da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 29th, 2022.

PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX) launched in early 2019. It’s been quite the volatile sector, to say the least, during the time of its short existence. Despite energy providing better returns lately, benefiting NRGX, they have raised their distribution aggressively. I believe they are in a position to raise their payout to investors due to their smaller relative yield at this time. The fund is also attractively discounted at this time, as investors remain cautious of investing in this sector via leveraged closed-end funds.

Since our previous update, NRGX has continued to provide a strong return relative to the broader market. Helped significantly by the strength in energy more broadly, no doubt.

NRGX Performance Since Previous Update (Seeking Alpha)

The Basics

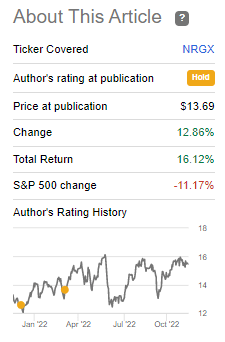

- 1-Year Z-score: 0.28

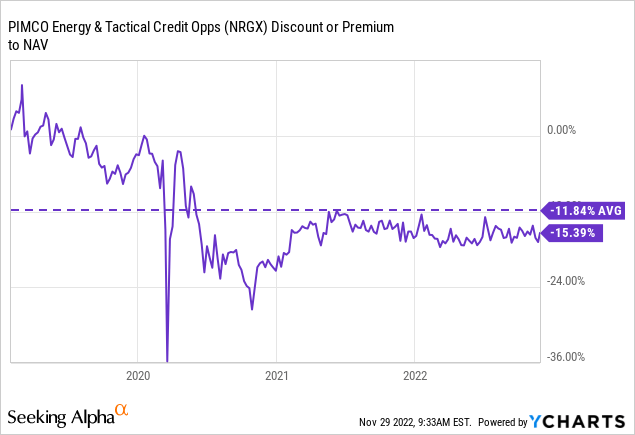

- Discount: 15.39%

- Distribution Yield: 5.70%

- Expense Ratio: 1.68%

- Leverage: 18.42%

- Managed Assets: $1.011 billion

- Structure: Term (anticipated liquidation date on January 29th, 2031)

NRGX’s investment objective is “to seek total return, with a secondary objective to seek to provide high current income.” They attempt to achieve this through a “flexible strategy by focusing on investments across the full value chain, capital structure and liquidity spectrum of the energy markets.”

They will “invest, under normal circumstances, at least 80% of its assets in investments linked to the energy sector and in investments linked to the credit sectors.” To be structured as a registered investment company [RIC], they will allocate no more than 25% to MLPs in their portfolio. That’s where the futures contracts can help juice that exposure up without breaking the rules.

…derivative instruments that provide economic exposure to these types of investments. To the extent the fund obtains exposure to MLPs through the use of total return swaps (“MLP swaps”), it expects to hold cash and cash equivalents and/or high quality debt instruments in an amount equal to the full notional value of such MLP swaps.

Similar to the other PIMCO funds, this fund is leveraged. However, unlike the fund’s fixed-income cousins, they aren’t leveraged right to the hilt. But similar to those cousins, they utilize reverse repurchase agreements. That means their costs have been rising as interest rates have been rising.

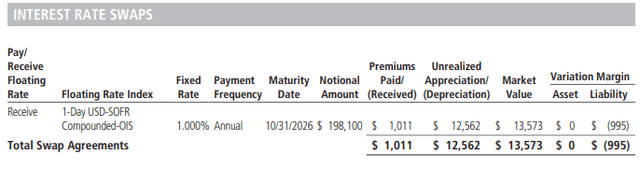

Another similarity to the PIMCO fixed-income funds is the employment of various derivatives. That includes buying and selling options, long and short futures contracts and interest rate swaps. The interest rate swaps, in particular, can be a great hedge against higher rates. They essentially swap a floating rate for a fixed rate.

NRGX Interest Rate Swaps (PIMCO)

Performance – How Energy Could Benefit Going Forward

Here’s a little backstory of the whole energy sector to get a better idea of where we are now.

As mentioned at the start, NRGX launched at the beginning of 2019. 2019 wasn’t a particularly strong year for energy, as it finished last in terms of the S&P sectors. However, it was a strong year overall, which still meant positive results at around 11.8% for the sector as a whole. This was after being the worst-performing sector in 2014, 2015 and 2018. It was runner-up as the worst-performing sector in 2017. And it was the top performing in 2016 after those weaker two years previously.

So certainly, after all these years of being a terrible sector to invest in, 2020 could be the year for energy stocks. Ultimately, with the superpower of hindsight, we know that all this weak performance from years prior was only set up for the grand finale when we saw negative oil futures contracts.

This obviously had hugely negative consequences for a fund launched in 2019; being a leveraged fund only exacerbated the downside. However, we have now seen a huge rebounding of the energy sector in 2021. 2022 is setting up to be a monster year for the sector. One of the only positive sectors with the way things are going.

While I would be hesitant to invest in more energy too aggressively, considering the expectations for a recession next year, I believe the sector has a couple of things going for it. First, China shouldn’t stay in lockdowns from COVID forever. If and when they open, demand for oil/natural gas and whatever other fossil fuels are used for energy could increase.

Secondly, OPEC seems more committed to helping support the current price after announcing production cuts several months ago. This was because they anticipated weak demand coming from weaker economies after central banks began raising interest rates aggressively. I believe this was a change in stance from back in 2015 when OPEC was more than content to keep pumping to drive out U.S. producers.

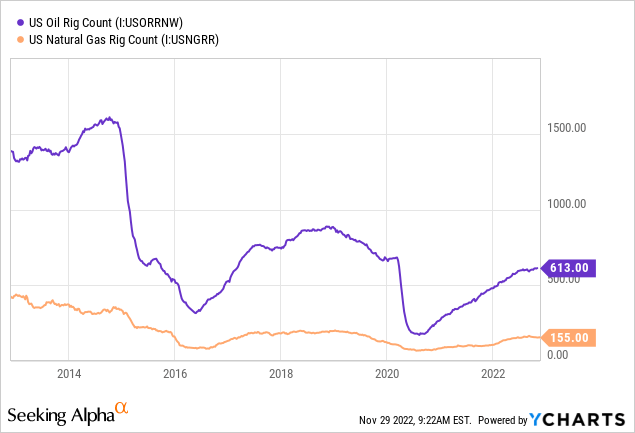

Thirdly, oil companies in the U.S. don’t seem interested in investing heavily in bringing up production. Instead, they are providing more returns to shareholders and staying highly profitable. Rig counts have been growing but at a relatively slower pace.

Ycharts

I’m not sure I blame them either since regulations, and the message out of the White House from the current administration has been quite negative on the fossil fuel industry. Why would they invest significant capital into an area of the market that is being ostracized?

I’m all for renewables, but I know this will be a transition of decades (centuries, maybe) and not years. There will also presumably always be a need for fossil fuels in some capacity, too. So the brown industry will never truly go away. One of the main reasons is that making equipment for renewable energy, such as wind and solar, requires oil.

I know this third point here can be quite a touchy subject for investors as it gets intertwined with political views, which is quite unfortunate, in my opinion. Anyway, the main points here are that this all bodes well for NRGX as it makes an interesting short and medium-term case.

This is especially true with the fund’s current discount being quite attractive. Despite the much better performance, investors seem cautious to step back into this fund. The fund has seemed to settle at around this 15% discount and has stuck there for about two years now.

Ycharts

They aren’t alone in being at a significant discount, as most energy CEFs remain quite deeply discounted after investors were burned for years from these leveraged investments. That’s always something to continue to consider before investing in a leveraged fund. The upside can be great, but the downside can be catastrophic.

Being a term fund, eventually, this discount can be realized. However, we have until 2031, so the draw for that characteristic isn’t really there at this point.

Distribution – Conservative Payout

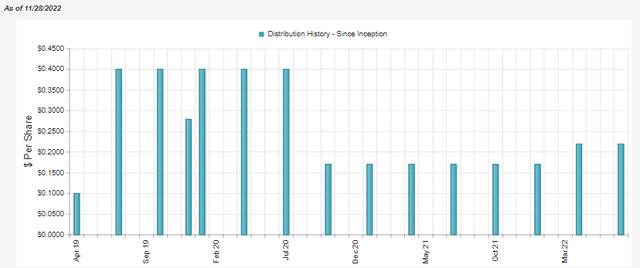

At this time, NRGX – and plenty of other energy funds are also being conservative in their payouts to investors. This could be another reason why investors are reluctant to invest in these funds. NRGX slashed its distribution in 2020. However, since then, they have reclaimed their pre-COVID price level without bumping up the distribution to the same level.

NRGX Distribution History (CEFConnect)

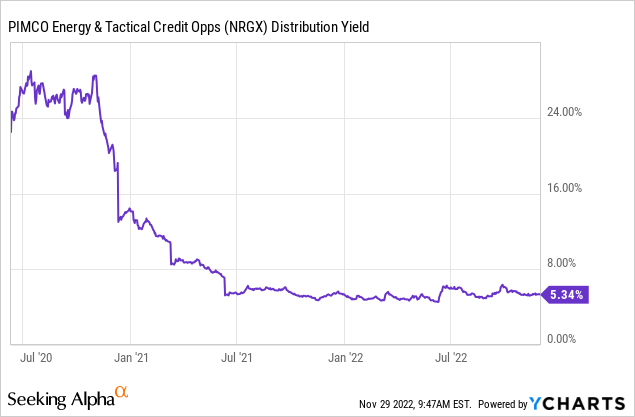

That means that the latest distribution yield of 5.70% is relatively low. On a NAV distribution rate, we are seeing an even lower 4.82% yield. Even U.S. Treasuries are offering competitive yields to this.

Ycharts

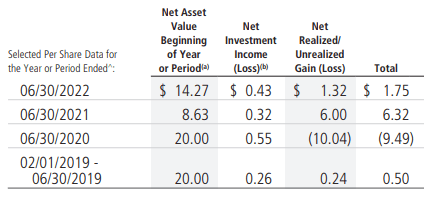

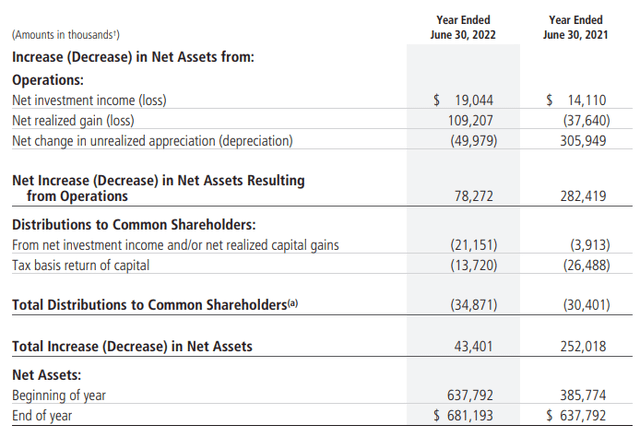

On a per-share basis, the net investment income in the fiscal year 2022 came to $0.43. At a current annual payout of $0.88, that puts NII coverage at nearly 50%. That’s actually fairly high for a fund with a meaningful allocation to equities.

NRGX Per Share Financial Data (PIMCO)

The realized gains have more than made up for any shortfall in the latest fiscal year too.

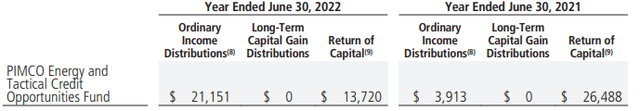

For tax purposes, the fund lists ordinary income and return of capital in the prior two years. Due to the sizeable losses accumulated before the last couple of years, the fund is sitting on capital loss carryforwards. In addition to the carryforward losses, they invest in MLPs, which means they receive distributions identified as a return of capital too. Those return of capital distributions received can get passed onto the classification for shareholders of NRGX.

NRGX Tax Classifications (PIMCO)

For energy funds, it has been harder to decipher constructive vs. destructive ROC that we’ve seen. They’ve had a lot of negative years back to back to back, so technically, ROC could be considered destructive. On the other hand, we know that the classifications of ROC coming from the MLP distributions also should be considered.

Too many investors see ROC distributions and immediately write off a fund. NRGX’s 2021 and 2022 fiscal years are good examples of constructive ROC, which is worth highlighting. The fund has appreciated quite considerably, yet, the classification of their distributions is still meaningfully classified as ROC. We could see some ROC for this fiscal year too. That can be beneficial because ROC defers tax obligations by reducing an investor’s cost basis.

So, in the end, one shouldn’t care what the fund did previously for losses, but they can invest now and get ROC distributions. Thereby not subjecting me to paying taxes until one sells the position. Of course, this is assuming one wants exposure to what the underlying NRGX portfolio contains.

NRGX’s Portfolio

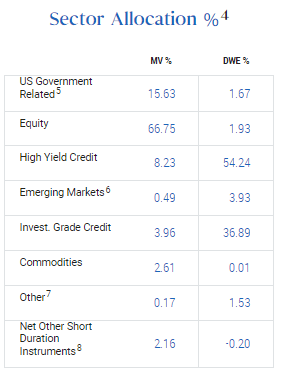

Overall, NRGX’s largest exposure is allocated to equity positions.

NRGX Asset Allocation (PIMCO)

This is followed, perhaps surprisingly, by U.S. Government related debt. This includes mostly exposure to T-Bills. They only yield around 1.17% as of NRGX’s last annual report. At this point, the yields are presumably higher as interest rates have risen rapidly since the end of June 2022.

This isn’t all that uncommon for NRGX, either. In the last update, the fund had over 16% allocated to U.S. Government debt. It would seem strange to have such a high allocation to what really isn’t necessarily the main focus of the fund.

Thinking of it another way, their leverage is essentially covered primarily entirely by the weighting in T-Bills. At this point, the results of the fund have been strong on a YTD basis, but with what we know now, results could have been even stronger.

Speaking of similarities, though, the overall industry exposure remains mostly allocated to pipeline investments. Pipelines were ~52% of the portfolio’s exposure earlier this year too.

NRGX Sector Allocation (PIMCO)

Following the pipeline and E&P allocations are various other sector exposure. Some exposure here not even having to do with the energy sector specifically.

PIMCO has something against posting any list with their top ten holdings easily and conveniently viewable. So it does take a bit more work to find them. Fortunately, they show a portfolio holdings list as of September 30th, 2022. It’s an excel file that’s downloadable from the link at the bottom of their website.

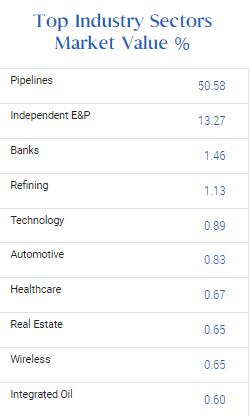

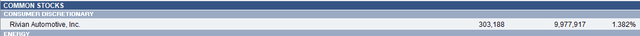

Rivian (RIVN) was one of their largest positions at a weighting of over 9% at the end of 2021. Since then, the shares have collapsed. It was a restricted security, so they couldn’t offload just any time they wanted.

Ycharts

With the latest update, they’ve taken the number of shares down from the 608,688 shares listed at the end of June to 303,138. However, too little, too late, as the damage was already done. It accounts for 1.382% of the portfolio at this point.

The largest positions for NRGX go to Venture Global LNG at an 8.464% weighting; this is then followed by Cheniere Energy (LNG), TC Energy (TRP) at 4.973%, The Williams Co (WMB) at 4.716% and Chesapeake Energy (CHK) at 4.682%.

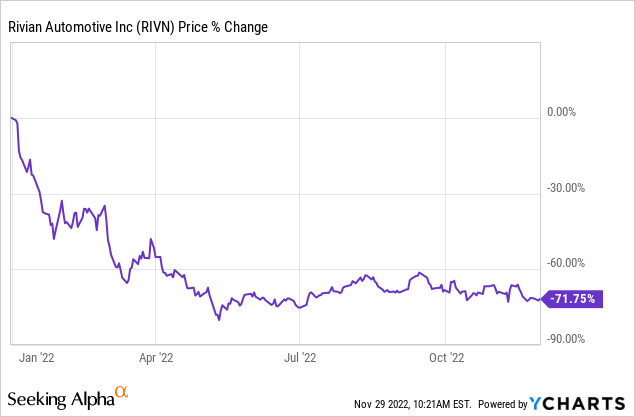

The Venture Global LNG position is another restricted security. It’s done incredibly well, but as we’ve seen with RIVN, that doesn’t always mean much in the end. The cost was under $20 million and then had a market value of $50.334 million. The market value was assigned at $61.104 million at the end of September.

NRGX Venture Global Security (PIMCO)

If you haven’t guessed already, they are focused on LNG.

Venture Global LNG is a long-term, low-cost producer of North American liquified natural gas (LNG). Our export facilities, Calcasieu Pass, Plaquemines LNG, CP2 LNG and Delta LNG, will supply the world’s growing demand for low-cost, clean and reliable North American energy.

LNG (Cheniere) is also another play on, you guessed it, LNG. LNG and LNG are so popular right now because the demand is surging for U.S.-provided energy in Europe as a source away from Russia. Demand was already increasing; this just pushed it over the edge to the next level.

With the Russian invasion of Ukraine, it appears likely that Europe could permanently shift its energy provider away from Russia. So besides the broader points of oil and natural gas remaining relevant, focusing on LNG seems to be the most appropriate tactical positioning for now in the energy space broadly.

Conclusion

NRGX is PIMCO’s offering in the energy space, a big departure from the fixed-income funds that this sponsor usually invests in. The fund has some fixed-income exposure, primarily to U.S. T-Bills, but overall, it is most heavily invested in equity positions in the pipeline industry. They’ve shown to have some interesting investments that are outside of the usual energy investments. RIVN is one of those, which can make it a bit more of a unique fund as well.

I believe there is a case for energy to remain relevant for years to come, which should bode well for NRGX. After such a strong run in the last two years, I would temper expectations going forward. At the same time, the fund is trading at quite an attractive discount, which could provide further upside potential if they can get that gap to close.

Be the first to comment