Andrii Dodonov

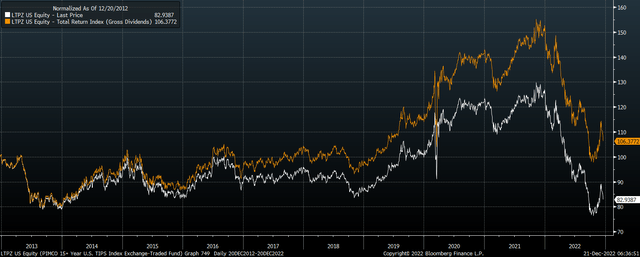

The PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (NYSEARCA:LTPZ) offers investors exposure to long-term inflation-linked bond yields. With average maturity of 22 years, the LTPZ is far more volatile than the iShares TIPS Bond (TIP), which has maturity of just over 7 years. The bear market in TIPS has seen the LTPZ lose 35% in price terms since the start of the year. Even when adding in the income holders have received tied to the consumer price index, the LTPZ has still fallen by 30%. 2023 is likely to be much kinder to the LTPZ, as the real yield is now 1.7% and monetary policy conditions are turning favorable. With an expense fee of 0.2%, the LTPZ’s cost is similar to the TIP’s 0.19%.

2022 Has Been A Tough Year For Long-Term TIPs

High rates of inflation tend to be positive for inflation-linked bonds, at least in nominal terms, as holders receive dividends that are linked to the consumer price index. Indeed, as their name suggests, this is the main reason why investors buy TIPs – to protect against inflation. However, the positive effect of high inflation on nominal returns has been far outweighed this year by the impact of falling inflation expectations and rising interest rate expectations.

LTPZ Price Return and Total Return (Bloomberg)

The more headline inflation rose, the more the bond market priced in higher interest rates and lower rates of inflation in the future. Ultimately, investors bought into the idea that the Fed would bring interest rates back to normal levels in order to bring down headline inflation, even at the expense of economic and financial market weakness.

Well Placed To Outperform In 2023

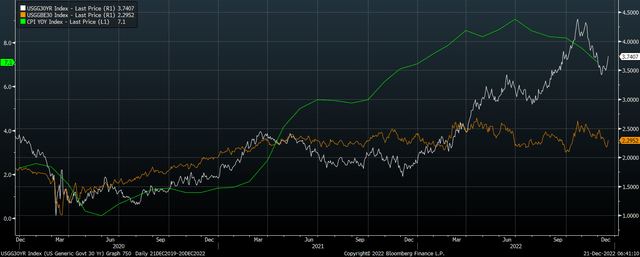

The combination of rising interest rate expectations and falling inflation expectations have seen the real yield on the LTPZ rise to 1.7%, from around -1% at the start of the year. Furthermore, as a result of the sharp rise in real yields and the negative impact that this has begun to have on the economy and financial asset prices, the outlook for monetary policy has also reversed. Investors are increasingly of the belief that the Fed’s hiking cycle is at or near its end, and markets are already anticipating interest rate cuts in the second half of 2023.

Headline CPI, 30-Year UST, 30-Year Breakevens (Bloomberg)

As headline inflation prints continue to subside, this should allow the Fed to take a more dovish stance, particularly if the real economy continues to deteriorate as the Conference Board’s Leading Indicator Index suggests. This should allow bond yields to decline and long-term bond prices to rise significantly. Whether inflation-linked bonds and the LTPZ will outperform will depend on the behavior of long-term inflation expectations.

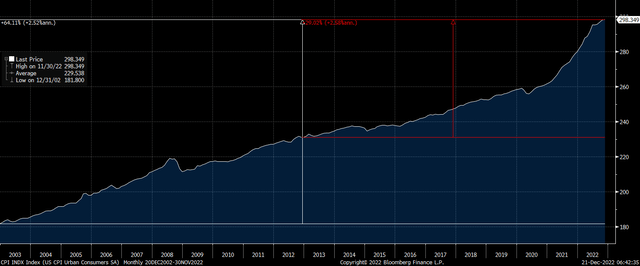

Headline Consumer Price Index (Bloomberg)

At present, 10-year breakeven inflation expectations sit at just 2.2%, while 30-year inflation expectations sit at just 2.3%. If we consider that the average inflation rate over the past 10 and 20 years has been 2.6% and 2.5%, these long-term expectations seem on the low side, particularly with government debt and deficit levels significantly higher now than they have been over the past 10 and 20 years. I see a strong likelihood that falling headline inflation will allow interest rate expectations to decline, which in turn will allow inflation expectations to rise, in a complete reversal of the trends seen in 2022.

A Deflationary Crash Is The Main Risk

One risk is that we see another large decline in asset prices that brings about a scramble for cash and a temporary drop in inflation expectations, as we saw in 2008 and 2020. While such episodes are rare, the extreme levels of debt in the U.S. economy and the still-elevated level of asset prices, mean that we cannot rule out another deflationary shock. While such a move would be highly likely to drive down nominal bond yields, real bond yields could rise as was the case in 2008 and 2020, which would spell trouble for the LTPZ. That said, this is more of a risk than a core scenario, and even if we do see a deflationary shock, this would likely be quickly followed by another round of fiscal and monetary stimulus, which would put a floor under long-term inflation expectations and support long-term LTPZ gains.

Be the first to comment