Patrik Stollarz/Getty Images News

Philips (NYSE:PHG) has shown an impressive transformation over the last decade from an electronics to health-tech company. During the transformation, the company managed debt levels and shareholder returns. Still, for a dividend investor, the company does not present an alluring investment proposition as the yield is modest and dividend growth will be low.

Moreover, the risk profile of the company has deteriorated as the diversification reduced by solely focusing on healthcare. On top of this, the prospect of an ageing population draws competition into the field of healthcare resulting in massive investments in health-tech companies. All in all, I expect Philips to remain a laggard in the short term.

Brief history

Philips is a multinational conglomerate with a 131-year history. As one of the (former) largest electronic companies in the world, many will have used the products made by this company. For example, the company invented the legendary ‘Compact Disc’ which was widely used before music carriers were digitized. The development of this music carrier was not coincidental as the company had founded Philips Records in 1950. Philips Records would eventually merge into Universal Music Group (OTCPK:UMGNF, OTC:UNVGY).

Other well-known and successful spin-offs are ASML (ASML), (OTCPK:ASMLF), NXP Semiconductors (NXPI) and Signify (OTCPK:PHPPY), (OTCPK:SFFYF). The history and rapid growth of ASML make for an interesting read, as does the history of NXP. Or as the company quotes on the website:

Our technology enabled the first words relayed from the moon

Transformation

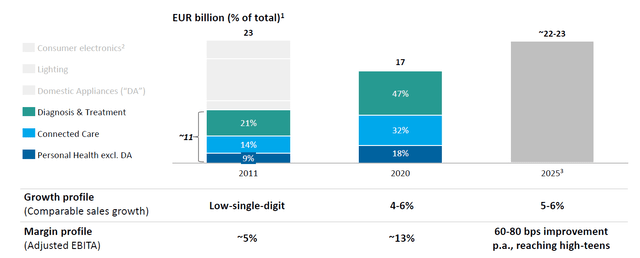

The current CEO, Frans van Houten, took the helm in 2011 and has embarked on a transformation of the company ever since. With a history of successful innovations and spin-offs, the current focus is Healthcare. Figure 1 shows how the turnover developed since 2011 and which divisions currently make up the company. It’s also clear every part of the company which has no link with health has been divested; Consumer electronics, Lighting and Domestic Appliances.

Figure 1 – Developme6nt of turnover and business segments (Philips.com)

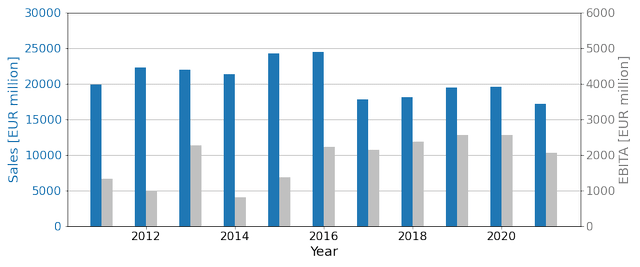

Clearly, the aim of management is to prioritize the margin profile and then focus on growth. When the sales are referenced against the EBITA, it becomes clear the company has been doing so successfully, see figure 2.

Figure 2 – Sales and EBITA development since 2011 (Philips.com, chart by author)

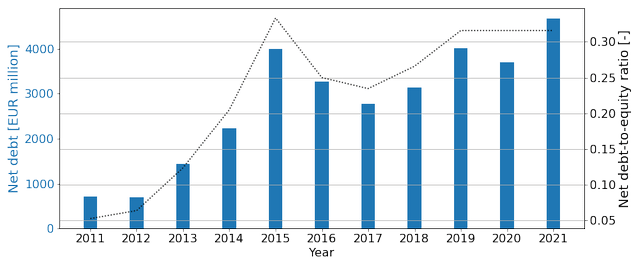

When a company undergoes large transformations the risk is that the debt profile deteriorates to fund takeovers and reorganization costs. This is exactly what happened at the start of the transformation when the company raised the debt level from €700 million (2011) to nearly €4Bn in 2015. Over the course of 4 years, net debt multiplied seven-fold. Since 2016 however management focused on debt levels and although Philips took on more debt, the debt to equity ratio has been capped by management, see figure 3.

Figure 3 – Philips net debt levels (Philips.com, chart by author)

An example of management maintaining the debt levels while transforming the business was the 2021 divestments and acquisitions. The Domestic Appliances segment was sold to Hillhouse for a sum of €2.7Bn. After tax, this transaction led to a €2.5Bn gain. Simultaneously, the company purchased both BioTelemetry, Inc. and Capsule Technologies for an aggregate net cash outflow of approximately EUR2.8Bn. With an ageing population, the focus on Healthcare is logical and investors can be pleased as the company is not transforming the business at every cost.

Outlook

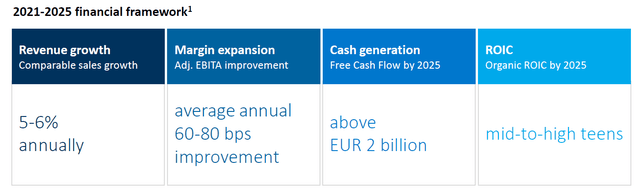

Ultimately the goal of the transformation is to increase performance and thereby achieve the targets laid out in the financial framework, see figure 4.

Figure 4 – Financial framework (Philips.com)

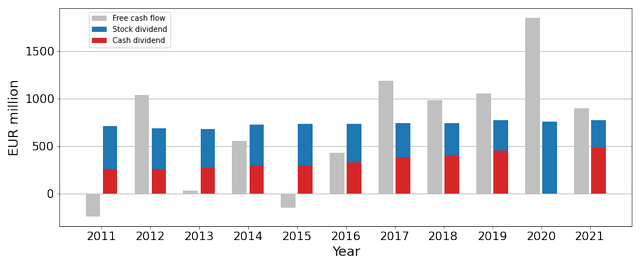

The outlook is modest but focuses on growth and especially an expected increase in free cash flow. Considering the average free cash flow over the last 5 years was approximately €1.2Bn per annum, the company needs to raise this number by €800 million. If the increased 2020 cash flow is excluded from the calculation, it actually follows the average free cash flow since 2017 moves around a level of €1Bn, meaning the company intends to double this over the next years, an ambitious target.

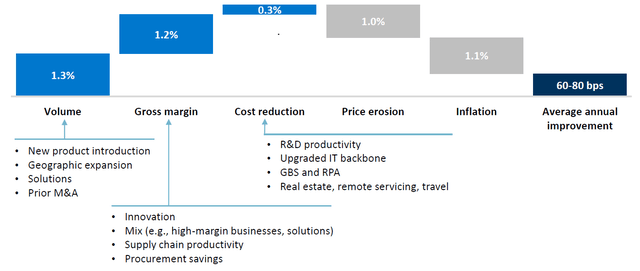

Moreover, the margin expansion of 60-80 bps (annual average) seems modest but may turn out to be ambitious as well. Figure 5 shows how the improvement must be achieved. Volume and gross margin growth is a little over 1%, but the same holds for the inflation. Considering the current debate on inflation and the actions of central banks, or in the case of the ECB inaction, an average inflation of 1.1% is rather low. Any upward adjustment in this inflation percentage has a relatively large effect on the margin expansion.

On the other hand, an improvement of 60 bps over a five-year period translates into a total of a mere 3%. That implies that a year with tailwinds can make a big difference as well but on the upside. Although the 3% margin gain doesn’t sound like a lot, it would bring the margin profile to a total of 16% by 2025. This margin has been not achieved over, at least, the last 25 years.

Figure 5 – Margin expansion (Philips.com)

Health risks

The single focus on Healthcare may boost margins, but it comes at the risk of less diversification. With the company putting all its eggs in the Healthcare basket, the lower diversification naturally leads to more risk. One could argue respiratory devices (Connected Care business segment) have little to do with e.g. Oral Healthcare (Personal Health), but the common denominator is Philips being a healthcare company.

Therefore reputational damage in one business segment is more likely to affect the overall brand. Previously consumers would not think twice purchasing a Philips-made light bulb when issues would have been reported with respiratory devices. But this changes when every product is tied to healthcare. Imagine you are the parent of a newly born and have to choose between the Philips brand or another when purchasing a pacifier while you just heard the healthcare behemoth issued a recall notification. You will think twice.

This example is not fictional as Philips had to recall DreamStation respiratory devices in June last year. One month later the FDA classified the recall as ‘most serious’ and in November this news got a follow-up tanking the stock even further. Effectively the issues with the ventilators have reversed the stock price gains since 2017, see figure 6.

Figure 6 – Stock price and notable events concerning ventilator recall (Yahoo Finance, chart by author)

Another issue that raises concern is the potential increased competition in Healthcare and especially Health-tech. The ageing population makes this an interesting area to focus on, but this also holds for other companies. According to TechCrunch the venture capital investment for health tech in the US was more than US$32Bn in 2021 alone. To put this in perspective, the total R&D expenses of Philips (worldwide) were EUR 1.8Bn (approx. US$2Bn) in 2021. With this amount of investment, competition will be fierce and just like the financial sector has to deal with fintech companies like PayPal (PYPL) or Adyen (OTCPK:ADYEY, OTCPK:ADYYF), the same will happen to Philips in the health tech space.

Shareholder returns

In 2021 owners of Philips’ shares had little pleasure from their holding as the previously mentioned recall overshadowed the financial performance of the company. Next to stock price, dividends and share buybacks return value to shareholders. Figure 7 shows the total dividend returned to shareholders has been remarkably constant since 2011. The company returns dividend both in cash (red) and stock (blue). Apart from 2020, the portion of cash dividend has steadily been growing, and since 2017, free cash flow has been sufficient to cover the annual dividend payments.

Since 2019 the company pays €0.85 dividend per year. Before 2018 the dividend payment was €0.80 for five straight years. If this five-year time frame is used, the next dividend increase will be in 2023. As a result of the recent stock price decline, the company is currently yielding 3.2%. This number is modest and dividend growth will be modest too. The current free cash flow barely covers the total dividend expenses and it cannot be ruled out management will choose to reduce debt to lower the debt-to-equity ratio before increasing shareholder returns.

Figure 7 – Dividend versus free cash flow (Philips.com, chart by author)

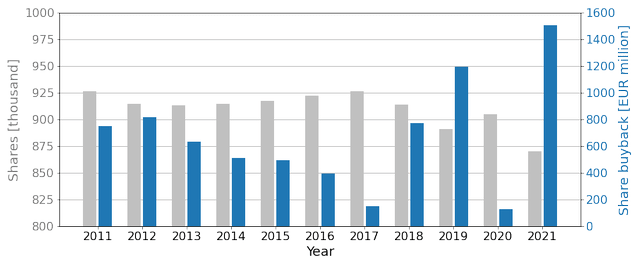

In addition to the dividend, Philips on average spends €0.5Bn per year on share buybacks. As demonstrated in figure 8 the buybacks are not evenly distributed over time. Note the values presented are the line item ‘purchase of treasury shares’ from the cash flow statement in the annual reports. Only since 2018 the amount of shares show a meaningful decline, but the total costs over this time frame were €3.6Bn. Although it is a painful conclusion, the money spent on buybacks has been a waste as the stock price is back at 2017 levels.

Figure 8 – Share count and buybacks (Philips.com, chart by author)

The total shareholder return has largely been affected by the stock price decline, but more important are the future returns of the stock. The ventilator recall appears to have been priced in but the potential effect of reputational damage on earnings is not clear and hard to estimate. Even without this potential effect, the margin expansion is modest and the company mainly relies on cost reductions to improve free cash flows.

Conclusion

Philips is still in the process of its transformation and will focus on improvement of the financial metrics over the next years. If the performance of the last years is taken as a starting point, returns to shareholders will mainly be in the form of buybacks and the dividend yield will be modest.

In my view, the risk profile of the company has deteriorated as the diversification reduced. by solely focusing on healthcare. On top of this the prospect of an ageing population draws competition into the field of healthcare resulting in massive investments in health-tech companies.

The company has shown an impressive transformation over the last decade while managing debt levels and shareholder returns. Still, for a dividend investor, the company does not present an alluring investment proposition as the yield is modest and dividend growth will be low. That leaves the option to invest in the company and hope for an uptick in the stock price once the DreamStation issues have been resolved. But in all likelihood, the gain will be limited, and with the risk awareness created by the recall, it will take some time before investor confidence returns and the stock price shows significant gains. All in all, I expect Philips to remain a laggard in the short term.

Be the first to comment