Fokusiert/iStock via Getty Images

Introduction

Philip Morris International (NYSE:PM), the tobacco giant with the international distribution rights to the world’s best-selling international cigarette brand Marlboro, announced its third quarter results on Thursday, October 20, 2022.

I have covered the company previously and concluded that I would not overemphasize its safe haven status attributed to its international exposure and strong growth in its non-combustibles segment. As a value investor, I am careful not to overpay for my holdings, and therefore PM needs to be carefully considered given its significant premium (non-GAAP forward P/E ratio of 15.5) over Altria (NYSE:MO, forward P/E ratio of 9.2) and British American Tobacco (BTI; OTCPK:BTAFF), forward P/E ratio of 8.6).

In this article, I will provide my opinion on the company’s third quarter results, with a particular focus on the heated tobacco segment, the revised offer for Swedish Match (OTCPK:SWMAY; OTCPK:SWMAF), and the agreement with Altria.

Philip Morris’ Strongly-Growing Heated Tobacco Segments Will Overcome The Russia/Ukraine Setback

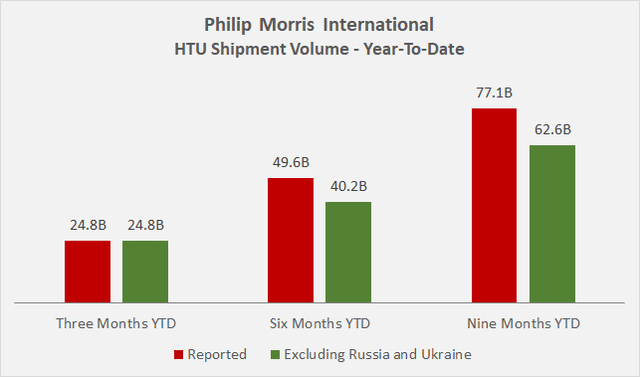

Russia and Ukraine are the main drivers of PMI’s success in the heated tobacco business, and the ongoing conflict is a key reason for the stock’s uninspiring but nonetheless acceptable relative performance in 2022. The spread of 77.1 billion heated tobacco units (HTUs) sold in the nine months year-to-date and 62.6 billion on an adjusted pro forma basis (excluding Russia and Ukraine) illustrates this fact quite well:

Figure 1: Heated tobacco units shipment volume on a year-to-date basis (own work, based on the company’s 1Q to 3Q 2022 earnings releases)

Growth in heated tobacco was relatively subdued in the second quarter, at 1.9% on a reported basis or 7.4% if Russia and Ukraine are excluded. Growth accelerated in Q3 – 17.1% and 21.9% on a reported and adjusted basis, respectively. While I am confident that PMI will overcome the setback due to the conflict in Ukraine, the spread between reported and adjusted volumes should be closely watched, nonetheless. In any case, the growth year-to-date on an adjusted basis leaves a positive aftertaste, and I am confident that management’s focus on heated tobacco products (see below) provides a solid foundation for long-term shareholder returns.

Finally, it should not be forgotten that PMI again reported solid growth in total shipments on a quarterly (0.6% and 2.3%, reported and adjusted) and year-to-date basis (1.7% and 3.4%, reported and adjusted) – something that is quite atypical for a tobacco company belonging to a sector that is said to be in terminal decline.

Philip Morris Has Not Officially Given In To Pressure From Activist Investors

PMI is apparently firmly committed to becoming a majority smoke-free company by 2025. In the first nine months of 2022, 30.4% of the company’s net revenue came from smoke-free products, or 29.6% if operations in Russia and Ukraine are excluded. On an operational level, PMI is well on its way to achieving this ambitious goal.

Earlier this year, the company announced its offer to acquire Swedish Match, maker of the top-selling oral nicotine pouch brand Zyn (slide 7, presentation dated May 11, 2022), for SEK 106 per Swedish Match share. The acquisition would not only allow PMI to enter the U.S. oral nicotine market as a de facto leader but could also give the company a significant advantage in terms of distribution capacity for its heated tobacco products, which it will market itself in the United States, beginning May 2024 (see below).

Apparently caving to pressure from activist investor Elliot Investment Management, which has acquired a stake in Swedish Match to oppose the deal at the aforementioned valuation, PMI announced today that it would increase the offer by SEK 10 per share, but will not consider further increases. Interestingly, PMI CEO Olczak cited that activist pressure wasn’t the reason for increasing the offer, but primarily the higher net value of the business to PMI due to Swedish Match’s cash flows generated in U.S. dollars, which has appreciated considerably since the initial offer.

The revised offer is still subject to a 90% acceptance condition, and I think it is very likely that activist investors will accept the revised offer, even if a 9.4% premium does not seem particularly lucrative. If the deal falls through, SWMAY’s share price would most certainly follow suit and result in book losses for Elliott et al. – something they would most likely want to avoid. PMI’s conviction is also underscored by its intention to independently develop its portfolio of heated tobacco and oral nicotine products in the U.S. in any event. This is underscored by the agreement announced today with Altria for the future marketing of heated tobacco products under the IQOS brand in the United States directly through PMI.

As a shareholder, I welcome the fact that PMI was not misled into paying an excessive price for Swedish Match, even though the transaction is of significant strategic importance. With a free cash flow yield of around 3%, PMI’s increased offer of SEK 116 does not seem unreasonably high, given SWMAY’s 45% margin and 20% compound annual growth rate (CAGR) in operating cash flow since 2018. Abandoning the Swedish Match transaction would certainly put PMI in a much more difficult position with respect to oral nicotine products and the distribution network it would have to build from scratch. However, investors should also not forget the technological qualities of IQOS ILUMA and ILUMA PRIME, which are now based on induction-based heating technology, similar to British American Tobacco’s (BTI, BTAFF) glo hyper X2. Earlier versions such as the IQOS 3 Duo use a conventional heating blade to create the nicotine-containing aerosol.

Altria And Philip Morris Go Their Separate Ways – I See Altria In A Disadvantageous Position

In my May 2022 article on Altria, I pointed to ongoing headwinds related to the marketing of IQOS in the United States. Altria and PMI apparently disagree about whether Altria has met the initial term and performance goals for the exclusive distribution rights that would allow it to extend the right to exclusively market IQOS and Marlboro HeatSticks in the United States after April 2024. In addition, Altria is apparently working on its own products, most likely based on heated tobacco technology, which could be submitted to federal regulators already early next year. Finally, it does not seem unreasonable to expect PMI to eye Swedish Match’s distribution capabilities in the U.S. to independently market IQOS and related products following the then hypothesized termination of its agreement with Altria.

Such a development would make PMI and Altria direct competitors in the U.S., and this seems the most likely outcome going forward, as PMI also announced today that the two companies have reached an agreement to end the commercial relationship for IQOS in the U.S. beginning in May 2024. This is obviously good news for PMI shareholders, as the company will soon have unrestricted access to the largest smoke-free market in the world.

Fundamentally, the agreement can be seen as a positive outcome for both companies, as it avoids what is likely to be a protracted court case that would almost certainly further delay the launch of IQOS and leave Altria without compensation altogether. Under the terms of the agreement, Altria has already received $1 billion on Oct. 19 and will receive another $1.7 billion plus interest on it (a 6% annual rate) in July 2023, but PMI has the right to make the final payment at an earlier date, thereby reducing the interest burden. Considering the growth prospects of the U.S. heated tobacco market, a consideration of $2.7 billion seems like a relatively small amount, but one should keep in mind that Altria has not really been able to successfully build the IQOS brand in the United States. Of course, this is only partly Altria’s fault due to the ongoing patent dispute with British American Tobacco. Personally, I think it is very likely that IQOS 3 Duo will not be marketed in the U.S. at all and PMI will focus directly on marketing IQOS ILUMA and ILUMA PRIME with their superior induction-based heating technology.

From an Altria shareholder’s perspective, today’s announcement is not positive. Certainly, the $2.7 billion in cash is better than nothing, considering that PMI likely would have pursued an independent marketing strategy after April 2024 anyway, but keep in mind that Altria will most likely no longer be allowed to market the Marlboro brand in a heated tobacco product (p. 9, Altria’s 2021 10-K). This would put Altria at a serious commercial disadvantage, given how well heated tobacco products are doing with consumers, according to PMI’s recent earnings reports. In such a case, Altria would of course still have a highly profitable combustibles portfolio, but would certainly not be able to compete on a level playing field with PMI, even if it succeeded in developing its own line of heated tobacco products.

Quick Investor Takeaway

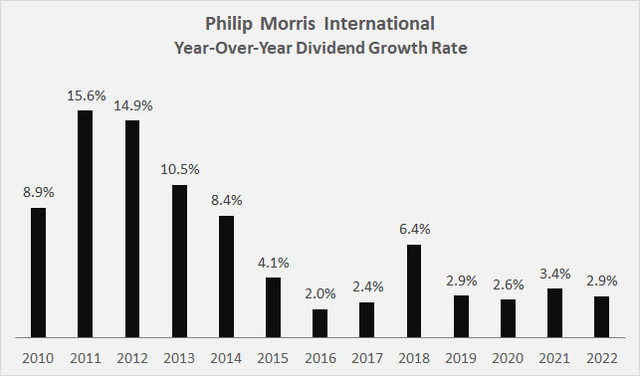

With today’s solid results, PMI has once again shown why it is rightly trading at a premium to Altria and British American Tobacco (although one can argue about the valuation spread). As an investor focused on cash flow, I was admittedly a bit disappointed with the recently announced dividend increase of only $0.02 per share, but it certainly did not come as a surprise and is consistent with increases in recent years (Figure 2). The company has emphasized on several occasions that it intends to invest heavily in growing its smokeless products segment. As a long-term shareholder, I have no problem with this, even if my PMI dividends lose purchasing power for the time being, as long as dividend growth accelerates once PMI solidifies its top position in the smokeless products segment.

Figure 2: PMI’s year-over-year dividend growth rate, based on the dividends declared each calendar year (own work, based on the company’s 2010 to 2021 10-K and the most recent announcement on September 14, 2022)

The company’s heated tobacco segment is growing strongly, and PMI is on track to become a majority smoke-free company by 2025. Of course, this goal is likely to be achieved only after a consolidation of Swedish Match’s revenues, and the transaction is still pending. However, the increased takeover bid and management’s strict stance make a successful completion of the transaction more likely than not. PMI shareholders should applaud CEO Olczak and his team for wisely conducting the negotiations without showing any sign of desperation by making a ridiculous offer for Swedish Match. The well-timed transaction with Altria further underscores PMI’s intent to enter and dominate the U.S. smoke-free market, and even from that perspective, it seems increasingly unlikely that Swedish Match shareholders will continue to resist the acquisition.

In principle, the $2.7 billion consideration paid to Altria is a positive for both companies. In the long run, however, I see Altria at a significant competitive disadvantage if it turns out that the company also gives up the right to market the Marlboro brand as a heated tobacco product. In this way, Altria will be an underdog player in this high-growth segment, even though the company could come up with its own heated tobacco device relatively soon. Altria investors like me should not despair, however, as the company still has the right to market several major premium cigarette brands (including Marlboro) in the U.S., and the inelasticity of the product should lead to significant price increases for the foreseeable future.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment