HJBC

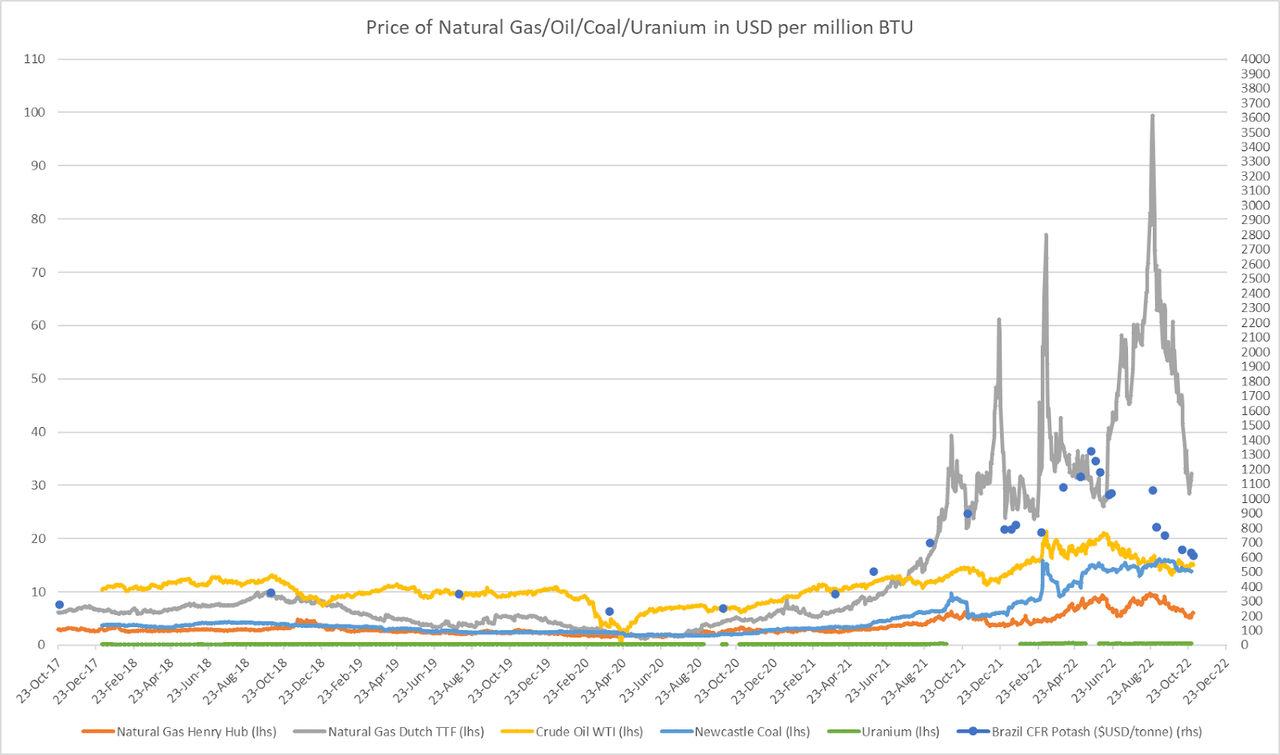

Natural gas is used for electricity generation, heating and cooking. Natural gas is also very important for fertilizer and food production. Since the Russian/Ukraine war started, natural gas supply has been disrupted with both Nord Stream 1 and 2 out of operation. This has put tremendous pressure on the supply to Europe which can now be felt in other parts of the world such as North America.

Currently there is an arbitrage opportunity between EU natural gas and U.S. natural gas (Henry Hub). This gap is expected to close with LNG supply coming online as the U.S. sells more natural gas to the EU.

Correlation Economics

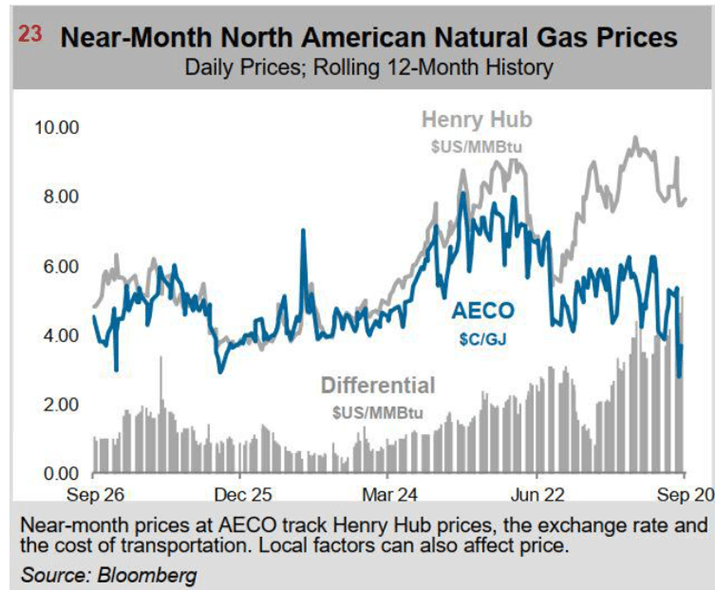

Another arbitrage can be found between AECO Canadian natural gas and U.S. Henry Hub natural gas. This gap is also expected to close as pipeline infrastructure projects are implemented over time. This makes me very bullish on AECO prices going forward because not only do we benefit from the rise in Henry Hub pricing, we also benefit from the AECO-Henry Hub distortion. To play this bullish case, we look at Pieridae Energy (OTCPK:PTOAF).

Bloomberg

Summary

Pieridae Energy is a natural gas producer with light oil as a byproduct (80% gas/20% liquids). The company is located in Alberta, Canada and produces 37,500-39,500 boe/d of product.

As the largest Foothills producer in North America, their assets make up some of the biggest conventional natural gas reservoirs on the continent. Our footprint stretches over one million gross acres of land (807,000 net acres); with ownership of three natural gas plants and more than 3,800 kilometers of pipelines in Alberta and British Columbia.

The Pieridae Advantage includes a commitment to net-zero emissions by 2050, a veteran management team with extensive upstream and midstream experience and the core elements necessary to advance an LNG Project off Canada’s East Coast.

Share structure

The float is very tight compared to its peers with only 158 million shares outstanding, which have caused problems for institutions to get a sizable position.

Valuation

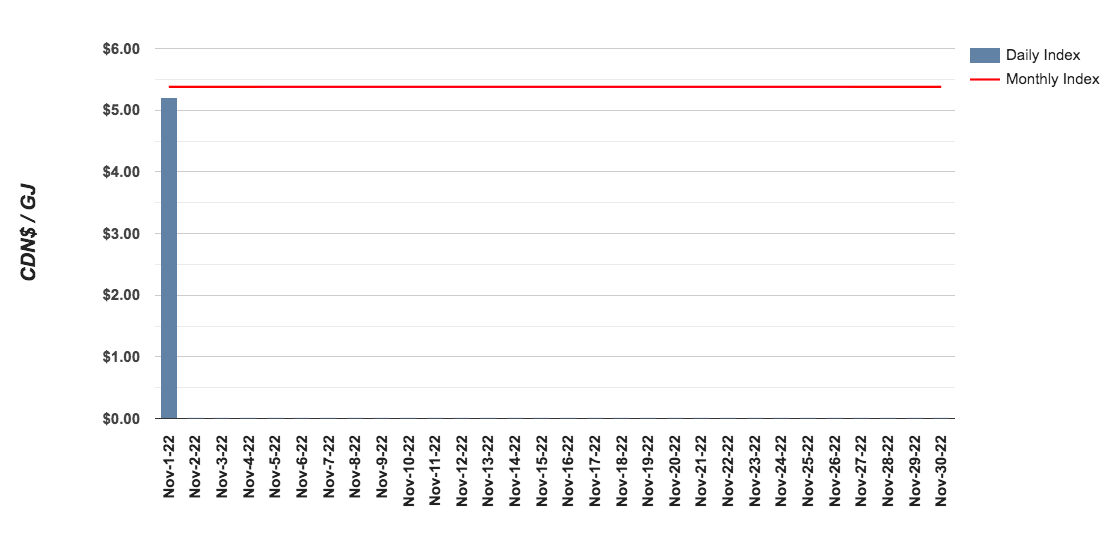

The picture below shows the natural gas price (AECO) at $5 CAD/GJ for November 1st, 2022.

AECO Alberta Portal

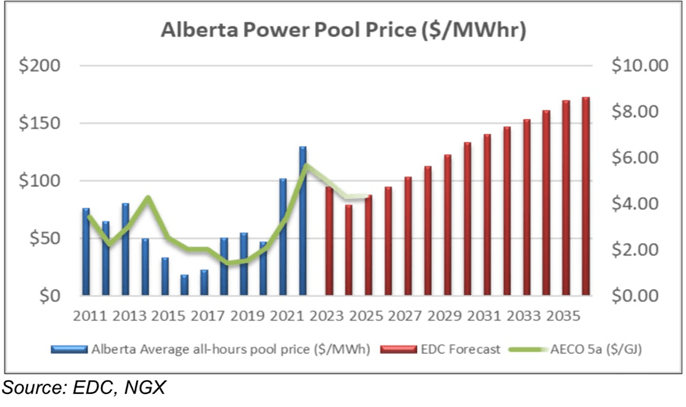

The outlook for natural gas prices looks promising. AECO natural gas could reach $8 CAD/GJ in a few years from now.

EDC, NGX

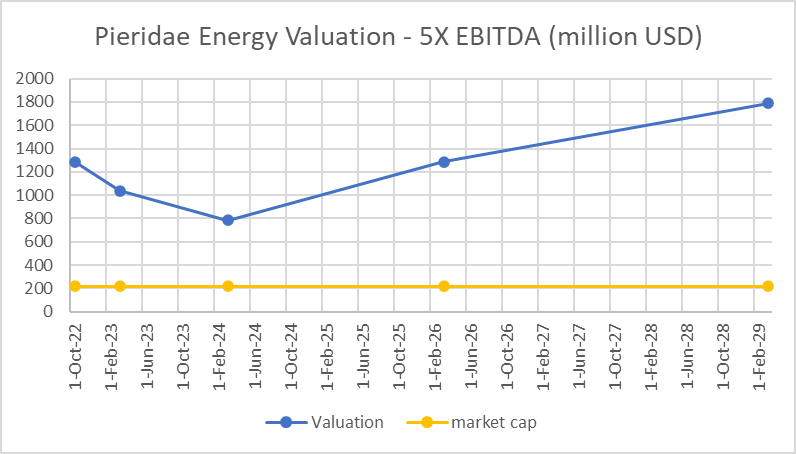

Based on this price outlook, Pieridae Energy’s valuation is shown below based on a 5X EBITDA multiple. The chart shows that the company is trading at a very cheap valuation. The company also has a $700 million CAD tax pool to tap into and has low capex requirements thanks to low decline rates of 8%.

Pieridae Energy Earnings Reports

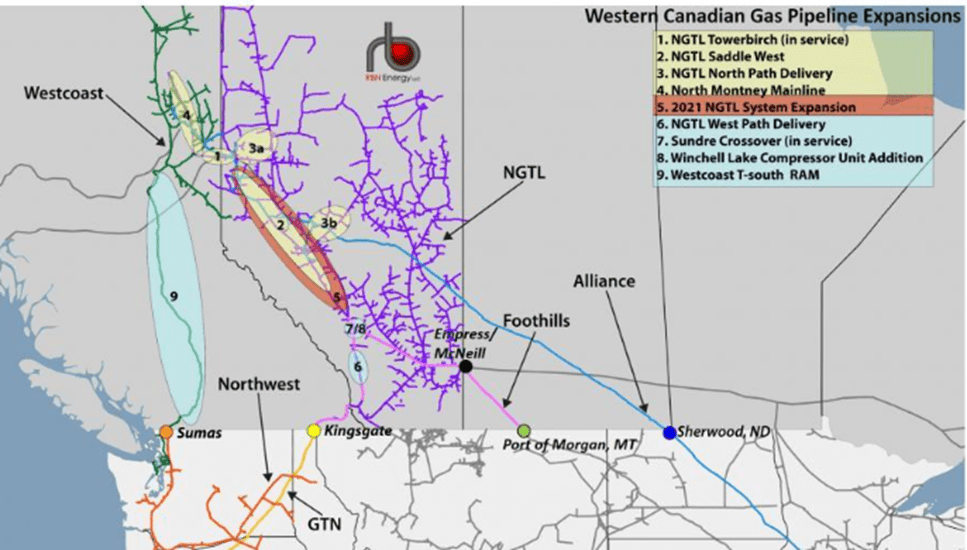

Keep in mind that the Alberta natural gas price has been correcting for a while caused by lack of pipelines. TC Energy, the operator of these pipelines, is working on an improvement of this infrastructure. By Q3 2023, the 2021 NGTL System expansion will be finished and by Q4 2023, the NGTL West Path Delivery will go into production as well.

TC Energy

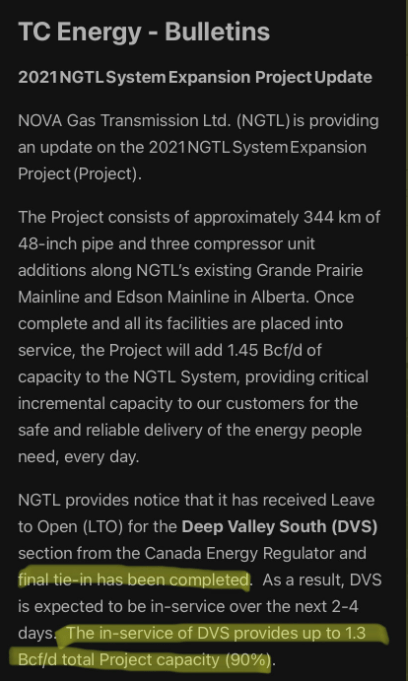

In the last week of October, TC Energy reported some great news. A large expansion on a 344 km long pipeline has now been completed and is in service. This news pushed the AECO price higher.

TC Energy Bulletin

Hedges

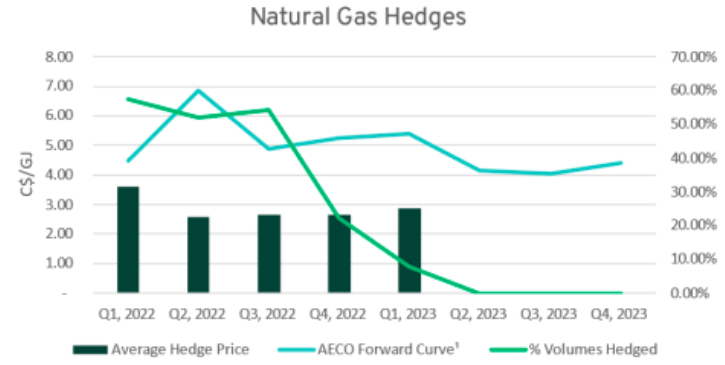

A large part of PEA’s production was hedged at low natural gas prices in the beginning of the year, but as the picture below shows, hedges are now coming off. The timing couldn’t be better in regards to the geopolitical tension surrounding natural gas and as we are headed into winter, pricing will become even better. Keep in mind that the netback will rise a lot as these hedges are removed. With hedges, the company will book an approximate net income of $100 million CAD at $4.5 CAD/GJ natural gas which corresponds with a P/E ratio of 2. Imagine what the profits will be with higher natural gas prices and less hedges. At these prices, the company should also be able to comfortably pay off its debt obligations ($200 million CAD debt). Any rise in the AECO price above $4.5 CAD/GJ will significantly speed up this debt repayment process. It is worthy to note that this debt has a very high interest rate (20%). When this debt is paid off, earnings could increase by $50 million CAD per year, providing huge financial leverage.

Pieridae Energy Presentation

Technical Analysis

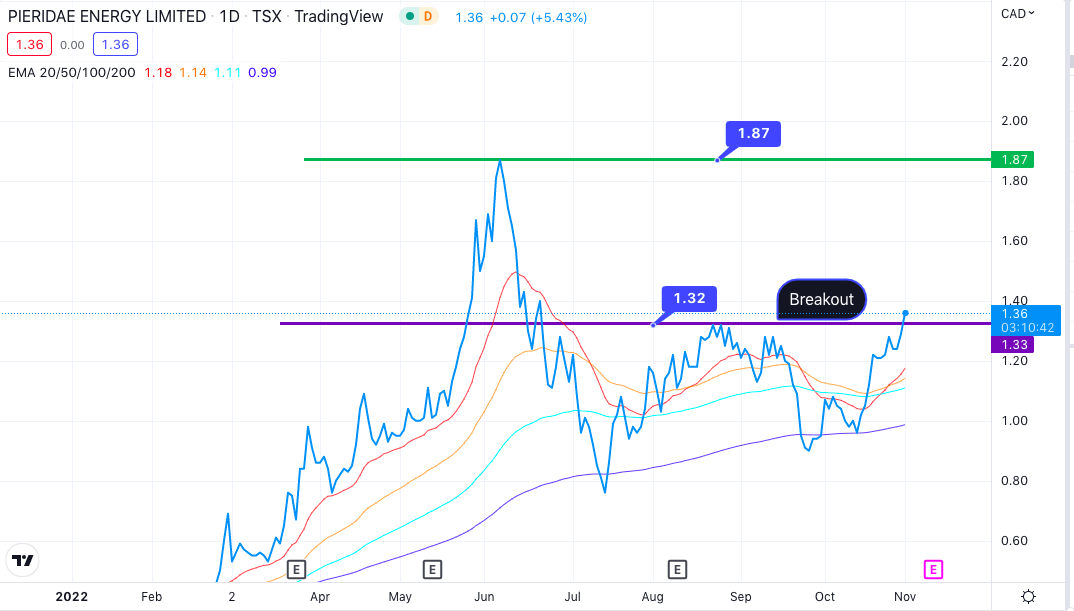

The following chart shows double support at the 200EMA and has now broken the ceiling. With a lot of bullish catalysts with regard to the macro outlook for natural gas, the technicals here look beautiful, setting up for a massive run higher.

TradingView

Risks

Pipeline construction delays, pipeline maintenance work and the price of natural gas dropping under $3 CAD/GJ will make it hard for the company to pay off debt, though the tight share structure could be used to attract smart money. New hedges with higher prices could secure a strong price floor.

Conclusion

Pieridae Energy has huge leverage to the Canadian AECO natural gas price. Pipeline infrastructure improvements are scheduled for delivery in 2023 which will give the natural gas price a fundamental floor. In regards to the geopolitics concerning natural gas, we assume that the Russian/Ukraine war is not coming to an end in the near future, which will support natural gas prices. Recently Qatar’s energy minister told the EU that a price cap on Russian natural gas would make them cut natural gas supply to the EU. Tensions regarding natural gas are rising all over the world and also keep in mind that we are approaching winter, which will push natural gas higher.

The timing to enter this trade couldn’t be better as hedges are coming off and prices are rising due to geopolitical tension. Furthermore the pipeline expansion will drain storage and raise natural gas prices.

This company is a buy and hold. The market is currently waking up to this gem.

Be the first to comment