SilviaJansen/E+ via Getty Images

Retail properties have been much maligned by mainstream news outlets in recent years, with what I view as being overblown concerns around a retail apocalypse. As such it’s become easy to paint the most visible real estate class, shopping centers, with this broad brush.

This brings me to Phillips Edison & Company (NASDAQ:PECO), which is a high quality shopping center player but underfollowed stock that deserves more attention. This article highlights why PECO is a sleep-well-at-night type of holding that one can buy today and reap the rewards tomorrow, so let’s get started.

Why PECO?

Phillips Edison is a large internally-managed shopping center REIT was founded back in 1991, and only recently became a publicly traded company with its IPO in July of last year.

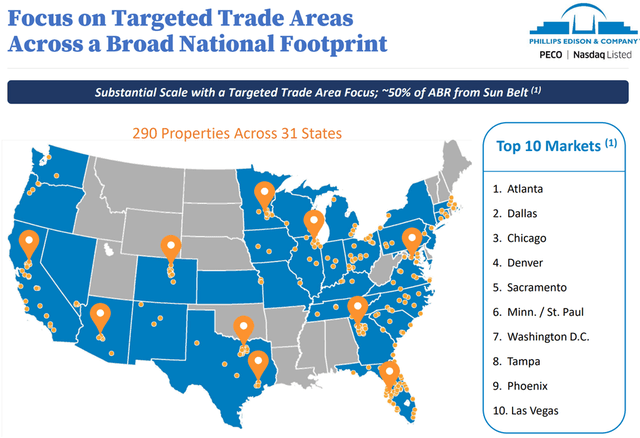

Its footprint spans 290 shopping centers (269 of which are wholly-owned) covering 31 million square feet across 31 states, and its top grocery tenants include household names such as Kroger (KR), Publix, and Albertsons (ACI). As shown below, PECO’s top markets includes both Tier 1 markets such as Atlanta and Dallas, and as well as growing markets such as Tampa, Florida.

PECO Geo Mix (Investor Presentation)

What sets PECO apart from the majority of its shopping center peers is its very high exposure to omnichannel grocery anchored centers, which represent 97% of PECO’s annual base rent.

These centers serve as essential last mile delivery points to their surrounding communities, as 90% PECO’s grocers offer a buy online, pick up in store option, and with U.S. adult consumers visiting grocery stores an average of 1.6 times per week. This strategy helps to drive additional foot traffic and sales for PECO’s tenants compared to e-commerce on a standalone basis.

Additionally, 72% of PECO’s ABR are deemed as necessity-based goods and services, such as groceries, consumer banks, and quick service restaurants making them well positioned in the face of a recession. This is reflected by the fact that PECO has weathered multiple recessions, including the one in 2020, during which it suffered only a 0.7% occupancy loss.

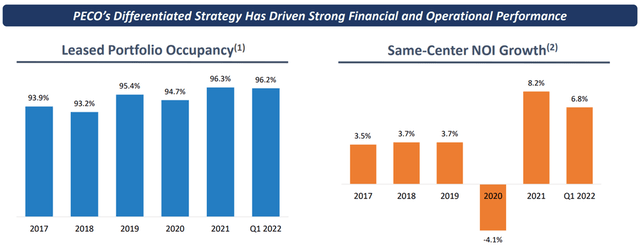

Phillips Edison continues to demonstrate solid portfolio fundamentals, with leased occupancy of 96% and robust same center NOI growth of 6.8% YoY during the first quarter. This was driven by high demand for its properties, as reflected by new and renewal rent spreads of 34% and 14.7%, respectively, and by strategic acquisitions, including $100 million on grocery-anchored real estate in Virginia, Texas, and Florida. As shown below, PECO’s occupancy has meaningfully improved in recent years.

PECO Occupancy (Investor Presentation)

Meanwhile, PECO maintains solid financial footing, with a net debt to adjusted EBITDAre of 5.7x, sitting below the 6.0x mark that is generally preferred for REITs. Moreover, recent increases in interest rates should have limited impact on its existing borrowings, as it has a weighted-average interest rate of 3.2% with an average maturity of 5.1 years, and 96% of PECO’s total debt is at fixed rates.

Near-term risks to PECO include higher cost of debt funding, which could make it more costly to do acquisitions. However, strength in lease renewal rates could be a simple way to increase the bottom line, and the company maintains a strong development pipeline, as noted by management during the recent conference call:

Our expectation is that renewals will continue to make up a larger percentage of our leasing volume given our high retention rates. We view our high retention rate as a strength since there is no downtime unless TI required for a new lease versus a new lease.

We continue to execute on our pipeline of ground up and repositioning projects. Currently, we have 20 ground up and redevelopment projects under active construction, which represents total investment of approximately $48 million.

The average yield on these projects is estimated to be 10% to 12% unlevered. We stabilized two of these projects in the first quarter, both are fully leased and rent has commenced.

In addition to the 20 active projects, we also have a pipeline of 10-plus projects expected to begin construction throughout the balance of this year. This activity will keep us on pace to meet our target of $45 million to $50 million of total redevelopment spend for 2022, with yields of 10% unlevered.

While PECO’s dividend yield of 3.3% (paid monthly) isn’t particularly high, it does come with a very safe 49% payout ratio, based on the midpoint of management’s 2022 Core FFO/share guidance of $2.21. As such, I see plenty of room for dividend growth given the strong portfolio fundamentals.

I see value in PECO at the current price of $33.19 with a forward P/FFO of 15.0 (based on the aforementioned guidance). This is considering the strong balance sheet, primarily grocery-anchored portfolio, and the fundamental growth. Sell side analysts have a consensus Buy rating on PECO, with an average price target of $37.75, translating to a potential one-year 17% total return including dividends.

Investor Takeaway

PECO is a high-quality grocery-anchored shopping center REIT that is well positioned to weather an economic downturn. The company has strong fundamentals, including a 96% leased occupancy rate and robust same center NOI growth. PECO also maintains solid financial footing, with and has a promising future with its development pipeline. As such, PECO appears to be a good buy for quality income and growth.

Be the first to comment