Blue Harbinger, Big Dividends PLUS–Bonds Are Back! Kativ

If you have worked hard and saved your money, it’s pretty easy to be frustrated with the US fed. They’ve kept interest rates artificially low for years thereby punishing savers with near 0% interest rates. But in case you haven’t noticed, things are changing dramatically in recent months. In this report, we compare and contrast a popular PIMCO bond fund with two very specific individual bond opportunities that you may find surprisingly attractive. We conclude with two critical takeaways.

Without further ado, let’s get right into it.

PIMCO Dynamic Income Opportunities (NYSE:PDO), Yield: 10.3%

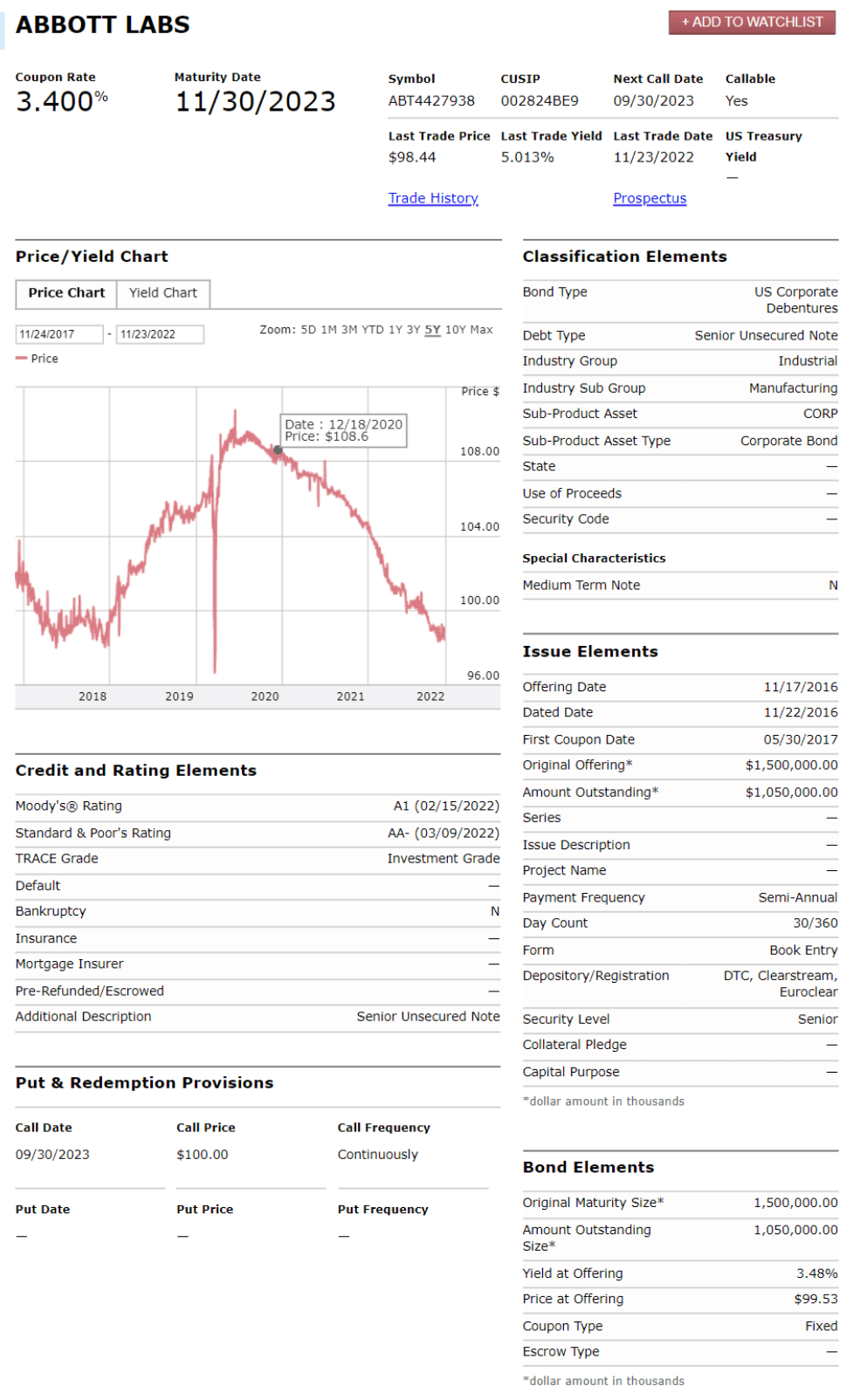

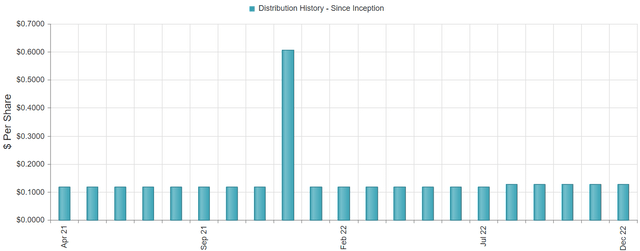

If you are into big income payments, this relatively new PIMCO closed-end fund (“CEF”) delivers an impressive monthly distribution (currently 10.3%). However, even if it’s simply the high-income payments you’re after, it’s hard not to notice the terrible year-to-date performance (see chart below).

As you know, when interest rates rise, bond prices fall. And as the fed has aggressively been raising rates this year, the share price of PDO has paid a steep price. Especially, considering its heavy use of leverage (borrowed money), currently just over 48% (the regulatory limit is 50%). Leverage magnifies the income payments of PDO’s underlying holdings (it currently owns hundreds of individual bonds), but it also magnifies price declines in the bad times (for example this year, as rates have been rising and prices have been falling). On one hand, PIMCO is very skilled and has the infrastructure in place to manage leverage better than individual investors could, but on the other hand, the leverage also magnifies risks and potential declines.

Another drawback of this fund is the potential for forced sales of underlying holdings at less than ideal prices. For example, as the price has fallen sharply this year, the leverage level has mathematically risen, and this creates the risk that the fund may need to sell assets at bad prices (thereby locking in capital losses) just to stay within regulatory leverage limits.

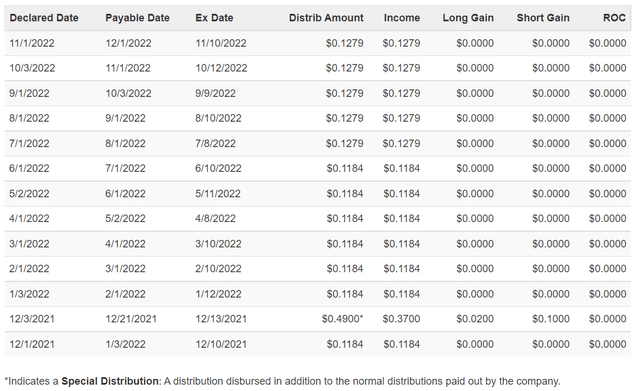

The good news for PDO is that it has been supporting its distribution payments based on the income produced by the underlying holdings, and NOT by returning capital to investors (a method some other PIMCO funds have been deploying, and which can reduce your costs basis and trigger unexpected capital gains taxes).

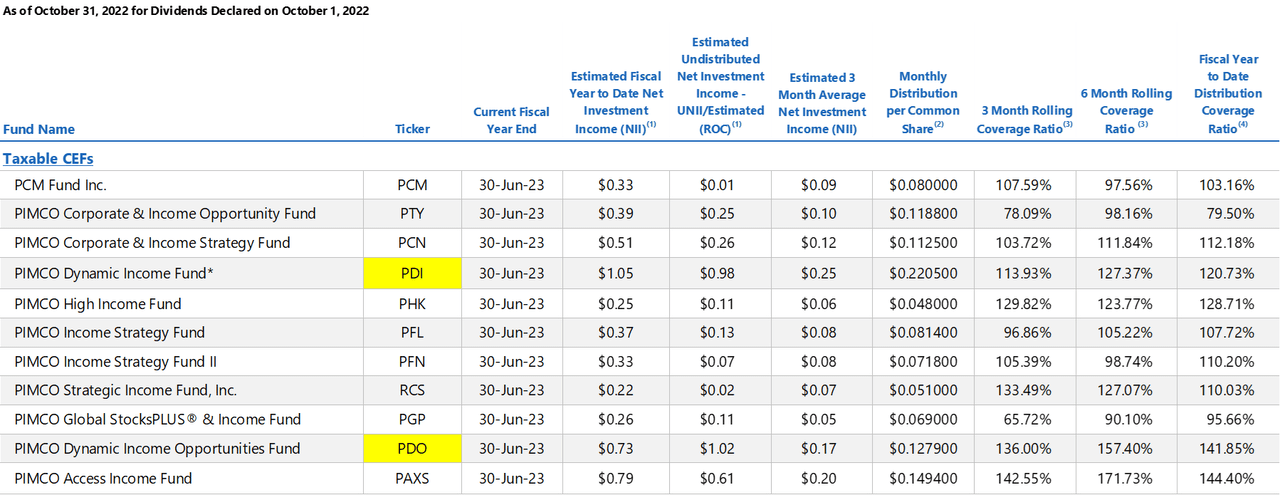

Another good thing about this fund is that it is less “stretched” than other PIMCO funds in the sense that the yield is slightly lower than other PIMCO funds (even though it has similar holdings) thereby making it somewhat easier (in some regards) to maintain the healthy distribution payments. For example, as you can see in the following table, PDO has a healthy amount of undistributed net investment income, as well as solid coverage ratios, especially as compared to some other PIMCO funds (this is a good thing).

PIMCO

This also bodes well for the potential for additional special dividends in the future.

Further still, with a relatively low duration of around 4.4 years, PDO is not overly sensitive to interest rate risks (especially considering almost one-third of its holdings will mature in 1 year or less thereby providing a healthy source of natural liquidity.

Additionally, PDO actually trades at a discount to its net asset value (currently ~4.6%–a rarity among PIMCO CEFs, which often trade at large premiums). Large discounts and premiums versus NAV is a unique characteristic of CEFs (as compared to other mutual funds and exchange-traded funds) and we generally greatly prefer to buy things at a discount, not a premium.

Overall, and despite the drawbacks and risks (such as interest rate risk, leverage risk, discount/premium risk, potential return of capital and uncontrolled capital gains and losses risks) this fund is attractive for its big steady monthly income payment. And with CPI and PPI inflation numbers starting to slow, the fed may also slow its interest rate hikes (CME fed fund futures are now actually predicting the first interest rate cut in the second half of 2023), which bodes well for the price of this fund, especially considering it can now make new fund investments at higher interest rates (when existing ones mature and roll off).

We previously wrote about the attractiveness of this relatively new big-yield bond fund for our members-only (and it has since risen in price and narrowed in discount to NAV), and it still offers a compelling high-income opportunity. PDO is attractive and worth considering if you are an income-focused bond investor.

1-Year US Treasuries, Yield: 4.7%

It might be odd to see US treasuries on this list, but the yield has amazingly gone from near 0% to 4.7% in the last year, and treasuries have some distinct advantages over bond funds. First and foremost, they’re 100% guaranteed by the full faith and credit of the US government. In this sense, they are a lot less risky than PIMCO bond funds, such as PDO.

YCharts

Secondly, with only 1 year to maturity, you will have a lot of control over interest rate risk. Specifically, if you hold until maturity, you are guaranteed (by the US government) to get paid in full. Whereas the PIMCO CEFs may undergo forced sales of some of their underlying holdings (thereby locking in ugly losses, as described above) because the bonds they hold have longer maturities and thereby more interest rate risk. By holding an individual treasury bond, you have total control over when you sell and when you decide to lock in any gains or losses (besides, with only 1 year to maturity, the price likely won’t vary too much at all).

And what’s particularly interesting (besides the fact that the yield has gone from 0% to 4.7% over the last year) is that the 1-year treasury actually currently yields more than the 10-year treasury (see chart above). This unusual inverted yield curve can be a sign of an ugly recession on the horizon. So if you are looking for safe income, 1-year treasuries are surprisingly attractive right now, currently yielding an impressive 4.7%.

Abbott Labs (ABT) 11/30/23 Corporate Bonds, Yield: 5.0%

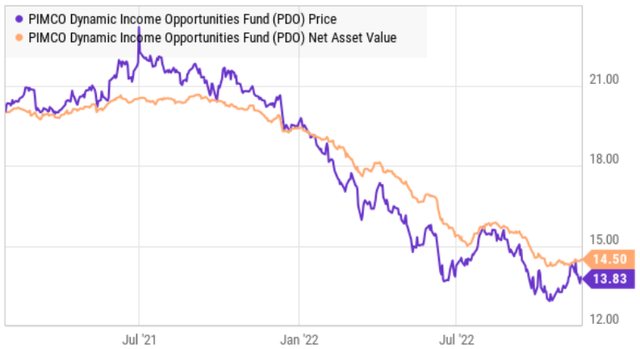

Investment-grade corporate bonds (such as these Abbott Labs bonds) can offer even higher yields than treasuries over the same period of time. For example, these Abbott bonds mature in roughly 1 year and offer a yield (coupon payments plus price appreciation) of over 5.0%, as you can see in the graphic below.

Finra-Morningstar

Abbott is a highly-rated healthcare equipment company (pharmaceutical, diagnostic, nutritional and medical device products) with a very healthy investment-grade credit rating (currently AA- from S&P). Notably, you can see the price of these bonds (in the chart above) has fallen sharply over the last year (largely due to Fed interest rate hikes) and they now trade below the $100 price they will mature at in one year. The bonds are continuously callable at $100 starting at the end of September next year (so you’ll receive a price gain versus the price you can currently buy them at, if they get called early).

Abbott is a good example of a corporate bond that’s gone from yielding close to zero (its price was recently well above $100) to now offering an attractive 1-year yield (little interest rate risk) between now and its roughly 1-year maturity date. A portfolio of attractive, relatively short-term, corporate bonds can be a great way to generate very healthy income, especially now that shorter-term rates are up sharply.

Takeaways:

The yield on shorter-term bonds is now the highest it’s been in over a decade. Some investors prefer owning bonds through very-high-yield CEFs (such as PDO), despite the risks. While others prefer owning individual bonds because of the distinct advantages (and especially now that shorter-term yields are up sharply).

Importantly, if you are going to invest in bonds, we recommend doing so through a diversified portfolio (we offer more specific bond examples in this new report: Top 10 Big-Yield Bonds) because it can help reduce your unwanted idiosyncratic risks. However, at the end of the day, you need to choose an investment strategy that is right for you; disciplined goal-focused long-term investing is a winning strategy.

Be the first to comment