term revenue growth, however profits could take a hit as the company makes heavy investments in marketing, R&D, and logistics to enhance competitiveness. Investors may also want to weigh political and delisting risks with Pinduoduo having no listing anywhere other than the U.S. currently.

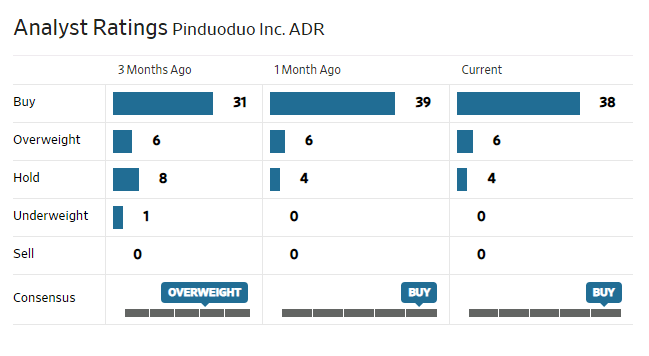

Analysts are mostly bullish on the stock.

WSJ

Be the first to comment