Bet_Noire/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 17th, 2022.

The PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (NYSEARCA:LTPZ) invests in long-term treasury inflation-protected securities, or TIPs. LTPZ currently yields 2.9%, but should see strong dividend growth, capital gains, and total returns if inflation remains elevated, as the fund’s holdings are indexed to inflation. On the other hand, LTPZ should underperform once inflation normalizes, especially if interest rates rise too. This is a distinct possibility, with Federal Reserve officials indicating they plan on bringing down inflation by hiking rates. If everything goes according to plan, rates would rise, inflation would fall, and LTPZ would underperform.

Although LTPZ would perform reasonably well if inflation remains elevated, the possibility of significant losses if interest rates rise and inflation normalizes is simply too great. As such, I would not be investing in LTPZ at the present time.

TIPs Overview

LTPZ exclusively invests in TIPs, a relatively niche asset class. As such, I’ll be including a short explanation as to how these securities work. Feel free to skip this section if you already know all about TIPs.

Treasuries, including TIPs, are the safest assets in the world, backed by the full faith and credit of the U.S. governments. Treasuries offer investors ultra-safe, dependable, albeit low, interest rate payments and dividends.

TIPs have the added benefit that their dividends, capital, and returns, are protected against inflation.

TIPs are protected against inflation, as their face value and coupon rate payments are indexed to the Consumer Price Index, or CPI, an inflation index, for positive values of said index. In simple terms, TIPs returns are roughly equal to their interest rate plus inflation.

Let’s explain the above with a quick example.

Say you invest $1,000 in TIPs at a 1% yield, equivalent to an interest payment of $10 per year.

If inflation increases to 10%, so would the value of your investment and interest. Your investment would increase in value from $1,000 to $1,100, while your interest payment would increase from $10 to $11.

Total returns would be equal to $100 plus $11, effectively equivalent to inflation plus interest rate (10% + 1%). Returns are generally distributed to investors in the form of dividends.

Higher rates of inflation would lead to greater gains and vice versa.

Deflation, on the other hand, has no effect on the value of your investment, interest, or shareholder returns/losses.

If inflation decreases to -10%, your investment would retain its $1,000 value, and your interest payment would remain at $10. This holds true for all rates of deflation.

With the above in mind, let’s have a look at LTPZ.

LTPZ – Overview

LTPZ is an index ETF investing in long-term TIPs. The fund shares the same characteristics, benefits, and drawbacks of ordinary TIPs, plus all relevant characteristics of long-term bonds. Let’s have a look at these, starting with the positive characteristics.

LTPZ – Benefits and Positives

Effective Inflation Hedge

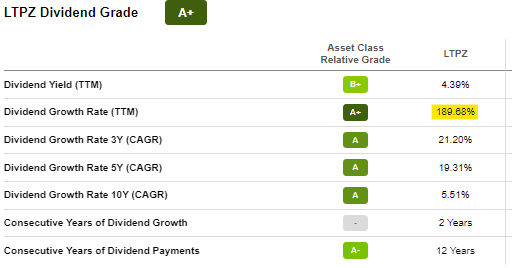

LTPZ’s holdings are all indexed to inflation, and so the fund performs particularly well when inflation is high. This is currently the case, with CPI rising 7.9% over the past twelve months, the highest inflation rate in more than 40 years. Rising prices means higher income, with LTPZ’s dividends skyrocketing by more than 180% in the past twelve months.

SeekingAlpha

Further growth seems exceedingly likely. As per LTPZ’s investment managers, the fund boasts a 3.0% trailing twelve-month distribution yield, but its underlying holdings generate 5.0% in income (as measured by the fund’s SEC yield). In the vast majority of cases, ETFs distribute all underlying generation of income, which means LTPZ’s yield should rise to 5.0% in the coming months. LTPZ’s dividends have grown by quite a bit in the past few months, as expected.

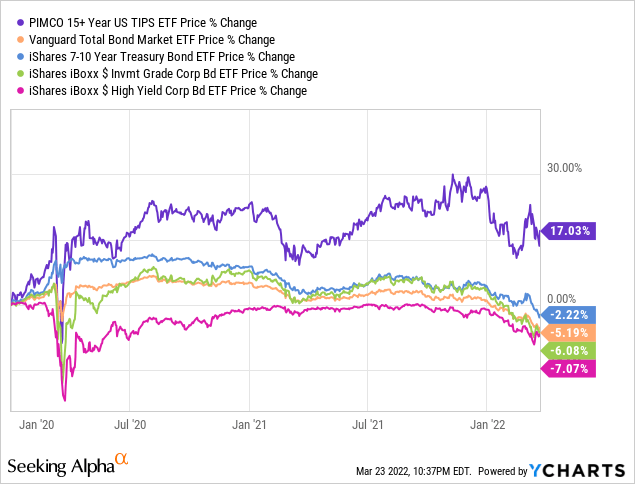

Rising prices also means higher TIPs prices, partly due to the structural reasons explained in the beginning of the article, and partly due to increased demand. Investors increase their demand for inflation-hedge securities, including TIPs, when inflation rises, resulting in higher asset prices. LTPZ’s share price itself has risen by 17% since 2020, reasonably strong results, and significantly higher than average.

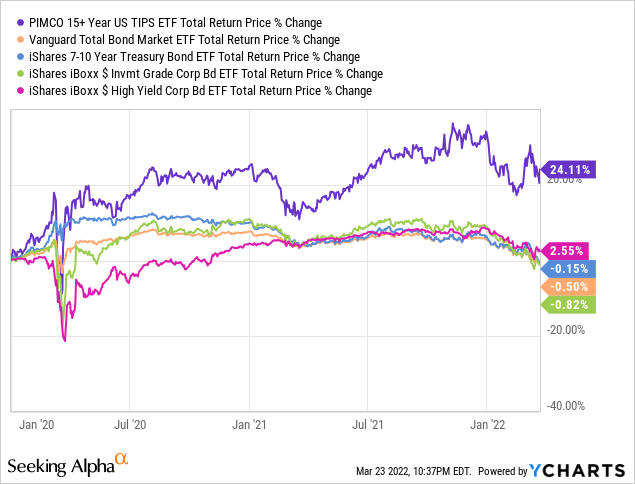

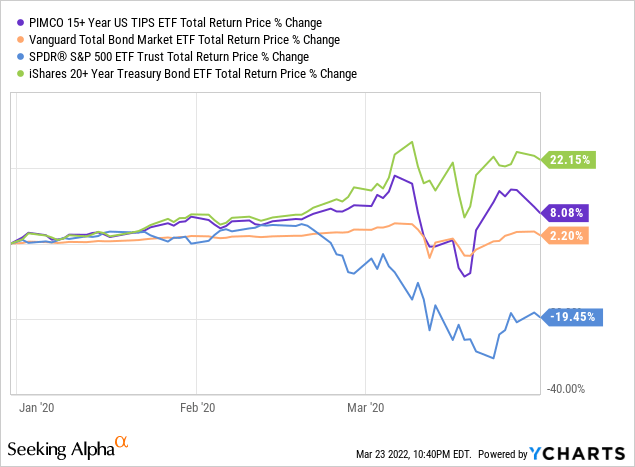

Strong dividend growth and capital gains ultimately led to significant, market-beating returns for LTPZ and its shareholders. The fund has significantly outperformed relative to most bonds and bond sub-asset classes since 2020, and by a lot.

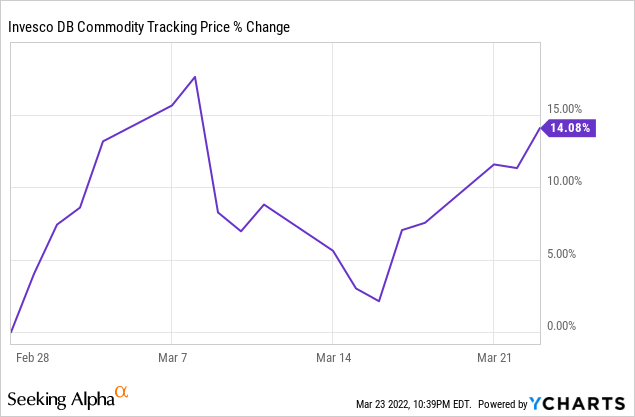

LTPZ should continue to see strong yields, dividend growth, capital gains, and total returns, as long as inflation remains elevated, as seems likely in the short term. Inflation has remained elevated for months, and sees no signs of abating. The ongoing war in Ukraine has also caused commodity prices to spike by more than 14% during March, and these have yet to be reflected in inflation figures.

Surging coronavirus cases in mainland China have also led to lockdowns across several Chinese cities, straining supply chains further. These disruptions should lead to delayed deliveries of consumer and industrial goods, hamper manufacturing, ultimately resulting in further inflation.

All signs point towards elevated inflation for months, in my opinion.

LTPZ is a moderately effective inflation hedge, and so should continue to outperform if inflation remains elevated. This is the fund’s most significant benefit, and its core investment thesis.

Downside Protection

LTPZ’s treasury holdings perform particularly well when economic conditions are tough, due to a flight to quality effect. Treasuries are the safest assets in the world, and investors flock to safety when times are tough. Federal Reserve policy also helps, as the Fed tends to engage in monetary stimulus, including buying TIPs, during recessions, further boosting asset prices. Expect LTPZ to outperform during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic. LTPZ outperformed both bonds and equities during said time period, although did underperform normal long-term treasuries. TIPs offer investors moderate downside protection, but long-term treasuries are the best security in this regard.

LTPZ – Risks and Drawbacks

LTPZ is a strong fund and investment opportunity, but it is not one without risks or drawbacks. Two stand out: underperformance when inflation is low, and interest rate risk. Let’s have a look at these two issues.

Underperformance When Inflation is Low

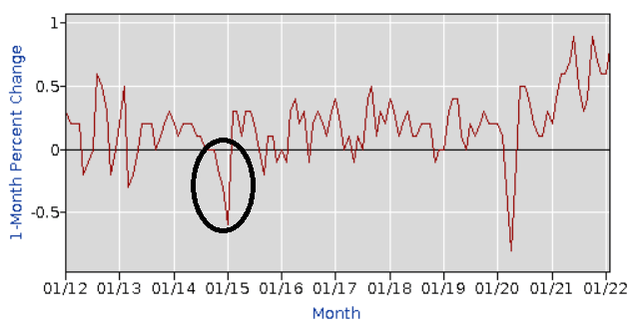

LTPZ’s dividends, share price, and returns, are strongly dependent on inflation. This is a benefit when inflation is high, but a negative when inflation is low. Inflation has not been low for any meaningful amount of time for years, but there was a brief period of plummeting inflation from mid-2014 to late-2014, circled below.

BLS

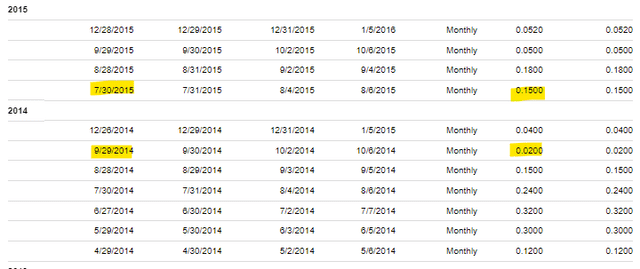

LTPZ did not perform too well during said time period. The fund’s dividend declined to effectively zero in September 2014, and remained there until July 2015, once inflation had recovered. Lower inflation meant dividends and yields collapsed, a significant negative for the fund and its investors.

SeekingAlpha

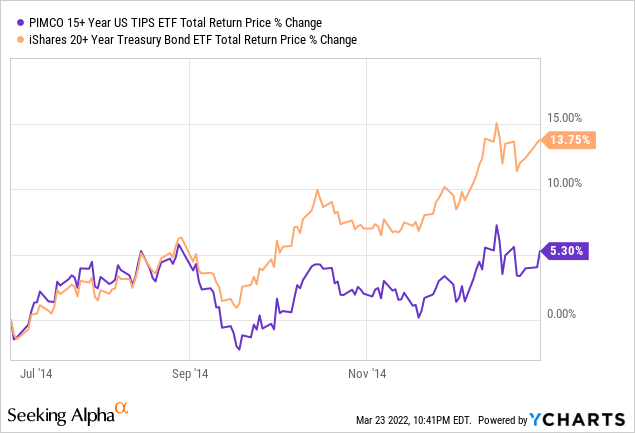

Total returns were better, but the situation was still broadly negative. LTPZ’s share price actually rose in the low single-digits when inflation collapsed, due to speculation: investors thought inflation would rise and rates would decrease, so long-term TIPs seemed like reasonable long-term investments. Still, normal long-term treasuries saw much higher gains, so it seems clear that LTPZ being indexed to inflation was a significant negative when inflation collapsed.

Although I do not believe that inflation will come down any time soon, I do think it will come down eventually, which will harm LTPZ. The Federal Reserve’s mandate includes low inflation, around 2.0% per year, and they have the tools and inclination to meet said mandate. LTPZ will not fare all that well once that occurs. Which brings me to my next point.

Interest Rate Risk

Bond prices are inversely related to interest rates. This has to do with the inverse relationship between bond prices and interest rates, as quantified by duration. These issues can get quite complicated, but the general idea is quite simple.

LTPZ’s share price is somewhat dependent on prevailing market interest rates. Lots of investors buy LTPZ and its 3.0% dividend yield when the average savings account yields 0.06%, buoying the fund’s share price. Lots of investors would sell LTPZ and its 3.0% dividend yield if savings account rates rose to, say, 10.0%, causing a collapse in the fund’s share price. Smaller interest rate increases would have smaller effects on the fund’s share price, but the effect would still be there, and it would be negative. Some investors will sell LTPZ if rates rise to 1.0%, some more would sell if these rise to 2.0%, and so on, and so on. Due to this, LTPZ’s share price should decrease as interest rates rise. Short-term bond funds can minimize these losses by replacing their low-yielding bonds once these matures. Long-term bonds, including LTPZ, can’t effectively do so, as their bonds take a long time to mature.

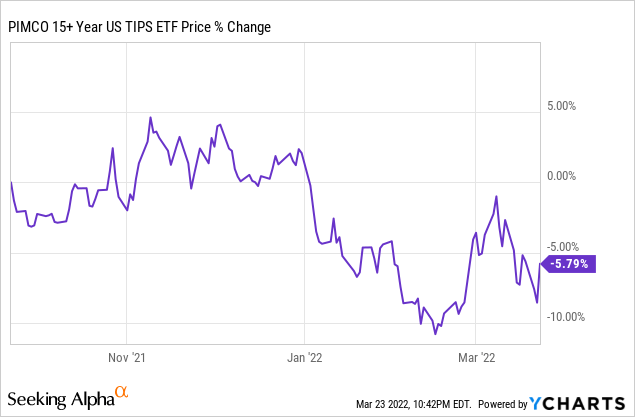

Interest rates are dependent on many factors, but Federal Reserve policy, and expectations thereof, are key. If the Federal Reserve wants to see higher market rates, rates will rise, and vice versa. Federal Reserve policy is, in turn, dependent on many factors, but inflation is key. The Federal Reserve hikes rates when inflation is high, to reduce consumer demand, cool down the economy, and bring down inflation. On the flipside, lower inflation gives the Federal Reserve room to stimulate the economy through lower interest rates. In any case, and as previously mentioned, inflation is currently quite high, and so the Federal Reserve is hiking rates. There was a small 0.25% rate hike in March, with Federal Reserve officials expecting six further hikes throughout the year. Higher interest rates, and expectations thereof, have caused LTPZ’s share price to decrease for the past six months or so, even as inflation remains elevated. Further hikes should cause further losses as well.

In my opinion, although LTPZ’s inflation and interest rate risk are both individually manageable, their combination is not. The fund could weather losses from lower inflation, it could also weather losses from higher rates, but losses from both, at the same time, could be disastrous. Losses would mount if rates rose to combat surging inflation, which seems like a distinct possibility: the Fed’s mandate includes bringing down inflation, and it does so through hiking rates, both are likely to occur in the coming years. LTPZ should significantly underperform once the Fed hikes rates to combat inflation, a significant negative for the fund and its shareholders.

In my opinion, the negative issues above outweigh the fund’s benefits, hence the fund’s bearish rating.

Conclusion

LTPZ is a moderately effective inflation hedge, and outperforms when inflation is high, as it currently is. On the other hand, the fund should underperform once the Federal Reserve hikes rates to combat surging inflation. As such, I would not be investing in the fund at the present time.

Be the first to comment